By Jeff Karger, JLL There’s no doubt that the office market today is much different than what it was five years ago. Employers across the nation have had to adjust their work models, time and time again, to meet the needs of their employees — and those in Grand Rapids are no exception. As landlords, employers and employees adapt to these changes, it’s important to understand the direction of the office market. Below, check out five factors that are defining it. 1. A flight to quality Like many other cities across the nation, Grand Rapids is experiencing a resounding flight to quality. Employers are seeking Class A and trophy spaces to appeal to their employees and offer them an experience, rather than just a cubicle to work in. Some of these office features can include free fitness centers, onsite cafés, coffee shops and restaurants, outdoor terraces and more. Plus, according to JLL research, 59 percent of employees expect to work at a company that supports their health and well-being. Interestingly enough, employees prioritize this over salary — a key reason why companies and landlords alike are investing in amenitized spaces with up-to-date HVAC systems, exercise classes and healthy food options. …

Midwest Market Reports

By Andy Gutman, Farbman Group This is a complicated and even confusing time for anyone trying to make sense of the commercial real estate market. Conflicting economic indicators and pervasive concerns about inflation — and even the potential for a recession — create a somewhat cloudy outlook, even as promising opportunities remain in some markets. In the Midwest, there are noticeable market-specific differences that give a sense of just how much variability there is across the region. Taking a closer look at the commercial real estate in a city like Detroit — where the commercial real estate investment activity remains high — and comparing it with other Midwest markets in terms of retail activity, receivership rates, commercial real estate taxes, crime rates and urban revitalization efforts, can start to give us a better sense of how and why some Midwest markets are currently viewed as more favorable than others. It can also give us a feel for what investors and commercial real estate decision-makers are likely to be evaluating when they look at how to spend their dollars in the months and years ahead. Detroit looking good What is it about Detroit that makes it an appealing commercial real estate …

By Denny Sciscoe, The Lund Co. The Omaha industrial market is experiencing increased leasing velocity, positive rent growth and record-breaking development. The market consists of 18 submarkets, totaling 103 million square feet of inventory. Omaha has traditionally been a risk-averse market with steady, slow-paced growth. Since 2016, Omaha has seen increased speculative development, which is absorbed as fast as it is built. In 2020, we began to see hyper-development, fueled by increased demand and developer confidence. The increased demand was a result of COVID-19, where we experienced five years of growth in a 12-month period as occupiers scrambled to find space for inventories and e-commerce, which was exasperated by the demand to store “just in case” inventories. The supply and demand dynamics of our market have been almost perfectly balanced. The average deliveries are around 1.3 million square feet annually, and our average absorption has been around 1.4 million square feet. Since the beginning of 2022, we are tracking about 5 million square feet of demand and another 2.2 million square feet of space that is currently in the construction pipeline. Overall vacancy currently sits at 2.6 percent, which is 100 basis points below our average of 3.6 percent. …

By Traci Kapsalis, JLL It’s no secret that the COVID-19 pandemic turned every office market across the globe upside down. In the process, quality of life, health and well-being have become top priorities for office workers, as well as a push for hybrid and flexible working models. To understand and support these evolving expectations, local governments, employers and landlords are working together to identify and shape their new future of work. In fact, new research from JLL reports that the next three years will be a critical phase for commercial real estate strategy, representing a crucial window of opportunity that will determine how successful companies (and cities) will be in adapting to rapid changes. At the crossroads of America, the Indianapolis market is well on its way to a reimagined office environment. Here are three demonstrable signs. 1. Flight to quality dominates the office market Leasing activity for Class A office properties is strong in Indianapolis. According to a recent report, activity in this sector is reaching new heights as it achieved 248,000 square feet of occupancy growth in the second quarter — the highest in a single quarter in over four years — and hit record-high rents of almost …

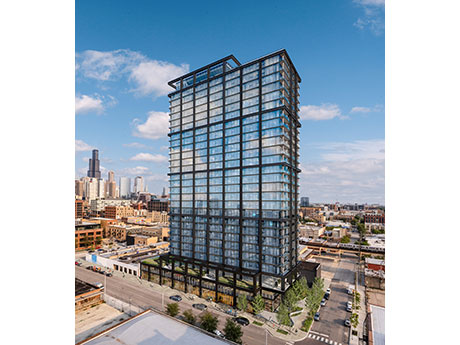

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

By Ryan Foran, Cresa As we approach the three-year anniversary of the start of the pandemic, it continues to affect the commercial real estate industry in many ways, with no asset class impacted as significantly as the office sector. While retail initially stumbled but rebounded, and industrial soared to unexpected heights amid distribution emergencies, millions of U.S. office employees continue a tenuous balance of working from home versus going into the office. The pandemic wasn’t all bad news for office tenants. Many businesses with simple infrastructure and experienced staff have been so effective with remote set-ups that they have shed office space permanently and eliminated rent from the books. Others have embraced emerging technologies like virtual meetings and chat solutions to reduce the need for face-to-face interaction. In one way or another, most businesses were able to leverage this unique situation to improve their business processes, technology and personnel, and have embraced remote work at some level. But many businesses with younger, less experienced staff have reported ongoing struggles with recruiting, mentorship, culture development and staff retention. Some of these may have been amplified by complex external factors such as an ongoing labor shortage, an unprecedented resignation of our older …

By Jill Rasmussen, Davis The Minneapolis – St. Paul medical office building (MOB) market remains strong with calculated strategic growth from both hospital systems and independent clinics. The MOB sector has been resilient during the pandemic, economic challenges and local civil unrest. Providers have been focused on expanding into new market areas to locate close to their patient base, providing full-service medical hubs offering outpatient surgery and specialty services to communities while offering lower-cost care away from a hospital campus. The overall market remains very stable with a current vacancy rate of 8.6 percent on-campus and 10.6 percent off-campus. There remains high interest in off-campus locations for most non-acute care for location access and cost savings. Base rents continue to increase both on- and off-campus due to demand and higher new construction pricing. Base rates have reached nearly $22 per rentable square foot (rsf) on average on-campus and $21/rsf for off-campus existing product. New MOB construction rates have increased from $24.50/rsf to $28+/rsf due to interest rate hikes and supply chain/labor issues, but new construction projects continue to move ahead based on provider’s strategic initiatives. Annual base rent increases are trending up due to current inflation levels from a historical …

By Jesseka Doherty and Johnny Reimann, Mid-America Real Estate The fundamental strength of the metro Minneapolis economy is on full display in the suburban retail real estate market this summer, where space is tight, new supply is limited, rents are on the rise and construction costs continue to challenge tenants and landlords alike. The macroeconomic picture in the first half of the year was stunning, actually. For the second quarter that ended June 30, the unemployment rate was a remarkable sub-2 percent, which was even lower than the national level of about 4 percent, and consumer spending was robust. Urban submarkets have been more challenged, but even in the Minneapolis central business district, retail rents are holding up as the office market shows stability. Driving demand With work-from-home still a factor, remote employees who live in the suburbs often are more inclined to shop, dine and play close to home, which bodes well for retail in proximity. Across key trade areas, retailers and other tenants in regional and community centers are more in demand than ever. Submarkets faring well include Apple Valley, Burnsville, Coon Rapids, Eagan, Maple Grove, Roseville and Woodbury. The densification of the suburbs also is driving demand …

By Dan Thies, Sansone Group We are more than halfway through the year and the multifamily market in the St. Louis metropolitan area continues to grow. As of the first quarter, there were 5,112 multifamily units under construction in the metropolitan area. So far, the rise in interest rates and the increase in construction costs has not dampened the enthusiasm of investors and developers for constructing new units in this market. Vacancy rates continue to stay low and lease rates continue to increase. As long as these market conditions continue, developers are going to bring new units to market. The new units being built will reflect new design features, which many developers are implementing in their communities. One of the many design trends taking place across the country and in the St. Louis area addresses the rise in the older population becoming renters. Many members of the baby boomer generation are looking to sell their suburban homes to downsize into smaller, more practical spaces. Their children have moved out of the home, and they no longer need all the space or maintenance of a home. They want to pull the equity out of their home and place it in a …

By Mary Lamie, Bi-State Development Modern bulk distribution buildings under construction in the St. Louis region hit a historic high earlier this year, approaching 8 million square feet. The record level of construction illustrates the industrial real estate market in the southwestern Illinois and eastern Missouri region continues to expand to meet ever-increasing demand as world and domestic markets strive to move beyond the disruption that has defined the past two years. The need for reliable freight logistics and flexible supply chains is proving more essential than ever to keep economies moving, and regions that can meet those needs while delivering the modern bulk and manufacturing space distributors and developers demand will have the greatest potential for continued growth. In mid-2022, nearly 7.4 million square feet remained under construction in the St. Louis region, a level of construction 78 percent higher than 2021 and 47 percent higher than the most recent five-year average. Also noteworthy is the fact that 100 percent of the modern bulk construction projects underway is speculative. That represents more speculative activity in the region today than in 2019, 2020 and 2021 combined, a clear indication that developers believe the St. Louis market is a solid place …