By Andy Gutman, Farbman Group Detroit’s office market, like many other large cities across the Midwest, has experienced many shifts — specifically in the office sector. Despite the challenges Detroit has seen over the past few years, the city has also shown great resilience. As companies continue to reconsider and revise their office needs, and workspaces evolve, Detroit is well positioned to capitalize on office occupancy in 2025 thanks to its historical assets, as well as opportunities in the city that are ripe for redevelopment. Tech, transportation and tenacity One of the city’s strengths in the office sector is its potential to rebound faster than many other Midwest cities. Unlike other markets that are overbuilt with more pain coming in the form of downsizing, such as Chicago, Detroit has avoided oversupply and isn’t overburdened with soaring vacancy rates. The city’s office market vacancy rate has slowly declined over the last several quarters — a positive sign for the local market. Detroit has also benefitted from steady and incremental growth, particularly by incubation, innovation and technology-focused tenants. It’s these types of tenants who have assisted in revitalizing the city’s urban core. The market is also characterized by a higher proportion of …

Midwest Market Reports

By Brian Lyss and Joshua Allen, CBRE St. Louis is typical of Midwest markets in that most of its office product continues to age. In fact, 73 percent of existing office supply in St. Louis was constructed before the 1990s. In a post-pandemic environment, users are seeking out amenity-rich prime space. Out of 53 million square feet of office product in St. Louis, 2.6 million square feet is considered “prime” in nature. Prime assets are the newest assets in St. Louis, located in walkable urban areas with an abundance of amenities. In early 2021, during the early stages of the pandemic, prime office availability (21.7 percent) was on par with non-prime (20.5 percent) as the market became increasingly concerned about the future of office use. Over the past 36 months, this surplus of available office has quickly turned into a shortage of prime assets. There has been virtually no new office construction in St. Louis, hitting the lowest levels on record. This fact guarantees that prime office space will remain tight until we see new construction begin to come out of the ground. Even if new construction does commence, the construction and lending environment is such that rates are anticipated …

By Mike Stromberg, Opus Kansas City made the list of emerging industrial markets back in 2016, and over the last nine years has more than proven itself to be a viable, profitable and competitive environment for development. Many rightly attribute the market’s continued growth to its central location within the U.S. as well as its transportation infrastructure, which includes the city’s location on the largest navigable inland waterway, at the cross-section of three interstate highways and in the middle of cross-country rail corridors running from Canada to Mexico and from coast to coast. These are unquestionably appealing features for businesses that want and need to quickly distribute products and access customers. Other qualities often lauded include a strong skilled labor pool with an estimated 2.4 million people — nearly 23 percent between the ages of 18 to 34 — living within a 50-mile radius of the city; a cost of living up to 14 percent lower than the national average; a historically low unemployment rate; and increasing wages above the national average. What really puts Kansas City on the map for developers, though, is how the state of Missouri has created a pro-business environment that leverages and advances these strengths. …

By Garrett Cohoon, Block & Co. Inc. Realtors The commercial real estate activity in the Kansas City metropolitan area showed substantial growth in 2024 for the retail, multifamily and industrial sectors. The office sector is still seeing record vacancy rates, but the annual loss over 2023 is slowing down. According to CoStar, the office vacancy rate for 2024 is up 11.8 percent in Kansas City while the national index is at a 13.9 percent increase. That’s only 0.5 percent higher than last year in Kansas City and we expect to see that trend turn around in the next year. The retail sector saw new brands like Aritzia grow into the Kansas City market. Whataburger opened its 14th location in the past two years as drive-thru restaurants have continued to be a preference for consumers and investors alike. Wellness-based businesses and health clinics have also made good strides in the market. Kansas City has seen an increase in new experiential attractions this year, including national businesses like Puttery minigolf, Andretti indoor karting and SandBox VR. These new attractions have been key to many new development complexes and redevelopments of existing strip centers. Mattel also announced a new adventure park to be …

By Cody Foster, Advisors Excel Topeka, the capital city of Kansas, has a population of approximately 125,000 people, located in a 12-county region with over 531,000 residents. The region’s population has grown over the past five years and is expected to increase by another 2.1 percent between 2023 and 2028. With an unemployment rate of around 3.5 percent as of mid-2024, the city’s economic outlook remains stable, providing a solid foundation for redeveloping key commercial properties — including the West Ridge Mall, the third-largest indoor shopping center in Kansas at 992,000 square feet. Since it opened in 1988, the West Ridge Mall has been a significant part of the city’s commercial landscape. The site features ample parking and anchors the Wanamaker Road commercial corridor, the region’s most significant retail hub, which garnered $1 billion in retail, grocery and dining spending during the past 12 months. However, like many malls nationwide, it faces challenges in a rapidly evolving retail environment. Retail trends: following consumer behavior The West Ridge Mall has seen a steady decline in business and occupancy over the last decade. Anchor stores Macy’s and Sears closed in 2012 and 2018, respectively. Various management companies tried to keep the retail …

By Russ Sagmoen, Isaac Berg and James McKenna, Colliers The greater Milwaukee retail landscape continues to thrive, with notable activity in regions such as Oconomowoc, Grafton, Franklin, Oak Creek and the Racine metro area. Franklin and Oak Creek have experienced steady growth over the past decade and are well-positioned to maintain this momentum. Meanwhile, Racine County has seen a surge of recent activity, largely fueled by Microsoft’s announcement of a $3.3 billion state-of-the-art data center in Mount Pleasant. The Racine/Kenosha I-94 corridor serves as a vital connector between the Milwaukee and Chicago MSAs, enhancing its attractiveness for economic expansion. Market-wide, we are seeing a great amount of activity from local and regional retailers/franchisees and a slowdown from national brands. While there is some activity from national retailers, they tend to be selective about their site choices, highlighting the importance of prime locations and price sensitivity. Because of this, the majority of retail activity is driven by local and regional enterprises. New retail product is scarce, with a lack of new construction due to rising interest rates and increasing land and construction costs. This has resulted in a decline in multi-tenant strip centers, with the bulk of new construction coming in …

By Matt Hunter, Hunter Real Estate Over the past few years, we have seen a noticeable trend in office tenants relocating to new office buildings, particularly in downtown Milwaukee. Notable companies such as Baker Tilly (~40,000 square feet), Old National Bank (~20,000 square feet), CBRE (~15,000 square feet) and Silvercrest Asset Management (~11,000 square feet) have all moved into new office buildings, which are classified as being constructed within the past five years. While these relocations highlight a shift in tenant preferences toward newer buildings, most leasing activity has been observed in recently renovated office buildings. One prime example of this is Baird, which expanded and renewed over 450,000 square feet at 777 E. Wisconsin Ave., reinforcing the demand for renovated office buildings. Other significant leasing transactions include Fiserv, which leased ~160,000 square feet at HUB640; Enerpac’s ~50,000-square-foot lease and Veolia’s ~30,000-square-foot lease at 648 N. Plankinton; Marcus Corp.’s ~50,000-square-foot lease at The Associated Bank River Center; and Allspring Global Investments leasing ~40,000 square feet at 417 E. Chicago St. These transactions further demonstrate the attractiveness of renovated spaces for businesses looking to enhance their operations. This trend reflects a broader “flight to quality” in the office market. Tenants are …

By James Young, JLL Through 2023 and 2024, JLL industrial has seen a historically high number of new leases signed. JLL research saw positive absorption in the third quarter of 2024 at 48,200 square feet, primarily driven by the completion of owner-built projects. This activity, combined with existing occupier commitment to the region and record-high asking rents, points to a thriving market. As the Milwaukee industrial market continues to grow its regional presence, there are a few factors that set it apart from its larger peer cities like Indianapolis or Minneapolis. In this article, we will discuss what is driving regional industrial activity and the market’s strong growth trajectory. Industrial evolution We continue to see wide expansion into the suburban market, though this has not always been the case. Relocating a tenant from an established urban industrial area to a suburban location was often challenging 15 years ago. Such a move could entail workforce relocation, warehouse closures and complex logistical changes that potentially risked business disruption. Today, JLL research shows other large occupiers are not only retaining their spaces in the Milwaukee market but are also actively expanding into suburbs like Waukesha and Menomonee Falls. JLL is tracking 11 build-to-suit …

By Mike Homa, R&R Realty Group Five years later and businesses are still adjusting to the new work environment brought on by the COVID pandemic. Omaha’s office space market is seeing a shift in how companies attract employees back into the office. With remote and hybrid work now widely accepted, developers and employers have realized that providing traditional office spaces is no longer enough to entice workers. Instead, they are focusing on creating environments that offer a blend of professional, personal and recreational amenities, transforming office spaces into lifestyle destinations. To make coming to the office more attractive, developers are offering amenities that cater to employees’ holistic needs. In some office parks, facilities such as onsite daycare centers are becoming a reality. These allow working parents the convenience of dropping off their children close to where they work, reducing commute time and providing peace of mind. It’s an amenity that goes beyond the typical office needs, addressing a significant aspect of employees’ personal lives. Green spaces are another amenity we see being increasingly incorporated into the surroundings of new buildings and broader development areas. We see outdoor spaces in office parks like Fountain Ridge Office Park, which offers amphitheater-style seating …

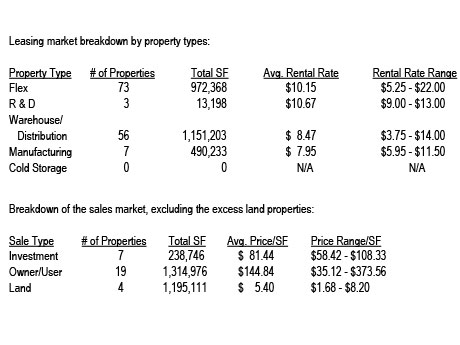

By John Dickerson, OMNE Partners Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year. In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well. Leasing pace Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year. Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.) One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square …