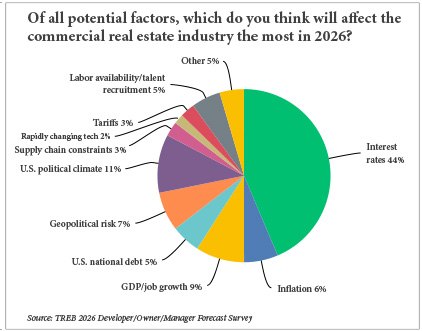

By Taylor Williams The results of Texas Real Estate Business’ annual reader forecast survey are in, and they paint a somewhat surprising picture of an optimistic business outlook for the new year. Why surprising? Well, geopolitically speaking, 2026 has already picked up right where 2025 left off. The Trump administration’s capture of Venezuelan president Nicolas Maduro and his wife in early January touched off a fresh source of geopolitical angst. The administration then subsequently ratcheted up its preexisting talk about Greenland becoming part of the United States, including issuing a threat to impose more tariffs on European countries that opposed that plan. Editor’s note: In mid-November, Texas Real Estate Business sent email invitations to participate in the annual online survey to three separate groups — brokers; developers, owners and managers; and lenders and financial intermediaries. The survey was held open through mid-December. Invitations to participate were also included in the Texas Real Estate Business e-newsletter, as well as through ReBusinessOnline.com. The tariff threat has since been walked back, but it’s hardly an understatement to say that the first month of 2026 has been rocky in terms of geopolitics. And when that happens, it’s anyone’s guess as to just how rattled markets …

Texas Market Reports

Editor’s note: (As of the publication of this article, Adam Gottschalk is no longer affiliated with STRIVE) By Taylor Williams The industry adage that “every deal is different” has never been an exaggeration or cop-out excuse for explaining trends and transactions — or lack thereof — in commercial real estate. It’s a simple fact that actually speaks to the nuanced, innovative and challenging structures and processes that permeate dealmaking in this business. The expression is especially applicable to investment sales and particularly convenient to invoke in times of rapidly shifting market and economic conditions. Therefore, a quasi-blanket statement that, all other factors behind held equal, Texas retail owners have minimal reason to sell right now must be evaluated in that context. As with any large sample size, there will always be multiple exceptions to the rule, and there will always be deals being brought to market as a function of an owner’s unique personal or capital situation(s). But by and large, outside of those scenarios, sources say that Texas retail owners don’t need to force things. “Unless there’s a life or a capital event — debt coming due or not wanting to add fresh equity to a deal — that …

By Taylor Williams “Economic development is the process of improving the economic well-being and quality of life for a community or nation through strategies like job creation, infrastructure development and advancements in education and health.” That’s the first sentence of the AI-driven overview that results from a simple Google search of the term “economic development.” And admittedly, that’s a very good start. Economic development is rooted in economics, a field that embodies the study of business, industry, jobs and wealth. The Google definition also pays tribute to the behind-the-scenes infrastructural work that is required to jumpstart and sustain most business endeavors, particularly regarding commercial real estate. And lastly, it covers what which may be the most important, end-all goal of economic development work: elevated quality of life for the people who live in, work at and patronize those commercial establishments. It’s that last part of the definition that appears to represent a growing niche and focal point within the spectrum of economic development work in Texas. Quality-of-life initiatives can be manifested in an array ofcommercial settings: housing, entertainment, food-and-beverage, hospitality. And as economic development professionals embrace many different roles — ambassadors of their communities, liaisons with developers and business owners, …

By Joshua Metzger, studio director, principal, Gensler The Emerging Trends in Real Estate 2026 publication jointly released by PwC and the Urban Land Institute (ULI) found that North Texas benefitted from more than 100 corporate headquarters relocations between 2018 and 2024, drawn by a business-friendly climate, robust infrastructure and a growing talent pool. The launch of the Texas Stock Exchange (TXSE), Nasdaq Texas and the reincorporation of the New York Stock Exchange’s regional office from Chicago to Dallas as NYSE Texas are further cementing the area’s status as a financial powerhouse. JPMorgan Chase, Citigroup, Charles Schwab and Fidelity are among the top employers in North Texas, while Wells Fargo recently opened a new $455 million campus in Las Colinas. All this momentum and more has made Y’all Street — the moniker used to contrast Texas’ growing market to Wall Street — the second-largest financial services market in the country, trailing only New York City. The sublease availability of office space in Dallas has dropped to 3.6 percent of total inventory, signaling strong demand and confidence in the market. The Dallas neighborhoods of Uptown and Turtle Creek are bracing for a surge in development, while suburban mixed-use projects continue to thrive. …

By Taylor Williams Although the Dallas-Fort Worth (DFW) industrial market is, objectively speaking, currently overbuilt, the recovery and return to healthy dynamics is already taking shape. As that unfolds, manufacturing facilities are having a moment. According to CBRE’s research, between 2021 and 2023 — the height of the post-COVID e-commerce craze that coincided with the last days of historically low interest rates — developers in DFW added nearly 130 million square feet of new industrial product. The supply boom mostly involved warehouse and distribution facilities, and absorption of new deliveries was coming along until this spring, when Liberation Day injected a staggering dose of economic uncertainty into the market. In recent weeks, leasing activity has begun to pick back up. But investors looking to deploy capital into industrial assets see more upside on deals for manufacturing facilities at the moment, whether that means buying existing plants with heavy built-in power sources or targeting distribution buildings that can support manufacturing through light conversions. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. At the annual DFW/North Central Texas Industrial conference that …

By Jamee Jolly, president and CEO, The Real Estate Council With record population growth and a $2.7 trillion economy, Texas faces mounting pressure to expand its housing supply and affordability. New legislation from the 89th legislative session gives developers, cities and investors new tools to build sustainable communities through stronger collaboration between the public and private sectors. From established patterns of corporate relocations, job creation and direct foreign investment to fostering emerging industries like renewable energy, semiconductor manufacturing, aerospace and financial services, Texas has a long history of economic strength, industry diversification and innovation. That track record makes it one of the nation’s premier destinations for both businesses and residents. Last year, according to U.S. Census Bureau data, Texas led the nation in population growth for the 14th consecutive year, adding more than 560,000 people to reach over 31 million statewide. In North Texas, the population in Dallas-Fort Worth (DFW) alone is expected to grow from 8 million to 12 million residents by 2050. While this growth fuels one of the world’s largest economies, it has also created a shortage of more than 320,000 homes and a rising challenge of housing affordability statewide, particularly at the entry-level price point, where …

Once upon a time, not so long ago, an industrial developer in Texas could pick an appropriately zoned spot on the map, throw up four walls and a roof, slap a few utilities in place and reasonably expect multiple tenants to quickly reach out and express a willingness to pay healthy rent for that space. That’s a colorful and simplified view of the pinnacle of the post-COVID Texas industrial market, but it’s not a farcical take. Between roughly early 2021 and mid-2023, phrases like “record-breaking,” “gangbusters” and “never seen anything like it,” were routinely used by brokers and owners alike to describe the state of industrial tenant demand. Combined with cheap debt and available equity, the ferocious need for warehouse, distribution and manufacturing space sparked absorption of older buildings and fresh capitalizations of new projects across all major markets. Tenants needed space yesterday, and supply chain disruptions — for developers and tenants — were simply a cost of doing business. And business was very, very good. Business is still good today. But the development landscape has undoubtedly shifted while the capital markets that govern said landscape have invariably cooled. New development, particularly in terms of equity, is significantly harder to …

By Taylor Williams DALLAS — As a metroplex, Dallas-Fort Worth (DFW) has the physical sprawl, population density, pace of job growth and volume of housing development to fairly be labeled as one of the biggest consumer markets in the country, on par with New York City and Los Angeles. It’s the extent to which affordability has matured in New York City and Los Angeles that marks the key difference between DFW and the coastal behemoths. Aside from rental housing, no asset class within commercial real estate captures a given market’s affordability better than retail. Retail rents in the most sought-after corridors and districts of New York City and Los Angeles seemingly have no ceiling, and that is reflected in the prices of the products and services that are dispensed from those spaces. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. It’s fair to assume that for most households that have relocated from the coasts to DFW, housing and jobs have been the most decisive factors. Yet retail spending does account for a good chunk of the average family’s disposable …

By Oliver Gray, Esq., of Gray Winston & Hart Valuing hotels for property taxation is one of the most complex and contested areas in real estate appraisal. And unfortunately for hotel owners, improper assessment is common and costly. Unlike office buildings or warehouses, hotels are not just physical assets — they are operating businesses. This distinction requires appraisers to carefully separate the taxable real estate, which is land and improvements, from the nontaxable business enterprise and intangible assets. Failing to do so risks unlawfully taxing the business itself, a critical concern for Texas hotel owners and property tax professionals. Texas law mandates that assessors appraise property at its fee-simple market value, excluding exempt intangibles and business value. For hotels, this means appraisers cannot simply capitalize the income of the operating business. Rather, they must make adjustments to remove components tied to franchise affiliation, management expertise, brand recognition and other intangibles. The challenge is clear: How can assessors, taxpayers and their appraisers correctly isolate the real property value from the going concern? What follows are several common approaches and their inherent weaknesses, which can skew an assessor’s conclusions or provide bases to challenge inflated assessments. Management Fee Method One widely used — …

By Taylor Williams Dallas-Fort Worth (DFW) is a multifamily powerhouse, and after nearly three years of elevated interest rates, massive volumes of new deliveries and stagnated trading activity, the metroplex’s investment sales market may soon be showcasing that alpha status once again. Of course, that sentiment was prevalent at the very beginning of the year too. Optimism for lower interest rates and pro-growth policies understandably accompanied the arrival of the second Trump administration. Local factors, such as the peaking of the wave of new supply and the ever-steady flow of jobs and people into the metroplex, augmented that sentiment such that many multifamily lenders and investors entered 2025 with considerably more ebullience following a couple of rough years in 2023 and 2024. “Coming out of the gates, things felt pretty good, but a lot of this year’s volatility was based on [interest] rate movement, which was primarily based on geopolitical issues,” says Drew Kile, executive managing director of investments at Institutional Property Advisors (IPA), a division of Marcus & Millichap. “Had rates come down methodically more like the last two months, there would have been less of an impact. It’s hard for buyers to make decisions when rates are whipsawing …

Newer Posts