By Chris Beason, NAI Ruhl Commercial Co. As we move through 2025, the commercial real estate market in the Quad Cities region continues to adjust to tighter capital markets, rising costs and evolving consumer and business preferences. The bi-state region of the Quad Cities includes Moline, East Moline and Rock Island, Illinois; and Davenport and Bettendorf, Iowa, as the main core cities. The Quad Cities is the largest metro area between St. Louis and Minneapolis on the Mississippi River. When you look at the fundamentals like industrial absorption, land sales and retail demand, the Quad Cities continues to outperform expectations. The level of investment we’re seeing from both global tech companies and regional developers shows long-term confidence in the strength and potential of our market. Pivotal year for industrial The Quad Cities market mirrored the national trends with increased development of industrial buildings and rising rental rates. While the new industrial development we have seen locally over the past three years is to be celebrated, there is still a shortage of smaller 10,000- to 50,000-square-foot buildings. This is especially true for companies that desire to purchase real estate. There is significantly more inventory for lease of smaller product available than …

Market Reports

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …

In a world where volatility has become the norm in commercial real estate, Memphis stands out as a market defined by consistency. While other cities have experienced dramatic swings in vacancy, absorption and construction activity, the Memphis office market continues to follow a more measured pace. “Slow and steady wins the race” is more than a phrase — it’s a fitting summary of how Memphis has maintained balance amid national disruption. Stability in supply Over the past couple of decades, the total supply of office product in Memphis has grown at a moderate pace, sitting at nearly 28 million square feet today. This disciplined approach has kept vacancy within manageable levels and prevented the oversupply issues seen elsewhere. With no new speculative construction of size since 2009, the market has had time to absorb shifts in tenant behavior without being flooded with excess space. Demand aligns with supply Because supply has remained relatively static, demand has shifted in composition rather than volume. Like many cities, Memphis has seen a “flight to quality,” with tenants prioritizing modern, amenitized spaces over outdated properties — even if that means reducing their footprint. A company that once leased 30,000 square feet in a Class …

By David Stecker, JLL As advanced manufacturing reshapes industrial real estate across the Midwest, Cleveland is emerging as a quietly powerful hub — offering scalable space, a strategic location and infrastructure ideal for high-growth sectors. While other Midwest metros have gained national attention for headline-grabbing investments, Cleveland is carving out its own unique path to growth, supported by advanced industries, a skilled workforce and a strong real estate foundation. The region’s industrial market remains competitive and resilient, even amid broader economic headwinds. Despite the recent move-out of Joann Fabric’s 1.4 million-square-foot facility in Summit County, overall fundamentals remain healthy, and Class A space is in especially high demand. For high-tech and manufacturing users seeking logistics-ready facilities in a cost-effective market, Cleveland delivers — offering the right mix of space, speed and strategic location that today’s industrial users are actively pursuing. A market of opportunity According to JLL’s second-quarter 2025 Cleveland Industrial Insights Report, total vacancy in the market sat at 3.8 percent. While this represents a slight uptick following Joann’s exit, it still signals robust market health. Class A availability is especially tight, driven by a wave of large leases signed in newly developed properties. That momentum is putting upward …

— By Bryce Aberg and Brant Aberg of Cushman & Wakefield — Optimism is returning to the San Diego industrial market after a few quarters of recalibration. Buyer appetite has resurfaced in core submarkets like Otay Mesa, Miramar and Carlsbad, which has created a ripple effect across the Greater San Diego industrial market. With an inventory of 162 million square feet as of the second quarter, San Diego is beginning to see the benefit of limited supply. Natural barriers like Mexico, the Pacific Ocean, Camp Pendleton and the nearby mountains are driving the San Diego industrial market toward full build-out. There is currently only 2.4 million square feet of inventory under construction, with not much more proposed. Following the all-time highs in rent growth and positive absorption seen in 2021 and 2022, San Diego’s enduring fundamentals and built-in advantages have kept it in place as one of the most stable and competitive in Southern California. With a diversified tenant base, high barriers to entry and a strategic position on the U.S.-Mexico border, fundamentals have held while others in the Southern California region have struggled in comparison. Bid-ask spreads are also starting to narrow as buyer and seller sentiments begin to …

When people think of Memphis, they often picture its musical legacy, its storied riverfront and its role as a logistics powerhouse. But fewer realize that Memphis is also quietly becoming one of the Southeast’s most dynamic retail markets. Despite headwinds that have impacted large-format retailers nationally, Memphis continues to attract new-to-market brands, redevelop aging assets and create spaces that resonate with today’s consumers. Economic foundations Memphis is riding a wave of transformational investment across multiple sectors. Ford Motor Co.’s $5.6 billion Blue Oval City, where the company’s all-electric truck and battery plant will be built, is already reshaping the regional economy. Google’s announcement of a 1,178-acre, $10 billion data center and office campus in nearby West Memphis in Arkansas adds another layer of momentum, as does the creation of the world’s largest supercomputer by xAI. Coupled with St. Jude’s $10 billion expansion, these projects underscore the region’s growth trajectory and long-term employment base. In retail, the past year brought a temporary pause in net absorption, with approximately 317,000 square feet coming back to the market — primarily due to national big-box closures like Macy’s, Joann Fabrics and Big Lots. Yet these macro shifts don’t tell the whole story. By the …

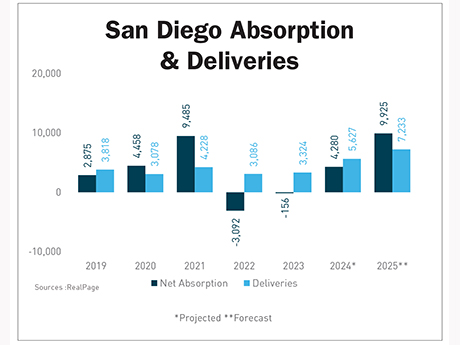

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

By Jane Witowich, business operations manager, Day One Experts In Collin County, two fast-growing Texas cities are charting a new path for economic development that prioritizes efficiency, adaptability and smart decision-making over traditional staffing models. Fairview and Melissa, a pair of suburban communities facing explosive population growth and mounting development pressure, have adopted a fractional approach to economic development. Instead of creating or adopting full-time, in-house departments, both cities have strategically partnered with outside expertise to stay visible in national site selection circles, foster new investment and keep costs in check. That decision, born out of necessity, is quickly proving to be a blueprint for others. A Model Rooted in Strategy The challenges faced by these teams in Fairview and Melissa are familiar to city leaders across Texas: developer interest is growing, expectations from residents are rising and yet budgets remain constrained. Hiring full-time economic development staff, building marketing infrastructure and funding national outreach campaigns — these initiatives often stretch beyond what smaller cities can reasonably afford. Rather than let those constraints define them, Fairview and Melissa made the deliberate choice to adopt a fractional model. Through partnerships with experienced consultants such as Day One Experts, led by veteran economic …

When asked what makes Florida appealing from a retail perspective, Steven Miskew, CEO of Southeast Centers, put it succinctly: “The good macro-economic drivers are here: population growth, lack of supply and low vacancy, all in a pro-business environment,” he said. As Miskew asserts, Florida’s population continues to swell as approximately 1,755 people move into the state daily, according to 2023 data from online self-storage platform StorageCafe. Additionally, U-Haul has ranked Florida as a top four growth state in its annual growth index — which analyzes the destinations for one-way moves across its fleet — every year since 2015. Seven Florida cities ranked in U-Haul’s top 25 growth metros in 2024. Florida’s growing population underpins the success of its retail sector as more rooftops directly correlates to more demand for corresponding services, including grocery, food-and-beverage, health and wellness and soft goods. Phil Kirkpatrick, business recruitment and property development at the City of Clearwater’s economic development and housing department, says that the Tampa Bay-area city is seeing very strong retail occupancy levels. “Vacancy is quite low as of the end of 2024, sitting at 5.4 percent,” says Kirkpatrick, acknowledging that the rate exceeds the vacancy rate of the overall Tampa Bay metro …

You can be a best-in-class operator with the coolest concept on the block, or you can be a well-capitalized landlord who knows all the right people, but if rapid, sustainable growth in the Boston retail market is what you seek, you might be SOL. According to local brokers, the high-demand, low-supply dynamic that currently exists in most major U.S. retail markets does not fully encapsulate the difficulties that tenants and landlords alike face in growing their footprints in the greater Boston area. As to why growing store counts or portfolios is so challenging in this market, the answer varies depending on who you ask. But a collective recap of all wide-ranging barriers to entry and disruptive forces at play paints a picture of a market that is borderline impenetrable for many tenants and perpetually stagnating for many landlords. “Boston remains an incredibly high-barrier-to-entry market,” says Zach Nitsche, director of retail capital markets in JLL’s Boston office. “A statistic we like to share with clients and industry people that haven’t historically invested in Boston and New England is that less than 5 percent of our total retail product has been constructed after the Global Financial Crisis. So far this year, the …