The Greater New Orleans industrial real estate market in 2025 is characterized by steady but cautious demand, where a persistent lack of new supply continues to limit product availability and constrain tenant options despite a user base that shows signs of wanting to grow. While local prospects for business are good, tenants seem to be keeping a wary eye on national economic trends. Interest rates have increased borrowing costs, prompting tenants to delay expansions and relocations as they navigate tighter budgets. Decision making is further slowed by uncertainty surrounding potential tariffs and their possible effects on material costs that could ripple through supply chains. High insurance premiums in a region affected by hurricanes force operators to reallocate funds from growth initiatives to coverage. Construction costs remain elevated; combined with a scarcity of viable development sites, speculative builds are extremely rare, which keeps inventory tight. These headwinds, some of which should sound familiar in other markets around the country, have slowed deal velocity, though there are projects in the works that can build momentum in South Louisiana. The $1.8 billion Louisiana International Terminal (LIT) in St. Bernard Parish, a public-private partnership with Ports America and Terminal Investment Ltd., begins construction in …

Southeast Market Reports

One cannot talk about, analyze, nor understand the New Orleans Central Business District (CBD) office market without a corresponding discussion of the entire CBD, not just the office building submarket. This is especially true when we look at the evolution of the New Orleans CBD since the late 1980s, and, more specifically to this article, since Hurricane Katrina. The New Orleans CBD office market is still the largest office submarket in this region. The submarket contains approximately 10.3 million rentable square feet. The balance of our submarkets (East Metairie, West Metairie, Kenner, Elmwood, West Bank, New Orleans East and the Northshore) contain a total of 8.6 million rentable square feet. More importantly, the CBD remains home for most of New Orleans’ “corporate” tenants, virtually all the region’s major law firms and financial institutions. That is the good news. However, the CBD has been transformed over the past 30+ years — and especially for the past two decades after Hurricane Katrina — from a traditional office-centric CBD to a mixed-use downtown area. The supply of office space in the CBD has shrunk from 70 buildings and 16.5 million rentable square feet in 1991, to 50 buildings and 13.8 million rentable square …

The Richmond industrial market has been undergoing a dramatic transformation that reads like a case study in strategic positioning and timing. Over the past decade, this “regional market” has become a U.S. powerhouse, boasting all the ingredients to attract, maintain and organically grow supply-chain focused global occupiers and institutional capital investment. Richmond’s strategic advantages include its prime location on I-95 — equidistant to both metropolitan D.C. and the Port of Virginia — attractive labor demographics, disciplined development and strong demand from Fortune 100 occupiers. Additionally, the surging data center hyperscalers and their suppliers have further catalyzed growth in the market. The result? Richmond now features one of the lowest U.S. vacancy rates, sustained year-over-year rent growth, a feeding frenzy of institutional capital routinely producing 10 to 15 bids and lender quotes per property that have fundamentally reshaped who owns, develops and finances industrial real estate in the market. From regional player to national stage Over the past decade, Richmond experienced a 68 percent increase in institutional investors and lenders, growing from 47 participants in 2015 to nearly 80 unique institutions that have invested in and loaned on Richmond industrial assets, with 50 cents of every dollar invested in Richmond coming from …

August 29, 2005 — a day no New Orleanian will forget: Hurricane Katrina. It has been two decades since the levees were breached and flood waters took over the city’s streets, homes and businesses. It was an event that changed the trajectory of the city of New Orleans. Twenty years later and the resiliency of New Orleans to always push on is evidenced by the stability of our multifamily market. Through a period of demolition, renovation and rebuilding, the overall market remains stable. The barriers to entry in the Metro New Orleans multifamily market are significant, and today as in the past, the equilibrium between supply and demand remains in sync. Like other Sun Belt markets, insurance premiums, interest rates and affordability are factors. However, they have not been a deterrent to the viability of the market or interest from investors and the capital markets. Our inventory of more than 55,000 units (professionally managed) spread out over seven parishes, remains strong. Overall metro occupancy is being reported between 92 to 94 percent with average rents of $1,300 per month. Parish by parish Eastern New Orleans and Algiers, which each have an inventory of approximately 4,000 units, offers the most affordable …

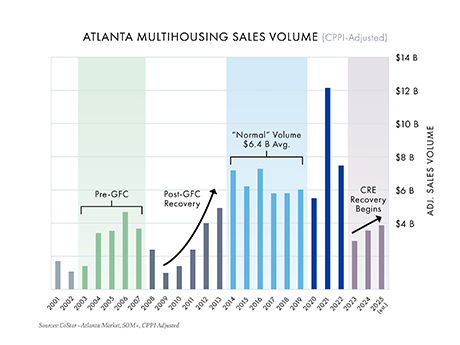

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

If you’ve spent any time driving around Atlanta recently, you’ve probably noticed something. More development sites are returning with bulldozers and developers are taking down land parcels in the suburbs the size of small European countries. But this time, the approach is more strategic than ever. Gone are the days when a developer would carve out a shopping center for base rents less than $40 per square foot and call it a day. Today, some metro Atlanta developers are assembling larger tracts and creating hybrid projects that include multifamily housing, storage and even industrial uses in the back of the parcel, saving the front-facing road frontage for ground leases, build-to-suits and limited shop space. Automotive and restaurants concepts are clamoring for pads. The result? Those once-overlooked “front and center” pad sites and strip centers are suddenly the belle of the ball. The downside is paying too much on the buy side for the dirt for aggressively low caps rates. But all I can say for the rental rates that I’m seeing is “Wow.” Restaurants still lead In Atlanta’s retail market, restaurants continue to be the leading driver of leasing activity. According to observations, excluding junior box space, food-and-beverage deals made …

After several years of breakneck growth, Atlanta’s industrial sector has clearly shifted into a mid-cycle recalibration. Vacancy has climbed to 8.4 percent, well above the 10-year average of 5.8 percent, as a record wave of big-box deliveries collides with softer demand. Twelve-month net absorption turned negative for the first time since 2011, dropping 453,000 square feet despite 14.9 million square feet of new deliveries over the past year. Developers and tenants alike are adjusting, but the region’s logistics advantages and diverse economy keep long-term fundamentals intact. Supply and demand The pandemic-era surge of speculative construction has decisively slowed. Construction starts have fallen roughly 70 percent from the five-year average, leaving 16.3 million square feet under construction, with just 25 percent available — down from 60 percent a year ago. Most large projects are now data centers, such as a 1.5 million-square-foot QTS facility in Fayette/Coweta County and a 1.2 million-square-foot Microsoft data center near Hartsfield-Jackson Atlanta International Airport. Vacancy is rising fastest in submarkets that saw heavy new supply. Kennesaw/Acworth, for example, has added over 9 million square feet since 2023 and now posts about 13 percent availability for buildings sized 200,000 square feet and larger. Sublease availability has grown …

Atlanta’s commercial office market is at a pivotal moment, caught between signs of stabilization and the lingering effects of a post-pandemic reset. Vacancy remains elevated, absorption is improving and tenant preferences continue to evolve — but fundamentals are beginning to shift as the market adjusts to the new workplace. Signs of a bottom? Hybrid work models, space optimization strategies and cautious expansions have elevated metro Atlanta’s office vacancy rates. Direct vacancy rates surpassed 24 percent for the first time and are hovering near all-time highs. Meanwhile, sublease availabilities have declined over 25 percent from their peak in 2023, and quality space remains difficult to find. The slowing pace of vacancy increases suggests the market may be nearing a turning point after recording negative annual absorption in four of the past five years. Net absorption, a key indicator for overall office sector health, totals negative 438,000 square feet, according to Colliers’ second-quarter 2025 report. While still in the red, this marks a significant improvement over previous years. Recent leasing activity suggests even more positive movement in the second half of the year, indicating that tenant departures are tapering and space givebacks are moderating. Leasing: quality vs. quantity Despite economic headwinds, leasing …

In the fourth quarter of 2024, the Orlando office market had the first quarter of positive absorption in four years, according to a recent Colliers market report. The market, like many across the nation, has navigated a period of recalibration in the wake of the pandemic and evolving work trends. Yet, a shift in tenant activity has signaled renewed leasing demand across the office landscape. In the fourth quarter, net absorption in the Orlando office market reached a positive 95,843 square feet. This is a significant improvement compared to the same period in 2023, which had a negative absorption of 297,714 square feet. Interestingly, it is the submarkets outside of Orlando’s central business district (CBD) that are shining. This is evident in two recent deals that are having a profound impact on the market. In December, we represented the seller when Charles Schwab purchased the Maitland Summit Office Park for $122 million. This was the largest office deal in Central Florida since 2021 and removed 500,000 square feet of Class A office space from the Maitland submarket, which is about 10 miles north of downtown Orlando. Around the same time, Mitsubishi signed a lease for 109,000 square feet in Lake …

Louisville is a city full of history, charm and grit. We’re the birthplace of Muhammad Ali, home to the Kentucky Derby and the heart of America’s bourbon culture. As our city has grown, so have its business opportunities. Louisville’s geographic location, its logistics network and its diversified economy have attracted significant investment from global businesses to set down roots in recent years. In 2023, Louisville was named as a top 5 U.S. metro for economic development by Site Selection magazine with over $1 billion in capital investment and 2,300 new jobs that year alone. Louisville’s overall commercial real estate market has grown along with the population, but the office market has had a softer rebound following the pandemic than other markets nationally. Office overview In second-quarter 2025, Louisville had over 235,000 square feet of positive office leasing activity that was negated by over 256,000 square feet of negative net absorption, primarily due to large move-outs from office users in the city’s suburban submarkets. Leasing activity in Louisville’s Central Business District (CBD) has rebounded. In the second quarter, the submarket saw over 6,100 square feet of net positive absorption from Class A leasing activity, including the Jefferson County Sheriff’s Office lease …