By Ben Reinberg, CEO, Alliance Consolidated Group of Cos. In late September, Texas-based software company Dell became one of the latest major companies to announce a full return-to-office (RTO) mandate. In a leaked memo to employees, Bill Scannell, the company president, wrote, “As we enter a new AI world, in-person human interaction will be more important than ever.” Just a few weeks later, Amazon announced a full RTO policy. And over the summer, Meta, the parent company of Facebook, informed employees that remote team members would not be eligible for promotions. These RTO announcements from major organizations have dotted the web for years following the pandemic, leading many investors to hope for a slow-but-steady march back to busy office buildings and revitalized downtowns throughout the Lone Star State. The actual data, however, tells a much different story. Reports on Texas’ commercial real estate markets indicate that nearly a quarter of all office space is vacant nearly four years after the pandemic. According to CommercialEdge, Dallas’ office vacancy rate is 22.9 percent, and Austin’s is 27.8 percent. Workforce trends reflect a similar situation. Austin was named the No. 1 metro for remote workers in 2023 by Coworking Mag, with nearly a …

Market Reports

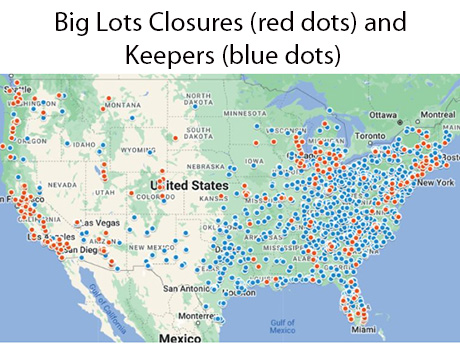

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

— Jason Hallahan, associate of Colliers Reno — Northern Nevada’s office market has shown continued resilience in 2024 as the region has seen robust tenant demand, fewer sublease availabilities and evolving market trends. Though Northern Nevada experienced an influx of vacant space that hit the market in the middle of the year, year-to-date tenant demand has been largely positive. Robust absorption in the first and third quarters of 2024 has driven annual net absorption to more than 77,500 square feet. While many larger office markets felt an immediate impact at the onset of the pandemic, Reno’s office market began to see the wave of sublease space hit the market at the start of 2022 — nearly two years later. At its peak in the first quarter of 2023, available sublease space accounted for 28.2 percent of all available space on the market. Northern Nevada’s sublease market has continued to shrink over the past two years as the total square footage recently dropped below 90,000 square feet. This is less than one-third of the 2023 peak, which was 303,000 square feet of available sublease space. This loss of sublease space is due to large sublease suites being occupied by new subtenants, …

By James Young, JLL Through 2023 and 2024, JLL industrial has seen a historically high number of new leases signed. JLL research saw positive absorption in the third quarter of 2024 at 48,200 square feet, primarily driven by the completion of owner-built projects. This activity, combined with existing occupier commitment to the region and record-high asking rents, points to a thriving market. As the Milwaukee industrial market continues to grow its regional presence, there are a few factors that set it apart from its larger peer cities like Indianapolis or Minneapolis. In this article, we will discuss what is driving regional industrial activity and the market’s strong growth trajectory. Industrial evolution We continue to see wide expansion into the suburban market, though this has not always been the case. Relocating a tenant from an established urban industrial area to a suburban location was often challenging 15 years ago. Such a move could entail workforce relocation, warehouse closures and complex logistical changes that potentially risked business disruption. Today, JLL research shows other large occupiers are not only retaining their spaces in the Milwaukee market but are also actively expanding into suburbs like Waukesha and Menomonee Falls. JLL is tracking 11 build-to-suit …

By Josh Wheeler, senior vice president of development & acquisitions, Stonemont Financial Group The Dallas-Fort Worth (DFW) metroplex remains at the forefront of industrial growth in the United States. According to CommercialEdge, the market boasts a pipeline of 15.7 million square feet under construction as of June 2024 after several large deliveries were completed in the first half of the year. Following several years of explosive growth caused largely by the rise in e-commerce during the pandemic, the market has cooled due to economic headwinds. Tenants are taking longer to make decisions about their spatial needs. Construction has slowed after almost 18 million square feet of space was delivered in the first half of the year, including Stonemont’s 565,000-square-foot industrial park in Wilmer, just outside the metro area. As a result, vacancy rose to 11 percent in the third quarter of 2024. The market has continued its 14-year-long trend of positive absorption, though 2024’s year-to-date absorption is 6.5 million square feet below last year’s number. However, there is ample reason to remain bullish on DFW and to view the market as well-positioned to maintain its status as one of the country’s leading industrial powerhouses. Trends remain favorable for the market, …

In our state of the market overview article in Southeast Real Estate Business October 2023, we defined three challenges in the metro New Orleans multifamily market. These are interest rates, inflation and insurance — or as we dubbed them “the three I’s.” Not to be redundant; however, a year later these elements are still very much factors in the current market and continue to define how multifamily assets are acquired, sold, financed and developed. There is, however, reason for optimism as each of these defining elements has diminished, albeit not completely, from where they were 12 months ago. Interest rates — On Sept. 18, the Federal Reserve reduced short-term rates by 50 basis points — the first reduction in four years. More importantly was the decline in the rate of the 10-year Treasury yield, which is what most multifamily loans are priced from. As of this writing, the 10-year Treasury yield was at 3.76 percent, the lowest it has been in the past 16 months. A further reason for optimism is the fact that the Fed has indicated the potential for four rate cuts next year. There is also the anticipation of further clarity in the capital markets once the …

— By Ben Galles, senior vice president of CBRE — Interest rates have been the biggest factor for Reno’s multifamily market this year, reaching some of the highest levels seen in a long time. The market for multifamily properties in Northern Nevada has been slow to adjust to the new lending environment, with sellers unwilling to price assets at a rate of return that would provide most buyers with positive leverage. In other words, the interest rate on loans used to purchase many of the current listings is higher than said property’s cap rate. Multifamily sales volume in Northern Nevada is down 14 percent compared to the same time last year. One of the major drivers for the drop in sales volume is that only three deals have secured bank debt, with the average loan to value (LTV) of those loans being roughly 48 percent. While cash transactions have represented more than 58 percent of the transactions, a large percentage of deals have involved owner financing. Some owners who needed to move their assets over the past 12 months found that offering below-market interest rate owner financing was a significant selling point. Many of the deals that closed with owner …

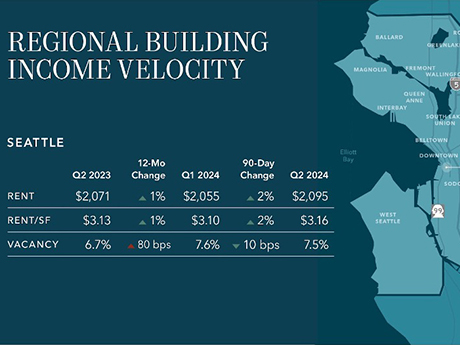

— By Dylan Simon, executive vice president, Kidder Mathews — This summer marked a major milestone in Seattle’s apartment market, demonstrating signs of vibrancy with increases in rental rates, growing liquidity and clarity in pricing in capital transactions. The city is gaining momentum and continues to bounce back from recent market fluctuations and the harsh impacts of the pandemic. Urbanization is here to stay — corporate employers are voting against Zoom as an effective tool — as we trend back toward human nature, which requires community and proximity. With limited new construction breaking ground, the stage is set for sustained rental rate growth, which will invariably result in a surge in sales prices. Transaction Activity on the Rise Transaction activity is steadily on the rise in Seattle’s multifamily market, proving conviction from the investment community. This uptick offers greater clarity on property values as the market adjusts from peak interest rates back in fall 2023. For owners and potential sellers, this shift suggests pricing hit a bottom in the past nine months and the only direction in pricing from here is upward. In our recently launched third-quarter Seattle market report, we’ve uncovered key sales insights that underscore this resurgence. During the …

By Mike Homa, R&R Realty Group Five years later and businesses are still adjusting to the new work environment brought on by the COVID pandemic. Omaha’s office space market is seeing a shift in how companies attract employees back into the office. With remote and hybrid work now widely accepted, developers and employers have realized that providing traditional office spaces is no longer enough to entice workers. Instead, they are focusing on creating environments that offer a blend of professional, personal and recreational amenities, transforming office spaces into lifestyle destinations. To make coming to the office more attractive, developers are offering amenities that cater to employees’ holistic needs. In some office parks, facilities such as onsite daycare centers are becoming a reality. These allow working parents the convenience of dropping off their children close to where they work, reducing commute time and providing peace of mind. It’s an amenity that goes beyond the typical office needs, addressing a significant aspect of employees’ personal lives. Green spaces are another amenity we see being increasingly incorporated into the surroundings of new buildings and broader development areas. We see outdoor spaces in office parks like Fountain Ridge Office Park, which offers amphitheater-style seating …

By Taylor Williams The concept of cap rates is an interesting phenomenon when you stop to think about it. Short for “capitalization rate” and calculated as net operating income (NOI) divided by sales price, this all-important real estate metric represents a page borrowed from Wall Street’s playbook, a savvy maneuver by investors to create a vehicle of asset valuation and apply it to select securities on a widespread basis. The circumstances of the metric’s inception are largely unknown, but all that matters is that the real estate industry has successfully propagated the use of cap rates as a crucial mechanism to underwriting and pricing transactions for these assets. And the most basic thing to know is that to a point, sellers like low cap rates because they reflect high purchase prices, and buyers prefer high cap rates for the opposite reason. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Yet for all their ubiquity, cap rates are fluid, representing snapshots of valuations at random points in time. Tenants move out, leaving spaces vacant, and a property’s …