By Ryan Sarbinoff, First Vice President, Regional Manager, Marcus & Millichap Retail metrics in the Valley have soundly improved after enduring some turbulence during the health crisis. Through the first nine months of 2021, net absorption totaled roughly 1.6 million square feet, putting the market on a trajectory to record its highest annual count since 2017. More than half of that absorption was logged between July and September, indicating that momentum is building. Phoenix retail market is in a much stronger position heading into 2022 Several factors are driving the uptick in retail space demand. Metro employment surpassed the pre- pandemic peak by August 2021, spearheading consumers’ ability to spend. At the same time, more seasonal residents are returning to the Valley after many chose not to travel in 2020, while tourism is also progressing. According to the City of Phoenix Aviation Department, passenger counts at local airports increased by 67 percent year-to-date through September relative to the same period last year. All these underlying forces benefit retail spending, and ultimately fuel tenant demand. Longer-term outlook is robust, piloted by growth trends Phoenix is expanding at a swift pace, with the metro’s favorable climate, quality of life and job availability attracting new residents. From the beginning of …

Market Reports

By John Stater, Research Manager, Colliers Southern Nevada gained 15,400 industrial jobs between August 2020 and August 2021, according to the Nevada Department of Employment, Training and Rehabilitation. The logistics and wholesale sectors added jobs on a year-over-year basis, while the natural resources and construction sectors lost jobs. Unemployment in the Las Vegas-Paradise MSA was 8.3 percent in August 2021. Over the past 12 months, total employment in Southern Nevada increased by 55,600 jobs, a 6.1 percent increase. Southern Nevada lost 241,900 jobs between February and April 2020 and had regained 71 percent of those lost jobs by August 2021. Southern Nevada is in its third major wave of post-Great Recession industrial development, with 6.6 million square feet of product now under construction. The fourth quarter of 2021 could see 2.3 million square feet of product added to inventory. Projects scheduled for completion in the fourth quarter of 2021 are currently 58 percent pre-leased. Projects completed this quarter were 98.8 percent pre-leased when completed. Net absorption this quarter was a record 4.45 million square feet. This brought net absorption up to 9.79 million square feet year-to-date, higher than the previous record for annual net absorption recorded in 2017. Warehouse/distribution net absorption …

By Garrett McClelland, Vice President, JLL With a global pandemic still in flux, strong demand for Orange County industrial remained constant throughout 2021. As we start the New Year, signs of a slowdown are nowhere in sight. Orange County’s overall vacancy was at 2 percent last quarter, which ranks among the lowest nationally. Demand continues to outpace supply — with limited inventory bringing the vacancy rate down and driving rents to historic highs. With very few viable options, tenants are forced to settle for anything that will satisfy their needs, or renew. Given this, developers have gotten creative to find solutions and build new industrial product in primary submarkets. The primary target for industrial developers in Orange County has been Class B and C office buildings located on industrial-zoned parcels. For example, Duke Realty recently bought a primarily vacant 100,000-plus-square-foot office building in Brea. The building is situated on 5.8 acres and is planned for a new modern warehouse industrial facility. According to JLL Research, out of the 12 conversion projects announced last year, nine were office to industrial. This shouldn’t come as a surprise as we’ve seen rapid rent growth in the industrial sector over the past 24 months. This has made office-to-industrial …

The metro Minneapolis retail real estate market is healthy overall coming out of 2021, with suburban submarkets on fire in many cases and urban submarkets generally subdued. A major overhang of supply was absorbed across the region last year as construction slowed dramatically, pushing retail vacancies down, rents up and sales prices of single and multi-tenant assets higher overall. It’s a testament to the market’s overall stability and resilience given the multiple waves of COVID, and events surrounding the George Floyd case that was prosecuted last year in the city. Work-from-home effect With many white-collar professionals still working from home and the center-cities tougher on mask mandates and vaccine requirements, the suburbs have shone the brightest. Vacancies were as low as 6 percent in some areas, with the overall market at 8.2 percent at year-end, according to the Minnesota Commercial Association of Real Estate/Realtors (MNCAR). Among the strongest performing submarkets have been Apple Valley, Maple Grove, Coon Rapids and Woodbury. The metro’s eight regional malls are generally faring well, unlike in some other markets across the U.S. that are more over-supplied. That said, there’s some adaptive reuse going on, including in the northwest suburb of Maple Grove where a freestanding …

By: Jamie Rash, Regional Director, Keystone Development + Investment Talk about a spark. When Spark Therapeutics announced plans at the end of last year to develop a $575 million gene therapy manufacturing plant in Philadelphia, it ignited the city’s evolution into a destination for the largest, most innovative life sciences firms in the world. Over $1 billion in venture capital (VC) investment is pouring into more than 50 Philadelphia life sciences companies that employ some 20,000 people, generating unprecedented demand for lab space. Supply is limited — even with 1 million square feet of lab space in development — and this supply shortage is driving some developers to capitalize on the demand by converting existing building stock. Moving Beyond Meds & Eds Philadelphia is a long-reputed “meds and eds” city, meaning it’s home to anchor institutions of higher learning and world-leading medical facilities that are known for innovation and opportunity. These institutions are major drivers of economic growth throughout the city. Previously, much of the activity in pharmaceuticals and biotechnology occurred in labs in suburban office parks and sprawling corporate campuses. In 2017, the city celebrated two cutting-edge, FDA-approved gene and cell therapies to treat specific types of cancer and …

By Randy Lacey, SIOR, senior vice president, CBRE | Oklahoma City; and Chris Zach, CPA, associate, CBRE | Oklahoma City Contrary to popular belief, the ongoing pandemic has been a boon to many aspects of the Oklahoma City economy. Industrial real estate growth has been more prominent than any other commercial sector. Those familiar with the city and surrounding area can vouch for the speed and intensity of housing demand and development, but industrial real estate has set itself apart over the last few years. OKC is Here to Stay Oklahoma City has a lot going for it. The market always has been well-positioned in terms of its central geographic location at the intersection of Interstates 35 and 40 and has seen tremendous growth and success in the last decade, with significant headway in the local industrial real estate market. The industry has proven its resiliency amid the pandemic and should continue to fare well into the future. But low costs of living and doing business have further bolstered the appeal of the community. In fact, Oklahoma City is only one of 14 cities across the country to add more than 100,000 people in the last 10 years, …

Raleigh-Durham is increasingly popping up at the top of shopping lists for multifamily investors, and buyer demand — coupled with strong rent growth — is resulting in record sale prices. As of this writing, 2021 is on pace to be one of the best years ever in terms of total transaction volume. As capital continues to flow into the market across the spectrum of investor groups from institutions to high net worth individuals, cap rates also have dropped into record territory. Just about every sale in the market is trading at a cap rate in the 3s, and even sub-3 percent in some cases. For example, Northmarq recently brokered the sale of the 489-unit Indigo Apartments in Morrisville on behalf of Blue Heron Asset Management. The asset sold for $121.9 million. The deal was one of the largest single-property multifamily sales in North Carolina in 2021, and the largest in Raleigh-Durham’s history upon closing. The property received multiple qualified offers before selling to Toronto-based Starlight Investments for $249,000 per unit, surpassing initial pricing guidance by nearly 20 percent. The phenomenon of lower return expectations and compressed cap rates is not unique to the Raleigh-Durham market. That trend is occurring throughout …

By Pat Harlan, Managing Director, JLL Labor, geography, population growth and a steady stream of cost-effective, “speed to market” solutions make Phoenix one of the most dynamic industrial markets in the country. Based on existing fundamentals, 2022 is on track to be another record year. As of third-quarter 2021, Phoenix had landed just under 16 million square feet of net leasing year-to-date. Absorption had improved by more than 28.5 percent in the same 12-month period, to total 8.5 million square feet. Nearly 94 percent of that activity was generated from ecommerce and food and beverage users. Vacancy had also dipped to pre-pandemic levels, falling by 100 basis points year-over-year to just 6.8 percent as of the end of the third quarter of 2021. Construction continues to ramp up, trying to meet a seemingly unending stream of demand. As of the end of the third quarter, there was 16.6 million square feet of metro Phoenix industrial space under development. The West Valley accounts for about 11.3 million square feet of this activity. The Southeast Valley represents an additional 3.4 million square feet. Two of the largest buildings underway in the market right now are the Cubes Glendale, totaling 1.2 million square feet, and Building …

The United States has been experiencing a housing crisis for years, one that is perpetuated by the COVID-19 pandemic. Whether it’s a lack of affordable housing properties for low-income families, a steady increase in housing prices over the years or exponentially high demand for new homes, the U.S. housing market within the past decade has been a wild ride. Indianapolis growth In the heart of Indiana, we’re seeing a hopeful trend. Indianapolis (Indy) was ranked as the fourth best housing market positioned for growth in 2022. A variety of factors could contribute to this distinction. For one, Indy is a thriving city and centrally located — not just within the state, but in the U.S. It’s home to two professional sports teams, and recently named one of the best cities for creating tech jobs by Forbes, with Fortune 500 corporations like Eli Lilly and Salesforce headquartered throughout the vibrant downtown. Marquee universities such as IUPUI, Butler and IU Medical School also bring more jobs into the fold. The 2020 Census found that metropolitan areas like Indianapolis are at the forefront of the state’s growth. Marion County remains the most densely populated county with more than 950,000 residents. Currently, the average …

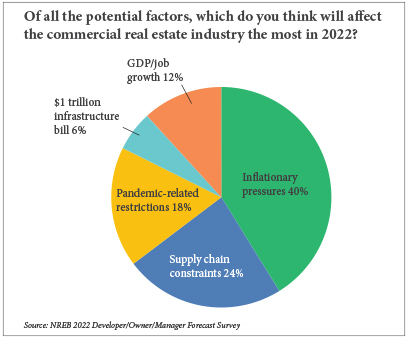

By Taylor Williams In late October of last year, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Northeast Real Estate Business’ annual reader forecast survey, commercial brokers and developers/owners in the region aren’t likely to be contributing to that fund any time soon. Inflation Could Linger When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, roughly a third of broker respondents selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. Concerns over pandemic-related restrictions on businesses, which adversely impact demand for space, was a close second among broker respondents. Some brokers elaborated on these views in the free-response section of the survey. “Continued inflation will …