By Mike Oliver, managing director, JLL Capital Markets Fundamentals remain strong within the multifamily markets of Northern New Jersey and the greater metro New York City area, though the dynamics have continued to shift since the onset of the pandemic. During COVID-19, there was movement away from urban areas toward the suburbs, creating a “tale of two cities” market dynamic. The suburban multifamily market became red-hot while urban markets cooled. Vacancies dipped below 80 percent in some instances, with heavy concessions being offered and flat to negative gross rent growth. Today, while the suburban markets remain very strong, urban markets are also now red-hot. This is attributable to more and more people heading back to urban centers in anticipation of returning to the office or simply wanting to be back in the excitement of downtown living and its dining, shopping and entertainment options. Additionally, many renters are being priced out of and fleeing Manhattan, Brooklyn and other New York City neighborhoods. Jersey City and the Hudson Waterfront provide attractive rental options with incredible access into Manhattan. Jersey City, for example, is demonstrating healthy fundamentals, as occupancy rates are back over 95 percent with strong growth on lease trade-outs. There …

Northeast Market Reports

By Brian Katz (CEO), Amy Staats (vice president), Jonathan Greenberg (director), Adam Caplan (director) and Hugh Scullin (vice president) of Katz & Associates The Northern New Jersey retail real estate market has been flourishing in the post-COVID-19 era. Inventory continues to shrink across the board, with exceptional demand for drive-thru locations and mid-size boxes. Furthermore, the modern, well-anchored neighborhood and power centers seldom have more than one or two small shop vacancies. Some categories in high demand include discount apparel, grocery, food, health and beauty, fitness and medical. Northern New Jersey specifically benefits from its critical mass and its ease of access to main roads and points of entry. Tenants that have been able to refocus and adapt have thrived in a market that already has a lot going for it. Simply put, the post-COVID bounce has been better than we could have imagined, and from a company standpoint, the pipeline of deals that are in the works or have closed has been among the strongest in our history. Leasing Activity Leasing activity is up. Market adjustments aside, leasing activity has pretty much returned to pre-pandemic levels. In some instances, it’s even easier to get deals across the finish line …

By Joe Aquino, president, JAACRES When Barneys New York department store closed in 2020, we saw a dramatic relocation of luxury retail on Madison Avenue to the south, apparently with a common goal of establishing better proximity to East 57th Street. Prior to that event, many luxury brands enjoyed a shop within a shop at Barneys, plus another store on the corridor, usually further uptown. Prior to the COVID-19 pandemic, this stretch of Madison Avenue was so tight for space that we saw East 59th Street, a major side street, securing tenants like Dior, Bathing Ape and Balmain. During the pandemic’s lockdown phases, retail vacancy rose dramatically, even in the most desirable areas. Now, post-pandemic, we see spaces along Madison Avenue getting filled by new and established luxury retailers ready to make a statement. Here are some of the key transactions that have either been recently completed or are in progress: Givenchy just left its cozy quarters at 749 Madison Ave. at the southeast corner of 65th Street to take the southeast corner at 625 Madison Ave. Versace will open in Givenchy’s place this fall. Wolford, a maker of luxury seamless tights, took the Lalique store at 607 Madison Ave. …

By Taylor Williams As the pandemic recedes from the minds and wallets of American consumers, the food and beverage (F&B) industry finds itself embroiled in a host of new financial problems, driven this time by pure economics rather than public health. Inflation and supply chain disruption are working both in tandem and within independent channels to bring new hardships to the sector, mainly in the form of elevated costs and delayed timelines for operating and expanding restaurants of all types. At the same time, F&B owners and operators finds themselves awash with pent-up demand to dine out, drink, socialize and enjoy entertainment attractions and activities. Meanwhile, across the Northeast, quality F&B spaces that went dark during the first 18 months of the pandemic have largely been reabsorbed. That confluence of circumstances encapsulates major incentives and opportunities for landlords to raise rents. Add in the fact that these property owners have in many cases been operating on deferred, reduced or restructured rent payment schedules for much or all of the last two years, and the move to push F&B rents is even more justifiable. For owners of traditional retail product — from power centers to neighborhood strip malls to single-tenant, net-leased …

By Taylor Williams Industrial brokers and developers throughout New Jersey and Eastern Pennsylvania are flush with tenant demand, but the frenetic pace and frequency at which revenues and costs change in this market has introduced a whole new set of operating challenges. In terms of the supply side of the market, developers of industrial product, like those of every other property type, have been squeezed by supply chain disruption. Prices and lead times for ordering key materials change radically and often without warning. Developers who try to circumvent these obstacles by ordering way earlier than normal in the process now run an increased risk of having to take delivery of supplies without having all permits and sources of construction financing in place. Such a misfire in timing can create lags in delivery, potentially alienating tenants needing turnkey space and generating additional short-term costs via storage of the materials before construction begins. In addition, misaligning these timelines can spook potential investors that want the certainty of knowing that a project is moving forward. “We’re buying supplies a year in advance and trying to sync up deliveries of those materials with when we expect to have full project approval,” says Peter Polt, …

By Becky Bedwell, vice president of development, Cottonwood Group As one of Boston’s fastest-growing and most dynamic areas, the Seaport District has gotten a lot of attention as it has undergone a multitude of transformations over the past 150 years. The area has evolved from a bustling railyard and shipping area in the early 20th century to a no-man’s land of parking lots in the 1990s to its most recent iteration: The Innovation District. While the spotlight is only growing brighter as several high-profile residential and mixed-use projects come on line in this distinctive and in-demand neighborhood, the headlines tell only part of the story. The Seaport District’s seemingly sudden emergence is the result of more than a decade of development and over $22 billion in public funding — efforts that have helped draw hundreds of new businesses and support a growing list of noteworthy developments. The challenges faced and opportunities realized by developers in this part of town reveal some important truths about what it takes to create great civic spaces and successful multifamily developments — not just in this city and this area, but in urban communities around the country. What follows are some best practices, consideration and …

By Joel Marcus of Marcus & Pollack LLP New York City has published three tax-year assessments since COVID-19 swept into our world. The New York City Tax Commission and New York City Law Department have had ample opportunity to reflect and refine their thinking on those assessments. The disease broke out in Wuhan, China, in late 2019 and soon spread around the world. Most of New York City noticed its impact in February and March of 2020 as businesses shut down at an accelerating rate, warranting government mandates and additional closures. So, what did New York City do for the 2020-2021 tax year? It significantly raised tax assessments. The Tax Commission and other review bodies refused to base their valuations upon the devastating catastrophic effects of COVID-19 that had ravished the city. Why do this? The answer is technical. New York City values real estate on a taxable status date, which is Jan. 5 each year. On Jan. 5, 2020, COVID-19 did not exist in assessors’ evaluation process. Nor did it exist in the review of assessments later in the year. Employment restrictions, mask mandates and lockdown requirements made it impossible to operate theaters, hotels, restaurants and many other businesses. …

By: Jamie Rash, Regional Director, Keystone Development + Investment Talk about a spark. When Spark Therapeutics announced plans at the end of last year to develop a $575 million gene therapy manufacturing plant in Philadelphia, it ignited the city’s evolution into a destination for the largest, most innovative life sciences firms in the world. Over $1 billion in venture capital (VC) investment is pouring into more than 50 Philadelphia life sciences companies that employ some 20,000 people, generating unprecedented demand for lab space. Supply is limited — even with 1 million square feet of lab space in development — and this supply shortage is driving some developers to capitalize on the demand by converting existing building stock. Moving Beyond Meds & Eds Philadelphia is a long-reputed “meds and eds” city, meaning it’s home to anchor institutions of higher learning and world-leading medical facilities that are known for innovation and opportunity. These institutions are major drivers of economic growth throughout the city. Previously, much of the activity in pharmaceuticals and biotechnology occurred in labs in suburban office parks and sprawling corporate campuses. In 2017, the city celebrated two cutting-edge, FDA-approved gene and cell therapies to treat specific types of cancer and …

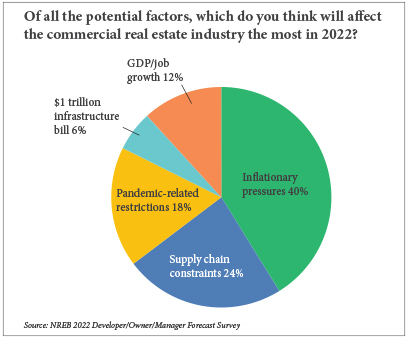

By Taylor Williams In late October of last year, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Northeast Real Estate Business’ annual reader forecast survey, commercial brokers and developers/owners in the region aren’t likely to be contributing to that fund any time soon. Inflation Could Linger When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, roughly a third of broker respondents selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. Concerns over pandemic-related restrictions on businesses, which adversely impact demand for space, was a close second among broker respondents. Some brokers elaborated on these views in the free-response section of the survey. “Continued inflation will …

By Clara Wineberg, principal and executive director, SCB Boston As we have all been forced to reexamine how we interact with and live in our homes during two years of a global pandemic, lessons learned for architects, developers and interior designers have been bountiful. In early 2020, those of us in the multifamily industry were wary about how we would make it all work; now, however, we realize the challenges we have faced in the last 24 months have provided immense opportunities to improve design of modern housing communities. In 2022 and beyond, multifamily design will continue to evolve to meet the changing definition of “home,” and how it connects us to our loved ones, communities and even ourselves. Everything From Home While home used to be just a place to hang one’s hat at the end of the day, in 2020, home took on a whole new meaning. It became not only the place we rest, but also our workplace, our children’s classroom, our fitness center and our entertainment venue. Our whole lives were — and to some extent still are — encapsulated within our homes. We expect this trend to continue moving into the future post-pandemic world. The …