By Andrew Chused, founding partner, head of investments, Hilco Redevelopment Partners From the nation’s beginning to modern times, Philadelphia has been a bellwether city with a proud legacy of leading the nation to many of its firsts, including the country’s inaugural medical school, library, hospital, business school and stock exchange. In this city of firsts, Hilco Redevelopment Partners (HRP) is unlocking and reinventing a large portion of the city: the former 1,300-acre Philadelphia Energy Solutions (PES) site on the city’s southwest side. Not only is the redevelopment of this site transforming a relic of the city’s industrial age into a new, sustainable economy for the first time, but the project will also transform the way logistics and life sciences companies grow in southwest Philadelphia. An Economic Hub The site, aptly named The Bellwether District, represents a new ecosystem for a variety of tenants, including logistics, e-commerce and life sciences. Located in the shadows of University City and along the Schuylkill River, the project will create over 32,000 jobs and serve as an economic catalyst that drives growth to the city and region for generations to come. Upon its acquisition of the property in June of 2020, HRP quickly began the …

Northeast Market Reports

By Tom Georges, investment sales broker, Northmarq The U.S. economy reported annualized growth of 2.6 percent in gross domestic product (GDP) in the third quarter, thereby avoiding a third consecutive quarter of negative growth. This positive news can be easily tempered by the fact that the growth was greatly affected by trade and inventory numbers, which were skewed as a result of world events like the war in Ukraine. But the news of growth was welcomed in an economy that has been starved for something positive for most of the year. Compounding the economic caution in the absence of sustained economic growth, of course, is the strain that inflation has inflicted on all Americans. In response to 40-year inflationary highs, the Federal Reserve has been forced to react with its primary inflation-countering tool: increasing interest rates. In early November, the Fed raised short-term rates to their highest level since January 2008. Additional rate hikes are anticipated in December, although signals suggest we’ll see increases in smaller increments going forward. Still, amid all the turmoil and uncertainty, several quick service restaurant (QSR) operators continue to roll out expansion plans and report better-than-expected sales and earnings. Restaurant Brands International (NYSE: QSR) recently …

By Lou Coletti, president & CEO, Building Trades Employers Association In the 1930s, the United States was in the throes of the Great Depression. Millions of people lost their jobs, and savings were obliterated overnight. President Franklin Delano Roosevelt seized the opportunity to bring the country back from the brink of economic collapse, creating the Works Progress Administration to put 8.5 million Americans to work building new schools, roads, bridges and water systems. In 2020, the country faced a similar shock to the system as COVID-19 locked down our cities, shuttered businesses and sent entire populations into isolation for months on end, only to contend with a maze of rules and restrictions as the economy reopened. Almost three years later, major metropolises like New York City have an unprecedented opportunity to rebuild both the physical infrastructure and social fabric of their respective regions. Much like in the days of the Great Depression, the construction industry has a key role to play in rebuilding our physical and social infrastructure. This time, however, it’s imperative that we prioritize equity, not only within individual projects but also within the industry at large. The combination of economic upheaval caused by COVID-19 and the …

By Taylor Williams “Negative leverage.” At face value, the term has an undeniably ominous connotation. The first half is an umbrella word for all things adverse and pessimistic, while the second evokes a sense of financial helplessness and dependency, of being permanently hamstrung by creditors. Yet in the context of industrial investment in major markets throughout the Northeast, the term is more synonymous with flexibility and acceptance, as it represents a framework through which deals continue to get done despite the very dicey conditions of the U.S. capital markets. Since the Federal Reserve began aggressively raising the federal funds rates this spring to combat severe inflation, all commercial property types have been hit with softening buyer demand and, consequently, price declines. At the time of this writing, the nation’s central bank had a target range of 3 to 3.25 percent for short-term interest rates, nearly 300 basis points above its stated goal at the beginning of the year. Increases of that magnitude in the cost of debt adversely impact demand across all asset classes, as there are only so many buyers that can pay entirely in cash. Investors that can pay all cash expect — and usually receive — discounted …

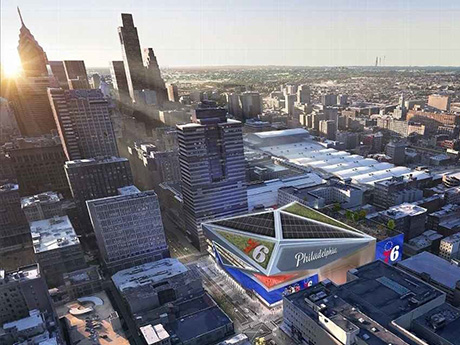

By Taylor Williams Though very much in its infancy, the Philadelphia 76ers’ recent decision to assemble a development team and file a formal proposal for a new arena at the current site of Fashion District Philadelphia has drawn the city’s retail market into speculation on how buildings, operators and streetscapes will be impacted. Known as 76 Place, the $1.3 billion venue would theoretically anchor the Market East corridor that connects Center City to Chinatown and Old City via its location atop the city’s largest public transit hub. The ability to centralize the arrival of fans, shoppers and diners from all cardinal directions, as well as multiple states, automatically sparks excitement for growth opportunities in the world of retail real estate. This project would immediately check that box. “The announcement of the new 76ers arena has generated a lot of discussion in the retail world,” says Steve Gartner, executive vice president at CBRE. “Bringing an arena to downtown Center City, especially one that’s adjacent to a convention center, will allow Philadelphia to hold more concerts and global events, like political conventions, that impact retailers and restaurants. These positive impacts will permeate the fabric of all of downtown.” “The retail community is …

By Jason Penighetti, attorney, Koeppel Martone & Leistman LLC In a far-reaching decision, New York’s highest court has affirmed the rights of tenants under a commercial net lease to protest assessments and reduce their real property tax burden. The ruling reversed a State Supreme Court dismissal of a petition on the grounds that only a property’s owner can file an administrative grievance with the Board of Assessment Review. In a net lease, the tenant is responsible for paying real estate taxes and other expenses stated in the lease. In the matter of DCH Auto vs. Town of Mamaroneck, the Court of Appeals in June 2022 published a unanimous decision stating that tenants contractually obligated to pay real estate taxes and authorized to protest assessments may file tax appeals even when they do not hold title to the underlying real estate. Restoring a Precedent DCH Auto operated a car dealership in a net leased property in Mamaroneck, New York. Its lease with the owner required DCH to pay the property’s real estate taxes in addition to rent. Commercial tenants with this type of lease commonly file tax appeals to correct excessive tax bills and mitigate operating costs. These occupiers include retailers …

By Marc DeLuca, CEO and eastern regional president, KBS Refreshing office properties with updated amenities is a time-tested strategy for infusing buildings with new life and appealing to future and existing tenants. While an asset’s location is a fixed element and a region’s fundamentals tend to change slowly, amenities are more flexible and can usually be implemented quickly if necessary for immediate impact. A recent report by flexible workspace provider TCC Canada found that many companies and their team members increasingly recognize the benefits of gathering teams in a central workplace. But after more than two years of varying degrees of remote work, it makes sense for property owners to invest in amenities that actually meet the needs and wants of office users — which have recently shifted. So which amenities are the best ones to include in today’s office buildings? As an owner and operator of premier office assets for the last 30 years, KBS has witnessed amenity preferences come and go. We know how to spot a passing fad versus a trend with legs. Based on our expertise in this area, here are a few amenities we see attracting office tenants in the current and emerging environment. Scalable …

By Kari Glinski, vice president of asset management, Federal Realty Investment Trust Philadelphia is known for many things, from being the City of Brotherly Love to a city rich in history, art, culture and food. As a result, the region is desirable for many residents and visitors and has been recognized in real estate circles for its housing and retail development opportunities. Throughout the pandemic, greater Philadelphia has lent itself to commuters, residents, tourists and hybrid employers by providing convenient access to other East Coast cities, vast amenities and outdoor recreation spaces, as well as unique dining, entertainment and shopping experiences. Recognizing the need to continue catering to the remote employees, shopping center owners and developers see ample opportunity across the region, specifically within the inner suburbs. In these locations, there is a great mix of diversity, mature employment bases and irreplaceable real estate where developers can continually create long-term value through blended opportunities. Federal Realty has been reinvesting in the greater Philadelphia and Southern New Jersey region for the past decade, strategically transforming our portfolio. Our company focuses on the ownership, operation and redevelopment of high-quality, retail-focused properties, with a mission to deliver long-term, sustainable growth through investing in …

By Taylor Williams As an exceptionally dense, compact market that’s only bordered by land on three sides, metro Boston and its brick-and-mortar retail sectors have long been subject to shortages of quality retail space. Even during the height of the pandemic, when some retailers and restaurants went under and sent vacated space back to the market, prime locations were quickly reabsorbed. As it did nationally during the shutdown of the U.S. economy, rent growth in Boston’s retail market subsided temporarily, only to rebound quickly via pent-up demand. Now, the economy is seemingly on the verge of recession, and consumers’ disposable incomes are being severely stretched by 40-year inflationary highs. Yet Boston’s healthy proportion of young people and strong growth in high-paying industries like tech, healthcare and life sciences still have numerous retail users and brokers feeling bullish on the market. But even the most aggressive and well-thought-out expansion plans can fall flat in the absence of good physical space in which to grow. A Tight Market According to data compiled by Newmark, there is roughly 500,000 square feet of pure-play retail space currently under construction throughout the Boston area. While construction timelines are fluid, the full-service real estate firm estimates …

By Brent Glodowski, director, capital markets group, Avison Young Conditions are looking up for retail real estate investment in New York City. In one sense, “up” is the only way to go for a sector that has been bumping along the bottom of a trough. But with inflation tempering investors’ recent fascination with multifamily and industrial properties, retail also offers opportunities to acquire price-corrected assets when those other property types hover near cyclical peaks. Retail’s Head Start New York’s retail real estate market was already suffering from changing consumer tendencies when COVID-19 arrived and thrust many retailers and their landlords into a full-blown crisis. Even when government-ordered shutdowns eased, remote work policies drained office buildings of the customer bases that had supported swaths of restaurants, shops and entertainment businesses. Home-bound workers became a redistributed daytime population, shifting demand for meal delivery and other retail to new areas. Hundreds of small businesses went under, leaving vacant storefronts in their wake. Some retailers altered business plans to serve shifting customer bases that had developed new, pandemic-influenced consumption practices. Landlords with vacancies to fill turned to traditional strategies, such as relocating tenants from out-of-the-way spaces to fill their most visible storefronts. Property owners …