By Chris Pearson, Industrial Specialist, TOK Commercial Idaho remains a prime area for industrial growth in 2022, with nearly 180 deals completed across Southern Idaho’s top markets. Activity is strongest in the Boise MSA as more than 1.2 million square feet of net absorption has been recorded so far in 2022. This is up from 1.1 million square feet at the end of June 2021. Top deals for the year include Federated Ordinance leasing 265,200 square feet of new construction in Caldwell, as well as Amazon leasing 141,400 square feet in North Meridian. Overall industrial vacancy has remained low across Idaho. Total vacancy in the Boise area has been below 1.5 percent over the past 12 months. It currently sits at 1.2 percent. Vacancy is slightly higher in the Magic Valley & Eastern Idaho MSAs, with total vacancy above 2.5 percent in both markets. However, total vacancy in Idaho Falls, the largest market in Eastern Idaho, hit a historic low of 1.3 percent in June. Vacancy is also at a record low in Twin Falls, the Magic Valley’s main industrial hub, which is currently at just 0.2 percent. Based on vacancy alone, supply appears to lag behind demand. This should not remain the case for …

Market Reports

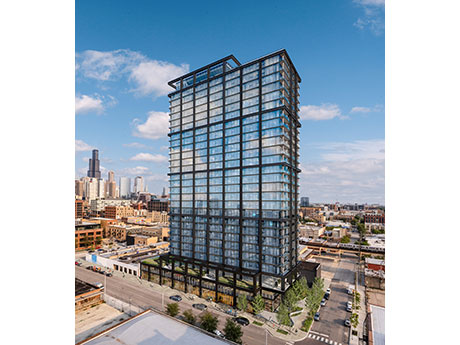

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

By Kevin Leamy, senior vice president, debt & equity, Northmarq Dallas-Fort Worth (DFW) has been one of the hottest multifamily markets in the country over the past five years. And as the area’s growth pushes further north, developers and investors are finding plenty of liquidity to support transactions. The northern DFW suburbs experienced a huge inflow of people over the past several years. The growth to suburbs such as Addison, Richardson, Plano, Frisco and McKinney gained even more traction during the pandemic. An increasingly diverse employer base and corresponding job growth are attracting people and driving demand for both for-sale homes and multifamily units. Instead of making a long commute into downtown Dallas or Fort Worth, there are now several big employers in North Dallas that offer high-quality jobs. One key catalyst for expansion was the opening of Toyota’s North American headquarters in Plano five years ago. The 100-acre campus is home to more than 4,000 employees. Other major corporations have followed, including the newly opened regional headquarters for J.P. Morgan Chase. Another factor drawing new residents to the area is strong schools, including a reputation for some of the best elementary and high schools in the country. Multifamily developers …

Remote Work Prompts Flight to Quality, High Urban Vacancies for Louisville Office Market

by John Nelson

The Louisville office market is taking diverse paths forward following the pandemic. The suburban Class A market is thriving with new construction, rental rate growth and resiliency in the face of downsizing tenants and negative absorption. A flight to quality among tenants has benefited local developers such as NTS Development, which has been constructing first-class, next-generation buildings at ShelbyHurst Office Campus since 2012. NTS recently completed its fifth speculative office building at the project, 425 North Whittington, a four-story, 130,000-square-foot building that is 60 percent leased with strong leasing activity. The flight to quality is driving tenants to choose higher-quality buildings with more expensive rental rates to help attract and retain talent and cater to a hybrid workforce. Traditional downtown occupiers are also considering the suburbs for the first time to create a workplace that draws employees back to the office. Suburban vacancy rates have increased since the end of 2019, with the Class A rate increasing by 490 basis points to 13.5 percent and the Class B vacancy rate increasing by 440 basis points to 15.2 percent as of second-quarter 2022. The average asking rental rate for Class A suburban space rose during this period despite increased vacancy rates. …

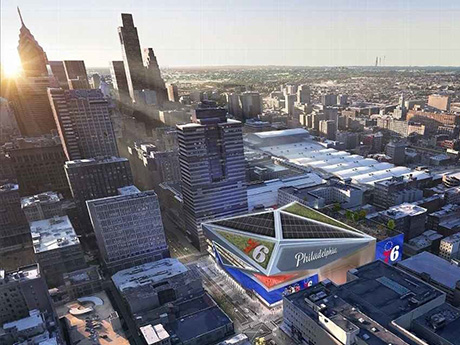

By Taylor Williams Though very much in its infancy, the Philadelphia 76ers’ recent decision to assemble a development team and file a formal proposal for a new arena at the current site of Fashion District Philadelphia has drawn the city’s retail market into speculation on how buildings, operators and streetscapes will be impacted. Known as 76 Place, the $1.3 billion venue would theoretically anchor the Market East corridor that connects Center City to Chinatown and Old City via its location atop the city’s largest public transit hub. The ability to centralize the arrival of fans, shoppers and diners from all cardinal directions, as well as multiple states, automatically sparks excitement for growth opportunities in the world of retail real estate. This project would immediately check that box. “The announcement of the new 76ers arena has generated a lot of discussion in the retail world,” says Steve Gartner, executive vice president at CBRE. “Bringing an arena to downtown Center City, especially one that’s adjacent to a convention center, will allow Philadelphia to hold more concerts and global events, like political conventions, that impact retailers and restaurants. These positive impacts will permeate the fabric of all of downtown.” “The retail community is …

By Brandon Rawlins, Principal Broker, and Bronson Rawlins, Retail Lead and Associate, JLL Like much of the country, the Idaho retail market is seeing a strong rebound in various retail sectors that appeal to the return of social gatherings and a hybrid approach to work life. Moreover, experiential retail is making a strong comeback as consumers crave fun and a return to normalcy. According to JLL’s recent Retail Outlook report, retail fundamentals continue to improve across most of the country, but particularly in the Sunbelt states. Shoppers are heading back to stores, moviegoers are going back to the theaters, and new demand for fun and immersive experiences is on the rise. The Boise area is no exception, with the announcement of several new major players, including Top Golf, Scheels and several mixed-use concepts that appeal to the new hybrid work experience that combines food, shopping and residential. Eatertainment concepts — entertainment with an emphasis on food and beverage — saw a national traffic surge of 22 percent from April 2019 levels and more than 36 percent year over year. Interestingly, retail activity is not just taking place in certain submarkets or neighborhoods; there is strong activity throughout the entire state. The impact of these developments will bring new tenants …

By Ryan Foran, Cresa As we approach the three-year anniversary of the start of the pandemic, it continues to affect the commercial real estate industry in many ways, with no asset class impacted as significantly as the office sector. While retail initially stumbled but rebounded, and industrial soared to unexpected heights amid distribution emergencies, millions of U.S. office employees continue a tenuous balance of working from home versus going into the office. The pandemic wasn’t all bad news for office tenants. Many businesses with simple infrastructure and experienced staff have been so effective with remote set-ups that they have shed office space permanently and eliminated rent from the books. Others have embraced emerging technologies like virtual meetings and chat solutions to reduce the need for face-to-face interaction. In one way or another, most businesses were able to leverage this unique situation to improve their business processes, technology and personnel, and have embraced remote work at some level. But many businesses with younger, less experienced staff have reported ongoing struggles with recruiting, mentorship, culture development and staff retention. Some of these may have been amplified by complex external factors such as an ongoing labor shortage, an unprecedented resignation of our older …

With vacancy in Louisville’s industrial bulk market sitting at 1.7 percent, an increase of supply is sorely needed. Fortunately, plenty is on the way. At the halfway point of 2022, over 9.5 million square feet of bulk inventory is under construction, with approximately 4.8 million square feet slated for completion by year-end. Due to the demand for big box distribution warehouse space, which skyrocketed due to COVID-19 and the increase of online ordering and e-commerce fulfillment, absorption (12.9 million square feet) outpaced construction (9.9 million square feet) to the tune of 3 million square feet, and depleted vacancies in the process. Average asking rent increased from $4.79 per square foot to $5.26 in the second quarter and is up 26.7 percent from $4.15 at this time last year. This can mainly be attributed to overall increase in demand and increased construction costs. With nearly 5 million square feet of new speculative product hitting the market by year-end, coupled with recent completions of approximately 3 million square feet and 1.6 million square feet of sublease space expected to hit the market in the near future, deal rates are expected to steady and could potentially decrease as competition among landlords increases over …

By Karena Gilbert, Office & Investment Associate, Colliers With a population of a little more than 795,000, the Boise metro area has consistently ranked as one of the fastest-growing places in the nation. Ada and Canyon counties saw a population increase of 7.8 percent from 2020 to 2022. This growth has brought both business and talent to the Boise area and around the state. In a city already ripe with highly skilled, educated and community-minded people, the influx of more talent helped stimulate the growth of local and newly planted companies. Unemployment was 2.4 percent in June 2022, its lowest since May 2018. We are once again seeing companies that have to work to attract and retain employees in this growing market. Boise office tenants have returned to work. There is a degree of remote work, along with the adoption of hybrid work, as many employers and employees are unsure how many days per week anyone will be required in the office. There is a strong desire to have employees back to work as it fuels collaboration, mentorship and training. Companies that had thought about reducing their footprint are now reconsidering and finding value in having a collaborative environment. Boise has smaller office users …

By Jill Rasmussen, Davis The Minneapolis – St. Paul medical office building (MOB) market remains strong with calculated strategic growth from both hospital systems and independent clinics. The MOB sector has been resilient during the pandemic, economic challenges and local civil unrest. Providers have been focused on expanding into new market areas to locate close to their patient base, providing full-service medical hubs offering outpatient surgery and specialty services to communities while offering lower-cost care away from a hospital campus. The overall market remains very stable with a current vacancy rate of 8.6 percent on-campus and 10.6 percent off-campus. There remains high interest in off-campus locations for most non-acute care for location access and cost savings. Base rents continue to increase both on- and off-campus due to demand and higher new construction pricing. Base rates have reached nearly $22 per rentable square foot (rsf) on average on-campus and $21/rsf for off-campus existing product. New MOB construction rates have increased from $24.50/rsf to $28+/rsf due to interest rate hikes and supply chain/labor issues, but new construction projects continue to move ahead based on provider’s strategic initiatives. Annual base rent increases are trending up due to current inflation levels from a historical …