Atlanta’s office market feels like a story of winners and losers. Tenants continue to pay increasing rents for the best located, highest-quality spaces while the sector overall experiences negative office absorption. Those big, shiny objects, so to speak, offer quite a contrast to the results of continued office sector adversity brought on by reduced office attendance, a downsizing leasing trend and swelling sublet space. Who’s in the best position to win? Well-capitalized owners with stabilized debt (or none) that can meet the increasing tenant demands for skyrocketing tenant improvement costs and other rental concessions. With continued construction cost increases and downward pressure on base rental rates, fiscally sound landlords with longer-term business plans are in the best position to transact. And, of course, the newest buildings with the best location, amenity package and a reasonable commute for the majority of the workforce continue to thrive. CoStar Group reports that during the past 12 months, net absorption in office buildings completed before 2020 was negative 4 million square feet compared to 1.1 million for newer properties. The Atlanta office market has produced some sizable transactions this year, fueling some optimism among landlords with larger blocks of space for lease. The most …

Market Reports

— By Ryan Sarbinoff, first vice president and regional manager, Marcus & Millichap — Phoenix ranks third among the major markets in terms of both total net in-migration and job creation since the end of 2019. The region has also posted one of the largest jumps in median household income. Combined, these factors underpin heightened demand for housing and support elevated multifamily development. While total deliveries will rise for the fourth consecutive year in 2024 to a record high of 22,000 rentals, apartment absorption has notably kept pace through mid-year. As such, metro-wide vacancy is on track to dip to 7 percent by December. This would mark both a 30-basis-point decline from the 2023 peak, as well as an 18-month low. The improving alignment of supply and demand will encourage a return to rent growth, albeit slight. The average effective rent will end 2024 at $1,585 per month, up from the year before but down 5.3 percent from the peak set in 2021. Apartment completions over the past year (ending in June) were most prevalent in the Avondale-Goodyear-West Glendale submarket, where a collective 5,200 units opened. This represented a 23.8 percent boost to existing stock. Yet, the substantial wave of openings …

By Russ Sagmoen, Isaac Berg and James McKenna, Colliers The greater Milwaukee retail landscape continues to thrive, with notable activity in regions such as Oconomowoc, Grafton, Franklin, Oak Creek and the Racine metro area. Franklin and Oak Creek have experienced steady growth over the past decade and are well-positioned to maintain this momentum. Meanwhile, Racine County has seen a surge of recent activity, largely fueled by Microsoft’s announcement of a $3.3 billion state-of-the-art data center in Mount Pleasant. The Racine/Kenosha I-94 corridor serves as a vital connector between the Milwaukee and Chicago MSAs, enhancing its attractiveness for economic expansion. Market-wide, we are seeing a great amount of activity from local and regional retailers/franchisees and a slowdown from national brands. While there is some activity from national retailers, they tend to be selective about their site choices, highlighting the importance of prime locations and price sensitivity. Because of this, the majority of retail activity is driven by local and regional enterprises. New retail product is scarce, with a lack of new construction due to rising interest rates and increasing land and construction costs. This has resulted in a decline in multi-tenant strip centers, with the bulk of new construction coming in …

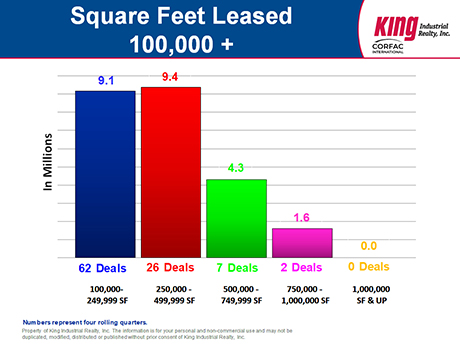

As the Atlanta industrial market continued its slowdown as of the end of the second quarter in 2024, there were three main stories to consider. First, the biggest news was that the Atlanta industrial market experienced four quarters of negative net absorption of 8.8 million square feet during this past year (we have had five quarters in a row.) At the same time in 2023, we reported 17.2 million square feet of positive net absorption, and in 2022, we reported 42.7 million square feet of positive net absorption, so these latest negative absorption numbers were a huge drop from the previous positive absorption numbers. The second biggest news story was that the Atlanta industrial market saw a dramatic slowdown in big-box deals. There were only nine transactions that were consummated over the past four quarters that were 500,000 square feet or larger, and none of those deals were over 1 million square feet. In contrast, in 2023, 21 big-box transactions were completed that were over 500,000 square feet, and 11 of those deals were 1 million square feet or larger. The year-over-year decline was 15 million square feet less. The third biggest news story was that the new construction …

— By Shawn Jaenson, executive vice president, Kidder Mathews — Reno’s industrial market has demonstrated remarkable resilience in the face of challenging economic conditions. Despite such uncertainties, the region has maintained a strong industrial presence, showcasing its ability to adapt and thrive. Overall, the market delivered more than 22 million square feet of new construction since the start of 2020 and has experienced more than 50 percent rent growth over the same period, rising from $0.55 (triple net) in fourth-quarter 2019 to $0.84 at mid-year 2024. As the nation grapples with inflation, supply chain disruptions and shifting consumer behaviors, Reno’s industrial sector has managed to effectively weather these challenges. The city’s strategic location and pro-business environment have positioned it as a critical logistics and distribution hub. These factors have allowed local businesses to remain competitive, even as national economic pressures mount. Sales activity has seen a recent uptick with four major sales occurring in the second quarter of this year. Prospect Ridge bought the four-building, 893,632-square-foot Airway Commerce Center from Tolles Development; CapRock bought a 707,010-square-foot building from Manulife; and Pure Development sold two buildings – one with 354,640 square feet and the other with 322,400 square feet – to Exeter …

Interviews by Jessica Johnson and Abby Lestin Big deal, little deal or no deal? In a hypothetical survey among several dozen women who work in commercial real estate that examines the significance of their growing segment of industry leadership, answers would likely run the gamut of those three options. The answer is subjective, of course. But regardless of individual sentiments, there can be no denying that commercial real estate does currently have a strong cast of experienced, capable women in leadership positions, and there is little reason to think that trend will slow or backtrack in the future. At France Media, the Atlanta-based parent company of Texas Real Estate Business, we see this pattern manifest in multiple forms. Our conference division, InterFace Conference Group, hosts dozens of industry events every year with panel discussions that routinely feature women in prominent speaking roles. We see more announcements about advocacy groups within the industry that are largely devoted to women and their occupational advancement and achievements, as well as launches of companies owned and led by women. And we count a growing contingent of women among our regular editorial sources and contributors. This isn’t just some initiative driven by diversity, equity and …

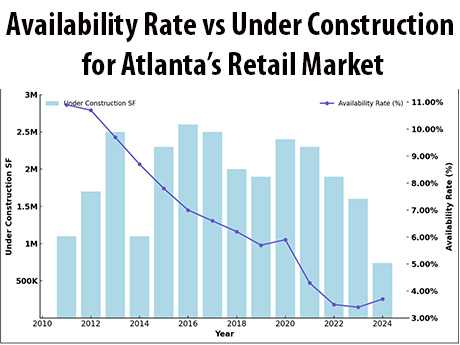

The Atlanta retail market continues to thrive with significant growth driven by a combination of strong demand, minimal new construction and low inventory levels. Long regarded as a key hub for commerce in the Southeast, metro Atlanta has seen its population increase rapidly over the years, which has, in turn, bolstered retail demand. As a result, Atlanta’s retail availability has hit record lows and has created a competitive market for tenants looking to secure high-quality spaces. Rental rates have increased, and investment sales volume has continued at a healthy pace as tenants vie for a limited amount of inventory. Rising rents, investment sales One of the standout trends in Atlanta’s retail market is the consistent increase in rental rates. Retail rents in the metro area have grown steadily over the past few years, with average rents rising from $21.07 per square foot in first-quarter 2023 to $22.83 per square foot by third-quarter 2024. This represents an impressive 5.2 percent year-over-year growth, significantly outpacing the national average of 2.4 percent. The city’s growing population and economic development have spurred greater demand for retail spaces, especially in high-traffic areas. Retailers are willing to pay premium rates to secure space in desirable locations, …

— By Roxanne Stevenson, senior vice president of Colliers — Reno’s retail market saw a dip in net absorption and a slight uptick in regional vacancy toward the middle of 2024. Tenant demand began to moderate this year after the robust leasing activity of 2022 and 2023. Vacancy reached a record low at the beginning of the year, dipping to 3.8 percent in the first quarter, though it now sits just above 4 percent. When analyzing the state of Reno’s retail market, there are several categories to consider: Tenant Activity Strong tenant demand, particularly in food and beverage, automotive,fitness and experiential concepts, should continue to stabilize the market. Reno has seen a handful of existing tenants expanding, as well as new entrants in recent years. Trader Joe’s opened its second location in South Reno and intends to plant a third flag in northern Sparks. Bob’s Discount Furniture and Twin Peaks are also opening their first locations in Northern Nevada at Redfield Promenade. Other notable and active tenants include Miniso, In-N-Out Burger, Starbucks, Dave’s Hot Chicken, Panera, Ace Hardware and Einstein Bros. Bagels. A few tenants, however, have shuttered their doors. There were three 99 Cents Only locations that filed bankruptcy …

By Matt Hunter, Hunter Real Estate Over the past few years, we have seen a noticeable trend in office tenants relocating to new office buildings, particularly in downtown Milwaukee. Notable companies such as Baker Tilly (~40,000 square feet), Old National Bank (~20,000 square feet), CBRE (~15,000 square feet) and Silvercrest Asset Management (~11,000 square feet) have all moved into new office buildings, which are classified as being constructed within the past five years. While these relocations highlight a shift in tenant preferences toward newer buildings, most leasing activity has been observed in recently renovated office buildings. One prime example of this is Baird, which expanded and renewed over 450,000 square feet at 777 E. Wisconsin Ave., reinforcing the demand for renovated office buildings. Other significant leasing transactions include Fiserv, which leased ~160,000 square feet at HUB640; Enerpac’s ~50,000-square-foot lease and Veolia’s ~30,000-square-foot lease at 648 N. Plankinton; Marcus Corp.’s ~50,000-square-foot lease at The Associated Bank River Center; and Allspring Global Investments leasing ~40,000 square feet at 417 E. Chicago St. These transactions further demonstrate the attractiveness of renovated spaces for businesses looking to enhance their operations. This trend reflects a broader “flight to quality” in the office market. Tenants are …

By Ben Reinberg, CEO, Alliance Consolidated Group of Cos. In late September, Texas-based software company Dell became one of the latest major companies to announce a full return-to-office (RTO) mandate. In a leaked memo to employees, Bill Scannell, the company president, wrote, “As we enter a new AI world, in-person human interaction will be more important than ever.” Just a few weeks later, Amazon announced a full RTO policy. And over the summer, Meta, the parent company of Facebook, informed employees that remote team members would not be eligible for promotions. These RTO announcements from major organizations have dotted the web for years following the pandemic, leading many investors to hope for a slow-but-steady march back to busy office buildings and revitalized downtowns throughout the Lone Star State. The actual data, however, tells a much different story. Reports on Texas’ commercial real estate markets indicate that nearly a quarter of all office space is vacant nearly four years after the pandemic. According to CommercialEdge, Dallas’ office vacancy rate is 22.9 percent, and Austin’s is 27.8 percent. Workforce trends reflect a similar situation. Austin was named the No. 1 metro for remote workers in 2023 by Coworking Mag, with nearly a …