By David Hodge and Tom Nickols, NAI Pfefferle While the national headlines often focus on trends such as rising vacancies and cooling rent growth, Milwaukee and its surrounding metros are telling a different story. Here resilience defines the market, and in some cases, opportunities are emerging due to our strategic location, balanced development and supportive business climate. Rate cuts change landscape The Federal Reserve’s recent rate cuts have altered the investment landscape. For the first time in years, capital markets are starting to unlock. Lower borrowing costs are already sparking new conversations with investors who had been sitting and waiting on the sidelines. This adjustment matters. Refinancing options are improving for property owners, development projects are resurfacing after being shelved for high financing costs and capital is beginning to flow again. For occupiers, rate cuts also open doors. Lower borrowing costs for developers encourage new construction and tailored build-to-suit options. This ultimately expands the range of available facilities and results in a healthier environment where tenants can negotiate from a position of choice rather than constraint. While many national markets remain hampered by an oversupply of speculative space, Milwaukee’s pipeline positions it for long-term strength compared to its peers. Local …

Market Reports

By Matt Hunter, Hunter Real Estate Milwaukee’s office market, like many others across the country, is in flux. Rising costs, shifting tenant demands and looming debt maturities are all testing the market’s strength. But out of that pressure comes reinvention, and Milwaukee is proving it’s up for the challenge. High-quality, well-located, amenity-rich office buildings are more important than ever. They’re essential to attracting and retaining top talent. Office buildings don’t just serve the tenants that occupy them, they grow the tax base, support local businesses, drive housing demand and help build a more vibrant and economically resilient city. One of the most defining features of Milwaukee’s current office market is what’s not happening: there’s virtually no new construction. With high interest rates, continually increasing construction costs and economic uncertainty, ground-up office development has largely stalled. This has created a limited supply of modern, Class A office space, just as tenants are placing greater emphasis on quality. That supply-demand imbalance is driving increased competition for top-tier buildings and putting upward pressure on rents in this high-end segment. Tenants want less space but better-quality space, and they’re willing to pay a premium for it. This is a significant opportunity for landlords of …

By David Goldfisher, The Henley Group Secondary and tertiary office markets across the Midwest, including Chicago, Minneapolis, Madison, Milwaukee, Cleveland, Cincinnati, Columbus and St. Louis, are facing mounting pressure. While each city has its own challenges, a common theme is clear — vacancies remain high and liquidity is thin. Tenant shuffling One of the defining dynamics today is tenant reshuffling rather than net growth. As leases expire, employers frequently move from one building to another, seeking modernized space and stronger amenities. Renovating in place is disruptive and costly, while relocating allows businesses to upgrade with minimal operational downtime. This “musical chairs” effect highlights a deeper structural issue. There are only so many large anchor tenants in Midwest cities and few new entrants are seeking major blocks of space. There is more repositioning for existing tenants than attracting new ones. Flight to quality Landlords and developers are competing to deliver amenities that encourage office attendance and support talent retention. Modernized lobbies, tenant lounges and flexible collaboration areas have become standard expectations. Hines’ upgrades at Chicago’s 333 West Wacker Drive and 601W Cos.’ reinvestment in the Old Post Office demonstrate the scale of investment required. But not all landlords can compete. With …

By Lee Kiser, Kiser Group Multifamily real estate investment in the Midwest in 2025 presents a compelling opportunity, driven by strong fundamentals, favorable market dynamics and emerging trends. Here’s an overview of the key trends and outlook. Strong rent growth Midwestern cities are experiencing some of the fastest rent increases in the nation. Cleveland leads with a 5.1 percent year-over-year rent growth, while other metros like Chicago, Kansas City and Detroit rank among the top 10 for rent gains, outperforming the national average. This surge is attributed to steady demand and limited new supply, allowing landlords to continue raising rents. Much of the rent growth is due to declining construction activity. Nationally, multifamily construction is expected to decline by 11 percent in 2025, with completions projected to fall to 317,000 units. The Midwest has a significantly smaller pipeline than the national statistics, with only 3.4 percent of inventory currently under construction versus 6 percent nationally. Workforce housing stock The Midwest is recognized for its affordability, with monthly multifamily rents averaging $1,405, which is lower than the national average of $1,823 and more than 10 percent less than the Sun Belt average. Midwest transaction velocity is shifting toward Class B and …

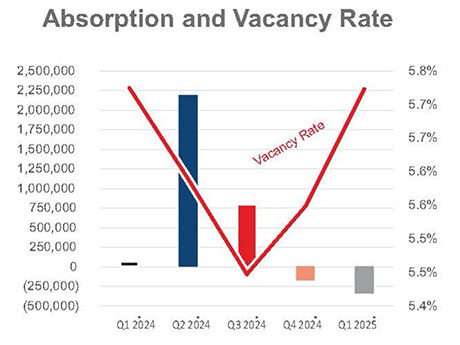

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …

By Russ Sagmoen, Isaac Berg and James McKenna, Colliers The greater Milwaukee retail landscape continues to thrive, with notable activity in regions such as Oconomowoc, Grafton, Franklin, Oak Creek and the Racine metro area. Franklin and Oak Creek have experienced steady growth over the past decade and are well-positioned to maintain this momentum. Meanwhile, Racine County has seen a surge of recent activity, largely fueled by Microsoft’s announcement of a $3.3 billion state-of-the-art data center in Mount Pleasant. The Racine/Kenosha I-94 corridor serves as a vital connector between the Milwaukee and Chicago MSAs, enhancing its attractiveness for economic expansion. Market-wide, we are seeing a great amount of activity from local and regional retailers/franchisees and a slowdown from national brands. While there is some activity from national retailers, they tend to be selective about their site choices, highlighting the importance of prime locations and price sensitivity. Because of this, the majority of retail activity is driven by local and regional enterprises. New retail product is scarce, with a lack of new construction due to rising interest rates and increasing land and construction costs. This has resulted in a decline in multi-tenant strip centers, with the bulk of new construction coming in …

By Matt Hunter, Hunter Real Estate Over the past few years, we have seen a noticeable trend in office tenants relocating to new office buildings, particularly in downtown Milwaukee. Notable companies such as Baker Tilly (~40,000 square feet), Old National Bank (~20,000 square feet), CBRE (~15,000 square feet) and Silvercrest Asset Management (~11,000 square feet) have all moved into new office buildings, which are classified as being constructed within the past five years. While these relocations highlight a shift in tenant preferences toward newer buildings, most leasing activity has been observed in recently renovated office buildings. One prime example of this is Baird, which expanded and renewed over 450,000 square feet at 777 E. Wisconsin Ave., reinforcing the demand for renovated office buildings. Other significant leasing transactions include Fiserv, which leased ~160,000 square feet at HUB640; Enerpac’s ~50,000-square-foot lease and Veolia’s ~30,000-square-foot lease at 648 N. Plankinton; Marcus Corp.’s ~50,000-square-foot lease at The Associated Bank River Center; and Allspring Global Investments leasing ~40,000 square feet at 417 E. Chicago St. These transactions further demonstrate the attractiveness of renovated spaces for businesses looking to enhance their operations. This trend reflects a broader “flight to quality” in the office market. Tenants are …

By James Young, JLL Through 2023 and 2024, JLL industrial has seen a historically high number of new leases signed. JLL research saw positive absorption in the third quarter of 2024 at 48,200 square feet, primarily driven by the completion of owner-built projects. This activity, combined with existing occupier commitment to the region and record-high asking rents, points to a thriving market. As the Milwaukee industrial market continues to grow its regional presence, there are a few factors that set it apart from its larger peer cities like Indianapolis or Minneapolis. In this article, we will discuss what is driving regional industrial activity and the market’s strong growth trajectory. Industrial evolution We continue to see wide expansion into the suburban market, though this has not always been the case. Relocating a tenant from an established urban industrial area to a suburban location was often challenging 15 years ago. Such a move could entail workforce relocation, warehouse closures and complex logistical changes that potentially risked business disruption. Today, JLL research shows other large occupiers are not only retaining their spaces in the Milwaukee market but are also actively expanding into suburbs like Waukesha and Menomonee Falls. JLL is tracking 11 build-to-suit …

By Matt Hock, NAI Greywolf In the active landscape of Milwaukee’s commercial real estate market, several trends are reshaping the way businesses, both tenants and landlords, approach office spaces. From the enduring impact of remote work to the changing preferences of tenants, the market is currently witnessing a focus on quality, adaptability and talent retention. Flight to quality persists While the market continues to see the flight to quality we have experienced for the past few years, the Milwaukee office sector is now also experiencing what has been termed as “competing with the couch.” Companies are battling the challenge of bringing employees back to the office and with that they are looking to solve this issue with providing spaces that offer more than your standard office setup. Basically, they are looking for amenities and features within the office that entice workers to come back, compared with what remote workers have with their home office setup. So, competing with the comforts of home, or the couch, in these cases. This has catalyzed a “flight to quality,” where businesses are investing in premium office spaces designed to enhance the overall employee experience. In effort to attract and retain top talent, companies are …

By David Pudlosky and Patrick Savoie, JLL Milwaukee remains a strong office market with leasing activity showing no sign of slowing. Post-pandemic, companies took a fresh look at their workplace strategies to adjust to hybrid working environments, and many rightsized their overall square footage while adding significant amenities and attractions that provide a rewarding office experience for returning workers. Despite a smaller footprint, tenants are seeking updated, highly amenitized spaces in Class A buildings. While amenities have always been a focus for landlords, the buildings that stand out today are the ones that focus on quality amenities over quantity. For example, today’s tenant will likely not be as interested in a building lounge unless it has comfortable seating, a café, strong Wi-Fi and more. To be relevant to tenants, amenities must be high end and culture focused. We’ve seen companies like Milwaukee Tool, Fiserv, Komatsu Mining Corp. and Northwestern Mutual invest in their downtown office spaces and make commitments to bring more employees downtown, and we expect this trend to continue. Building owners can learn from what Class A building landlords are doing to drive leasing activity, and learn how investing in quality, amenity-driven spaces will likely bring in new …

Newer Posts