By Taylor Williams When it comes to industrial supply growth in Central Texas, the usual suspects — land availability, interest rate movement, time-consuming permitting and approval processes — are all secondary to the need for more infrastructural development to support these projects. Roadways, public transit systems, electrical capacity, sewerage and water services — these are the key ingredients in the recipe for successful industrial development in Central Texas that can sometimes be overlooked or understated in importance. As such, economic development corporations (EDCs) in the area are prioritizing infrastructure development in their work as they help developers add much-needed industrial space to support the area’s burgeoning population. While underlying, efficient infrastructure is critical to all real estate developments and human occupation, it is especially crucial to industrial projects. Large-scale manufacturing facilities — think Tesla in East Austin and Samsung in its northern suburb of Taylor — employ thousands of people. Housing hasn’t caught up to population growth in many of the surrounding communities, necessitating alternate means of commuting. In addition, manufacturing and e-commerce facilities tend to have above-average electrical capacity requirements. Financially, meeting that demand might be made somewhat easier in a state that has a deregulated power grid, but logistically, …

Texas Market Reports

InterFace Panel: Macroeconomic, Institutional Market Obstacles Hinder Retail Supply Growth in Austin

By Taylor Williams The Austin retail market is in dire need of more quality space, but between the newfound volatility in the U.S. capital markets and longstanding local policies that have hamstrung commercial developers in the state capital, delivering that space is no easy feat. The city’s remarkable growth story is well-documented. Big Tech has made Austin its home away from home, spearheading what was a 33 percent increase in population between 2010 and 2020, according to the Austin Chamber of Commerce. But the paces of growth of housing and infrastructure — two crucial prerequisites for retail development — haven’t kept up with the surging head count. In addition, the Austin bureaucracy is notorious for slow-moving entitlement and permitting processes, at least in the eyes of Texas developers who have done business in zone-free Houston or certain municipalities of Dallas-Fort Worth that make it a point to fast-track new projects. These issues at the local level have merged with debt market disruption on the national circuit, rendering a scenario in which the process of financing and building new retail space is fraught with headaches, delays and pitfalls. The number of ways in which new projects can be killed in action …

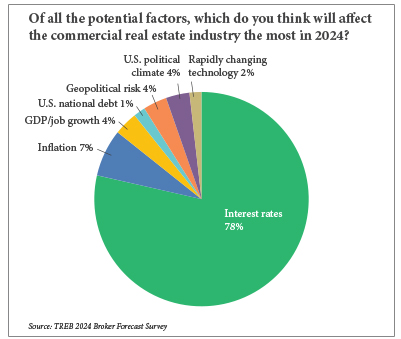

By Taylor Williams For the last several years, as COVID-19, inflation and interest rate hikes have chronologically rocked the commercial real estate industry, the term “dry powder” has increasingly factored into investment discussions. While the term generally refers to cash or capital that is parked on the sidelines, 2024 could well be the year for its deployment. There are several basic reasons for endorsing this notion. First, at its December meeting, the Federal Reserve signaled that it would cut rates three times this year, which should theoretically make debt financing more accessible and less expensive — though the extent of that depends on the magnitude of the reductions. Second, as evidenced by the stock market tear following that announcement, investors are itching to deploy capital and will rally around just about any reason to do so, proven or not. Third, there is roughly $537 billion in commercial real estate loans that will mature next year, according to New York City-based Trepp. This staggering volume of impending maturities in a high-interest-rate environment all but assures that some assets will be forced into sales, whether by owners pre-default or lenders post-default. And finally, the 10-year Treasury yield — the benchmark rate against …

By Taylor Williams The Houston industrial market has generally performed quite well over the past few years, even as a global pandemic, record inflation and hard-hitting interest rate hikes have rocked the commercial real estate industry as a whole. Demand for industrial space has held firm due to rebounding energy prices and expansions in infrastructure and traffic at Port Houston, as well as organic population growth and economic diversification that has elevated the market’s role as a distribution hub. According to data from CBRE, the market has a 6 percent vacancy rate and posted 5.1 million square feet of positive net absorption through the first three quarters of 2023. The volume of new construction was on track to outpace absorption in 2023 when the report was released. But that was not the case in 2021 and 2022, years in which net absorption equaled and exceeded 7 million square feet, respectively. New deliveries totaled approximately 5.6 million and 5.4 million square feet in each of those years, driven not only by the aforementioned factors but also by a temporary uptick in demand for e-commerce services in the wake of the pandemic. In any market or asset class, when absorption exceeds supply …

By Sandy Schmid, director of acquisitions and development, StarPoint Properties In the fast-paced world of commercial real estate, foresight is as valuable as bricks and mortar. Despite whispers of distress on the horizon for the Lone Star State in 2024, the multifamily real estate market is ablaze with potential. Texas is one of the hottest destinations for developers and investors, and the strategic play is to not just weather the storm, but rather to ride it to success. Recent predictions of multifamily distress starting in the latter half of 2023 have certainly raised eyebrows and fueled speculation. However, predicting the Texas real estate market is akin to forecasting a Wild West shootout — a challenging task given the state’s history of resilience and its ongoing growth. Texas has consistently proven its ability to rebound from economic challenges, and current indicators suggest that the multifamily sector is poised for sustained growth. A Growth Powerhouse One factor supporting the optimistic outlook is the impressive trajectory of Texas’ GDP growth. The state saw a notable increase in its GDP over recent years: 5.7 percent growth in 2021, 2.7 percent in 2022 and 3 percent in the first quarter of 2023 alone. This data compares …

By Ryan Johnson and Tyler Grisham, managing partners and market leaders, SRS Real Estate Partners Those who live and work in Dallas-Fort Worth (DFW) should be grateful for the metroplex’s strong fundamentals. There are a lot of macro-level factors that are out of whack and hurting the commercial real estate business, but there are also a lot of macro factors working in favor of DFW that not many major markets in the United States can claim. Thinking glass half-full, DFW has enjoyed exceptional growth in employment, housing and population over the last decade. According to the U.S. Census Bureau, DFW now boasts nearly 8 million residents, which makes it the nation’s fourth-largest metropolitan area. According to the Dallas Regional Chamber, 14 major companies relocated to North Texas in 2023 — Kelly Moore Paint Co., Inbenta, McAfee Corp., Frontier Communications and West Shore Homes, among others. Thinking glass half-empty, DFW has sky-high construction costs, the highest interest rates in recent memory, highest exit cap rates/lowest valuations in recent memory and just a general market mentality that causes developers, banks and investors to exercise great caution. Active Segments, Trends Given these challenges, it may be surprising that there are retailers that are …

By Taylor Williams Retail owners are facing critical questions about whether to sell or hold their properties in the current environment, which is still defined by uncertainty about whether interest rate hikes have truly peaked and investment sales prices have actually bottomed out. Investment sales decisions frequently hinge on analysis of cap rates, defined as a property’s net operating income divided by its sales price. Generally speaking, higher cap rates indicate lower sales prices and are therefore sought by buyers, whereas lower cap rates reflect higher prices and are preferred by sellers. Cap rates are fluid and tend to move linearly with interest rates. Thus, the Federal Reserve’s campaign of 11 interest rate hikes totaling 500 basis points over the last 20 months has caused cap rates in all asset classes to rise, or as industry folks say, to decompress. The extent to which this cap rate movement influences an investor’s sell-or-hold dilemma varies from deal to deal, but the common denominator is that it complicates all such decisions. At the inaugural InterFace Houston Retail conference, a panel of capital markets professionals delved into the numerical analysis and anecdotal evidence that investment sales brokers are relying on to guide clients …

By Taylor Williams The growth story of Central Texas is compelling enough that commercial developers and investors are still aggressively targeting the region, even as costs of doing business hit the roof. In fact, both cities recently cracked the Top 10 on Urban Land Institute’s list of markets to watch in the organization’s Emerging Trends report for 2024. To dispense with the bad and obvious, the region — loosely defined as the swath of land bookended by the Austin and San Antonio metro areas — is not exempt from wide-ranging industry headwinds. Newer trends like working from home, as well as entrenched issues like a shortage of affordable housing and crushing interest rates, impact deals and projects in high-growth markets perhaps even more harshly than their smaller counterparts. This is simply due to the principles of supply and demand. Further, the region faces homegrown challenges stemming from a decade-plus of hyper-accelerated expansion, namely a skyrocketing cost of living and insufficient infrastructure to support demand from tenants and residents. But the fundamentals of job and population growth remain so robust in Central Texas that buyers and builders, particularly within the industrial and multifamily spaces, can still invest and develop in this …

By Taylor Williams DALLAS — Just 18 months ago, multifamily lenders and investors in major Texas markets were underwriting record-high levels of rent growth to accompany historically low cap rates, giving capital sources little hesitation to lend at negative leverage. Following a spate of nearly a dozen interest rate hikes, the opposite is now mostly true. Negative leverage occurs when a buyer’s going-in capitalization rate is lower than the all-in interest rate on the debt attached to the property. The scenario tends to manifest when a property with an encumbered cash flow is purchased in a high- or rising-interest-rate environment. As a rule of thumb, net operating income should comfortably cover debt service, or at least clearly be moving in that direction at the time of acquisition. When times are good — meaning prices are high for sellers and money is cheap to borrow for buyers — negative leverage can present a flexible and creative way of getting deals across the finish line. Lenders and equity partners may be willing to accept negative leverage in the short run because they are confident that rents/cash flows will soon increase, or that interest rates will remain low, or both. But the ability to …

The effects of sweeping macroeconomic forces in recent years are now manifesting themselves in industrial projects in Dallas-Fort Worth (DFW). And while the market still enjoys healthy fundamentals and tenant demand, the product being delivered now comes with a new look, functionality and set of requirements from end users. To some degree, this paradigm shift in how industrial properties are conceived, designed and constructed stems from major economic factors and trends that are beyond the ability of architects, contractors and developers to control. To start with the obvious, interest rates are now five times what they were 18 months ago. When hikes of that magnitude are enacted so expeditiously, real estate professionals of all walks are impacted, even if it’s in an indirect manner. “Demand for industrial space is there; if developers are building, the rents are probably there to cover those costs,” says Mike Williams, vice president of preconstruction at Dallas-based Talley Riggins Construction Group. “But for developers that are trying to form a team to get enough equity to get a loan — those deals aren’t working anymore with these rates. So paying extra close attention to who your clients are and their funding sources has been the …