By Peter Hauser, Principal, Avison Young The Orange County multifamily sector is extremely strong. Rents continue on a positive upward trend and occupancies remain very high, hovering around 97 percent. It is unquestionably a landlord’s market. Many years of supply constrained NIMBY-ism that created the lack of new construction is coming to an end, however. The California governor has mandated that cities approve quality residential developments with the goal of increasing density and combatting the significant housing shortage. There are currently 6,800 new multifamily units in the process of being delivered. While there are projects in the majority of cities, Irvine, Anaheim, Orange and Santa Ana are seeing the most development activity. Some very active Orange County developers include Trammel Crow Residential, Alliance, the Irvine Company, Western National Group, JPI, Wermers Companies, Avalon, Fairfield, Shopoff Realty and Garden Communities. Alliance Residential is nearly complete on its 1,221-unit Park & Paseo in Santa Ana, near the border of the master-planned Tustin Legacy community. Wermers Companies is also in the process of finishing the 603-unit Elan, located less than a mile from downtown Santa Ana near the intersection of the 55 and 5 freeways. The 653-unit Avalon Brea Place is starting to …

Market Reports

The I-40/I-85 Corridor is an emerging distribution area with a remarkably strong tenant mix between national manufacturers and distribution users, making it one of the most fundamentally sound corridors in the Sun Belt. The I-40/I-85 Corridor, squarely centered between the Triad (Greensboro, Winston-Salem and High Point) and the Triangle (Raleigh, Durham, Chapel Hill), is home to companies such as Walmart, Lidl, Ford, Kidde, Amazon, Chick-Fil-A, UPS, Lenovo, FedEx, Coca-Cola, among others. This corridor is seeing rapid expansion and is poised to be an epicenter of industrial activity in the region as the logistical significance of the area is attracting larger users and a growing amount of institutional capital. Recently, this submarket has seen significant demand from larger users leading speculative developers to plan large, Class A industrial parks. Historically, the market has been dominated by older manufacturing buildings. The newer development in the area is making these properties more obsolete due to their lower efficiencies, a phenomenon marking a larger shift in the composition of the emerging submarket. The industrial inventory’s makeup is continuing to evolve over time, marking the transition from smaller manufacturing properties to distribution and significantly larger manufacturing operations. Buildings currently under construction are average a footprint …

By Phil Breidenbach, Senior Executive Vice President, Colliers Companies are coming back to the office in Phoenix. Businesses are envisioning the return of their workforce as many look for new space or reconfigure their existing facilities. Building owners feel the momentum. We have reason to be optimistic — the future of the office and how we use the workplace is exciting! Getting there, however, will be turbulent. Your patience may be tested. Colliers’ fourth-quarter office report shows vacancies stabilizing market wide, positive absorption occurring in key submarkets and rents increasing marginally. Positive fourth-quarter absorption was led by leasing in new Class A+ buildings like 100 S. Mill. This Hines/Cousins project is 80 percent leased by institutional, “household name” tenants at record rents several months prior to completion. Vacancy rates may, however, continue to fluctuate as certain downsizing continues. Some institutional users are adopting work from home for much of their workforce, convinced this strategy will help with employee retention and cost reduction without impacting productivity — assumptions yet to be proven. This strategy has corporate America subleasing space, allowing leases to expire and vacating spaces, which is stagnating recovery. ‘Short Term’ — The Renewal Mantra for 2022 We speak with office occupiers regularly about back-to-work strategies. …

The “retail apocalypse” predicated on the pandemic never really materialized. Instead, we’ve seen retail do what it always does: evolve. Much as the rest of the country, metro Detroit’s retail real estate market has evolved and come back in a big way. Tenants on the move As vaccines were adopted and the economy allowed to reopen, the economic rubber band snapped back quickly and stronger than many of us could have predicted. Retailers were dusting off pre-pandemic expansion plans and back to signing leases in 2021. We saw new openings and new market searches from BJ’s Wholesale Club, Burlington, Carvana, Chick-fil-A, Chipotle, Starbucks, Crunch Fitness, Edge Fitness, Gabe’s, iFly, Jollibee, Meijer, Portillo’s, Ross, Shake Shack, Smoothie King, T.J. Maxx, Total Wine & More and Tropical Smoothie Café. 2021 also presented a big void in the Michigan furniture market following the bankruptcy of Art Van (which controlled 30 to 35 percent of the market). Numerous players including Gardner White Furniture, Ashley Furniture and Value City Furniture all quickly snapped up this real estate, immediately increasing their market share. Other categories that continue to seek space include car washes (which has to be one of the most active categories out there …

By Clara Wineberg, principal and executive director, SCB Boston As we have all been forced to reexamine how we interact with and live in our homes during two years of a global pandemic, lessons learned for architects, developers and interior designers have been bountiful. In early 2020, those of us in the multifamily industry were wary about how we would make it all work; now, however, we realize the challenges we have faced in the last 24 months have provided immense opportunities to improve design of modern housing communities. In 2022 and beyond, multifamily design will continue to evolve to meet the changing definition of “home,” and how it connects us to our loved ones, communities and even ourselves. Everything From Home While home used to be just a place to hang one’s hat at the end of the day, in 2020, home took on a whole new meaning. It became not only the place we rest, but also our workplace, our children’s classroom, our fitness center and our entertainment venue. Our whole lives were — and to some extent still are — encapsulated within our homes. We expect this trend to continue moving into the future post-pandemic world. The …

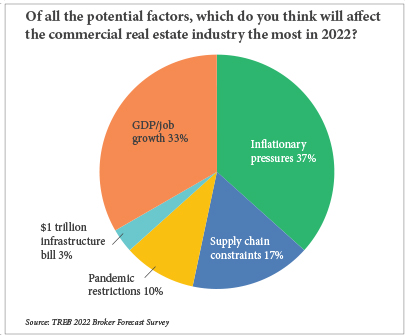

By Taylor Williams In late October, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Texas Real Estate Business’ annual reader forecast survey, commercial brokers and developers/managers in the Lone Star State aren’t likely to be contributing to that fund any time soon. When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, both of these groups selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. It’s worth noting that the survey officially closed on Monday, Dec. 13, about a week before the nation began to see a major surge in COVID-19 cases, most of which were classified as the Omicron variant. In the subsequent three-week period, …

The Raleigh-Durham region is experiencing increasing optimism despite the lingering impacts of COVID-19. While some reentry plans have been delayed and companies are still grappling with the way in which they will utilize office space moving forward, tenant demand is expected to rebound sharply in the first half of 2022. “We’ve seen an encouraging uptick in tenant activity since the second quarter of 2021, and we expect that trend to accelerate,” says Kathy Gigac, principal of Avison Young and a member of the firm’s Occupier Solutions Team. “Tenants seem ready to get back to some sense of normalcy.” Local economic fundamentals are sound, as reopening efforts and positive job growth have allowed Raleigh-Durham’s unemployment rate to recover from a pandemic high of 12 percent to 3.2 percent as of Sept. 2021. The region continues to witness major economic development wins with companies such as Google and Apple announcing plans to create thousands of new jobs. In its largest presence on the East Coast, Apple will invest $1 billion over a 10-year period to create a 3,000-job campus to eventually span 1 million square feet. In the most recent announcement from an office-using tenant, Fidelity Investments will add 1,500 jobs in …

A lot has changed in the world since the beginning days of the COVID-19 pandemic in early 2020. Fast forward to November 2021 and the world is a very different place. Over 46 million people have been infected in the United States alone with over 750,000 deaths officially attributed to the virus. Most businesses have been forced to shut down in-person work for some period of time and many have instituted remote work programs until the beginning of 2022. The real question on everyone’s mind is when will we return to normal and more specifically, what will the new normal look like? Although we will most certainly have to deal with the aftereffects of COVID-19 and any variants that surface, there is light at the end of the tunnel. To date, approximately 427 million doses of the vaccine have been administered with over 192 million people fully vaccinated. Recently, Pfizer announced that it has developed an easy-to-administer COVID-19 pill, which when used in combination with a widely used HIV drug, can cut the risk of hospitalizations or death by 89 percent in high-risk adults who have been exposed to the virus. Given the combination of vaccinations, natural immunity for those …

By Taylor Williams Northern New Jersey is teeming with new multifamily projects, many of them transit-oriented, that mesh suburban locations with urban lifestyles, making the region a desirable alternative to living in New York City. But more housing product is unquestionably needed. According to the U.S. Census Bureau, the Garden State’s population grew by 5.7 percent from approximately 8.8 million to 9.3 million in 2020. New Jersey is the 11th-most populous state and the fifth-smallest state by area, and thus has the highest level of population density in the country. The combination of a growing population and a very limited supply of land means that infill development sites that provide direct access to major cities, most notably New York City and Philadelphia, are highly coveted by developers of all property types. But developers that can deliver the right kind of housing on those sites play central roles in helping municipal leaders bring new jobs, retailers and restaurants to their communities. CENTURION Union Center, a mixed-use project which includes nearly 300 new homes and approximately 27,000 square feet of retail space, is just one such project that ties together a basic need for housing with a larger revitalization of the community. …

By Taylor Williams The factors that have long enticed Texas retailers and restaurants to locate in mixed-use environments are back in full force, such that these users are once again willing to pay a premium for spaces built-in density and walkability. In some ways, this trend never really disappeared in Texas, one of the first states to reopen during the early months of COVID-19. Through measures passed in 2020 like sanctioning to-go alcohol sales and allowing businesses to stay open, albeit at reduced capacities, Texas has worked to minimize retail and restaurant closures and prevent large volumes of these spaces from being returned to markets. Neither has the state’s job and population growth slowed during the 22-month global health crisis, allowing developers across all asset classes to push forward. In addition, the newfound desire from consumers and businesses to work, shop and dine outdoors as much as possible has kept trains rolling on mixed-use projects, which inherently connect different uses through external features like trails, open streets, pocket parks and plazas. From a design standpoint, those connective features remain critically important, says Barry Hand, principal in the Dallas office of global architecture firm Gensler. “Pocket or linear parks are viewed …