By Taylor Williams It’s a tough time in the Austin multifamily market, and architects and general contractors (GCs) are being asked to do their part to minimize the financial distresses of their developer clients and to facilitate the work of the agencies that lease the buildings they design and build. The state capital is on the back nine — it’s tough to say which hole precisely — of an apartment building frenzy that materialized in the immediate post-COVID era. Times were starkly different then in terms of costs of capital and trended rent projections, and developers and their capital partners made hay while there was light. Project partners on developments that were delivered in the past 12 to 18 months as part of the building boom may not have felt as acutely pressured to design for efficiency. But those working on new projects today do not have that luxury and are being asked to think and design with cost savings in mind. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. One could argue that developing multifamily product with financial …

Market Reports

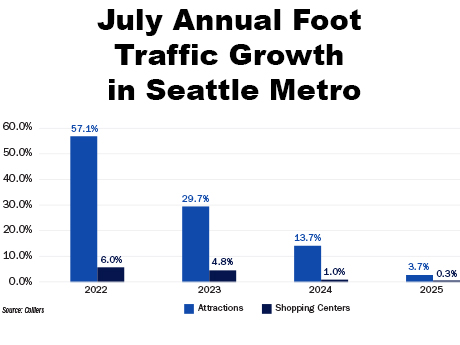

— By Jacob Pavlik of Colliers — As big-box retailers scale back or exit the market, a new class of tenants is reshaping the retail landscape across the Puget Sound region. Experiential retail is taking their space and providing destinations for consumers and the experiences they crave. This umbrella term includes concepts that prioritize interaction, entertainment and social connection. This is emerging as a compelling solution for landlords looking to drive foot traffic and re-energize shopping centers. The shift is not accidental. The pandemic disrupted traditional social experiences and accelerated the decline of large-format retail by getting people more accustomed to buying online, even if they “picked up” the item later in a store. Now, with consumers eager to reconnect in person, experiential concepts have gained traction. These tenants often don’t sell goods or services in the conventional sense. Instead, they offer immersive experiences that encourage group participation and repeat visits. Recent examples include Mirra, a 12,000-square-foot social entertainment venue that opened in Bellevue’s Lincoln Square, a mixed-use shopping center with three hotels, and more than 1.2 million square feet of office space. Adjacent to Cinemark Reserve in the South Tower, Mirra offers immersive virtual reality party games and transitions to …

By Mitch Faccio, senior vice president, MLG Capital Texas’ multifamily market is at a unique inflection point. After several years of historic levels of new construction and softening fundamentals, conditions are shifting in ways that may benefit current owners and new investors. Slowing development, sustained population growth and the widening affordability gap between renting and owning are creating conditions that seem to favor existing assets. A Market Reset After Record Construction Over the last several years, multifamily development surged in Texas. Dallas-Fort Worth, Houston, San Antonio and other metros all experienced a wave of new supply that outpaced demand. By 2023 and 2024, this boom in development had led to softer occupancies, higher concessions and flat or even declining rents. Net operating income (NOI) growth slowed as the market absorbed this record wave of deliveries, according to data from CoStar Group and RealPage. Now, that dynamic seems to be shifting. Construction costs have risen faster than achievable rents, making new developments financially difficult to justify, according to data from RealPage and the 2024 Turner Construction Index. In fact, multifamily starts in many Texas metros are down significantly from recent peaks. As a result, many planned projects have stalled, and the supply …

By Taylor Williams Retail and restaurant operators looking to enter or expand within the Philadelphia metro area are increasingly looking at suburban locations, and owners of those properties and seasoned brokers within the market both say there’s more to the trend than a simple lack of availability in key urban retail nodes. “The suburbs have been the preferred asset class — to some degree the first choice — for some retailers,” says Kari Glinski, vice president of asset management at regional owner-operator Federal Realty Investment Trust. “It started during COVID, when everybody was home, and with a lot of people living in the suburbs, we’ve seen strong demand. For well-located suburban properties, the leasing volume over the past three years has been at historical highs.” “Even over the past 12 to 24 months, supply has absolutely been constrained and should be even more constrained going forward,” Glinski continues. “For well-located properties backed by demand, new development can work. But right now, with where the cost of capital is, there’s not going to be a huge pop in new supply, thus creating a scarcity of well-located retail space.” Glinski acknowledges that since Federal Realty doesn’t operate many projects in the city, …

Louisville’s retail market continues to show strength in 2025, with grocery anchors driving much of the momentum. Despite national headwinds such as moderating rent growth and elevated construction costs, the metro has proven resilient, posting a vacancy rate of just 3.5 percent, outperforming the national benchmark of 4.8 percent, according to CoStar Group. Asking rents averaged $17.42 per square foot, reflecting steady demand across the region. At the center of this activity are grocers like Kroger, Publix and BJ’s Wholesale Club, each reshaping Louisville’s retail landscape in unique ways. Kroger is deepening its footprint with multiple new stores, including a 123,000-square-foot location under construction on Beulah Church Road that is scheduled to open in 2026. Publix, one of the most closely watched entrants to the Kentucky market, has expanded aggressively after opening its first store, securing 60,000 square feet at Blankenbaker Plaza and 56,000 square feet at Prospect Point. BJ’s Wholesale Club has adopted a redevelopment approach, razing the former Sears building at Jefferson Mall to deliver a 104,000-square-foot store that opened earlier this year. Collectively, these projects underscore the draw of essential, needs-based retail while fueling complementary leasing activity in their surrounding trade areas. Concepts gaining ground That momentum …

By Chris Collins, Marcus & Millichap The Minneapolis–St. Paul apartment market is currently experiencing a transformation, shaped by shifting economic conditions, changing demographics and evolving public policy. Having strong fundamentals in past multifamily housing development, the Twin Cities have entered a period of recalibration. After years of record-breaking development numbers, the construction pipeline has slowed dramatically, while demand remains across the metro. Like many markets, the Twin Cities face affordability challenges, aging populations and regulatory uncertainty. A major factor of the current market is the sharp decrease in new apartment construction. Following a peak in multifamily housing permits of more than 15,000 in 2022, the Twin Cities saw a sharp decline to just 7,400 from April 2024 to March 2025. This steep reduction is largely driven by public policy such as rent control, operating costs and rising construction costs, which now average in the low to mid-$300,000 per unit, while the market value of newly built apartments hovers near $250,000. As a result, many developers find it financially unfeasible to break ground on new projects without substantial public subsidies. The construction pipeline has declined by more than 50 percent from its peak, and the number of units under construction will …

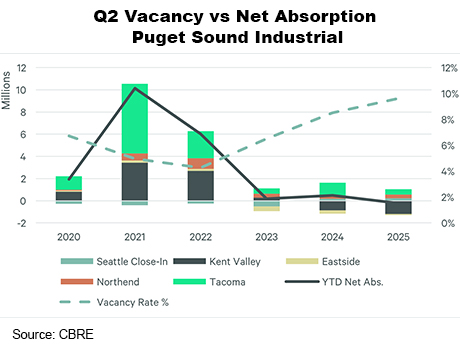

— By Andrew Hitchcock of CBRE — The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April. While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing. Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 …

Executing ground-up development for pure-play retail space — or retail product in mixed-use settings — in Houston is immensely challenging these days for a variety of reasons. This is in spite of the fact that the city has the underlying job and housing growth needed to justify a greater inventory of retail product. While all retail developers in Houston face similar headwinds in terms of costs of capital and construction materials/labor, as well as elevated tenant improvement (TI) costs and hefty required return thresholds from investors, it’s difficult to single out any one of those factors as most responsible for the dearth of new retail development. Some issues will be felt more acutely in some submarkets than others. Certain companies may have better connections and capital situations such that they can circumvent some of the uncontrollables. But no matter the combination of barrier-to-entry factors, the net result is the same: a market that cannot adequately supply retail product to meet demand. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. At the annual InterFace Houston Retail & Mixed-Use conference that …

The Richmond retail market has maintained strong fundamentals as the city’s diverse economic base and solid residential growth continue to fuel a historically low vacancy rate. Demand is very strong from a variety of uses, ranging from soft goods and restaurants to entertainment and personal services such as med spas and boutique fitness. The coffee segment, long dominated by Starbucks Coffee, has seen a number of new competitors enter the market. Dunkin’ has been on a strong growth cycle, and more recently Dutch Bros Coffee, Scooters Coffee, Foxtail Coffee and PJs Coffee have been actively looking for sites. 7 Brew has been particularly active, opening two new stores and filling their pipeline with additional sites. However, the real story in Richmond is the number of mixed-use projects that are in the planning stages or have broken ground, with virtually all of them anchored by a grocery store. In Chesterfield County, the first phase of development for Springline at District 60 is near completion. Located at the intersection of Midlothian Turnpike and Chippenham Parkway, work was recently completed on a new 150,000-square-foot office building anchored by Timmons Group, while the 298-unit apartment building, The James at Springline, is nearing completion. …

By Joe Mahoney, Opus In today’s industrial landscape, where some U.S. metros are grappling with double-digit vacancies and an oversupply of speculative product, the Minneapolis-St. Paul metropolitan area continues to stand apart. With consistently strong fundamentals, measured development, disciplined absorption and diverse demand, the Twin Cities have historically avoided the peaks and valleys of fluctuating supply and demand that plague other cities. Looking at current data, during the first two quarters of 2025, industrial vacancies here hovered around 4 percent while the national average was 9.3 percent, according to CBRE. In fact, the Twin Cities have the fifth lowest industrial vacancy rate in the country. Steadfast economics This stability is no accident. The Twin Cities of Minneapolis and St. Paul rank as the 13th largest industrial market in the country due to a number of factors. Among the most impactful, they have a robust corporate base that includes 17 Fortune 500 companies in industries ranging from manufacturing, technology, agriculture and healthcare to medtech, energy, retail and financial services. This diversity helps drive consistent demand. In addition, above-average wages that outpace inflation, below-average unemployment rates and above-average job growth, household resiliency and demographic stability together help make Minnesota a good place …