— By Shane Shafer, Managing Director, Northmarq — The Inland Empire submarkets have maintained rent increases, low vacancy rates and employment growth. Plus, unlike other Southern California markets, the IE has seen a migration into the area — not out. The population of the Inland Empire region in an average year expands by about 50,000 residents. This is the fifth largest gain among the largest 50 metros, per 2021 Census numbers. A Jobs-Rich Market Gaining Momentum Local employment showed signs of growth and resurgence, adding jobs each of the past four quarters. Year-over-year total employment increased by more than 83,000 positions, which equates to a gain of more than 5 percent. Contrast this with other markets, and you can see why the Inland Empire is on most investors’ top 10 lists for buying, and why expectations are so high for the market to have continued rental growth. The logistics sector is one of the biggest and fastest growing in the United States. These jobs have consistently grown over the past 10 years, increasing by more than 10 percent. This year, Amazon inked a record-setting 4.1-million-square-foot facility in Ontario, while companies like Target, Shopify, Best Buy, AutoZone and others also made large commitments. The …

Market Reports

— By Shane Shafer, Managing Director, Northmarq — The Inland Empire submarkets have maintained rent increases, low vacancy rates and employment growth. Plus, unlike other Southern California markets, the IE has seen a migration into the area — not out. The population of the Inland Empire region in an average year expands by about 50,000 residents. This is the fifth largest gain among the largest 50 metros, per 2021 Census numbers. A Jobs-Rich Market Gaining Momentum Local employment showed signs of growth and resurgence, adding jobs each of the past four quarters. Year-over-year total employment increased by more than 83,000 positions, which equates to a gain of more than 5 percent. Contrast this with other markets, and you can see why the Inland Empire is on most investors’ top 10 lists for buying, and why expectations are so high for the market to have continued rental growth. The logistics sector is one of the biggest and fastest growing in the United States. These jobs have consistently grown over the past 10 years, increasing by more than 10 percent. This year, Amazon inked a record-setting 4.1-million-square-foot facility in Ontario, while companies like Target, Shopify, Best Buy, AutoZone and others also made large commitments. The …

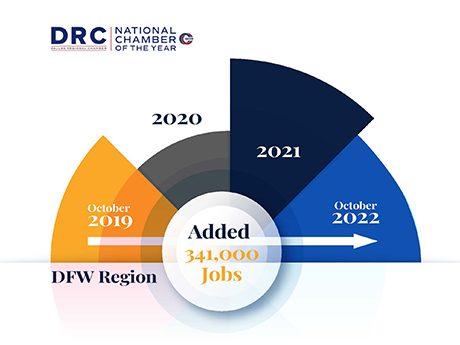

By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates While December’s national jobs report painted an optimistic picture of the employment landscape, some sources have noted that workers in commercial real estate are leaving the industry. Yet although some national brokerage firms may be trimming the fat to cut costs in light of recent economic uncertainty, this trend does not seem to apply to Texas-based commercial real estate companies. In fact, according to Estateserve, with the Texas office market booming, vacancy rates dropping and rents rising, “Texas’ commercial real estate is experiencing a resurgence.” As a national executive search firm that has served the industry for more than two decades, RETS Associates has a seasoned perspective on job markets throughout the country. Here are the trends we are noticing throughout the industry in Texas and why we believe the market is poised for ongoing strength and stability. Continued In-Migration Texas is the ninth-largest economy in the world, as well as one of the leading markets in the country in job and economic growth. The Dallas-Fort Worth (DFW) area in particular, the fourth-largest MSA in the country, led the country in population growth in March 2022 and in post-pandemic job …

Nashville’s industrial market continues to see strong demand going into 2023. In fact, more than 1.7 million square feet of leasing activity was recorded throughout fourth-quarter 2022, bringing the year-to-date transaction volume just shy of an impressive 8.8 million square feet. Even overall vacancy sat at 3 percent during the final quarter of 2022, and while that was a slight increase compared to the previous quarter, it still was 30 basis points below the national vacancy average. Despite a recessionary environment and uncertainty of what’s next in the commercial real estate sector, Nashville’s industrial market is uniquely positioned for the upcoming year. As Nashville’s industrial market still experiences growth, there are several macro-economic trends impacting it that are worth keeping an eye on, such as e-commerce and third-party logistics demand. Interest rates have also risen, making it very tricky to value property and cap rates due to the debt markets. This has triggered limited investment activity from buyers and sellers alike across all property types, including industrial. Industrial developers are also being more cautious as rising interest rates have increased construction costs. Many developers and investors have purchased land or have land under contract, for example, but are waiting for …

— By Rob Martensen, Senior Executive Vice President, Colliers International — There are a lot of questions being asked about the Phoenix industrial market as we turn the calendar to 2023. Having been an industrial broker in this market for 25 years, I have seen many ups and downs, which are historically driven by the residential construction market. Phoenix used to be a one-industry town…and that industry was growth. Sure, we’ve had large companies like Motorola, Avnet and Intel, but the industrial market has been mostly driven by people moving to Arizona and buying houses and household goods. Phoenix has transformed in the past five years into a thriving city that now supports many industries. The largest is advanced manufacturing. This includes semiconductors, battery manufacturing, electric vehicle manufacturing and all supporting businesses. Intel is in the process of a $20 billion expansion to their existing facility, while Taiwan Semiconductor Manufacturing Company (TSMC) is under construction on a $12 billion chip making factory. TSMC recently announced it’s going to immediately start on Phase II of this factory, which will be another $28 billion spent in Phoenix. It is estimated that 160 new companies have moved to Phoenix to support these two new …

By Ken Martin, JLL The Indianapolis industrial real estate market ended 2022 nearing a record high for a single year with more than 19.6 million square feet of absorption. Much of this was recorded in Hendricks, Johnson and Hancock counties with total year-end net absorption of 7.3, 6.4 and 3.2 million square feet, respectively. These submarkets continue to offer tenants excellent access to both interstate highways to transport goods across the country, as well as strong employment bases. Developers and tenants often cite employment bases as their No. 1 criteria in selecting an optimum site. With vacancy at an all-time low of sub 5 percent for the majority of 2022, developers and owners were able to push rents as demand outstripped supply. As recently as two to three years ago, rents were consistently in the high $3’s per square foot range and now we consistently see rents in the $5 per square foot range or higher. Year-end asking rents averaged $5.54 per square foot overall and $6.48 per square foot for mid-sized warehouse space. In some markets, however, rents for warehouse space were well above the average. In the central business district, for example, asking rates for warehouse …

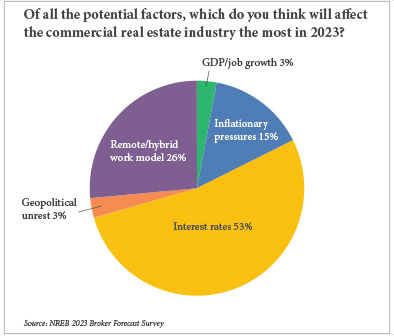

By Hayden Spiess First comes inflation, then come interest rate hikes. The fact that this sequence is a predictable one does not temper the discomfort of reckoning with it, and the commercial real estate industry is as familiar with this pain as any. This familiarity was made clear in the results of an exclusive survey by Northeast Real Estate Business, which was conducted via email toward the end of 2022. Two groups, one comprising brokers and the other consisting of developers, owners and managers, were asked to assess the state of commercial real estate in the region with both retro- and forward-looking perspectives. Of the brokers questioned, approximately 53 percent believed that interest rates would be the factor to affect their industry the most in 2023 (see chart). These individuals selected this option from a list that included other factors such as remote/hybrid work models, inflationary pressures and GDP/job growth, which received 26.5, 14.7 and 2.9 percent of the vote, respectively. The other two options — supply chain constraints and election results — received no votes. Developers likewise identified interest rates as the demographic, political or economic factor likely to cause the most disruption within the industry. An …

Tennessee’s Appeal Process Allows Nashville Taxpayers to Challenge Assessments for New Construction

by John Nelson

Over the past decade, Nashville has enjoyed a baffling explosion of growth that sent cranes shooting up all over the city, festooned with developer names like Bell, Clark and Giarratana. Highrise towers of glass and steel rose out of the old rail yards like the emerging monolith in the opening scene of “2001: A Space Odyssey” multiplied in a funhouse mirror. The Metropolitan Government is eager to add new projects to its tax rolls, and its Assessor of Property decides when and how that happens. The assumptions made by the assessor’s office about a project’s cost and timing dictate how quickly and how much a new building is taxed. So, as always, taxpayers need to keep an eye on what the assessor is doing. The assessor’s difficult job has become even more complicated in the post-COVID quagmire of supply chain failures. Twelve-month projects have stretched into 24-month projects, and the assessor’s assumptions about completion times have been thrown out of whack. To make matters worse, Tennessee’s property tax statutes were not designed to give relief for construction delays or lengthy projects, and now the clock is ticking. Assessing new construction The last Davidson County reappraisal was in 2021, and the …

— By Jerry Holdner, Southern California Region Lead, Innovation & Insight, AVANT, Avison Young — The industrial market in the Inland Empire has been performing beyond what most of the industry projected over recent quarters. The region boasts a low unemployment rate of 4.2 percent, as of November 2022, which is below the anticipated 5.4 percent estimated a year ago. It is important to highlight, however, that job creation has been uneven. Leisure and hospitality jobs are still underwater, for example. The bright spot is that high-value-added jobs in a broad range of sectors like technology, software development, aerospace, scientific research, medical products and pharmaceutical development continue to grow, which bode well for the industrial sector. Here are some key market indicators, according to Avison Young’s fourth-quarter Inland Empire Industrial Insights report: • There was 38.9 million square feet of new industrial construction underway at the end of 2022. This is down 37.1 percent as compared to the end of 2021 when 28.4 million square feet was under construction. • There was 13.9 million square feet of positive absorption in 2022, down 53.5 percent when compared to 2021’s record-high total of 29.9 million square feet of positive absorption. This represents 2.5 percent …

— By Andrew Cheney, Principal, Lee & Associates — The metro Phoenix office market continues a slow recovery as it battles the nation’s highest rates of both sublease growth and inflation. Starting off the fourth quarter at only 532,000 square feet (year-to-date), net absorption in Greater Phoenix remained well off the 20-year average mark of 1.6 million square feet. Direct office vacancy stands at a seemingly high figure of 17.6 percent. However, this is in line with the 20-year average of 18 percent. Currently, there are six key trends impacting Phoenix’s office market. Small tenants are back in the office. I imagine most brokers will report that the highest concentration of active, touring prospects are in the market for less than 10,000 square feet. These company sizes want to be in the office in metro Phoenix, and not just a few days a week. High-quality spec suites rule. Landlords recognize that smaller tenants are driving leasing activity — and that these small tenants will not wait for a build-out. Instead of holding one or two spec suites in inventory at any one time, landlords are building out large batches of five to seven spec suites at a time. And they’re spending money to build …