By Evan Lyons, Encore Real Estate Investment Services Looking back on 2022, it could be said that Detroit’s economic performance last year mirrored that of the city’s tenacious Detroit Lions’ football season. Both were mired in doubt, plagued by volatility and sustained by grit, yet beyond all expectation, when the clock ran down, both proved the naysayers wrong. Just as the Lions surprised doubters by finishing their season at 9-8 and beating their divisional rivals, the Green Bay Packers, Detroit surpassed expectations by outpacing the national jobs growth rate of 5.8 percent at mid-year 2022 with a rate of 8.6 percent year-over-year. Gains in employment and wages are expected to continue over the next few years, according to a University of Michigan study. The city bolstered its “offensive line” with new store openings and new construction throughout the urban core. Stadiums and parks were filled again, fueled by crowd-pleasing events and programing, including Belle Isle parks’ notorious, over-waxed giant slide, which went viral and gained infamy last year for catapulting riders who dared venture a ride. Detroit also scored points in visits to leisure and hospitality establishments during the past 12 months. Visits increased by 50 percent from June …

Market Reports

Affordable HousingDistrict of ColumbiaMarket ReportsMarylandMultifamilySoutheastSoutheast Market ReportsVirginia

More Affordable Housing Options Needed in Greater D.C. Region, Says Fossi of Enterprise Community Development

by John Nelson

WASHINGTON, D.C. — In 2019, the Metropolitan Washington Council of Governments issued a report stating that the D.C. region — comprising the city, Northern Virginia and suburban Maryland — needed to add 320,000 more housing units between 2020 and 2030, and that at least 75 percent of this new housing should be affordable to low- and medium-income households. Rob Fossi, senior vice president of real estate development at Enterprise Community Development, says the figure has only climbed in recent years due to macroeconomic and local challenges. “In the three years since that report was issued, this demand has only intensified while supply chain interruptions, interest rate spikes and competing resource challenges precipitated by the COVID-19 pandemic have all been challenges to maintain pace,” says Fossi. Enterprise Community Development, an affiliate of Enterprise Community Partners, is the top nonprofit owner and developer of affordable homes in the Mid-Atlantic with a portfolio spanning about 13,000 apartments that house more than 22,000 residents. The firm is actively developing and preserving affordable housing across the region in order to address the demand, which Fossi says shows no signs of abating anytime soon. “There is little doubt that the demand for quality affordable housing will …

The retail market across the Raleigh-Durham region, also known as the Triangle, soared to new heights in 2022 despite significant global economic headwinds. Spurred by population growth and major economic development announcements, 2022 was filled with the groundbreaking and opening of new retail and mixed-use projects across the region. For the second consecutive year, North Carolina witnessed record-breaking economic development activity. New and expanding companies announced more than 12,700 jobs and more than $11 billion in new investments in the Triangle region alone. While the urban sectors lagged through 2020 and 2021, they saw a resurgence in 2022 with major tenant announcements for Smoky Hollow (Kane Realty Corp.) such as Midwood Smokehouse, The Crunkleton, Madre, Dose and New Anthem Beer Project. Downtown Raleigh also featured the delivery of 301 Hillsborough at Raleigh Crossing (Barings), Tower Two of Bloc 83 (City Office REIT) and construction of Seaboard Station (Hoffman & Associates). Downtown Durham boasted major groundbreaking, retailer and restaurant announcements as well, including the groundbreaking of Novus (Austin Lawrence Partners), encompassing 23,000 square feet of ground-floor retail space and 27 floors of high-end residential. American Tobacco Campus reimagined its restaurant mix to announce Five Star, Press, Queen Burger and the soon-to-open …

As port authorities around the country invest billions of dollars in infrastructural improvements, industrial users are taking notice and looking for sites near all the action. In the Southeast, the elevated demand for new industrial space near the Port of Savannah and Port of Charleston is pushing the boundaries as far as what’s considered normal levels for property performance indicators such as new construction, rent growth and leasing activity. “It’s hard to say that anything is ‘normal’ right now — there are a lot of new phenomena out there,” says Robert Barrineau, senior vice president of CBRE’s Charleston office. “We are seeing nationally now that a tie to a seaport as being key for economic growth and for operational efficiencies for companies.” In one of the bigger announcements in 2022, Hyundai Motor Group chose a 3,000-acre site in Bryan County, which is close to both the Port of Savannah and Interstate 95, for its $5.5 billion manufacturing plant. Construction is already underway, and the facility should be operating at full capacity, which entails production of 300,000 units annually, by the first half of 2025. The South Korean automotive giant intends to use a combination of local labor and AI technology …

By Dean Willmore, Executive Vice President; Kyle Kirchmeier, Associate; Alex Stanisic, Vice President; and Laura Wilhelm, Senior Field Research Analyst, CBRE Las Vegas’ current industrial market is surprisingly resilient. There is, of course, a possibility of planned projects being put on hold or not moving forward at all due to rising inflation and economic uncertainty, but leasing activity hasn’t slowed. Regardless of never-before-seen rent growth, record-low vacancy and a marked increase in asking lease rates every 60 days, the market still may not have peaked. As of the third quarter of 2022, the average asking lease rate was $1.19 per square foot (triple net), and the overall vacancy rate remained at a very low 1 percent. However, industrial/flex space in the 2,000- to 5,000-square-foot range, which is still dealing with the effects of the pandemic, has shown no noticeable rent growth. Some landlords are even offering leasing incentives to attract tenants. If the market contracts in 2023, smaller tenants in this size range will be the first to see its effects. Nearly half of the 17 million square feet under construction during the third quarter was pre-leased, and nearly 80 percent of those projects were in North Las Vegas. The largest lease of the quarter occurred in the submarket, with …

By Scott Dunwoody, Cushman & Wakefield It’s not too much of a stretch to say that St. Louis’ life sciences sector dates back to Lewis & Clark’s Corps of Discovery and all the scientific findings revealed upon their return to the city in 1806. More than two centuries later, St. Louis remains at the forefront of life sciences. The region is a center of plant science research and a cornerstone of global agriculture technology, with institutions such as Washington University in St. Louis (WashU) and St. Louis University playing critical roles in the biotech and medical fields. These factors translate into significant economic development benefits for the region and a positive impact on the area’s commercial real estate market. St. Louis is home to the largest concentration of plant scientist PhDs in the world. All that talent supports and drives more than 750 plant and medical science organizations across the region, including large employers such as Bayer (formerly Monsanto), Bunge, Benson Hill, IFF, Novus and Pfizer, and has led to significant investments throughout the region. What’s more, St. Louis ranks No. 14 nationally in National Institutes of Health funding, having secured more than $3.3 billion in the past five years. …

Talk to any commercial broker across the Raleigh-Durham market and you will hear much of the same feedback. In answer to the basic questions, one hears, “The in-office work week is now three days, primarily Tuesday through Thursday.” This trend, which was slowly becoming more evident over the last 20 years with the growth of the digital economy, was accelerated by the pandemic. And further aided by the wider availability of high-speed internet, the demands of the digital workforce are taking people out of their offices and, in some cases, around the world. Companies that value their digital workers are letting them make business decisions that affect the office building markets around the world. It is fascinating to watch. Recent data published by Kastle Systems (a keycard and security supplier for commercial buildings) shows that based on keycard swipes across the 10 largest cities in the United States, we are witnessing structural change in both the traditional work week and employee work hours, in degrees that are directly impacting the need for office space. As a result, employers are downsizing their leased footprints, opting for less square footage and/or shorter leases. Those companies with large numbers of digital workers are …

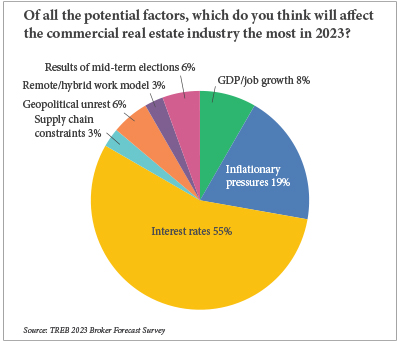

By Taylor Williams If inflation was the story of 2022, then basic economic theory dictates that interest rate hikes and their subsequent impacts will be the featured issue of 2023. For when it comes to whipping inflation, the Federal Reserve only has so many tools in its kit. The nation’s central bank can raise reserve requirements for lenders and sell Treasury notes all day long, but nothing has as direct and powerful of an effect on the monetary supply as movement in short-term interest rates. Simply put, higher interest rates discourage borrowing activity, which reduces the amount of money circulating in the system. In the past 12 months, the U.S. economy has seen no fewer than seven rate hikes totaling 425 basis points, with the Fed indicating that more increases are on the docket for 2023. Much like severe inflation itself, the rate hikes that inevitably follow rampant price escalation tend to touch nearly every facet of commercial real estate. Developers and investors respectively face higher interest rates on construction and acquisition loans. Brokers must adjust prices on properties they’re listing for sale or rent in response to these variables. End users tend to be somewhat insulated from these impacts, …

By Cathy Jones, Founder and CEO, Sun Commercial The 2022 Las Vegas retail market can be characterized by a generally positive outlook and some strong trends, even in the face of market uncertainty. A few of these core trends are quite interesting. Market research shows significant upward trends in asking rents, decreases in vacancy and certain key indicators driving this process. When broken down further, we find that these trends are emphasized in certain geographic areas more than others. The Southwest Las Vegas Valley submarket is seeing the greatest change in growth and development, followed closely by Henderson/Southeast. As an example, 93,592 square feet of retail space was constructed in the third quarter alone in the Southwest and Henderson; 91.2 percent of this space was pre-leased. The current amount of net absorption in the total market is 1.3 million square feet year to date. Half of this annual total occurred in the Southwest and Southeast submarkets. These two markets saw an explosion of growth driven largely by the housing boom. As new developments are constructed and homes sold, retail developments expand to meet that growing demand. There is more compartmentalization, however, than in the past with more community-oriented unanchored strip centers dominating the …

By Artie Kerckhoff and Joshua Allen, CBRE For businesses, the conversation around the return to office has shifted. Most companies find themselves considering how to entice workers back instead of when to call them back. It’s an interesting dynamic, born out of stopgap remote-working policies and catalyzed by an employee’s market. Where does this leave the St. Louis office market? The metro’s overall office vacancy rate remained steady at 12.9 percent at the end of the third quarter. Yet, leasing velocity has shown significant improvement with leases signed at newly constructed buildings like Forsyth Pointe & Commerce Tower in Clayton and Edge@West in Creve Coeur. In addition, a handful of tenants have signed new leases at existing prime Class A, amenity-rich buildings such as Centene Plaza C Building, The Plaza in Clayton and Shaw Park Plaza. The reason for this uptick is a trend that’s playing out in St. Louis and across the country: an overall flight to quality. Prime at a premium At the onset of the pandemic, office users signed short-term extensions and took a wait-and-see approach to get through the immediate crisis. Now, as those extensions expire, they’re migrating to prime Class A office space with collaborative, …