— By John K. Jackson of Colliers Phoenix — Casa Grande, Ariz., stands at a pivotal juncture that could see it transition into a Tier II retail market this year. Phoenix’s Greater Metropolitan Area has been characterized by historically low retail vacancy rates, prompting retailers and developers to explore opportunities outside the urban core. Casa Grande’s strategic location less than 50 miles south of Phoenix Sky Harbor International Airport makes it well-positioned to capitalize on this migration. The Dynamics of Casa Grande’s Growth Casa Grande has experienced notable growth in recent years. It was the seventh fastest-growing U.S. city in 2021, experiencing a remarkable 24 percent population increase since 2016. This growth, paired with job creation across sectors, is attracting major employers, including Lucid, LG Energy Solution and Kohler. These three firms promise to collectively bring more than 6,400 jobs to the area. Such economic development lays a solid foundation for retail expansion. After all, a growing workforce typically leads to increased consumer demand. The significant investments being made in the area further bolster Casa Grande’s potential as a retail hub. Lucid has recently expanded its manufacturing complex to 4 million square feet, with plans for additional land acquisition to support …

Market Reports

A notable shift in the way we live, work and play has occurred since the pandemic — one that emphasizes efficiency, multi-functionality and convenience. The result has been an increase in the demand and popularity of mixed-use developments. Developers love them for their efficiency. Investors love them for their diversity. And consumers love them for their ability to achieve said live-work-play trifecta all under one roof. Within Orange County, South Coast Metro stands out as an area that fosters this type of urban development, blending retail, multifamily, office and cultural assets in a way that fosters economic growth and community engagement. Adjacent to John Wayne Airport, this 2,500-acre district shows how strategic development can create a self-sustaining urban environment. A Retail Powerhouse with Expanding Opportunities South Coast Metro is arguably most known for being the home of South Coast Plaza. The West Coast’s largest luxury shopping destination saw record annual sales exceeding $2.3 billion in 2023. While luxury retail remains a major draw, the broader South Coast Metro caters to a diverse range of shopping experiences, which includes the boutique-driven OC Mix and SoBECA District, as well as major national retailers. This variety underscores a key trend in commercial real estate: …

Raleigh-Durham’s office market entered the year on a positive note as 2024 ended strong. Vacancy was largely flat in the fourth quarter, net absorption neared 300,000 square feet and move-outs were sparse. After years of uncertainty and short-term renewals dominating the landscape, companies are now committing to longer leases. Clarity around business drivers, a growing labor pool and new market entrants are all contributing factors to this decisive turn. Firms are confidently making long-term real estate decisions, bringing lease terms back to the five- to 10-year range. While the vibrancy of the pre-pandemic era has not fully returned, data shows a steady recovery throughout 2024, and 2025 is poised to bring even stronger growth. In 2024, Raleigh-Durham welcomed several notable commitments from companies establishing a foothold in the market, like Jewelers Mutual, JTL and Amgen. Leasing activity stayed strong through the fourth quarter, supporting the net absorption of nearly 160,000 square feet of office space over the course of the year. Rents have seen some downward corrections overall, but well-located, highly amenitized assets have retained rent stability. Recent recommitments from major companies like Nutanix and Hitachi highlight the area’s enduring appeal. Vacancy closed out December at 17.3 percent but was …

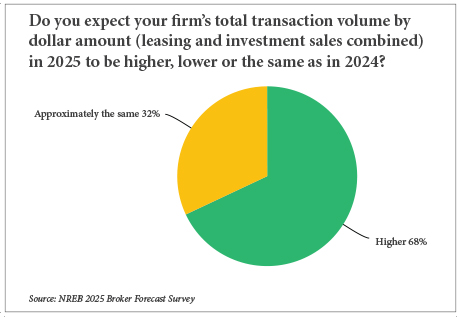

By Taylor Williams They may not be ready to do cartwheels and pop champagne, but when it comes to business expectations for 2025, commercial real estate professionals in the Northeast have a decidedly brighter outlook than in recent years. The last two years have been defined by barriers to economic growth on numerous levels. Pick your post-COVID geopolitical or macroeconomic poison — stubborn inflation, crushing interest rate hikes, multiple wars, restarting of global supply chains — all culminating with an incredibly heated U.S. presidential election. Is it any wonder that “survive till ’25” became the rallying cry of the commercial real estate industry? And while 2025 has arrived, the election has been decided and the Federal Reserve has strung together a series of small, yet meaningful cuts to short-term interest rates, the hangover from the aforementioned disruptors has not fully evaporated. Donald Trump’s return to the Oval Office brings a fresh slate of questions about how certain policies — namely tariffs and mass deportations — will impact business at both the national and local levels. And the expectation-smashing December jobs report proved sufficient to immediately pause the Fed’s would-be pattern of rate cuts. And it’s only been one month. As …

— Scott Hintze and Marti Weinstein of Diversified Partners Commercial Real Estate — Phoenix’s retail development market is seeing a surge in optimism as the city benefits from a growing economy and a shift in political leadership. With the new administration coming into power, the outlook for the Phoenix retail market has become increasingly positive, promising a wave of new projects and investment opportunities in the coming years. The city’s rapid population growth, expanding infrastructure and bustling job market have positioned Phoenix as one of the most attractive cities in the U.S. for retail development. The new administration has brought a renewed focus on urban development, job creation and business-friendly policies, which is expected to help stimulate both demand for retail spaces and the construction of new commercial properties. Government support, including incentives for developers and tax breaks for businesses, is anticipated to foster a thriving retail sector that will benefit both local residents and national retailers looking to expand into the area. Several projects we have been working on have seen unprecedented demand from tenants. We recently completed a 25,000-square-foot building across from Gilbert Mercy Hospital that includes a two-story Starbucks, the first in the market. In addition to …

The secret is getting out about Apex, a western suburb of Raleigh that also lies 20 miles south of Chapel Hill. In 2018, Realtor.com ranked the city as the No. 1 fastest growing suburb in the United States. This was aided by the master planning of local homebuilder/developer ExperienceOne Homes, which debuted its large-scale Sweetwater residential development in 2016. The allure of Apex didn’t stop there as the local schools within the Wake County Public School System have long been considered top-notch. As more and more families moved to the once-sleepy town, the need for community-serving retail became apparent. And not just any sprawling shopping center would suffice. Retail Strategies of N.C. Inc., on behalf of development partner The Kalikow Group, a multifamily and mixed-use development firm based in Westbury, New York, and the aforementioned ExperienceOne, set out to create a sense of place that would resemble village towns in Northeast states such as Maine and Massachusetts. What all of these hamlets have in common is they are built up over decades around a town center, thus the idea of Sweetwater Town Center was established. East Side The “hard part” was essentially in the rearview mirror as ExperienceOne had already …

By Brian Lyss and Joshua Allen, CBRE St. Louis is typical of Midwest markets in that most of its office product continues to age. In fact, 73 percent of existing office supply in St. Louis was constructed before the 1990s. In a post-pandemic environment, users are seeking out amenity-rich prime space. Out of 53 million square feet of office product in St. Louis, 2.6 million square feet is considered “prime” in nature. Prime assets are the newest assets in St. Louis, located in walkable urban areas with an abundance of amenities. In early 2021, during the early stages of the pandemic, prime office availability (21.7 percent) was on par with non-prime (20.5 percent) as the market became increasingly concerned about the future of office use. Over the past 36 months, this surplus of available office has quickly turned into a shortage of prime assets. There has been virtually no new office construction in St. Louis, hitting the lowest levels on record. This fact guarantees that prime office space will remain tight until we see new construction begin to come out of the ground. Even if new construction does commence, the construction and lending environment is such that rates are anticipated …

— By Brett Polachek of Newmark — Phoenix’s multifamily market experienced dynamic shifts in 2024, driven by strong population growth, economic expansion and single-family cost of ownership. Phoenix remains a top relocation destination, with a population growth rate of 1.8 percent (+85,000 residents), nearly double the national average of 0.98 percent. This influx is supported by the addition of more than 52,000 jobs from October 2023 to October 2024. Phoenix also has the fifth healthiest rent-to-income ratio among 30 major U.S. markets that we sampled. Demand for multifamily housing reached record levels, with 14,528 units absorbed annually, marking the strongest performance since 1994. The supply experienced an annual increase of 6.4 percent as 19,835 units delivered last year. The far West Valley submarkets of Avondale, Goodyear and West Glendale led supply growth, adding 6,100 units to their inventory. The market showed resilience despite this historic supply wave. Occupancy rose 1 percent year over year to 93.7 percent, while Class B units clocked in a 94 percent occupancy rate. This was followed by Class A at 93.8 percent and Class C at 93.2 percent. These figures remain slightly below pre-pandemic levels, but they reflect a strong recovery trajectory. Asking rents in …

For all Top 50 NMHC third-party management firms, the subject of managing rising operating costs is a topic that has come to be front and center in many recent client conversations. “As 2025 budget discussions were taking center stage toward the end of 2024, our clients increasingly highlighted the issues of rising operating costs,” says Lisa Narducci-Nix, director of business development at Drucker + Falk. “This trend”, she adds, “underscores our need for strategic planning and cost management to navigate the continued challenges ahead.” The multifamily sector is facing unprecedented headwinds as operating costs continue to rise, driven by factors ranging from inflation and labor shortages to increased insurance premiums and energy expenses. As a result, multifamily operators are working to find ways to maintain profitability while providing quality living spaces for their residents. “In this challenging environment, it is clear to us that adapting to these rising costs will require a multifaceted approach — one that blends innovation, strategic marketing, operational efficiency and technological adoption,” says Narducci-Nix. Challenges of rising costs Across its 11-state footprint spanning over 42,000 units, Drucker + Falk has seen operating costs for many of its managed assets surge in recent years. The supply chain …

By Mike Stromberg, Opus Kansas City made the list of emerging industrial markets back in 2016, and over the last nine years has more than proven itself to be a viable, profitable and competitive environment for development. Many rightly attribute the market’s continued growth to its central location within the U.S. as well as its transportation infrastructure, which includes the city’s location on the largest navigable inland waterway, at the cross-section of three interstate highways and in the middle of cross-country rail corridors running from Canada to Mexico and from coast to coast. These are unquestionably appealing features for businesses that want and need to quickly distribute products and access customers. Other qualities often lauded include a strong skilled labor pool with an estimated 2.4 million people — nearly 23 percent between the ages of 18 to 34 — living within a 50-mile radius of the city; a cost of living up to 14 percent lower than the national average; a historically low unemployment rate; and increasing wages above the national average. What really puts Kansas City on the map for developers, though, is how the state of Missouri has created a pro-business environment that leverages and advances these strengths. …