By Brooke Jacobsen, Colliers The Greater Cincinnati and Northern Kentucky office market is weathering the post-pandemic era with surprising nuance. While national headlines continue to focus on uncertainty and high vacancy, the local market is quietly seeing stable, albeit selective, activity, especially in healthcare and specialized user segments. After a slow winter, leasing activity across the region began to thaw in the second quarter of 2025. Year-to-date net absorption remains slightly negative, but market sentiment is gradually shifting, particularly among small to mid-size tenants. Most of the deal activity is coming from users in the 2,500- to 5,000-square-foot range, with several groups focused on healthcare and logistics services. Cincinnati’s Class B and C office space is seeing an unexpected level of demand, driven by affordability, location flexibility and users with highly specific space needs. Medical office continues to stand out as one of the most active sectors. Demand is strong across both urban and suburban submarkets, with notable traction in Cincinnati submarkets. Much of the recent healthcare-related activity has come from specialty practices, private groups and regional health systems looking to reposition their outpatient services. While Northern Kentucky offers value, many users are choosing to locate on the Cincinnati side …

Midwest Market Reports

By Ashish Vakhariya, Marcus & Millichap Detroit’s retail market continues to show pockets of strength amid broader economic and retail sector headwinds. More affluent northern suburbs and the revitalizing urban core have demonstrated greater resilience, while limited construction activity should support the backfilling of existing space. Detroit’s position among the highest-yielding metros in the country will likely remain a key draw for investors, with capital focusing on well-located, necessity-based and service-oriented retail assets. Big-box downsizing and rising cost pressures create a cautious leasing environment: Detroit’s retail landscape recorded more than 1 million square feet of negative net absorption over the nine months that ended in March, with preliminary second-quarter figures indicating continued space relinquishment. Strained consumer demand and structurally challenged retail formats have contributed to a wave of bankruptcies and consolidations among major tenants, including Party City, Big Lots, Macy’s and Walgreens. Trade policy uncertainty has further heightened tenant caution, as elevated input costs are expected to weigh on leasing activity. A recent Michigan Retailers Association survey found that more than 60 percent of businesses statewide rely on imported goods. With consumers more price-sensitive, many retailers may struggle to pass on higher costs; however, tenants reliant on locally sourced inventory …

By Maria Davis and Colton Rupprecht, R&R Real Estate Advisors In the real estate industry, customer expectations around office space have undergone a significant shift — both in what they need and what they want. It’s not just about square footage anymore; it’s about how that space functions, feels and aligns with the values of the companies who occupy it. This transformation is playing out in three critical areas: the rise of small, amenity-packed spaces; a surge in outdoor-focused design that brings the comforts of home into the workplace; and a more rooted and interactive approach to sustainability. Smarter spaces As more companies return to in-office work, many are rethinking how they use space — prioritizing flight to quality. Increasingly, customers are gravitating toward compact offices that offer high-impact amenities rather than expansive square footage. These smaller footprints are more efficient, but they also demand more thoughtful design and planning. Technology is key in amenity designing, as efficient developers are integrating infrastructure that anticipates the needs of a tech-forward workforce. Whether it’s bracketing out spaces for high-speed fiber and built-in video conferencing hubs or artificial intelligence (AI)-powered building systems that manage lighting, the design is important in making a more …

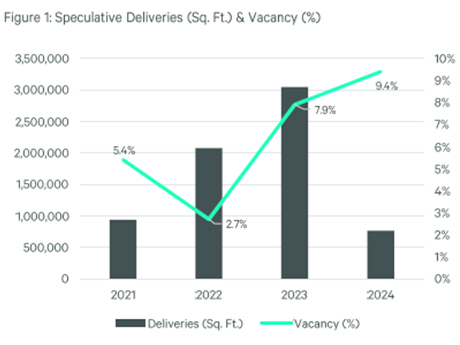

By Harrison Kruse and Ned Turner, CBRE As we near the second half of 2025, the Des Moines industrial market is starting to see a shift in fundamentals, as new deliveries and the pipeline of new big-box speculative warehouse product have come to a complete halt. Like many cities in the upper Midwest post-COVID, the Des Moines MSA saw an influx of out-of-state developers backed by institutional capital go ground up with new big-box product when the economy was stimulated by the Federal Reserve reducing the federal funds rate below 1 percent. This resulted in historically compressed treasury yields and an abundant amount of liquidity injected into the capital markets. This effect on the national economy escalated consumer demand for e-commerce and locally, ag-related products, which are the state of Iowa’s most valuable export on an aggregate basis. The Des Moines MSA between 2021 and 2024 had more than 6.8 million square feet of new industrial space delivered to the market, which is about 10.2 percent of the total market size on a square-foot basis. During those years, net absorption increased on an annual basis between 800,000 and 1.5 million square feet. Pre-COVID, Des Moines’s average net absorption was between …

By Ben Azulay, Bradford Allen As summer approaches, I’m noticing Chicago’s downtown buzzing with renewed energy, and new signs that the Loop’s office market is heating up as well. In fact, research by my firm, Bradford Allen, suggests a Chicago office market nearing its bottom and poised for recovery. Improved leasing activity, strategic landlord adaptations and discounted sales are reshaping downtown Chicago’s market, particularly in high-demand submarkets like the West Loop and Fulton Market. Client certainty Office tenants in downtown Chicago are demonstrating increased confidence about their space needs, as reflected in significant expansion deals and long-term commitments. In fact, office expansions drove at least five of the 10 largest leases signed during the first quarter, including Stripe more than doubling its footprint at 350 N. Orleans from 45,000 to 89,000 square feet and Blue Owl’s second expansion at 150 N. Riverside from 27,000 square feet to 54,000 square feet. Large new leases included BP renewing 240,000 square feet at the CME Center, and Goldman Ismail signing a 43,000-square-foot deal at 191 N. Wacker. Leasing volume totaled 1.7 million square feet, up from 1.3 million square feet year-over-year, with the West Loop alone securing 916,760 square feet of leasing activity. …

By Lee Kiser, Kiser Group Multifamily real estate investment in the Midwest in 2025 presents a compelling opportunity, driven by strong fundamentals, favorable market dynamics and emerging trends. Here’s an overview of the key trends and outlook. Strong rent growth Midwestern cities are experiencing some of the fastest rent increases in the nation. Cleveland leads with a 5.1 percent year-over-year rent growth, while other metros like Chicago, Kansas City and Detroit rank among the top 10 for rent gains, outperforming the national average. This surge is attributed to steady demand and limited new supply, allowing landlords to continue raising rents. Much of the rent growth is due to declining construction activity. Nationally, multifamily construction is expected to decline by 11 percent in 2025, with completions projected to fall to 317,000 units. The Midwest has a significantly smaller pipeline than the national statistics, with only 3.4 percent of inventory currently under construction versus 6 percent nationally. Workforce housing stock The Midwest is recognized for its affordability, with monthly multifamily rents averaging $1,405, which is lower than the national average of $1,823 and more than 10 percent less than the Sun Belt average. Midwest transaction velocity is shifting toward Class B and …

By Ethan Elser, PACE Equity In today’s turbulent commercial real estate landscape, developers and property owners face challenges to secure sufficient competitively priced capital. High interest rates, compressed valuations and a low leverage lending environment have complicated funding strategies and eroded traditional capital stack assumptions. More and more, property owners and developers are turning to Commercial Property Assessed Clean Energy (C-PACE) financing due to its core attributes: low cost, nonrecourse, long-term and fixed-rate capital. With amortization periods of up to 30 years, owners and developers recognize that C-PACE terms are virtually unmatched in the private debt markets. As an assessment tied to the property rather than the borrower, C-PACE funding is being leveraged more than ever to support creative solutions in today’s marketplace. C-PACE has evolved into a dynamic financial tool used across the lifecycle of a building — from new construction to recapitalizations to retrofits. C-PACE is used by savvy commercial real estate professionals to optimize their capital structure and boost their internal rate of return (IRR). Identifying the financial utility of C-PACE in a shifting market C-PACE is growing in popularity as an alternative to mezzanine debt, preferred equity and other high-cost financing. In today’s environment, C-PACE is …

By Joshua Turner, Landmark Commercial Real Estate The commercial real estate market in Wichita and South Central Kansas has shown remarkable resilience and growth in recent years. Following the challenges of the pandemic, the region has not only recovered but is now thriving. Wichita’s central location and business-friendly environment have long attracted investments in retail, office, industrial and mixed-use developments. Prior to the pandemic, low vacancy rates and steady rent growth indicated a strong and promising market. While retail and office spaces experienced temporary setbacks due to shifting work and consumer habits, the industrial sector remained active, fueled by e-commerce demand. The region’s lower costs and pro-business climate helped it weather economic fluctuations better than many larger metro areas. Since 2021, Wichita’s commercial real estate market has experienced an impressive resurgence. The industrial sector is booming, driven by manufacturing, logistics and distribution expansion. Retail has adapted to evolving consumer preferences, with experiential and mixed-use developments gaining popularity. Office spaces are being reimagined to accommodate hybrid work models, offering flexible solutions that meet modern business needs. Wichita’s population has steadily grown over the past decade, reflecting the city’s increasing economic opportunities and high quality of life. Currently home to nearly 400,000 …

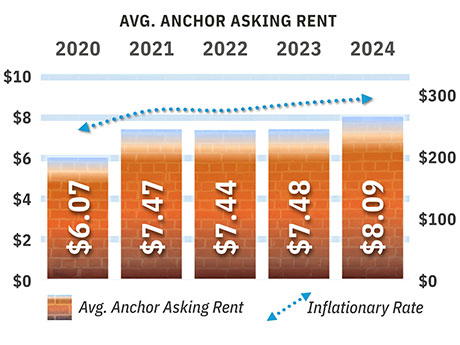

By Duke Wheeler, Reichle Klein Group The ongoing redevelopment of nonfunctional department store structures such as Sears and Elder Beerman, along with the retenanting or repurposing of structures such as Kmart, Giant Eagle and Value City, paved the way for many statistical and actual market improvements in the greater Toledo, Ohio, trade area. This positive trend and message supersede the closing announcements from over the past several months. First, the numbers: The overall retail market vacancy rate improved from 11.5 percent to 8.3 percent over the prior five-year period. This represents approximately 650,000 square feet of positive absorption. Most of this absorption occurred among anchor space, defined for the purpose of this article as space 20,000 square feet or larger. The vacancy rate for anchor space improved from 11 percent to 5.1 percent. Self-storage played a large role as roughly 300,000 square feet of anchor retail space was converted by the storage industry. The balance of positive absorption can be attributed to pent-up retail demand as occupiers compete for well-located, existing space in a market with limited new construction and increased construction costs. In some cases, landlords have found or will find themselves better off with a replacement tenant than …

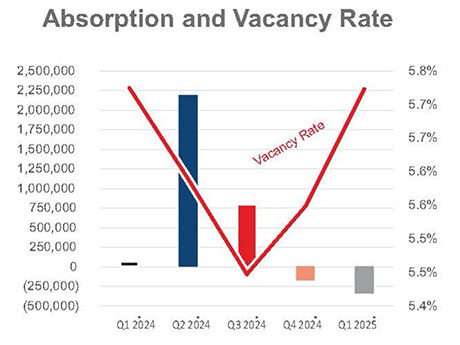

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …