By Ashish Vakhariya, Marcus & Millichap Detroit’s retail market continues to show pockets of strength amid broader economic and retail sector headwinds. More affluent northern suburbs and the revitalizing urban core have demonstrated greater resilience, while limited construction activity should support the backfilling of existing space. Detroit’s position among the highest-yielding metros in the country will likely remain a key draw for investors, with capital focusing on well-located, necessity-based and service-oriented retail assets. Big-box downsizing and rising cost pressures create a cautious leasing environment: Detroit’s retail landscape recorded more than 1 million square feet of negative net absorption over the nine months that ended in March, with preliminary second-quarter figures indicating continued space relinquishment. Strained consumer demand and structurally challenged retail formats have contributed to a wave of bankruptcies and consolidations among major tenants, including Party City, Big Lots, Macy’s and Walgreens. Trade policy uncertainty has further heightened tenant caution, as elevated input costs are expected to weigh on leasing activity. A recent Michigan Retailers Association survey found that more than 60 percent of businesses statewide rely on imported goods. With consumers more price-sensitive, many retailers may struggle to pass on higher costs; however, tenants reliant on locally sourced inventory …

Market Reports

— By Will Moss of MMG Real Estate Advisors — After a turbulent stretch marked by oversupply and softening rents, Salt Lake City’s multifamily market is showing signs of stabilization in early 2025. Demand is returning, rent declines are easing and investor confidence is on the rise, all pointing to a market that may have found its footing. “We’re not calling a full recovery just yet,” says Will Moss, sales agent at MMG Real Estate. “But what we’re seeing is a return to fundamentals, steady demand, measured construction and buyers who are ready to transact again.” In first-quarter 2025, net absorption reached 1,044 units, outpacing the 894 units delivered and marking the first time in over a year that demand exceeded new supply. Over the past 12 months, approximately 4,500 units were absorbed, well above the metro’s historical average. Demand Rebounds, But Challenges Linger Salt Lake City mirrors national trends where improved economic confidence and easing inflation have begun to unlock pent-up housing demand. Notably, demand has been strongest among mid-tier renters, though even luxury properties, despite being the main source of new supply, posted a 1.8 percent rent increase year-over-year. Still, rents overall declined 0.3 percent annually, continuing a …

By Eric Jacobs, chief global growth officer, Aimbridge Hospitality With different verticals and geographic hotspots driving continued travel and performance potential in hospitality properties, investments in these assets should be on the radars of forward-thinking investors. A resilient market that was most recently challenged by the COVID-19 pandemic, the hotel sector continues to be an area of curiosity and consideration for investors looking for their next opportunity. At the start of the year, hotel transaction volume was projected to rise by 15 to 25 percent nationally, according to JLL’s Global Hotel Investment Outlook report for 2025, with institutional capital flowing back into the sector. While this projection hasn’t come to fruition, exploration of hospitality deals is ongoing, and the most prepared investors and developers are keeping fingers on the pulse of markets that will generate returns in the future. Enter Houston. A current standout market and one to watch, the city’s unique demand drivers, performance metrics and positioning within the larger Texas market have created fertile ground for hotel investment. Convention Disruption Brings Opportunity One of the most significant factors behind Houston’s surge today is the simultaneous renovation and expansion of convention centers in Austin, Dallas and Fort Worth. These …

The Charlotte industrial market continues to display resilience in 2025, navigating a national slowdown with more stability than a lot of other markets. While economic headwinds and record supply volumes have created challenges nationally, Charlotte’s fundamentals remain anchored by consistent tenant demand, especially for Class A space under 200,000 square feet. As vacancy stabilizes and rent spreads narrow between asset classes, a clear flight to quality trend is reshaping how tenants prioritize space and make leasing decisions throughout the region. In first-quarter 2025, Charlotte recorded just over 1 million square feet of net absorption, maintaining positive momentum while absorbing the wave of speculative deliveries over the past several years. Fifty-six percent of all leases signed in the first quarter were for Class A space — the highest percentage recorded for Class A product since 2016, according to research from Avison Young. This stands out in light of the significant volume of new construction deliveries that have come on line vacant in recent years. With the rent premium between Class A and B product narrowing, tenants are increasingly seizing the opportunity to relocate into newer, more efficient facilities. The tenant-in-the-market (TIM) pipeline tells a compelling story. More than 12 million square …

By Maria Davis and Colton Rupprecht, R&R Real Estate Advisors In the real estate industry, customer expectations around office space have undergone a significant shift — both in what they need and what they want. It’s not just about square footage anymore; it’s about how that space functions, feels and aligns with the values of the companies who occupy it. This transformation is playing out in three critical areas: the rise of small, amenity-packed spaces; a surge in outdoor-focused design that brings the comforts of home into the workplace; and a more rooted and interactive approach to sustainability. Smarter spaces As more companies return to in-office work, many are rethinking how they use space — prioritizing flight to quality. Increasingly, customers are gravitating toward compact offices that offer high-impact amenities rather than expansive square footage. These smaller footprints are more efficient, but they also demand more thoughtful design and planning. Technology is key in amenity designing, as efficient developers are integrating infrastructure that anticipates the needs of a tech-forward workforce. Whether it’s bracketing out spaces for high-speed fiber and built-in video conferencing hubs or artificial intelligence (AI)-powered building systems that manage lighting, the design is important in making a more …

— By Jason Koch and Adam Riddle of MMG Real Estate Advisors — espite recent challenges, the Denver multifamily market is showing clear signs of a comeback. With new supply beginning to taper off, demand accelerating, and investor confidence returning, 2025 is shaping up to be a year of renewed opportunity for multifamily owners and investors. Momentum Is Building Behind the Numbers After a year of downward pressure, Denver’s multifamily market is beginning to turn the corner. First-quarter 2025 recorded net absorption of 2,544 units, a 170 percent jump from the prior quarter indicating a surge of renter demand. Over the past 12 months, absorption reached 9,200 units, the highest total since 2021. MMG Managing Director Jason Koch notes, “Demand is back. Lease-ups are moving more quickly, especially for quality, well-located product. It’s clear that renters still want to be in Denver.” While average rent is down 3.4 percent year-over-year, the first quarterly uptick in nearly a year suggests the bottom may already be behind us. At $1,813, Denver remains one of the strongest-performing rental markets in the Mountain West, particularly in suburban pockets where new supply is limited. High-Quality Product Leading the Charge Much of the recent absorption has …

By Tom Kucharski, CEO of Invest Buffalo Niagara When Ralph Wilson selected Buffalo to be the home of the new Bills franchise in the American Football League in the 1950s, it was one of the nation’s 10 highest populated cities, making it a natural fit. However, a general shift around the country away from traditional manufacturing as a major base for economic activity, combined with a number of other factors, led to a decline in the city’s employment and population bases in the ensuing decades. Over the past 25 years, Buffalo has reversed that trend, emerging as a city on the rise. The region recently saw its first population growth in over 70 years, according to the 2020 census. That growth has been spurred by a diversification of the local economy, attracting businesses in industries such as advanced manufacturing, food processing and life sciences. Companies were especially enticed by the region’s low cost of doing business and affordable energy supplied by the nearby Niagara River. A key to maintaining that momentum has been Buffalo’s self-reinvestment, including massive redevelopment projects centered around reclaiming the city’s waterfront district. The first wave of these efforts began about a decade ago. Specifically, prior to …

Charlotte’s multifamily market is turning a corner after a once-in-a-generation supply wave that introduced 19,000 new apartments into the metro area in 2024. While rent growth will be muted for most of the year as the market continues to absorb the new supply, the dynamic will shift toward the end of 2025, putting landlords back in the driver’s seat. Record-low new apartment starts this year, combined with steady population growth and an economic climate that favors renting over owning will boost leasing activity in the second half of the year — and may even produce rent growth for the first time since 2022. Fundamentals in play Like many other Sun Belt cities, Charlotte has been on a joyride of growth stemming from in-migration since the COVID-19 pandemic. The city’s population expanded 2.2 percent between 2023 and 2024, making it one of the fastest-growing markets in the Southeast. Another 56,000 new residents are expected to move in by the end of the year, according to research from Berkadia. The long-term forecast for population growth is even rosier: the Charlotte Regional Business Alliance forecasts the metro population will surge by 50 percent over the next 25 years, driving demand for housing. Tariff …

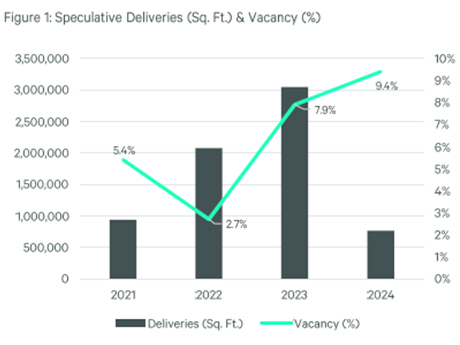

By Harrison Kruse and Ned Turner, CBRE As we near the second half of 2025, the Des Moines industrial market is starting to see a shift in fundamentals, as new deliveries and the pipeline of new big-box speculative warehouse product have come to a complete halt. Like many cities in the upper Midwest post-COVID, the Des Moines MSA saw an influx of out-of-state developers backed by institutional capital go ground up with new big-box product when the economy was stimulated by the Federal Reserve reducing the federal funds rate below 1 percent. This resulted in historically compressed treasury yields and an abundant amount of liquidity injected into the capital markets. This effect on the national economy escalated consumer demand for e-commerce and locally, ag-related products, which are the state of Iowa’s most valuable export on an aggregate basis. The Des Moines MSA between 2021 and 2024 had more than 6.8 million square feet of new industrial space delivered to the market, which is about 10.2 percent of the total market size on a square-foot basis. During those years, net absorption increased on an annual basis between 800,000 and 1.5 million square feet. Pre-COVID, Des Moines’s average net absorption was between …

— By William (Bill) Froelich of Colliers — s of first-quarter 2025, Oahu’s industrial market remains one of the tightest in the nation — but signs of softening are emerging. Our 41.9 million square foot market reported a vacancy rate of 1.2 percent, the highest in over two years, up from 0.9 percent in fourth-quarter 2024 and a near-record low of 0.6 percent in third-quarter 2023. Net absorption was negative at -115,001 square feet in first-quarter 2025, marking the fifth quarter of negative net absorption in the last six. Despite this, direct weighted average asking base rents reached a new high of $1.56 per square foot per month, reflecting continued landlord leverage in a market with severely constrained supply. Industrial operating expenses also rose, averaging $0.54 per square foot monthly, pushing our gross rents over $2.00 per square foot. Raw Land Market: A Race to Buy Before It’s Gone In a typical year, Oahu absorbs 10 to 20 acres of raw industrial land. But in a short period between the end of 2021 and the first half of 2022, over 100 acres had traded, driven by high-profile acquisitions such as Amazon’s 50-acre purchase and Costco’s 45-acre site purchased for almost …