By Derek Jacobs of Avison Young Through the financial uncertainty and confusion of the past four years, Raleigh-Durham has stood out as an exemplary industrial market that has strengthened in economic diversity and stability despite greater national and global market trends and challenges. The outlook for Raleigh-Durham is very positive thanks to local and state governments that support business, an excellent central East Coast location and a market environment where industrial demand heavily outweighs supply. Triple-net rents in Raleigh-Durham grew by nearly 39 percent since first-quarter 2020, while total vacancy has remained below 4 percent. The most affordable Class C product has an exceptionally low vacancy rate of 2.7 percent due to lower rent costs outweighing the opportunity costs of moving into a nicer, newer building that will be more expensive in most cases. The newest and most costly Class A industrial product in Raleigh-Durham has also shown strong demand, with a vacancy rate (5.7 percent) lower than the vacancy rate for all industrial product classes combined across the country (6.1 percent). Industrial occupiers and residents in Raleigh-Durham work, do business in various industries and provide services that supply further market growth. Around half of the industrial property in Raleigh-Durham …

Market Reports

— By Dave Cheatham, President, Velocity Retail Group and X Team Retail Advisors — Phoenix’s retail market has rebounded post-pandemic and is now considered a winning bet, along with industrial and multifamily. The market has benefitted from surging consumer demand, population expansion and a robust technology industry, largely fueled by accelerated growth in the chip manufacturing sector. Strong and positive economic performance has established a foundation on which retailers have built success across the Valley of the Sun. There are challenges, to be sure, which range from interest rate hikes and rising inflation to chaos in the capital markets and reduced investment transaction volume, in addition to increased construction costs. New construction has been limited, as evidenced by the fact that no Target, Lowe’s or Home Depot stores have been built in the Valley since the recession. That appears to be changing as plans for big box stores that had been idle for a decade are shifting to expansion mode once more. Second-generation space is in high demand due to the higher costs of building new, standalone stores. Market indicators are trending upward for the retail sector. Vacancies are at a record low, demand remains high and rents are continuing …

By Adam Ferguson, Bernard Financial Group If 2022 was a lesson in how rapidly things can change in commercial real estate, 2023 was an exercise in adaptation for both borrowers and lenders alike. Detroit is no stranger to change or adaptation. From becoming the Motor City and growing into the country’s fourth-largest city during the first half of the 20th century to a renaissance in the 2010s after several decades of bumps and bruises, Detroit continues to add to its storied history. With billions of dollars of investment within the city limits and growing suburban sectors, Detroit’s multifamily market is making significant advancements by adding fresh developments to a market where 38 percent of multifamily inventory is over 50 years old. While certainly not the only catalyst, low interest rates help to spur development. Lower cost of capital is especially impactful in markets like Detroit where building costs are high and rents are low compared with other major markets. Southeast Michigan averaged over 3,800 units of multifamily housing building permits issued per year over the past decade. Compare that to an average of 988 from the decade prior and one can discern the growth in demand for multifamily housing financing …

InterFace Panel: Macroeconomic, Institutional Market Obstacles Hinder Retail Supply Growth in Austin

By Taylor Williams The Austin retail market is in dire need of more quality space, but between the newfound volatility in the U.S. capital markets and longstanding local policies that have hamstrung commercial developers in the state capital, delivering that space is no easy feat. The city’s remarkable growth story is well-documented. Big Tech has made Austin its home away from home, spearheading what was a 33 percent increase in population between 2010 and 2020, according to the Austin Chamber of Commerce. But the paces of growth of housing and infrastructure — two crucial prerequisites for retail development — haven’t kept up with the surging head count. In addition, the Austin bureaucracy is notorious for slow-moving entitlement and permitting processes, at least in the eyes of Texas developers who have done business in zone-free Houston or certain municipalities of Dallas-Fort Worth that make it a point to fast-track new projects. These issues at the local level have merged with debt market disruption on the national circuit, rendering a scenario in which the process of financing and building new retail space is fraught with headaches, delays and pitfalls. The number of ways in which new projects can be killed in action …

— By Blake Bozett, founder and CEO, The Zett Group — The Boise metro (Boise, Eagle, Meridian, Garden City) is made up of 75 licensed assisted living facilities, 42 of which have more than 30 licensed beds. Of those 42 assisted living facilities, the ownership type is made up of: national owner/operator (18), local owner/operator (12), REIT (4), regional owner/operator (3), local development company (2), privately held real estate investment firm (1), 1031 investment platform (1) and non-profit (1). These ownership stats aren’t necessarily unique to other metros such as Seattle and Portland with institutional capital typically owning a large share of the buildings. What’s interesting to me on a micro level is that the single asset, one to two off owners are more interested in selling than years past. What started as a simple mom-and-pop operating business a few decades ago has turned into a sophisticated and challenging operating business with extreme expense, inflationary and regulatory pressures. Having come from the operations side of the business I’ve seen many of these challenges firsthand. Therefore, it no surprise why the local owner who has owned his/her assisted living facility for 20 years may have greater appetite for selling despite less …

— By Greg Swedelson and Jon-Eric Greene, co-founders, SSG Realty Partners — Although there continues to be much speculation and concern about the impacts of inflation, high debt costs, rising unemployment and an economy that may be heading for a slowdown in the coming year, there is reason to believe that the outlook for the Salt Lake City commercial real estate market is quite positive. With more than $100 billion in annual GDP, Salt Lake City’s economic growth rate is poised to end the year up nearly 3.5 percent (and nearly 80 percent since 2011). Although many are projecting a more moderate growth rate of 2.8 percent entering 2024, the overall economy and commercial real estate market in SLC remain resilient, if not robust. Offering a combination of affordability, abundant job opportunities and a business-friendly environment, SLC has attracted some of the nation’s largest corporations and specialized tech companies, and with them, talent to fuel meaningful employment growth. So much so, in fact, that net employment is up nearly 10 percent over the pre-Covid levels of 2019, with no sign of slowing. Like so many markets, SLC has seen a precipitous drop in investment sales volume across all commercial sectors …

— By Brian Polachek, Senior Vice President, SRS Real Estate Partners — The holiday season is upon us, and as 2023 draws to a close the real estate community turns its focus towards the future, particularly to what 2024 holds. Let’s look at recent developments and future expectations of the Phoenix retail market, a sector that has shown remarkable growth and resilience. Phoenix’s retail landscape has experienced a significant growth period, primarily due to a combination of factors including substantial population increases, strong consumer spending, minimal store closures and limited new retail space has been built. This surge in growth is largely attributed to Phoenix’s rising appeal as a place to live as well as a business-friendly environment. The influx of new residents and businesses has created a robust consumer base, driving up spending and providing a diverse market for retailers. Remarkably, the Valley has seen positive absorption for nine consecutive quarters, totaling 4.2 million square feet in the past year alone. As a result, Phoenix has become one of the leading U.S. markets in retail demand, bringing vacancy rates down to a record low of 4.5 percent, according to CoStar. This ongoing demand signifies not only the market’s current …

While there has been a discernible dip in the volume of industrial leasing activity occurring in the greater Baltimore metropolitan area this past year, optimism remains high among owners and investors of this asset class given the diminishing volume of new product under construction, the still low 7.4 percent overall vacancy rate, record high — yet stabilizing — average asking rents of $10.54 per square foot net and the fact that 10 million people are not likely to soon move away from the Baltimore-Washington, D.C. corridor, the fourth-largest combined metropolitan statistical area in the country. Oh yes, spirits remain high following the Baltimore Orioles’ underdog ride to the top of the American East standings this summer. Never underestimate the power of a professional sports franchise to energize an entire region. The metro Baltimore industrial market consists of more than 3,600 buildings, totaling more than 266 million square feet of space that includes flex and industrial Class A, B and C buildings. Year-to-date, the market has yielded negative absorption of approximately 1 million square feet of space, including nearly 300,000 square feet this past quarter. The bad news of GXO Logistics shuttering a 571,000-square-foot distribution center in Harford County and laying …

— By Tami Lord, Senior Vice President, SRS Real Estate Partners — No longer the Cowtown of ages past, Denver has developed into an economically diverse, midsized city as demonstrated by both the residential and business growth over the last decade. Major companies now include Denver on their target list for potential headquarters, regional hubs, and distribution locations. Compared to the coastal markets, Denver is more affordable and offers a very desirable quality of life for employees, helping to put Denver on the short list. The pandemic only increased Denver’s growth trajectory. All of a sudden, people were able to maintain their current employment while living in a setting known for over 300 days of sun annually with easy access to hiking, skiing, biking, camping…the list goes on. The population growth has spurred rising housing and land prices. Coupled with rising construction costs, increasing real estate taxes, long permitting times and a tight employment market, traditional retail development has slowed. The lack of significant new development has pushed retail vacancy to a near-record low of 4.1 percent across the metro, according to data from CoStar. Many downtown retail markets across the country have been hit with higher vacancy rates in …

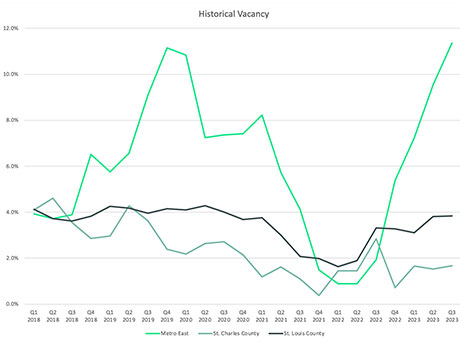

By Matt Hrubes and Joshua Allen, CBRE St. Louis is located at the crossroads of the U.S. at the intersection of I-55 (north/south) and I-70 (east/west), making it a prime location for industrial real estate users and developers alike. The Greater St. Louis area is separated by the Mississippi and Missouri rivers, giving it a natural division of industrial submarkets. Each side of the Mississippi River tells a different story as it relates to industrial real estate. Metro East To the east of the Mississippi River is the Metro East industrial submarket, which was the first in the area to offer real estate tax abatement, resulting in larger industrial developments ranging in size from 500,000 square feet to over 1 million square feet. Over the last decade, this area has seen some of the largest speculative developments in the region from national developers such as Panattoni, NorthPoint and Exeter, as well as local developers like TriStar. Absorption had been at all-time highs with groups like Amazon, World Wide Technology, Geodis, Sam’s Club, P&G and Tesla leasing space as buildings were being completed. That is, until 2023 when a wave of space became available either through sublease, speculative development completions or …