By Louis Suarez, Misty Bowe and Brian Bruggeman, Colliers The Twin Cities medical real estate market has experienced many different phases over the last few years, reflecting the region’s journey toward post-pandemic recovery. Currently, this sector is experiencing a notable shift that is fueled by rising vacancy rates for on-campus hospital properties contrasted with a low vacancy rate of 4.9 percent for off-campus medical buildings. This shift is significantly influenced by the push to outpatient surgery centers, ongoing financial pressures and consolidation trends. Additionally, experts in this region are predicting a scarcity of new medical building supply in 2024, which is expected to exert ongoing pressure on rental rates for existing medical office space, despite the stabilization of interest rates that is anticipated to come later this year. As of the fourth quarter of 2023, the current construction pipeline consists of a mere 84,000 square feet, all of which is spoken for with no additional supply projected to come to market in the next year, which is a nearly 80 percent decrease year-over-year. The dramatic increase in interest rates, rising construction costs and capital constraints have pushed asking rents for new proposed projects to well above $30 per square foot …

Midwest Market Reports

By Kellen Cushing, Carmody MacDonald PC Commercial and residential construction projects are inherently complex undertakings involving numerous parties working under tight deadlines and limited budgets. Change is inevitable and unpredictable in these projects, most often due to changes in project scope, incomplete or incorrect design, and unforeseen physical conditions. When something doesn’t go according to plan, it can impact the other parties’ abilities to perform their jobs in a timely manner and lead to litigation. Claims and litigation can be costly, time consuming and stressful for all parties, and may damage the relationship and reputation of the parties involved. Proper contractual planning among project owners and contractors can reduce the likelihood of litigation. Making preliminary management plans and incorporating them into the project’s contracts provides effective ways to address changes that can occur during a project and keep things moving forward. While preparation cannot always prevent roadblocks in construction projects, preemptive planning can make for much smoother sailing, even in the face of unpredictable circumstances. The best ways to avoid or minimize costly and time-consuming lawsuits include the following: Know your contract. Create a clear and comprehensive contract that defines the scope, schedule, budget, quality and responsibilities of …

By Stephen Daum, Colliers The eyes of the sporting world once again focus on downtown Indianapolis as it hosts the 2024 NBA All-Star Game at Gainbridge Fieldhouse in mid-February. It is anticipated that the game will have a $320 million economic impact to the city. Indianapolis was set to hold the 2021 NBA All-Star Game, but the COVID-19 shutdown forced a postponement until 2024. Similarly, the pandemic also stunted development efforts in the central business district. But like the return of the All-Star Game, downtown development projects have rebounded, with an estimated $9 billion in projects set to be completed over the next few years. In anticipation of hosting the All-Star Game, Pacers Sports & Entertainment finished an extensive $400 million remodel of Gainbridge Fieldhouse, including new seats, expanded social gathering areas, plus the new outdoor Bicentennial Unity Plaza — offering public basketball courts and an ice skating rink in the winter. Overlooking Bicentennial Plaza is Commission Row, a 30,000-square-foot mixed-use, multi-story development. Basketball isn’t the only sport driving downtown development. Indy Eleven, a United Soccer League (USL) franchise headed by local developer Ersal Ozdemir, has begun construction on its expansive Indy Eleven Park. This will be located just south …

By Adam Ferguson, Bernard Financial Group If 2022 was a lesson in how rapidly things can change in commercial real estate, 2023 was an exercise in adaptation for both borrowers and lenders alike. Detroit is no stranger to change or adaptation. From becoming the Motor City and growing into the country’s fourth-largest city during the first half of the 20th century to a renaissance in the 2010s after several decades of bumps and bruises, Detroit continues to add to its storied history. With billions of dollars of investment within the city limits and growing suburban sectors, Detroit’s multifamily market is making significant advancements by adding fresh developments to a market where 38 percent of multifamily inventory is over 50 years old. While certainly not the only catalyst, low interest rates help to spur development. Lower cost of capital is especially impactful in markets like Detroit where building costs are high and rents are low compared with other major markets. Southeast Michigan averaged over 3,800 units of multifamily housing building permits issued per year over the past decade. Compare that to an average of 988 from the decade prior and one can discern the growth in demand for multifamily housing financing …

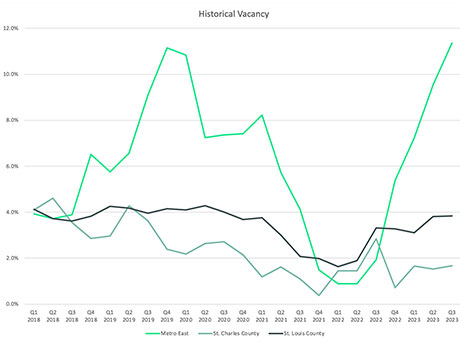

By Matt Hrubes and Joshua Allen, CBRE St. Louis is located at the crossroads of the U.S. at the intersection of I-55 (north/south) and I-70 (east/west), making it a prime location for industrial real estate users and developers alike. The Greater St. Louis area is separated by the Mississippi and Missouri rivers, giving it a natural division of industrial submarkets. Each side of the Mississippi River tells a different story as it relates to industrial real estate. Metro East To the east of the Mississippi River is the Metro East industrial submarket, which was the first in the area to offer real estate tax abatement, resulting in larger industrial developments ranging in size from 500,000 square feet to over 1 million square feet. Over the last decade, this area has seen some of the largest speculative developments in the region from national developers such as Panattoni, NorthPoint and Exeter, as well as local developers like TriStar. Absorption had been at all-time highs with groups like Amazon, World Wide Technology, Geodis, Sam’s Club, P&G and Tesla leasing space as buildings were being completed. That is, until 2023 when a wave of space became available either through sublease, speculative development completions or …

By Nick Fiquette, Sansone Group Lingering effects of COVID-19 In the aftermath of the global pandemic, the St. Louis real estate market finds itself at a crossroads, continuing to see the persistent impacts of COVID-19. Corporate strategies are evolving as companies evaluate their real estate footprints to accommodate the changing work environment and desires of employees. As lease expirations loom, businesses are engaged in a delicate dance of evaluating their physical space needs. The pendulum of work-from-home policies, initially adopted to streamline footprints, appears to be swinging back. Recently, Edward Jones listed a 227,000-square-foot Class A building that it owns on the market for lease and is planning on occupying it instead. This example could serve as a positive indicator for the future of the office market. The market is transforming as companies look to accommodate employee demands, prioritizing safe, walkable areas and amenity-rich buildings. This shift is particularly evident in the struggle faced by commodity real estate, as businesses increasingly gravitate toward locations that contribute positively to the employee experience. As a result, investors are remaining cautious about purchasing office assets due to surging interest rates and uncertainties surrounding the future of the office market. Corporate giants reevaluate real …

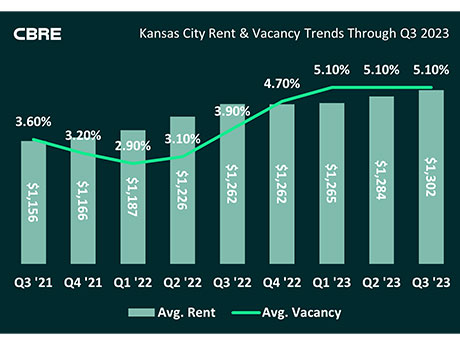

By Max Helgeson, CBRE As the national real estate landscape undergoes transformative shifts, Kansas City has emerged as one of the region’s most attractive multifamily markets. There are a myriad of attributes making Kansas City an unrivaled destination to deploy capital in the heart of the Midwest. Here are six key areas that propel the market to the forefront of real estate investors’ considerations. Economic anchors, diversification Kansas City has one of the nation’s most diverse economies with no sector comprising more than 15 percent of overall employment. A national leader of several durable industries provides unmatched economic stability and significant risk mitigation for investors. Moreover, the metro’s strategic location in the heart of the U.S. and strong transportation infrastructure make it a favored logistical hub for corporations across the world. Finally, the market is a base for startups and entrepreneurs drawn to the area’s abundant talent pool and competitive office space rates. Strategic infrastructure, connectivity Infrastructure is a cornerstone of Kansas City’s rise to prominence. The city’s strategic network of highways, interstates, railways, fiber networks and a major airport not only facilitates connectivity but positions it as a hub for commerce. This strategic infrastructure acts as a magnet, pulling …

By John Faur, Newmark Zimmer The Kansas City industrial real estate market has been on a historical run since 2020 with over 40 million square feet of inventory added in that time frame. This run of new construction has catapulted Kansas City to the 15th largest industrial market in the country by square footage, despite only being the 31st largest MSA by population. During most of this period, the strong market dynamics which exist in Kansas City, such as strategic highway infrastructure, a centralized location, four Class-1 railroads, availability of bulk land sites and an active development community, were further amplified by the low-interest rate climate and record levels of tenant activity. The continued high pace of speculative industrial construction starts in 2022 positioned 2023 to experience a healthy amount of new deliveries, with almost 8 million square feet of speculative industrial space delivering to the market. While the financial markets presented opportunity during this run of growth, continuous rate hikes in 2023 created challenges that resulted in a significant decrease in year-over-year speculative construction starts (3.5 million square feet of speculative construction has occurred year to date in 2023 as compared with more than 13 million square feet in …

By John Bogdasarian, Promanas At a time when the multifamily marketplace is experiencing some turbulence after an extended period of strong growth, some developers, owners and investors are rethinking, repositioning and reworking their approach to a commercial real estate sector that has historically been one of the most reliable investments and dependable asset classes. Current market conditions, however, are not as favorable. A report by The Motley Fool this summer highlighted a 21 percent decline in apartment value. Overbuilding has saturated some markets, contributing to an increase in vacancy rates to around 7 percent and helping push rent growth down to 0.8 percent. In conjunction with persistently high interest rates and increasing delinquency issues with renters, the result is that building a traditional apartment product is a very tricky proposition. Even though the apartment market is somewhat dysfunctional at the moment, there are still plenty of opportunities in multifamily. For thought leaders and forward-thinking commercial real estate investors and professionals, the key is to understand the market, be flexible in your development and investment strategies, and be able to execute an approach that does work in the current marketplace. For those looking to maximize multifamily returns in 2024, there are …

By J. Byron Brazier Equitable development is a knotty concept. In theory, development equity sounds easy and essential. In practice, it’s not clearly defined and not easily sustainable — economically, socially or politically. Equitable development is generally seen as an approach that revitalizes and empowers disinvested communities by meeting residents’ wants and needs, diminishing disparities and spurring economic growth, ensuring residents benefit from such growth and creating conditions for people to live healthy and happy lives. That definition is accurate but incomplete. Equitable development has multiple meanings, some less intuitive than others. Chicago lawyer Danielle Meltzer Cassel says there are three ways to define development equity. The first is the one above, which is the direct model of equitable development. This model rectifies inequality through what development directly produces, such as affordable housing in areas where there’s little or no such housing, good jobs for people who are unemployed or underemployed, greater access to quality healthcare and education, and other resources that allow communities to thrive. There are two other definitions, the indirect model and what Cassel calls the procedural model of equitable development. The indirect model involves real estate developments that do not directly benefit disinvested communities, such as …