By Joshua Turner, Landmark Commercial Real Estate The commercial real estate market in Wichita and South Central Kansas has shown remarkable resilience and growth in recent years. Following the challenges of the pandemic, the region has not only recovered but is now thriving. Wichita’s central location and business-friendly environment have long attracted investments in retail, office, industrial and mixed-use developments. Prior to the pandemic, low vacancy rates and steady rent growth indicated a strong and promising market. While retail and office spaces experienced temporary setbacks due to shifting work and consumer habits, the industrial sector remained active, fueled by e-commerce demand. The region’s lower costs and pro-business climate helped it weather economic fluctuations better than many larger metro areas. Since 2021, Wichita’s commercial real estate market has experienced an impressive resurgence. The industrial sector is booming, driven by manufacturing, logistics and distribution expansion. Retail has adapted to evolving consumer preferences, with experiential and mixed-use developments gaining popularity. Office spaces are being reimagined to accommodate hybrid work models, offering flexible solutions that meet modern business needs. Wichita’s population has steadily grown over the past decade, reflecting the city’s increasing economic opportunities and high quality of life. Currently home to nearly 400,000 …

Midwest Market Reports

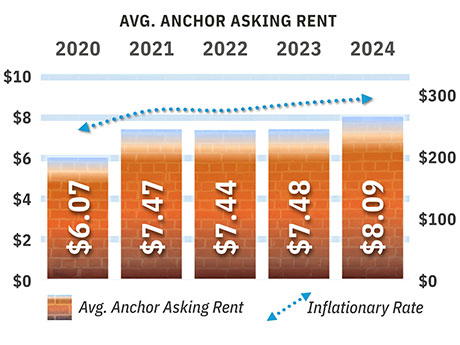

By Duke Wheeler, Reichle Klein Group The ongoing redevelopment of nonfunctional department store structures such as Sears and Elder Beerman, along with the retenanting or repurposing of structures such as Kmart, Giant Eagle and Value City, paved the way for many statistical and actual market improvements in the greater Toledo, Ohio, trade area. This positive trend and message supersede the closing announcements from over the past several months. First, the numbers: The overall retail market vacancy rate improved from 11.5 percent to 8.3 percent over the prior five-year period. This represents approximately 650,000 square feet of positive absorption. Most of this absorption occurred among anchor space, defined for the purpose of this article as space 20,000 square feet or larger. The vacancy rate for anchor space improved from 11 percent to 5.1 percent. Self-storage played a large role as roughly 300,000 square feet of anchor retail space was converted by the storage industry. The balance of positive absorption can be attributed to pent-up retail demand as occupiers compete for well-located, existing space in a market with limited new construction and increased construction costs. In some cases, landlords have found or will find themselves better off with a replacement tenant than …

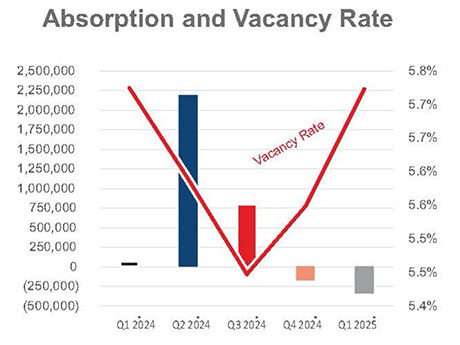

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …

The future of retail is bright for those willing to innovate, says Kathleen Brill, executive vice president and director of leasing and strategic partnerships for East Peoria, Illinois-based Cullinan Properties. “It’s no longer about square footage — it’s about activation,” emphasizes Brill. “Mixed-use, walkability and experience will continue to shape leasing trends.” Grant Mechlin, executive director of retail and multifamily brokerage services for St. Louis-based Sansone Group, says the narrative of retail leasing has shifted from survival to strategy. “Retailers are being more selective about where and how they grow, but there is no slowdown in activity,” he says. “Physical stores remain critical to brand identity, customer acquisition and fulfillment. Looking ahead, we expect to see more hybrid uses, especially where retail blends with wellness, services and entertainment.” Today’s retailers are activating their storefronts and rightsizing their footprints at a time when the cost of construction is at a record high, and many national chains have announced store closures or bankruptcies. The supply pipeline, already extremely thin by historical standards, will be further constrained by rising construction costs, helping limit fluctuations in vacancy rates, states Cushman & Wakefield in its first-quarter retail report. The brokerage firm reports a national vacancy …

By Steven Bauer, Colliers The office towers that define Chicago’s landscape have unique histories and personalities, but not all are created equal in the eyes of the tenant. Buildings seeing the highest demand, classified even higher than Class A, are “trophy buildings” — buildings with high-quality finishes, newer and more efficient construction, and are often amenity rich with exclusive lounges, rooftop decks, fitness centers and private bars. It’s especially important in today’s market to distinguish between the two distinct building categories because while Chicago’s real estate market is a vibrant and complex one, there is more to the story than what you see in the headlines. While the overall vacancy rate in the Loop remains at a historic high above 25 percent, trophy space vacancy is under 10 percent, and demand continues to be robust. The story of flight to quality and flight to trophy assets has been told repeatedly since the COVID pandemic — complete with statistics that back the trend up. In the fourth quarter of 2024 alone, owners of trophy class buildings finalized anchor tenant renewals with Mayer Brown and PwC, both of whom kept roughly the same square footage as they had previously leased. With the …

By Trina Sandschafer, AIA, Project Management Advisors Adaptation and reinvention are core parts of what makes American cities great, and Chicago is a prime example. Whether rebuilding, reimagining space for modern usage or creating new neighborhoods from formerly empty lots, the city has become known for its unique ability to bring new energy and life to formerly underutilized areas. Chicago knows how to reimagine the built environment and is leading the way with several transformative development strategies. Adaptive reuse: A well-tested Chicago tactic Chicago’s long history of adaptive reuse began with the pioneering residential loft developers. In the wake of nationwide manufacturing declines, these enterprising developers saw opportunity in the city’s largely vacant warehouses and manufacturing buildings. The success of these early loft conversions encouraged further reimagining of Chicago’s aging industrial and office stock into condominiums, apartments, offices, entertainment venues and hospitality spaces, which continue to this day. Now, adaptive reuse strategies are helping to increase the supply of housing and restore economic viability to communities dealing with the lingering impact of the pandemic on local businesses. Converting legacy structures to new and better uses is more environmentally sustainable and can be more cost-effective than demolishing older buildings and starting …

By Chris Bruzas, Berkadia After a particularly challenging and unpredictable 2024, marked by continued interest rate volatility and a persistent bid-ask spread differential that contributed to low transaction volume, the Indianapolis apartment market is showing promising signs of stabilization as we move into 2025. Yardi Matrix data highlights Indianapolis’ resilience, posting 2.7 percent year-over-year rent growth in November. This performance is especially noteworthy as it surpasses several popular Sun Belt markets, which have experienced declines, dipping into negative territory. The outlook for 2025 appears more balanced, with new supply moderating to approximately 3,500 units from 2024’s record-breaking 6,500+ deliveries. This timing aligns well with the market’s strong population growth, as Indianapolis expects to welcome 22,200 new residents in 2025, significantly exceeding the historical average of 12,800 annual net movers. Key factors of the population’s growth are due to the presence of reputable universities and colleges, such as Indiana University-Purdue University Indianapolis (IUPUI). Compared with other major metropolitan areas, Indianapolis offers a relatively low cost of living, making it an attractive destination for those looking to maximize their quality of life without the high expenses associated with larger cities. The region’s economic fundamentals remain strong, anchored by transformative projects including Eli …

By Jason Capitani, L. Mason Capitani/CORFAC International The automotive industry and business as a whole have always operated in cycles. Looking back at 2009, when Southeast Michigan faced significant challenges, the region’s recovery in the years that followed shows how resilient the local economy can be. Yet, as we navigate today’s post-COVID landscape, some still hope for a more gradual and stable recovery. Though questions remain about whether Detroit should have seen a market correction years ago, or if electric vehicle programs have artificially propped up the economy, only time will tell. Michigan’s jobless rate hovers around 4 percent, lower than the national average of over 7 percent, marking the lowest level since before the pandemic. The state has added over 450,000 jobs since 2020. While the automotive sector remains dominant, other thriving industries include advanced manufacturing, defense, IT, medical devices, food processing and logistics. 2025 outlook: early weakness with potential for shift Demand for industrial space in late 2024 and early 2025 has been weaker, with net absorption at its lowest since 2021. This dip might signal a shift in the auto industry, with some speculating a return to hybrid or combustion engine production, though these decisions take time …

By Lance Evinger III, Hendricks Commercial Properties In an era where consumers seek more than just products, experience-driven spaces are reshaping the commercial real estate landscape. In Indianapolis, developers and urban planners are increasingly focused on transforming some of the city’s most underutilized yet high-potential areas into dynamic destinations that foster engagement, connection and excitement. Indianapolis boasts a diverse and rapidly evolving commercial real estate market that continues to attract significant investment and development. Key sectors — including office, industrial, retail and mixed-use developments — have experienced steady growth, with a strong focus on adaptive reuse projects and innovative design concepts. The city’s strategic central location, robust infrastructure and thriving convention scene make it a prime destination for businesses and developers alike. Named USA Today’s No. 1 Convention City in the U.S. in 2024, downtown Indianapolis attracts over 10 million visitors annually, a number that continues to grow. In the past year, downtown hotels have set all-time monthly revenue records, fueled by major events like the NFL Combine and NBA All-Star Weekend. At the same time, the Indiana Convention Center has seen a 14.5 percent year-over-year increase in visitors, further cementing the city’s reputation as a top-tier event destination. With …

Developers identify industrial hot spots as areas with low vacancy rates that justify speculative construction. These centrally located sites offer convenient highway access and proximity to a wide labor pool. In the Midwest, examples of industrial development hot spots where demand has remained strong include Chicago, Minneapolis, Columbus and Louisville, according to Steve Schnur, chief operating officer with Chicago-based CRG. He cites these markets because of their affordability, business-friendly environment and robust logistics infrastructure. These areas tend to keep a healthy supply-demand balance, he adds. Luckily for those whose livelihood is tied to the industrial property type, 2025 is expected to bring a return to pre-pandemic demand drivers, according to CBRE’s “U.S. Real Estate Market Outlook 2025.” The brokerage firm states that industrial occupiers will focus on longer-term strategies to improve warehouse efficiency, ensure supply chain resiliency and meet the needs of an evolving consumer base. At the beginning of this year, CRG inked a lease with States Manufacturing for 503,440 square feet at The Cubes at French Lake in metro Minneapolis. The 1 million-square-foot facility, completed in 2024, marked the largest speculative industrial project ever developed in the state, according to the developer. On the other end of the …