The Memphis office market continues to defy national post-pandemic office trends, fueled by persistent occupier demand and limited amounts of vacancy within primary submarkets. Although, the market closed out the 2023 year with 34,430 square feet of occupancy losses caused by two large tenant vacancies, the first quarter of 2024 reversed the trend as net absorption swung positive, recording 140,788 square feet of occupancy gains. The Memphis unemployment rate remained low at 3.5 percent in May, just above the Tennessee unemployment rate of 3.0 percent and below the national average of 4.0 percent, according to data from the U.S. Bureau of Labor Statistics. Ford Motor Company’s Blue Oval City began its hiring in 2023, with most of its hiring to occur in the second half of this year, which could begin to further compress the unemployment rate, as approximately 5,600 direct jobs are estimated to be created in West Tennessee. The company leased 42,910 square feet of office space on the edge of the Memphis office market. The auto giant plans to use the new space as a training facility. Additionally, the Elon Musk-led xAI company announced Memphis as being the new home for its “Gigafactory of Compute,” claiming to …

Market Reports

By Todd Pease, Michelle Klingenberg and Britney Aviles, JLL Since the Cincinnati office landscape upended during the pandemic, area businesses, building owners and broader leaders sought opportunities to help entice employees to return to the office, reclaim the area’s vibrancy and spur economic growth. These stakeholders realized that to entice employees back into the office, they would need to make it worth the commute. Throughout this evolution, one thing continues to drive tenants into office buildings: high-quality amenities. Amenity demands have changed over the last few years and there are new ways for building owners to create spaces that engage employees. Amenities of the past Up until 2020, the standard “five days in the office” model meant that office buildings strived to accommodate as many professionals as possible while maintaining efficiency. The space planner was the lead consultant on planning offices, and they would work with tenants to design spaces in a way that most efficiently accounted for their company headcount. Regarding office amenities, tenants most valued high parking ratios, conference facilities, gyms and locker rooms, and onsite food options. It was all about productivity and it didn’t matter if productivity took place in a gray cubical under florescent lighting. …

Metro Detroit’s retail market is characterized by strong tenant demand and investors’ eagerness to acquire and backfill vacant properties. In the downtown area, the revitalization efforts and adaptive reuse developments that started well before the pandemic continue. In fact, this year marked Detroit’s 100th commercial demolition, accelerated by $95 million in American Rescue Plan Act funding. Over the past five years, the City of Detroit has invested $1 billion in preserving or developing more than 4,600 affordable housing units. The hard work is paying off. Between July 2022 and July 2023, Detroit experienced population growth for the first time since 1957, according to the U.S. Census Bureau. A major highlight this year was the reopening of the long-abandoned train station, Michigan Central Station. Ford Motor Co. redeveloped the property in the city’s Corktown neighborhood into a 30-acre technology and cultural hub. Until Aug. 31, the first floor will be open for “Summer at The Station,” where visitors can take self-guided tours and enjoy food and beverages outside. This fall, the first commercial spaces will begin opening to the public. Meanwhile, developer Bedrock topped off construction of its Hudson’s project, the redevelopment of the former J.L. Hudson’s department store site. General …

— By Holly Chetwood, Retail Specialist, TOK Commercial — The Boise MSA retail market had one of its strongest quarters on record with net absorption reaching 559,000 square feet at the end of March of this year. Multiple big-box spaces were backfilled in the first 90 days of the year including the former K-Mart and Gordmans spaces in Nampa as well as both Bed, Bath, and Beyond locations in Boise and Meridian. In addition, the highly anticipated Scheels opened its first Idaho store at Ten Mile and I-84 in Meridian. Along with a healthy level of net absorption, nearly 100 transactions were recorded, the highest number of deals seen in a quarter since 2021. The top five deals of the quarter were all over 25,000 square feet, however, leasing activity continues to be primarily driven by tenants in spaces below 2,000 square feet. These deals have accounted for 52 percent of transactions over the past 12 months. As demand stayed high, vacancy continued to tighten throughout the first 3 months of the year. Total vacancy ended the quarter at 4.4 percent, its lowest level in nearly a year. The majority of submarkets are seeing vacancy remain between 2 to 4 percent. …

— By Candice Chevaillier, CCIM, Principal, Lee & Associates | Pacific Northwest Multifamily Team — Absorption still lags supply in the Seattle MSA contributing to higher vacancy and flat rents. In Q1 2024 3,000 units were delivered, yet only 2,800 were absorbed. Vacancy is stabilizing at 6.9 percent this quarter and then is expected to trend down starting in Q3, finally allowing meaningful growth in rents. Construction costs remain high and options for financing limited, curtailing new development. This is creating demand for existing value-add acquisitions. 2024 and 2023 sale volume in the Seattle MSA is still a trickle of what it was in 2022 and 2021, shifting Cap Rates slowly upwards. This trend is expected to be short-lived. As interest rates finally begin to fall, and rents begin to rise, investors who catch this inflection point will prevail from best pricing and benefit while more conservative capital sits on the sidelines.

— By Brad Umansky, President & Head Coach, Progressive Real Estate Partners — Occupancy and lease rates have continued to trend higher throughout Southern California’s Inland Empire retail market as a lack of new construction combined with strong retail demand has kept vacancies near record lows. Looking ahead, factors affecting the market are 99 Cent Only’s bankruptcy, the substantial slowdown in sales activity, and the minimum wage increase to $20/hour for fast food workers. Occupancy & Lease Rates Occupancy is currently reported at 94.3% by Costar, but removing spaces 10,000 SF or larger, results in occupancy of 97.2% which demonstrates the lack of available shop space. In my 30+ years of working in this market, I have never seen such a lack of options for shop tenants. As a result, when shop spaces become available owners are mostly commanding a higher lease rate than what the previous tenant was paying. 99 Cent Only Bankruptcy Dominates Recent Activity Since April, when 99 Cent Only declared bankruptcy and promptly decided to liquidate all 371 stores in the chain, industry participants have been analyzing these locations. As of June 2nd, it has been determined that Dollar Tree is acquiring 170 of the …

— By Alex Muir, Senior Vice President, Lee & Associates | Seattle — As we near the halfway mark of 2024, capital markets activity in Seattle remains slow. The year has largely consisted of price discovery and waiting for interest rates to drop. With that said, the sales volume for office assets has nearly surpassed the 2023 total. Four transactions over $30 million have occurred year-to-date, all of which are larger than any deal last year. These sales are emblematic of the type of deals that are driving investment activity, with three being owner-user acquisitions — Alaska Airlines, Costco, Seattle Housing Authority — and the fourth involving a loan assumption. Distressed sales are occurring more frequently as well, with several buildings in downtown Seattle trading below $150/SF. While it has yet to materially impact vacancy, there are signs of life in the leasing market. Pokémon recently signed a lease for 16 floors in The Eight, an under-construction tower in the Bellevue CBD. This is the largest lease in the market in three years. Other tenants, such as ByteDance and Snowflake, have signed leases larger than 100,000 SF, as a new wave of tech companies grow in the market. With the …

By Charlie Adams and Walker Adams of NAI Brannen Goddard Industrial real estate in Atlanta is in limbo as of the second quarter of 2024. Certain submarkets in Atlanta have been overbuilt and tenant demand with historically active users (third-party logistics, wholesale, e-commerce, etc.) has decreased in comparison to what was seen over the last four years. As a result of the space grab during COVID-19, many logistics tenants are sitting on excess inventory within their buildings. Consumer demand has cooled, increased interest rates have dampened the economy as a whole and rents have risen 14.5 percent year-over-year, according to CBRE’s most recent report. The impact of these headwinds for traditional industrial (warehouse and distribution) real estate is positive. Developers haven’t had the fundamentals allowing overbuilding to a point of hyper-supply. Industrial construction starts have been few and far between over the past 12 months, and we believe this lack of new supply will keep Atlanta’s fundamentals healthy through this limbo we’re currently experiencing. With 4 million square feet of net absorption in first-quarter 2024 and 15.9 million square feet under construction, we should see 2025 vacancy in line with current vacancy, assuming absorption continues at a similar pace. Therefore, …

— By Vanessa Herzog, SIOR, CCIM, Principal, Lee & Associates | Seattle — Industrial markets in the Pacific NW are adjusting to new parameters but remaining steady. Vacancy rates are hovering around 7% in the 6-county region along the I-5 corridor (Arlington to Vancouver, WA). Leasing activity slowed in the first quarter but started picking up as we progress through the second quarter. New construction is active with permitted projects, but the regional project pipeline is diminishing, not due to demand, but due to high land price expectation, stabilized rental rates and continued high costs of new construction. We think this trend will continue well into 2025 leaving Developers and Land Sellers frustrated. Regionally, large land parcels are difficult to find or assemble, leaving Developers looking at infill assemblages, land use changes or full site redevelopment. IOS specialized properties are slowing in demand from Tenants. Finally, we are seeing the small owner user facilities for sale or lease, and the demand from this user group level off. Here are some statistics: Total Inventory at 398M SF, Current Vacancy rate 7% (27.8M SF), Market Asking Rates $1.12/SF/Mo., Sublease Space 20% of total vacancy (5.6 M/SF): New Construction underway 9.9M SF. Demand …

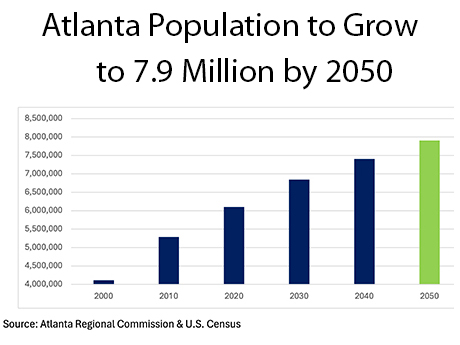

By Will Mathews and Mike Kidd of Colliers What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration. Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons. 7.9 Million by 2050 According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of …