We are fortunate to live and work in a region that experiences steady growth and maintains a healthy economy. From a commercial real estate perspective, the Richmond market is a consistent performer due to its diversified economy and reliable and consistent business drivers. Industrial and multifamily construction activity has remained strong without being overbuilt, eliminating the pattern of “boom and bust” that some other areas experience. A submarket that has been red hot is Scott’s Addition, a 20-square-block neighborhood that has been transformed from warehouses and light industrial to a mixed-use mecca of multifamily, office and retail. Developers and tenants alike appreciate the proximity to the interstate, numerous amenities and abundant diversity within the community. Exceptional walkability scores, along with a thriving restaurant and brewery scene, seem to be driving tenants’ willingness to pay the highest rents in the area. The high cost of new construction also informs these rents and, ultimately, is passed through to end users. Scott’s Addition will likely continue to be a desirable location for many, although high rents and challenging parking will remain an issue for some. Another very desirable submarket and consistent performer is Glen Forest. Primarily office- and medical-focused, this area offers Class …

Southeast Market Reports

In the Tampa Bay area, industrial activity remains strong to this point in 2024. According to market research from Colliers, the industrial market closed the first quarter of the year with a vacancy rate below 6 percent. From 2019 to 2022, leasing activity increased, with some fluctuations between quarters. Meanwhile, 2023 saw more than 12.2 million square feet of renewals, expansions and new leases in the greater Tampa Bay area. The data backs up what we are seeing as brokers – a high-demand market with positive net absorption. With that, there are also several trends that have emerged in 2024. 1.) A generally competitive but well-balanced market. While the Tampa Bay industrial market is competitive, it’s overall well-balanced — favoring neither the landlord nor tenant in its current state (of course, dependent on size and submarket). This balance can be attributed to a slowdown in new construction, high occupancy rates, rising rental rates and continued strong demand. However, rates are not rising as quickly as they have been in the past few years, and tenants are selective about space and want to see several options and thoroughly survey the market before executing a deal. There are also pockets of the …

Remember the “retail apocalypse”? Fast forward to today and it seems to be quite a different story. Retail is currently viewed by many as the most attractive sector within the commercial real estate industry, due in part to an all-time low vacancy rate and increasing rental rates. Atlanta’s retail vacancy rate has dropped to 3.6 percent, which is the lowest rate on record according to CoStar Group. The low vacancy rate coupled with an extremely limited amount of new retail space under development due to high construction costs has created a market unlike anything we have seen in a long time. Increased construction costs along with higher interest rates have made it cost-prohibitive to build traditional retail power centers; however, grocery-anchored retail is the anomaly with Publix taking the lead. Several mixed-use developments that include a large retail component are underway as well, including High Street in Dunwoody, Medley in Johns Creek and Centennial Yards in downtown Atlanta, just to name a few. Additionally, some retail space has been taken off line as malls reinvent themselves. Examples include the partial demolition of North DeKalb Mall in Decatur to make way for a new mixed-use development known as Lulah Hills; Northlake …

The Memphis office market continues to defy national post-pandemic office trends, fueled by persistent occupier demand and limited amounts of vacancy within primary submarkets. Although, the market closed out the 2023 year with 34,430 square feet of occupancy losses caused by two large tenant vacancies, the first quarter of 2024 reversed the trend as net absorption swung positive, recording 140,788 square feet of occupancy gains. The Memphis unemployment rate remained low at 3.5 percent in May, just above the Tennessee unemployment rate of 3.0 percent and below the national average of 4.0 percent, according to data from the U.S. Bureau of Labor Statistics. Ford Motor Company’s Blue Oval City began its hiring in 2023, with most of its hiring to occur in the second half of this year, which could begin to further compress the unemployment rate, as approximately 5,600 direct jobs are estimated to be created in West Tennessee. The company leased 42,910 square feet of office space on the edge of the Memphis office market. The auto giant plans to use the new space as a training facility. Additionally, the Elon Musk-led xAI company announced Memphis as being the new home for its “Gigafactory of Compute,” claiming to …

By Charlie Adams and Walker Adams of NAI Brannen Goddard Industrial real estate in Atlanta is in limbo as of the second quarter of 2024. Certain submarkets in Atlanta have been overbuilt and tenant demand with historically active users (third-party logistics, wholesale, e-commerce, etc.) has decreased in comparison to what was seen over the last four years. As a result of the space grab during COVID-19, many logistics tenants are sitting on excess inventory within their buildings. Consumer demand has cooled, increased interest rates have dampened the economy as a whole and rents have risen 14.5 percent year-over-year, according to CBRE’s most recent report. The impact of these headwinds for traditional industrial (warehouse and distribution) real estate is positive. Developers haven’t had the fundamentals allowing overbuilding to a point of hyper-supply. Industrial construction starts have been few and far between over the past 12 months, and we believe this lack of new supply will keep Atlanta’s fundamentals healthy through this limbo we’re currently experiencing. With 4 million square feet of net absorption in first-quarter 2024 and 15.9 million square feet under construction, we should see 2025 vacancy in line with current vacancy, assuming absorption continues at a similar pace. Therefore, …

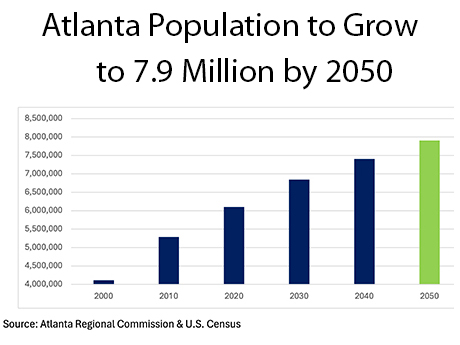

By Will Mathews and Mike Kidd of Colliers What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration. Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons. 7.9 Million by 2050 According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of …

By Ben Eisenberg of Transwestern In 2023 and continuing into 2024, Miami’s industrial sector experienced moderate growth due to reduced lease turnover and despite accelerating interest rates and economic uncertainty. However, the market’s strong industrial fundamentals and international connectivity via Miami International Airport and PortMiami continue to demonstrate its enduring strength and resilience. Miami’s industrial market is powered by freight, logistics and e-commerce demand, along with traditional distribution, service and light assembly. The region continues to experience steady population growth that drives sustainable consumption of goods and services and, ultimately, the need for warehouse space. Accounting for nearly 27 percent of Florida’s overall population, Miami was home to more than 6.2 million people at the end of 2023 and is projected to grow to 6.3 million this year. The region’s population has expanded by nearly 7.6 percent over the past 10 years. Increased migration to the Sun Belt has boosted wealth, disposable income and consumption, making Miami one of the nation’s wealthiest metro areas, with some of the highest average home values. In the first quarter of 2024, Miami’s unemployment rate reached a record low of 1.5 percent and has remained below 2 percent since the fourth-quarter 2022. The region’s …

Miami’s multifamily sector was on fire from the end of 2020 through the beginning of 2023 as the market received a wave of newcomers, primarily from affluent Northeastern and Western states. During the height of the pandemic, roughly $1 out of every $6 in income that moved nationwide relocated to Florida, more than any other state. And Miami-Dade County saw the second highest inflows of any county in the country behind only Palm Beach, two counties to the north of Miami-Dade. This influx resulted in tremendous rent growth, booming new development and record-setting sales. The period also marked dozens of corporate expansions and relocations to the area and a consistent sub-3 percent unemployment rate dating back to August 2022, which is below today’s 3.8 percent national rate. Since then, things have slowed down, though the epic in-migration of wealth has made a permanent impact. Miami’s multifamily fundamentals stand out as a beacon of resilience amid supply challenges across the Sun Belt. Infill rents have remained flat since 2022, notching slight increases in 2024, and occupancy has faltered only slightly. This is rarely celebrated, but in this case, it represents Miami’s unique strength. Demand also emerged for a higher caliber of …

The retail sector in South Florida is undergoing adjustments that reflect the region’s dynamic economic landscape and evolving consumer preferences. One notable trend is evident in the restaurant sector, where owners increasingly aim to expand by opening new locations and entering lucrative markets. This trend is primarily driven by consumer spending, particularly the continual growth of Miami’s tourism industry. Visitors directly inject capital into the local economy, leading to increased disposable income that often circulates back through experiential commerce such as restaurant sales. A clear indicator of the local market’s strength is the ongoing rise in rental asking rates, significantly surpassing national averages. A robust 4.6 percent upturn in asking rent this year, as reported by CoStar Group, demonstrates retailers’ ability not just to survive but to thrive in a market with elevated asking prices compared to the rest of the state. This upward trend in rent is accompanied by a low 2.8 percent vacancy rate, according to CoStar data, indicating a competitive landscape where profitable lease opportunities are increasingly scarce for tenants. The retail sector within the restaurant industry continues to thrive, showing significant activity and heightened interest. The influx of high-net-worth individuals and a post-pandemic resurgence in immigration …

By Christine Espenshade of Newmark Baltimore is an often-overlooked gem of a city along the Northeast Corridor between Washington, D.C., and New York City. This waterfront town is home to two major sports teams, a world-class symphony and art museums that rival those in the best cities around the world. Baltimore is more often referenced as the location for various crime TV shows rather than being known as home to two of the top medical facilities in the world — Johns Hopkins Hospital and the University of Maryland Medical System — Johns Hopkins University, and headquarters for famous companies such as Under Armour, T. Rowe Price and McCormick Spices. The multifamily market in Baltimore is also often overlooked by investors in favor of larger cities. However, to spur the development of top-quality rental products, Baltimore City and Baltimore County offer lucrative property tax abatements for new developments. The region continually sees consistent population growth due to the “eds and meds” nature of the economy, and the lower cost of living when compared to D.C. or Philadelphia attracts a well-educated workforce looking to enjoy the live-work-play lifestyle. The popularity of Baltimore for employers and employees is evident when considering the 35,000 …