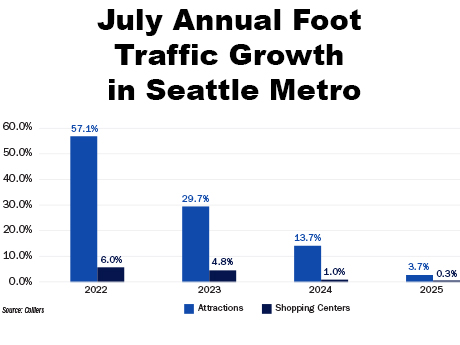

— By Jacob Pavlik of Colliers — As big-box retailers scale back or exit the market, a new class of tenants is reshaping the retail landscape across the Puget Sound region. Experiential retail is taking their space and providing destinations for consumers and the experiences they crave. This umbrella term includes concepts that prioritize interaction, entertainment and social connection. This is emerging as a compelling solution for landlords looking to drive foot traffic and re-energize shopping centers. The shift is not accidental. The pandemic disrupted traditional social experiences and accelerated the decline of large-format retail by getting people more accustomed to buying online, even if they “picked up” the item later in a store. Now, with consumers eager to reconnect in person, experiential concepts have gained traction. These tenants often don’t sell goods or services in the conventional sense. Instead, they offer immersive experiences that encourage group participation and repeat visits. Recent examples include Mirra, a 12,000-square-foot social entertainment venue that opened in Bellevue’s Lincoln Square, a mixed-use shopping center with three hotels, and more than 1.2 million square feet of office space. Adjacent to Cinemark Reserve in the South Tower, Mirra offers immersive virtual reality party games and transitions to …

Market Reports

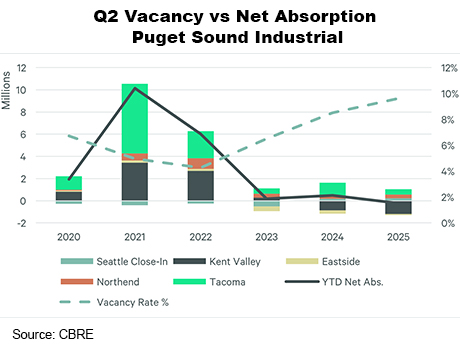

— By Andrew Hitchcock of CBRE — The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April. While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing. Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 …

— By Dan Dahl of Kidder Matthews — Seattle’s office market has proven more resilient than other cities in past downturns, with smaller declines and quicker recoveries. This cycle is different. Seattle has been hit harder and is recovering more slowly than the rest of the country. San Francisco often signals what’s to come, with the Emerald City trailing by about 12 months. AI-driven leasing activity in San Francisco is gaining momentum — signaling growth for Seattle — but the local market still faces headwinds. Demand Softens as Tenants Downsize Demand for office space in Seattle remains weak. Most tenants with upcoming lease expirations are downsizing. Tech companies have historically driven office demand here, but now they are shedding space, laying off employees and working from home. Tenants have the leverage. Concessions like free rent, reduced rates and built-out spaces are abundant, providing the opportunity for tenants to pursue a flight to quality and upgrade to higher-end space. Investment Market Under Pressure The investment side is equally challenged. Owners with near-term loan expirations are often in a pinch. Their loan balances exceed current building values due to high vacancies, lower rental rates, elevated cap rates and higher interest rates. As a …

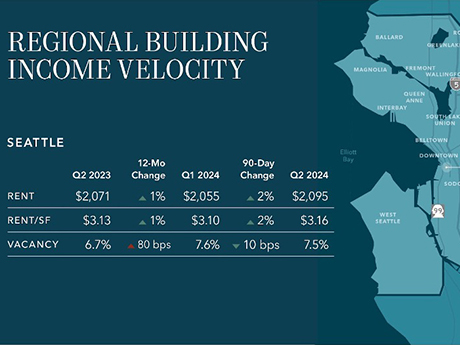

— Tim McKay of Cushman & Wakefield — Seattle’s multifamily market has faced challenges over the past few years. Rent growth has been flat as a significant number of new units were delivered in 2023 and 2024. This new supply also led to concessions and even rent declines in some markets. Submarket supply issues and the new statewide rent control legislation have also contributed to market headwinds. However, 2025 has brought signs of recovery, and there’s optimism about the market’s trajectory over the next few years. It feels like Seattle has bounced off the bottom and is starting to climb back up, similar to the recovery seen in 2011 after the Global Financial Crisis. Rebounding Demand The multifamily market has seen a recent uptick in demand, which can be attributed to several factors. A key driver has been the return-to-office mandates from major employers like Amazon and Starbucks. Seattle’s population is also expected to grow again, and the supply of new units hitting the market has drastically declined. These factors are contributing to renewed growth after a four- to five-year stagnation. Stabilizing Rental Rates Owners are starting to put properties under contract again. Land prices haven’t returned to previous levels, …

— By Dylan Simon, executive vice president, Kidder Mathews — This summer marked a major milestone in Seattle’s apartment market, demonstrating signs of vibrancy with increases in rental rates, growing liquidity and clarity in pricing in capital transactions. The city is gaining momentum and continues to bounce back from recent market fluctuations and the harsh impacts of the pandemic. Urbanization is here to stay — corporate employers are voting against Zoom as an effective tool — as we trend back toward human nature, which requires community and proximity. With limited new construction breaking ground, the stage is set for sustained rental rate growth, which will invariably result in a surge in sales prices. Transaction Activity on the Rise Transaction activity is steadily on the rise in Seattle’s multifamily market, proving conviction from the investment community. This uptick offers greater clarity on property values as the market adjusts from peak interest rates back in fall 2023. For owners and potential sellers, this shift suggests pricing hit a bottom in the past nine months and the only direction in pricing from here is upward. In our recently launched third-quarter Seattle market report, we’ve uncovered key sales insights that underscore this resurgence. During the …

— By Leah Masson, senior director, Cushman & Wakefield — The real estate landscape in the Puget Sound region is shaped by a dynamic contrast between the Eastside and Downtown Seattle. The Eastside continues to thrive, particularly with its robust tech activity. Major developments, such as the Eight, Skanska’s 540,000-square-foot project, is nearing full occupancy, underscoring the area’s strong demand. OpenAI is actively seeking space on the Eastside, with expectations of more artificial intelligence groups to follow. It’s worth noting that the Eastside is not plagued by the safety issues that have been a concern for Downtown Seattle. The anticipated 2025 opening of the light rail is set to drive even more growth in the area. Downtown Seattle is also experiencing an uptick in leasing activity, with active tenants expanding in terms of both square footage and lease term lengths. Since 2021, professional services groups, such as law and engineering firms, have been the primary drivers of leasing, but there is now a welcome return of tech companies to the Seattle market. New AI-focused tenants are beginning to emerge, moving out of coworking spaces and seeking permanent office locations in the city. However, Downtown Seattle continues to face significant challenges, …

— By R.J. Vara, first vice president of investments, Marcus & Millichap’s The Vara Group — The Seattle industrial market is undergoing a transitional phase marked by rising vacancies, fluctuating demand and evolving investment dynamics. There was a robust surge from 2020 to 2022, which saw nearly 19 million square feet of industrial space absorbed and more than $8.4 billion in transaction volume. However, the market experienced a reversal in 2023, with roughly 2 million square feet of previously absorbed space becoming available. This shift, driven by decreased container traffic at local ports, rising interest rates and elevated inflation, has continued into 2024, with speculative construction projects contributing to elevated vacancy rates. As of mid-year, Seattle’s industrial vacancy rate has increased by about 2 percent year over year, reaching 7.7 percent. This has surpassed the national average of 6.6 percent. The rise in vacancies is primarily attributed to the completion of new distribution facilities, with spaces of more than 100,000 square feet now available in double digits. Delivery numbers are expected to fall to their lowest level since 2017, but investors are beginning to explore opportunities in the southern regions. Regarding investment activity, Seattle’s industrial sales volume has notably increased …

— By Jacob Pavlik, research manager, Colliers — A 10-mile drive east of Seattle, Bellevue is the top destination for urban retail activity in the Puget Sound. High incomes, healthy daytime employment and the most active office leasing market in the Pacific Northwest means not much more is needed to make a retail space thrive. That is, except reasonable fit-out costs for new space. The Bellevue CBD has seen significant new construction for office buildings (with lots of ground-floor retail opportunities), delivering 3.3 million square feet over the past year alone. Unfortunately, sky-high construction pricing and office market financing challenges have made it difficult to get retail leases done in new buildings. Second-generation spaces in the submarket are the reasonable but diminishing alternative. Second-generation spaces are filling up faster than they become available. The demand is partially from tenants whose buildings were torn down for redevelopment. Given the cost of fitting out a space in a brand-new building elsewhere in the Bellevue CBD, second-generation space is the most lucrative alternative. First-generation space, which delivers as a cold shell without HVAC, plumbing or dry wall, can cost upward of $400 per square foot to build out. Landlords tend to offer $100 …

— By Candice Chevaillier, CCIM, Principal, Lee & Associates | Pacific Northwest Multifamily Team — Absorption still lags supply in the Seattle MSA contributing to higher vacancy and flat rents. In Q1 2024 3,000 units were delivered, yet only 2,800 were absorbed. Vacancy is stabilizing at 6.9 percent this quarter and then is expected to trend down starting in Q3, finally allowing meaningful growth in rents. Construction costs remain high and options for financing limited, curtailing new development. This is creating demand for existing value-add acquisitions. 2024 and 2023 sale volume in the Seattle MSA is still a trickle of what it was in 2022 and 2021, shifting Cap Rates slowly upwards. This trend is expected to be short-lived. As interest rates finally begin to fall, and rents begin to rise, investors who catch this inflection point will prevail from best pricing and benefit while more conservative capital sits on the sidelines.

— By Alex Muir, Senior Vice President, Lee & Associates | Seattle — As we near the halfway mark of 2024, capital markets activity in Seattle remains slow. The year has largely consisted of price discovery and waiting for interest rates to drop. With that said, the sales volume for office assets has nearly surpassed the 2023 total. Four transactions over $30 million have occurred year-to-date, all of which are larger than any deal last year. These sales are emblematic of the type of deals that are driving investment activity, with three being owner-user acquisitions — Alaska Airlines, Costco, Seattle Housing Authority — and the fourth involving a loan assumption. Distressed sales are occurring more frequently as well, with several buildings in downtown Seattle trading below $150/SF. While it has yet to materially impact vacancy, there are signs of life in the leasing market. Pokémon recently signed a lease for 16 floors in The Eight, an under-construction tower in the Bellevue CBD. This is the largest lease in the market in three years. Other tenants, such as ByteDance and Snowflake, have signed leases larger than 100,000 SF, as a new wave of tech companies grow in the market. With the …

Newer Posts