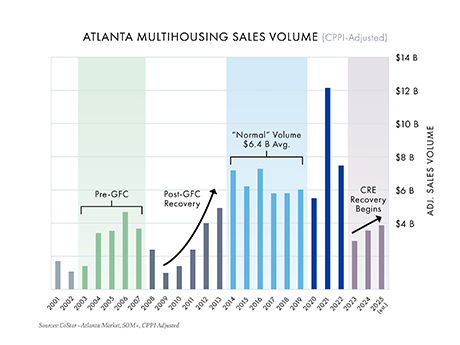

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

Southeast Market Reports

If you’ve spent any time driving around Atlanta recently, you’ve probably noticed something. More development sites are returning with bulldozers and developers are taking down land parcels in the suburbs the size of small European countries. But this time, the approach is more strategic than ever. Gone are the days when a developer would carve out a shopping center for base rents less than $40 per square foot and call it a day. Today, some metro Atlanta developers are assembling larger tracts and creating hybrid projects that include multifamily housing, storage and even industrial uses in the back of the parcel, saving the front-facing road frontage for ground leases, build-to-suits and limited shop space. Automotive and restaurants concepts are clamoring for pads. The result? Those once-overlooked “front and center” pad sites and strip centers are suddenly the belle of the ball. The downside is paying too much on the buy side for the dirt for aggressively low caps rates. But all I can say for the rental rates that I’m seeing is “Wow.” Restaurants still lead In Atlanta’s retail market, restaurants continue to be the leading driver of leasing activity. According to observations, excluding junior box space, food-and-beverage deals made …

After several years of breakneck growth, Atlanta’s industrial sector has clearly shifted into a mid-cycle recalibration. Vacancy has climbed to 8.4 percent, well above the 10-year average of 5.8 percent, as a record wave of big-box deliveries collides with softer demand. Twelve-month net absorption turned negative for the first time since 2011, dropping 453,000 square feet despite 14.9 million square feet of new deliveries over the past year. Developers and tenants alike are adjusting, but the region’s logistics advantages and diverse economy keep long-term fundamentals intact. Supply and demand The pandemic-era surge of speculative construction has decisively slowed. Construction starts have fallen roughly 70 percent from the five-year average, leaving 16.3 million square feet under construction, with just 25 percent available — down from 60 percent a year ago. Most large projects are now data centers, such as a 1.5 million-square-foot QTS facility in Fayette/Coweta County and a 1.2 million-square-foot Microsoft data center near Hartsfield-Jackson Atlanta International Airport. Vacancy is rising fastest in submarkets that saw heavy new supply. Kennesaw/Acworth, for example, has added over 9 million square feet since 2023 and now posts about 13 percent availability for buildings sized 200,000 square feet and larger. Sublease availability has grown …

Atlanta’s commercial office market is at a pivotal moment, caught between signs of stabilization and the lingering effects of a post-pandemic reset. Vacancy remains elevated, absorption is improving and tenant preferences continue to evolve — but fundamentals are beginning to shift as the market adjusts to the new workplace. Signs of a bottom? Hybrid work models, space optimization strategies and cautious expansions have elevated metro Atlanta’s office vacancy rates. Direct vacancy rates surpassed 24 percent for the first time and are hovering near all-time highs. Meanwhile, sublease availabilities have declined over 25 percent from their peak in 2023, and quality space remains difficult to find. The slowing pace of vacancy increases suggests the market may be nearing a turning point after recording negative annual absorption in four of the past five years. Net absorption, a key indicator for overall office sector health, totals negative 438,000 square feet, according to Colliers’ second-quarter 2025 report. While still in the red, this marks a significant improvement over previous years. Recent leasing activity suggests even more positive movement in the second half of the year, indicating that tenant departures are tapering and space givebacks are moderating. Leasing: quality vs. quantity Despite economic headwinds, leasing …

In the fourth quarter of 2024, the Orlando office market had the first quarter of positive absorption in four years, according to a recent Colliers market report. The market, like many across the nation, has navigated a period of recalibration in the wake of the pandemic and evolving work trends. Yet, a shift in tenant activity has signaled renewed leasing demand across the office landscape. In the fourth quarter, net absorption in the Orlando office market reached a positive 95,843 square feet. This is a significant improvement compared to the same period in 2023, which had a negative absorption of 297,714 square feet. Interestingly, it is the submarkets outside of Orlando’s central business district (CBD) that are shining. This is evident in two recent deals that are having a profound impact on the market. In December, we represented the seller when Charles Schwab purchased the Maitland Summit Office Park for $122 million. This was the largest office deal in Central Florida since 2021 and removed 500,000 square feet of Class A office space from the Maitland submarket, which is about 10 miles north of downtown Orlando. Around the same time, Mitsubishi signed a lease for 109,000 square feet in Lake …

Louisville is a city full of history, charm and grit. We’re the birthplace of Muhammad Ali, home to the Kentucky Derby and the heart of America’s bourbon culture. As our city has grown, so have its business opportunities. Louisville’s geographic location, its logistics network and its diversified economy have attracted significant investment from global businesses to set down roots in recent years. In 2023, Louisville was named as a top 5 U.S. metro for economic development by Site Selection magazine with over $1 billion in capital investment and 2,300 new jobs that year alone. Louisville’s overall commercial real estate market has grown along with the population, but the office market has had a softer rebound following the pandemic than other markets nationally. Office overview In second-quarter 2025, Louisville had over 235,000 square feet of positive office leasing activity that was negated by over 256,000 square feet of negative net absorption, primarily due to large move-outs from office users in the city’s suburban submarkets. Leasing activity in Louisville’s Central Business District (CBD) has rebounded. In the second quarter, the submarket saw over 6,100 square feet of net positive absorption from Class A leasing activity, including the Jefferson County Sheriff’s Office lease …

Louisville’s industrial market stands out as a steady force, resisting the fluctuations often seen in surrounding Midwest cities such as Cincinnati, Columbus and St. Louis. Midyear figures show Louisville’s year-over-year rent growth exceeding the national percentage and its vacancy rate 340 basis points below the national rate, both signs of a healthy market. Additionally, Louisville’s recognition in national trade publications and recent announcements of General Electric/Haier and Ford’s electric vehicle (EV) investment at its Louisville Assembly Plant suggests positive future job growth. A sturdy foundation Louisville’s centralized location has helped secure its place as a major logistical powerhouse and develop relationships with major industrial business players such as UPS, Ford and General Electric. UPS announced its first expansion into Louisville in 1981 and has continued to grow its operations since, including the recently opened $100 million automated medical labs shipping facility. Ford also continues to invest in Louisville, recently leasing a 567,433-square-foot facility in Southern Indiana and a 426,300-square-foot facility in Louisville’s Bullitt County submarket just south of Louisville Muhammad Ali International Airport. Additionally, General Electric/Haier will move washer/dryer manufacturing processes to Louisville, creating 800 new jobs and confirming Haier’s Louisville manufacturing operations as its global hub. A resilient market …

Louisville’s retail market continues to show strength in 2025, with grocery anchors driving much of the momentum. Despite national headwinds such as moderating rent growth and elevated construction costs, the metro has proven resilient, posting a vacancy rate of just 3.5 percent, outperforming the national benchmark of 4.8 percent, according to CoStar Group. Asking rents averaged $17.42 per square foot, reflecting steady demand across the region. At the center of this activity are grocers like Kroger, Publix and BJ’s Wholesale Club, each reshaping Louisville’s retail landscape in unique ways. Kroger is deepening its footprint with multiple new stores, including a 123,000-square-foot location under construction on Beulah Church Road that is scheduled to open in 2026. Publix, one of the most closely watched entrants to the Kentucky market, has expanded aggressively after opening its first store, securing 60,000 square feet at Blankenbaker Plaza and 56,000 square feet at Prospect Point. BJ’s Wholesale Club has adopted a redevelopment approach, razing the former Sears building at Jefferson Mall to deliver a 104,000-square-foot store that opened earlier this year. Collectively, these projects underscore the draw of essential, needs-based retail while fueling complementary leasing activity in their surrounding trade areas. Concepts gaining ground That momentum …

The Richmond retail market has maintained strong fundamentals as the city’s diverse economic base and solid residential growth continue to fuel a historically low vacancy rate. Demand is very strong from a variety of uses, ranging from soft goods and restaurants to entertainment and personal services such as med spas and boutique fitness. The coffee segment, long dominated by Starbucks Coffee, has seen a number of new competitors enter the market. Dunkin’ has been on a strong growth cycle, and more recently Dutch Bros Coffee, Scooters Coffee, Foxtail Coffee and PJs Coffee have been actively looking for sites. 7 Brew has been particularly active, opening two new stores and filling their pipeline with additional sites. However, the real story in Richmond is the number of mixed-use projects that are in the planning stages or have broken ground, with virtually all of them anchored by a grocery store. In Chesterfield County, the first phase of development for Springline at District 60 is near completion. Located at the intersection of Midlothian Turnpike and Chippenham Parkway, work was recently completed on a new 150,000-square-foot office building anchored by Timmons Group, while the 298-unit apartment building, The James at Springline, is nearing completion. …

Richmond’s office market stands out as a resilient post-pandemic performer, with strong relocation activity, a notably low vacancy rate driven by steady return-to-office trends and dynamic development, including office-to-residential conversions that are reshaping both the office and retail landscapes. Relocations have outpaced renewals in 2025, accounting for 78 percent of leases signed so far this year — the highest ratio of new leases to renewals since before 2019. This marks an increase even over the past few years, which were already remarkably healthy. Richmond’s overall leasing activity remains stable, escaping the post-pandemic decline that crippled many other markets. The region has also recorded positive absorption for four consecutive quarters, signaling steadily increasing demand following occupancy losses from 2021 through 2023. Return-to-office initiatives have reignited space needs that have been put on hold for months, or even years. As a result, average daily employee attendance in downtown Richmond has risen from 2,200 in 2022 to more than 3,000 in 2025, according to Placer.ai data, analyzed by CBRE Research. While this still trails pre-COVID levels by about 43 percent, it reflects progress toward restoring a balanced office market. Class A and B properties have repeatedly shown positive net absorption when broken down …