By Taylor Williams Architects and general contractors are shaking up the ways in which they design and construct industrial projects in response to financial pressures faced by their clients, an elevated emphasis on sustainability and shifts in how tenants utilize spaces. The nuts and bolts of designing and developing commercial properties are fickle by nature, as they are beholden to consumer preferences, which are in a perpetual state of flux. Yet the current shifts in industrial design and construction practices should not be viewed as indicators of the sector’s waning popularity among investors. “Despite a difficult rate environment that is causing challenges for all sectors of the economy, we have deep optimism about the near- and long-term future for the industrial market in New Jersey and Pennsylvania,” says David Greek, managing partner at regional firm Greek Real Estate Partners. “This region sits amid the most densely populated area in the nation and continues to grow. At the same time, the consumer shift to e-commerce is not nearly complete, creating a dramatic long-term need for logistics facilities to accommodate this historic change.” In other words, industrial is still hot. And the most visible and basic change occurring within the property type — …

Northeast Market Reports

By Taylor Williams No matter your size, market and scope of operation, for retail owners and operators, there is no such thing as total immunity from the likes of e-commerce, COVID-19, inflation and interest rate hikes. But there is such a thing as absorbing those socioeconomic hits in stride, learning and evolving from them and re-emerging on significantly more solid ground. And that is largely the path that the Philadelphia retail market has traversed over the past few years. The timing of the pandemic dismantled the launch of Fashion District, the redevelopment of the former Gallery at Market East Mall that should have ushered in a new scene of experience-based, locally merchandised retail in Philadelphia. Retailers and restaurants along Center City District’s main shopping corridors quickly devised solutions to the global healthcare crisis and were returning to normalcy when bad timing once again intervened. This time, it took the form of the Delta variant, which delayed plans to reopen existing stores or launch new ones and erased some of the positive momentum that landlords and tenants had recouped. For their part, suburban retail properties, many of whose performances were bolstered in the short run by pandemic- driven population influxes, are …

By Taylor Williams For the past several years, including during the height of the pandemic, the Boston retail market has performed well, if unspectacularly. Defined and driven by stable fundamentals in terms of job growth and tenant demand, the state capital’s retail sector has proven itself a reliable environment in which to expand store counts and park long-term money. But few, if any commercial markets and asset classes are wholly immune to the effects of sluggish and disruptive macroeconomic activity. Through no fault of its own, the Boston retail market is seeing its paces of growth slow across the key verticals that are development, leasing and investment sales. That said, seasoned players in this space know better than to panic. Boston remains a dynamic market, despite data from the U.S. Census Bureau showing that the city’s total population shrunk by about 25,000 people, or 3.7 percent, between April 2020 and April 2022. In addition, even in an inflationary economy, Boston consumers tend to retain healthy disposable income levels. A burgeoning life sciences sector that is bringing thousands of well-paying jobs to the city and a steady flow of students and young professionals across its 25-plus colleges and universities lie at …

By Taylor Williams “Numbers never lie; they simply tell different stories depending on the math of the tellers.” Mexican-American poet Luis Alberto Urrea may not have been talking about commercial real estate development and investment when he wrote that line, but the implications of that statement are undeniably applicable to those fields. The use of numerical projections in commercial development and investment is different from employing sabermetrics in sports or using predictive analytics to diagnose illnesses in medicine. Hard costs are what they are, and the formulas that developers and investors rely on to make critical decisions tend to be well-established in their rigidity, even if their inputs can and do change. Respecting the time-tested veracity of these formulas can make the difference between coasting through a down cycle or being crushed by it. Yet this is a world in which complex equations, algorithms and computations increasingly influence key business decisions. And so the ability to accurately forecast, control and manipulate numerical inputs is beyond valuable. Underwriting represents the piece of the real estate development or acquisition process in which these numerical details are shoved under the microscope and relentlessly finagled in hopes of keeping a development or deal alive. …

By Samuel Haydock, business development and client care – environmental services, BL Companies. Connecticut’s industrial past and subsequent decline has left the state dotted by abandoned factories and associated pollution — contaminated soil, groundwater, abandoned buildings and neighborhood blight. The impact can be seen across the state, from urban centers like Waterbury and Bridgeport that have block after block of brownfields to rural communities such as Plainfield and New Milford, where the town was developed around mills or factories that now sit vacant and dilapidated. While Connecticut has led the way in recent years with significant funding for assessment and remediation of brownfields to jumpstart redevelopment, the state still suffers from a reputation as having environmental regulations that thwart investment and growth. How We Got Here The main culprit is an environmental statute known as the Connecticut Transfer Act. Passed in 1985 as a “buyer beware” law to disclose the presence of pollution and protect buyers from unwittingly purchasing cleanup liability, the law has — whether fairly or unfairly — been blamed for the creation of brownfields and the lack of investment needed to revitalize them. Ask any commercial real estate broker about the Transfer Act, and he or she …

By Elliott Pollack, Esq., Pullman & Comley LLC Although COVID-19 resulted in the pumping of significant dollars from the federal government into municipal and county budgets, generally speaking, property tax assessment offices remain understaffed and undertrained. Many assessors recognize these realities and are successful in convincing local leaders to appropriate funds to retain independent contractors to perform various assessment and collection functions. The theory is that these expenditures are non-recurring and are preferable to staffing assessment offices on a full-time permanent basis. As an example, Connecticut assessors almost always contract with certified revaluation companies to perform statutorily required, community-wide revaluations every five years. They contract with these companies because they simply lack the personnel to do the work themselves. In addition, reliance on outside contractors can, to some degree, insulate municipal staff from angry property owners who are unhappy with their new assessments. Another perhaps unplanned benefit to retaining outside contractors is that unless communications with the contractors can be made promptly after new assessments are published, at least in Connecticut, property owners are compelled to resort to judicial remedies to challenge their values. Since court proceedings tend not to conclude for a year or even more, localities obtain the …

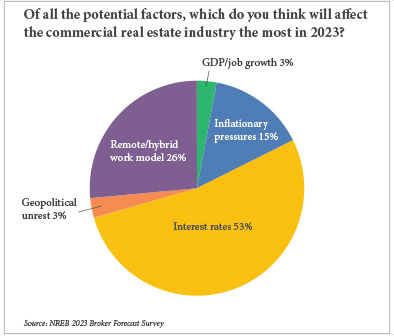

By Hayden Spiess First comes inflation, then come interest rate hikes. The fact that this sequence is a predictable one does not temper the discomfort of reckoning with it, and the commercial real estate industry is as familiar with this pain as any. This familiarity was made clear in the results of an exclusive survey by Northeast Real Estate Business, which was conducted via email toward the end of 2022. Two groups, one comprising brokers and the other consisting of developers, owners and managers, were asked to assess the state of commercial real estate in the region with both retro- and forward-looking perspectives. Of the brokers questioned, approximately 53 percent believed that interest rates would be the factor to affect their industry the most in 2023 (see chart). These individuals selected this option from a list that included other factors such as remote/hybrid work models, inflationary pressures and GDP/job growth, which received 26.5, 14.7 and 2.9 percent of the vote, respectively. The other two options — supply chain constraints and election results — received no votes. Developers likewise identified interest rates as the demographic, political or economic factor likely to cause the most disruption within the industry. An …

By Ben Starr, partner at Atlantic Retail As the retail real estate industry seeks to understand what may lie ahead in 2023, a study of the wild ride it took in 2022 will likely produce the best clues. As early as March of last year, it was clear that 2022 would be a year of activity like none of the prior 15. While headlines through the spring and summer emphasized a run-up in consumer prices and a recession hovering on the back of interest rate hikes, users of retail space intensified their pursuits of new opportunities, unbowed by the looming economic clouds. Everyone — traditional commodity retailers, direct-to-consumer concepts, restaurants, fitness users, medical and other services — was chasing deals. Whether small or large or in primary, secondary or tertiary markets, activity heated up with each new month. Reflecting Larger Trends With its dense middle-class demographics, close proximity to Boston and high traffic counts, Saugus has historically been in high demand among category killers as well as high-profile service and restaurant operators. Though its local mall, Square One, has struggled as larger, more regional malls rose in upscale neighboring markets, the heavily traveled Route 1 corridor has remained one of …

By Ken Colao, president and CEO, CNY Group Whether you’re on the Jersey Parkway or the Turnpike, you’ve undoubtedly driven past commercial buildings and office parks that have stood in the Garden State for decades. But the age of many of these structures is starting to cause problems. Earlier this year, JLL released a report in which the real estate firm estimated that 57 percent of suburban office space nationwide is old enough to be considered functionally obsolete. In New Jersey, specifically, that figure rises to 72 percent, among the highest in the nation. Based on two decades worth of construction experience in New Jersey and New York, CNY Group believes the two most likely outcomes for these structures involve upgrades to true Class A offices or conversion to life sciences facilities. Keeping Offices Intact With a growing number of people migrating out of urban cores, suburban office developers are revitalizing their properties to attract new tenants. When employees began moving away from city centers, employers didn’t particularly follow them, but that trend could change. Businesses will decrease their real estate footprints in urban areas unless costs of occupancy are reduced, safety is maintained and environmental standards and practices are …

By Taylor Williams The New York City retail market is currently functioning like an episode of The Price Is Right. Developers, investors, brokers and operators are all trying to attach fair values to rents and sales prices for spaces of all sizes and submarkets. But after a tumultuous period marked by a global pandemic and record inflation, followed by a string of severe interest rate hikes, accurately assigning those numbers is easier said than done — at least in some submarkets. According to data from JLL, at the end of the third quarter, the average rent throughout New York City was $290 per square foot, down 5.3 percent year over year. That figure represents an improvement from the second quarter of 2022, when rents posted a 12 percent decline on a year-over-year basis. In addition, JLL’s data shows that 58 new leases were signed in the third quarter. While that figure marks a decline of 13 percent from the second quarter, it also constitutes an increase of 7.4 percent on a year-over-year basis. These numbers suggest that after retail leasing and sales completely stagnated in 2020 due to an unprecedented public health crisis, the market corrected sharply in 2021 and …