By David Goldfisher, The Henley Group Secondary and tertiary office markets across the Midwest, including Chicago, Minneapolis, Madison, Milwaukee, Cleveland, Cincinnati, Columbus and St. Louis, are facing mounting pressure. While each city has its own challenges, a common theme is clear — vacancies remain high and liquidity is thin. Tenant shuffling One of the defining dynamics today is tenant reshuffling rather than net growth. As leases expire, employers frequently move from one building to another, seeking modernized space and stronger amenities. Renovating in place is disruptive and costly, while relocating allows businesses to upgrade with minimal operational downtime. This “musical chairs” effect highlights a deeper structural issue. There are only so many large anchor tenants in Midwest cities and few new entrants are seeking major blocks of space. There is more repositioning for existing tenants than attracting new ones. Flight to quality Landlords and developers are competing to deliver amenities that encourage office attendance and support talent retention. Modernized lobbies, tenant lounges and flexible collaboration areas have become standard expectations. Hines’ upgrades at Chicago’s 333 West Wacker Drive and 601W Cos.’ reinvestment in the Old Post Office demonstrate the scale of investment required. But not all landlords can compete. With …

Market Reports

By David Stecker, JLL As advanced manufacturing reshapes industrial real estate across the Midwest, Cleveland is emerging as a quietly powerful hub — offering scalable space, a strategic location and infrastructure ideal for high-growth sectors. While other Midwest metros have gained national attention for headline-grabbing investments, Cleveland is carving out its own unique path to growth, supported by advanced industries, a skilled workforce and a strong real estate foundation. The region’s industrial market remains competitive and resilient, even amid broader economic headwinds. Despite the recent move-out of Joann Fabric’s 1.4 million-square-foot facility in Summit County, overall fundamentals remain healthy, and Class A space is in especially high demand. For high-tech and manufacturing users seeking logistics-ready facilities in a cost-effective market, Cleveland delivers — offering the right mix of space, speed and strategic location that today’s industrial users are actively pursuing. A market of opportunity According to JLL’s second-quarter 2025 Cleveland Industrial Insights Report, total vacancy in the market sat at 3.8 percent. While this represents a slight uptick following Joann’s exit, it still signals robust market health. Class A availability is especially tight, driven by a wave of large leases signed in newly developed properties. That momentum is putting upward …

By Andrew Jacob, Colliers The Cincinnati/Northern Kentucky industrial market demonstrated notable resilience in the second quarter of 2025, balancing strong long-term fundamentals with cautious short-term sentiment. Amid national headlines of slowing industrial demand and heightened uncertainty, the region continues to distinguish itself with a combination of strategic location, steady demand and disciplined development. Market fundamentals At the close of the second quarter, the market’s total inventory stood at approximately 293.6 million square feet, supported by a healthy vacancy rate of 5.2 percent, which remains below the national average of 7.1 percent. Bulk warehouse asking rates have remained relatively steady at $5.95 per square foot, reflecting a market rebalancing after several years of oversupply from robust development activity. In contrast, flex space asking rates continue to climb, now averaging $8.11 per square foot. This upward pressure is fueled by a scarcity of new supply — driven by land constraints and elevated construction costs. The market recorded 539,000 square feet of positive net absorption in the second quarter, bringing the year-to-date total to over 1 million square feet. This consistent absorption highlights enduring occupier demand despite broader caution in the national market. New construction activity continued at a measured pace, with 2 …

By Brooke Jacobsen, Colliers The Greater Cincinnati and Northern Kentucky office market is weathering the post-pandemic era with surprising nuance. While national headlines continue to focus on uncertainty and high vacancy, the local market is quietly seeing stable, albeit selective, activity, especially in healthcare and specialized user segments. After a slow winter, leasing activity across the region began to thaw in the second quarter of 2025. Year-to-date net absorption remains slightly negative, but market sentiment is gradually shifting, particularly among small to mid-size tenants. Most of the deal activity is coming from users in the 2,500- to 5,000-square-foot range, with several groups focused on healthcare and logistics services. Cincinnati’s Class B and C office space is seeing an unexpected level of demand, driven by affordability, location flexibility and users with highly specific space needs. Medical office continues to stand out as one of the most active sectors. Demand is strong across both urban and suburban submarkets, with notable traction in Cincinnati submarkets. Much of the recent healthcare-related activity has come from specialty practices, private groups and regional health systems looking to reposition their outpatient services. While Northern Kentucky offers value, many users are choosing to locate on the Cincinnati side …

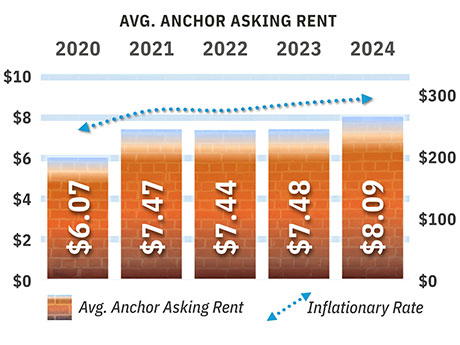

By Duke Wheeler, Reichle Klein Group The ongoing redevelopment of nonfunctional department store structures such as Sears and Elder Beerman, along with the retenanting or repurposing of structures such as Kmart, Giant Eagle and Value City, paved the way for many statistical and actual market improvements in the greater Toledo, Ohio, trade area. This positive trend and message supersede the closing announcements from over the past several months. First, the numbers: The overall retail market vacancy rate improved from 11.5 percent to 8.3 percent over the prior five-year period. This represents approximately 650,000 square feet of positive absorption. Most of this absorption occurred among anchor space, defined for the purpose of this article as space 20,000 square feet or larger. The vacancy rate for anchor space improved from 11 percent to 5.1 percent. Self-storage played a large role as roughly 300,000 square feet of anchor retail space was converted by the storage industry. The balance of positive absorption can be attributed to pent-up retail demand as occupiers compete for well-located, existing space in a market with limited new construction and increased construction costs. In some cases, landlords have found or will find themselves better off with a replacement tenant than …

By George Pofok, Cushman & Wakefield | CRESCO Real Estate The Northeast Ohio market has consistently been a stable industrial hub, and over the last couple years, has been attracting the interest of investors and developers from other regions. Spanning approximately 527 million square feet, this market stretches from Cleveland down I-77 to include Akron-Canton. In the second quarter of 2024, the overall vacancy rate decreased to 2.8 percent, driven by 1.1 million square feet of positive direct absorption, a strong recovery from the negative absorption in the first quarter. Over the past few years, the vacancy rate has remained between 2.4 and 3 percent. Leasing activity kicked off the year robustly, with 4 million square feet of leases in the first quarter. However, it normalized in the second quarter, with 1.6 million square feet leased, which was slightly below the usual pace. The market is expected to remain stagnant due to limited inventory and a lack of new speculative construction starts, which continue to hinder demand from local and regional tenants seeking to expand and backfill spaces. Leasing deals are trending longer, between five to 10 years, with annual rental rate increases averaging 3 to 4 percent. Meanwhile, the …

By Donald Lydon, Avison Young Cleveland offers a mix of hurdles and opportunities across its industrial, office and multifamily sectors. With limited speculative construction, landlords are poised to leverage rental increases. Meanwhile, developers eyeing Cleveland should anticipate longer lead times for new projects, navigating through municipal regulations and land availability challenges. This nuanced landscape presents openings for savvy investors, developers and occupiers looking to capitalize on Cleveland’s evolving real estate dynamics. Resilient and mature, yet relatively untapped industrial market presents opportunities to national developers. Cleveland’s industrial sector is in a strong position relative to similar Midwest markets. With vacancy rates comfortably low at around 4 percent, rents are edging upward as developers struggle to find capital outlay nationally and spec development has all but stopped in most markets. The current landscape features a mix of large distribution hubs and older, yet prime, manufacturing facilities in key locations across Cleveland and Akron. Many facilities leased to third-party logistics companies seem to be stockpiling goods where others sit nearly empty, reflecting evolving needs in logistics and storage amid ongoing supply chain adjustments. This dynamic is leading to diverse demands: from small to mid-sized multi-tenant flex spaces (10,000 to 30,000 square feet) to …

By Jeff Bender, Thomas McCormick and Seattle Stein, Cushman & Wakefield We’ve been doing this for a while. Every cycle with gang-busters demand and absorption comes to an end, as does every downturn. So, with the Cincinnati industrial market, we find ourselves in the doldrums since mid-2023, and we may not fully turn the corner until next year. Perspective and context matter, though. We’re coming off record absorption and demand at the end of 2020 and through 2022, when we also closed the year with an unsustainable 1.7 percent vacancy rate. Before the entire world paused for COVID in early and mid-2020, we had a record year in 2019 as well. While vacancy hovers around 6 percent at mid-year, that is basically the Cincinnati industrial market’s historical average. Four consecutive quarters of negative net absorption certainly defines “doldrums,” but that must be weighed against the previous 48 consecutive quarters of positive net absorption through mid-2023. We’ve also seen a slight increase in asking rental rates, up to $6.25 per square foot, despite negative absorption. So, despite a lackluster past 12 months, we have positive momentum, and that’s bolstered by many of the factors that have always made Cincinnati one of …

By Todd Pease, Michelle Klingenberg and Britney Aviles, JLL Since the Cincinnati office landscape upended during the pandemic, area businesses, building owners and broader leaders sought opportunities to help entice employees to return to the office, reclaim the area’s vibrancy and spur economic growth. These stakeholders realized that to entice employees back into the office, they would need to make it worth the commute. Throughout this evolution, one thing continues to drive tenants into office buildings: high-quality amenities. Amenity demands have changed over the last few years and there are new ways for building owners to create spaces that engage employees. Amenities of the past Up until 2020, the standard “five days in the office” model meant that office buildings strived to accommodate as many professionals as possible while maintaining efficiency. The space planner was the lead consultant on planning offices, and they would work with tenants to design spaces in a way that most efficiently accounted for their company headcount. Regarding office amenities, tenants most valued high parking ratios, conference facilities, gyms and locker rooms, and onsite food options. It was all about productivity and it didn’t matter if productivity took place in a gray cubical under florescent lighting. …

By Dan Wendorf, JLL The industrial landscape in Columbus is not just thriving — it’s breaking records. As highlighted in JLL’s fourth-quarter 2023 Columbus Industrial Insights Report, 2023 marked another milestone year for the market. With over 19 million square feet under construction and surpassing 2022’s nearly 7 million-square-foot total, Columbus has solidified its position as a national industrial hub. The report also showed total vacancy increased 3.8 percent year over year due to 15.7 million square feet of speculative completions, which finished the year at 30 percent leased. Although a modest uptick, Columbus continues to diversify its industrial scene from exclusively being known as once a “logistics and parcel delivery hub” to now being recognized for its growth in advanced manufacturing and data centers. As exemplified by investments from Facebook, Google and Meta, the market has evolved into a multifaceted industrial powerhouse. In particular, investments in microchip factories have stimulated the need for additional warehousing from suppliers, and this trend is expected to continue in the coming year. This article explores how Columbus has become a key player in industrial development, factors motivating businesses to move their operations to central Ohio and what’s in the pipeline to keep an …

Newer Posts