While the health of the retail market along the Magnificent Mile continues to recover incrementally with a rebound in foot traffic following a prolonged downturn, Chicago’s neighborhoods and suburbs are bustling with leasing activity. In fact, limited retail supply in the suburbs and throughout most of the city’s neighborhoods is one of the biggest challenges facing the market, according to Michael Flinchbaugh, an associate director with Chicago-based Bradford Allen. He says the dynamic has pushed up rents, leading to more national retailers entering corridors that have historically been occupied by local stores. “Groups that are not as well capitalized are struggling to find affordable space for lease,” says Flinchbaugh. The Loop, on the other hand, is sitting at a vacancy rate around 30 percent, according to Flinchbaugh. He says the hope is that the number of office-to-residential conversions slated to occur in the next two to three years will bring retailers back to the submarket as it becomes more of a live-work community. The Loop is located south of the Chicago River, while the Magnificent Mile is situated on the city’s Near North Side. Long known for its high-end shops, hotels and restaurants, the one-mile section of Michigan Avenue referred …

Market Reports

August 29, 2005 — a day no New Orleanian will forget: Hurricane Katrina. It has been two decades since the levees were breached and flood waters took over the city’s streets, homes and businesses. It was an event that changed the trajectory of the city of New Orleans. Twenty years later and the resiliency of New Orleans to always push on is evidenced by the stability of our multifamily market. Through a period of demolition, renovation and rebuilding, the overall market remains stable. The barriers to entry in the Metro New Orleans multifamily market are significant, and today as in the past, the equilibrium between supply and demand remains in sync. Like other Sun Belt markets, insurance premiums, interest rates and affordability are factors. However, they have not been a deterrent to the viability of the market or interest from investors and the capital markets. Our inventory of more than 55,000 units (professionally managed) spread out over seven parishes, remains strong. Overall metro occupancy is being reported between 92 to 94 percent with average rents of $1,300 per month. Parish by parish Eastern New Orleans and Algiers, which each have an inventory of approximately 4,000 units, offers the most affordable …

— By Bryan Ledbetter of Western Retail Advisors — Phoenix’s retail market continues to surge. Vacancies are dipping below 5 percent, gross absorption is exceeding 1.5 million square feet in the third quarter and asking triple-net rates continue to increase, reaching into the mid-$50 to $60 per square foot range for newly constructed space. West Valley Leads the Charge in New Development After decades of limited retail construction, metro Phoenix — and the West Valley, in particular — are flush with new space. Projects like SimonCRE’s Prasada in Surprise and Vestar’s Verrado in Buckeye are among the major new developments providing the high-end availability that tenants and residents have been asking for. Although elevated debt and construction costs have tempered new development, more than 1.2 million square feet is still under construction. The lion’s share of that product is already pre-leased. This keeps developers and investors bullish on Phoenix, and on the lookout for the Valley’s next development frontier. Though the West Valley reigns as Phoenix’s latest retail boom market, outliers in the East Valley are teeing up for their turn in the spotlight. Apache Junction is a great example… Far Southeast Valley Emerges as a Growth EngineA neighbor of …

By Joel Marcus, senior partner, Marcus & Pollack LLP COVID-19 and the government-ordered shutdown had immediate negative consequences for all types of real estate, and New York City’s tax valuations took this into account. Damage from the pandemic still weighs down property values today, compounded by cultural shifts that sapped demand for commercial properties. Fair market values have evolved to reflect pervasive vacancy, building obsolescence and the heightened cost of serving tenants that have abundant alternatives to choose from. At the same time, work-from-home practices reduce space requirements. Retailers, restaurants and hotels see half the foot traffic they once had from nearby office buildings, adding to ongoing pressure from e-commerce and other challenges to create excess vacancy, constrained rental streams and declining market values. Valuation for property taxation has not evolved, however, judging by the revaluation tax assessments the city’s Department of Finance is issuing. Revaluations ostensibly update taxable property values to current fair market value. Yet New York’s assessors habitually inflate valuations by applying pre-pandemic rental rates and vacancy assumptions, ignoring the rents landlords are actually collecting today and turning a blind eye to fundamental changes in demand for commercial space. Old thinking persists among these assessors, and it …

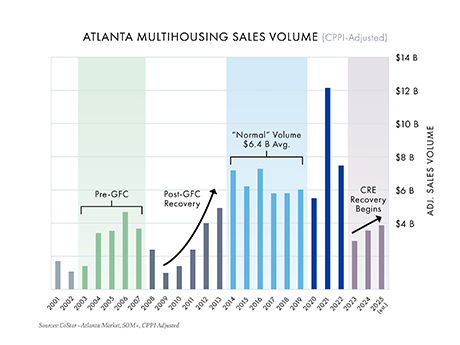

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

By David Goldfisher, The Henley Group Secondary and tertiary office markets across the Midwest, including Chicago, Minneapolis, Madison, Milwaukee, Cleveland, Cincinnati, Columbus and St. Louis, are facing mounting pressure. While each city has its own challenges, a common theme is clear — vacancies remain high and liquidity is thin. Tenant shuffling One of the defining dynamics today is tenant reshuffling rather than net growth. As leases expire, employers frequently move from one building to another, seeking modernized space and stronger amenities. Renovating in place is disruptive and costly, while relocating allows businesses to upgrade with minimal operational downtime. This “musical chairs” effect highlights a deeper structural issue. There are only so many large anchor tenants in Midwest cities and few new entrants are seeking major blocks of space. There is more repositioning for existing tenants than attracting new ones. Flight to quality Landlords and developers are competing to deliver amenities that encourage office attendance and support talent retention. Modernized lobbies, tenant lounges and flexible collaboration areas have become standard expectations. Hines’ upgrades at Chicago’s 333 West Wacker Drive and 601W Cos.’ reinvestment in the Old Post Office demonstrate the scale of investment required. But not all landlords can compete. With …

— By Rick Nelson of Mark IV Capital — The Northern Nevada industrial market continues to stabilize following several years of rapid expansion and then a recalibration driven by broader economic uncertainty. Current conditions have presented challenges, particularly in the logistics and distribution sectors where tariffs and shifting trade policies have created a more cautious investment climate. Fortunately, there are signs of resilience and forward momentum. The region’s vacancy rate stands at 11.7 percent, down from its peak in fourth-quarter 2024, per CBRE. The market also recorded its third consecutive quarter of positive net absorption, with 130,433 square feet absorbed that quarter, bringing the year-to-date total to 1.9 million square feet. Although current construction activity has moderated to 1.6 million square feet currently underway, the development pipeline remains robust, with an additional 15.8 million square feet in planning stages. This underscores sustained investor interest despite elevated vacancy and measured tenant activity. Advanced manufacturing and data centers are poised to be the vanguard of industrial development in the greater Reno area going forward. Cushman & Wakefield recently named Reno No. 5 among emerging data center markets worldwide in its 2025 Global Data Center Market Comparison Report. This recognition reflects the growing …

By Taylor Williams Although the Dallas-Fort Worth (DFW) industrial market is, objectively speaking, currently overbuilt, the recovery and return to healthy dynamics is already taking shape. As that unfolds, manufacturing facilities are having a moment. According to CBRE’s research, between 2021 and 2023 — the height of the post-COVID e-commerce craze that coincided with the last days of historically low interest rates — developers in DFW added nearly 130 million square feet of new industrial product. The supply boom mostly involved warehouse and distribution facilities, and absorption of new deliveries was coming along until this spring, when Liberation Day injected a staggering dose of economic uncertainty into the market. In recent weeks, leasing activity has begun to pick back up. But investors looking to deploy capital into industrial assets see more upside on deals for manufacturing facilities at the moment, whether that means buying existing plants with heavy built-in power sources or targeting distribution buildings that can support manufacturing through light conversions. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. At the annual DFW/North Central Texas Industrial conference that …

If you’ve spent any time driving around Atlanta recently, you’ve probably noticed something. More development sites are returning with bulldozers and developers are taking down land parcels in the suburbs the size of small European countries. But this time, the approach is more strategic than ever. Gone are the days when a developer would carve out a shopping center for base rents less than $40 per square foot and call it a day. Today, some metro Atlanta developers are assembling larger tracts and creating hybrid projects that include multifamily housing, storage and even industrial uses in the back of the parcel, saving the front-facing road frontage for ground leases, build-to-suits and limited shop space. Automotive and restaurants concepts are clamoring for pads. The result? Those once-overlooked “front and center” pad sites and strip centers are suddenly the belle of the ball. The downside is paying too much on the buy side for the dirt for aggressively low caps rates. But all I can say for the rental rates that I’m seeing is “Wow.” Restaurants still lead In Atlanta’s retail market, restaurants continue to be the leading driver of leasing activity. According to observations, excluding junior box space, food-and-beverage deals made …

By Sam Rolfe, The Lerner Company It seems Omaha’s retail market shows no signs of slowing down from a position of strength, which received a tangible boost when the metro-area population hit the magic 1 million mark. It’s funny that this population hurdle opens the eyes of retailers so much more than 970,000 would, but there’s no doubt that it does, and the market has reacted accordingly, with year-over-year asking rents up 5.4 percent. The seemingly rapid growth and development have not vastly affected the city’s historically strong fundamentals and high occupancy rates however, with the vacancy rate in the metro at 4.4 percent. This low vacancy is partially a byproduct of the historically low supply that has plagued the market in recent years. Over the last decade, we have seen vast westward growth and somewhat stagnant activity in the urban core and central region. Although the westward march continues, it is now coupled with large amounts of urban development, making the city’s retail market strong within eastern submarkets. The old adage “retail follows rooftops” has held true throughout this growth cycle, as retail developments follow the suburban growth of both homes and apartments. One example of this is at …