By Taylor Williams The Houston industrial market has generally performed quite well over the past few years, even as a global pandemic, record inflation and hard-hitting interest rate hikes have rocked the commercial real estate industry as a whole. Demand for industrial space has held firm due to rebounding energy prices and expansions in infrastructure and traffic at Port Houston, as well as organic population growth and economic diversification that has elevated the market’s role as a distribution hub. According to data from CBRE, the market has a 6 percent vacancy rate and posted 5.1 million square feet of positive net absorption through the first three quarters of 2023. The volume of new construction was on track to outpace absorption in 2023 when the report was released. But that was not the case in 2021 and 2022, years in which net absorption equaled and exceeded 7 million square feet, respectively. New deliveries totaled approximately 5.6 million and 5.4 million square feet in each of those years, driven not only by the aforementioned factors but also by a temporary uptick in demand for e-commerce services in the wake of the pandemic. In any market or asset class, when absorption exceeds supply …

Market Reports

— By Jeff Lefko, Executive Vice President, Hanley Investment Group Real Estate Advisors — Hanley Investment Group is expanding and opening its newest office in San Diego in early 2024. San Diego, the eighth most populous city and the fifth largest county in the United States, ranks second only to Los Angeles County in California, boasting a population nearing 3.28 million. With a substantial GDP of $206 billion, San Diego holds the 17th largest metropolitan area position in the U.S. and the fourth largest in California. The city’s economy thrives on defense, tourism, international trade and research/manufacturing sectors. Notably, in 2022, San Diego experienced an 8 percent growth in life science employment, reinforcing its position as a premier life science research destination. Attracting 28.8 million annual visitors, it stands as a prominent U.S. travel destination, generating approximately $13.6 billion in yearly spending and employing 214,000 San Diegans directly and indirectly. San Diego’s robust economy, diverse population, quality education, and prime location render it a desirable hub for commercial retail investment. The business-friendly climate further enhances its allure, while the limited supply of new retail construction helps maintain stable real estate fundamentals. The changing economy and rising interest rates have caused …

Atlanta’s industrial sector and its historically strong performance have fortified the city as a strategic Southeast location and gateway market nationwide. Activity, which has decreased since peak demand during the COVID-19 pandemic, is now returning to normalized levels. The net new requirement pipeline remains robust primarily due to the influx of manufacturing, advanced manufacturing, life sciences, automotive, alternative energy and data center projects. How owners and tenants invest in industrial properties has also shifted. Owners are seeking properties with short weighted average lease terms and investments below replacement cost. Meanwhile, occupiers are making moves to crisis-proof their networks with onshoring and nearshoring of production that was previously conducted overseas, and they’re adjusting their overall supply chain and logistics strategies to diversify and avoid dependence on one region or vendor. Players in the market remain cautiously optimistic, which has subdued demand, but that is expected to be short-lived once macro-economic conditions stabilize. High inflation and rising interest rates over the past 12 to 18 months have significantly contributed to decreased demand in Atlanta. However, with continued population growth and Atlanta’s central location in the Southeast, the metro area’s compressed demand will be short-lived. With that said, Atlanta’s industrial market remains strong …

— By Jeffrey Swinger, Executive Vice President | Las Vegas, Multifamily Investment Sales, Colliers — Las Vegas is on a roll right now, continuing to raise the bar year after year, and we are bullish on the long-term outlook of Southern Nevada’s future. UNLV’s Center for Business and Economic Research predicts that Southern Nevada’s population will gain 41,900 new residents in 2023 and increase another 2.4 percent in 2024. This wave of growth, coupled with strong local economic activity and enhanced infrastructure investments, has created more jobs and more demand for housing. With more than $8.12 billion of new major projects delivered in 2023, there is another $2 billion currently under construction with plans to deliver in 2024 and 2025. Additionally, there is another $17.25 billion of announced and proposed projects keeping Las Vegas’s momentum moving forward. Significant projects that were delivered in 2023 include the Fontainebleau, the MSG Sphere and the inaugural Formula 1 Heineken Silver Las Vegas Grand Prix. The Fontainebleau is the latest hotel/casino along the Strip, valued at $3.7 billion, and will add 3,644 rooms to the hotel inventory count. The MSG Sphere is Las Vegas’s newest entertainment venue featuring the largest spherical building in the …

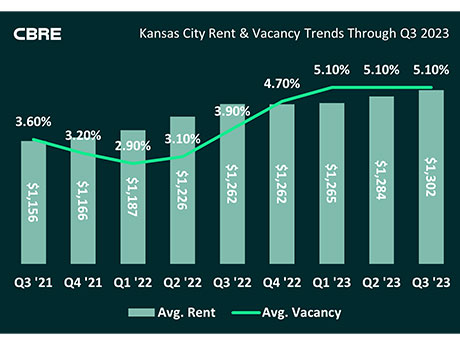

By Max Helgeson, CBRE As the national real estate landscape undergoes transformative shifts, Kansas City has emerged as one of the region’s most attractive multifamily markets. There are a myriad of attributes making Kansas City an unrivaled destination to deploy capital in the heart of the Midwest. Here are six key areas that propel the market to the forefront of real estate investors’ considerations. Economic anchors, diversification Kansas City has one of the nation’s most diverse economies with no sector comprising more than 15 percent of overall employment. A national leader of several durable industries provides unmatched economic stability and significant risk mitigation for investors. Moreover, the metro’s strategic location in the heart of the U.S. and strong transportation infrastructure make it a favored logistical hub for corporations across the world. Finally, the market is a base for startups and entrepreneurs drawn to the area’s abundant talent pool and competitive office space rates. Strategic infrastructure, connectivity Infrastructure is a cornerstone of Kansas City’s rise to prominence. The city’s strategic network of highways, interstates, railways, fiber networks and a major airport not only facilitates connectivity but positions it as a hub for commerce. This strategic infrastructure acts as a magnet, pulling …

— By Joseph W. Brady, CCIM, SIOR, President, The Bradco Companies — A population boom has brought houses, companies and retailers to the High Desert also known as the Mojave River Valley. The “High Desert” used to be a term that referred to one area: the northern region of San Bernardino County that is beyond the Cajon Pass. As such, many other “High Desert” popped up, including the nearby Joshua Tree Area, in addition to namesakes in Arizona, Nevada and Oregon. That led this particular area to be rebranded as the Mojave River Valley, notes Joseph W. Brady, president of The Bradco Companies in Victorville, Calif. As a long-time, 35-year resident, of the Mojave River Valley, he is the longest serving commercial broker in the region. What is the current state of commercial real estate in the Mojave River Valley? Retail is rather steady, with each of the cities — Apple Valley, Adelanto, Hesperia, and Victorville — all seizing new opportunities for commercial. Sprouts grocery stores (remodel of the former Toys”R”Us) are coming into Victorville and the Town of Apple Valley. We also have many smaller national tenants that continue to expand in the retail marketplace. Retail vacancy levels continue …

— By Jon-Eric Greene, Colliers — Hawaii has historically been home to many of the nation’s top grossing retail locations (as measured by gross sales), including one of the highest grossing regional malls in Ala Moana Center, and the world-famous retail street, Kalakaua Avenue in Waikiki. However, since COVID shutdowns, Hawaii retailers and shopping centers have struggled to recover. While the tourism and hotel markets have bounced back, an important visitor demographic — the international shopper — has yet to return. Tourism is Hawaii’s No. 1 industry, with almost every dollar circulating through the economy tracing back to visitors. In 2019, Hawaii welcomed a record 10.4 million visitors. However, in 2020, arrivals plummeted to 2.7 million visitors due to the pandemic. The state experienced rebounded visitor numbers in 2021 and 2022 of 6.8 million and 9.2 million visitors respectively and expected to end 2023 with 9.3 million visitors. The visitor profile has changed dramatically, however, impacting many retailers and shopping centers. In 2019, around 3 million visitors were international, with over 50 percent (1.58 million) coming from Japan. In 2022, only 900,000 of Hawaii’s 9.2 million visitors were international, including just 192,500 Japanese. So, while overall visitor counts to Hawaii …

By Sandy Schmid, director of acquisitions and development, StarPoint Properties In the fast-paced world of commercial real estate, foresight is as valuable as bricks and mortar. Despite whispers of distress on the horizon for the Lone Star State in 2024, the multifamily real estate market is ablaze with potential. Texas is one of the hottest destinations for developers and investors, and the strategic play is to not just weather the storm, but rather to ride it to success. Recent predictions of multifamily distress starting in the latter half of 2023 have certainly raised eyebrows and fueled speculation. However, predicting the Texas real estate market is akin to forecasting a Wild West shootout — a challenging task given the state’s history of resilience and its ongoing growth. Texas has consistently proven its ability to rebound from economic challenges, and current indicators suggest that the multifamily sector is poised for sustained growth. A Growth Powerhouse One factor supporting the optimistic outlook is the impressive trajectory of Texas’ GDP growth. The state saw a notable increase in its GDP over recent years: 5.7 percent growth in 2021, 2.7 percent in 2022 and 3 percent in the first quarter of 2023 alone. This data compares …

In recent years, Atlanta has become a top choice for corporate relocations, causing double-digit multifamily rental rate growth, an increase in pricing and a general benefit to the industry as a whole. In 2021, rental rates rose at an average of 11.7 percent and last year that number reached 16.8 percent. As a result, from 2021 through much of 2022 the metropolitan area experienced a record amount of investment activity, with $20.8 billion and $14.8 billion trading hands, respectively. During the first six months of 2023, however, transaction activity slowed and began returning to more typical levels, dropping approximately 82 percent year-over-year from those highs. Much of the decline in transaction activity experienced today can be accredited to the Federal Reserve’s sizable interest rate hikes over the past 18 months, resulting in a significant expansion in cap rates and a divide between buyer and seller pricing expectations. During the first half of 2023, approximately 54 transactions occurred, compared to 172 recorded for the same period last year for assets valued at $5 million or more. Much of this activity was driven by smaller deal sizes and private capital as institutional investors embrace a “wait and see” agenda in hopes of …

— By Paul Sweetland, SIOR, Vice Chairman, Colliers Doherty Industrial Group — Throughout 2023 we were often asked if the Las Vegas industrial market had “missed the memo” on the slowdown since other western markets were experiencing a slowdown that we had yet to see. With record under-construction numbers and net absorption numbers being on pace to finish the year with the second highest total of the last five years, Las Vegas didn’t appear to be slowing down. However, there are certain sectors that show initial signs of a pending change. Land Sales: Land sale transactions have seen a 75 percent drop from the prior year. Peak land pricing was $36.00 per land square foot in the summer of 2022, and by the fourth quarter of 2023 it had dropped 25 to 35 percent as demonstrated in the limited closings that occurred. Although lease rates continued to increase, developer underwriting had seen significant changes in exit CAP rates along with debt, equity and construction financing due to an unstable interest rate environment with the Feds continued rate increases at the fastest pace in 40 years. Lower land pricing or significant lease rate increases are going to be necessary for the …