By Taylor Williams Office owners have spent the last two-plus years undertaking every creative measure they can fathom — and afford — to get tenants and their employees to legitimately want to come back to their buildings. From investing in upgrades to physical amenities to hiring hospitality-minded professionals for property activation to offering personalized incentives, nothing has been out of bounds when it comes to recouping occupancy. Enough time has now passed such that owners can judge the extent to which their ideas and initiatives have worked. Of course, the goalposts for what defines success in the office sector have shifted radically during that time. Profit margins and forecasts have shrunk as 60 to 70 percent occupancy three to four days a week now starts to look pretty good, all other factors being held equal. It’s simply a different world. “We are never going back to pre-pandemic ways,” says Ami Figg, senior leasing specialist at Houston-based Hartman. “What COVID-19 has done for the office market is equivalent to what September 11 did for the travel industry. There will always be a need for traditional office space, but it’s changed forever, so it’s upon us as landlord and tenant reps to …

Texas Market Reports

By Taylor Williams The current industrial development landscape in Texas is a true testament to the awesome power of demand — and of interest rate hikes. From El Paso to Houston, industrial users of all sizes and across all industries continue to demand new or expanded spaces to accommodate their ever-growing warehousing, distribution and manufacturing needs. E-commerce, nearshoring, COVID-19 — name your impetus — they’ve all contributed to a feverish pace of industrial development and absorption in recent years. According to fourth-quarter 2022 data from CBRE, Dallas-Fort Worth (DFW) saw an annual supply gain of about 36.1 million square feet in 2022 while posting positive net absorption of 36.5 million square feet. Third-party logistics users drove much of the new leasing activity, which contributed to a 4.6 percent vacancy rate at the end of the year. The market has now posted consecutive years of sub-5-percent vacancy. Fittingly, there remains more than 75 million square feet of product under construction throughout the metroplex. In Houston, developers delivered approximately 18.8 million square feet of new industrial space in 2022, per CBRE. Yet the market posted more than 30 million square feet of positive absorption over the course of last year, and the …

By Brett Merz, senior vice president, asset management, KBS Realty Advisors The demand for office properties with amenities that reflect an awareness of environmental, social and governance (ESG) principles is growing as a result of younger generations joining the workforce and investing. A recent study by CNBC Make It found that one-third of millennials in the United States place a high focus on investment products with ESG factors. This tendency naturally extends to the places where they work. In fact, 47 percent of 18- to-34-year-olds in the United Kingdom say they would look for a new role if they thought their employer was not committed to the cause. This finding demonstrates that ESG is becoming an essential part of recruitment and retention — particularly among younger workers. Since millennials and gen Zers make up the majority of today’s workforce, ESG is becoming a rising concern among office owners. In the growing markets of Dallas and Austin, businesses are now seeking office spaces that offer eco-friendly features to help attract and retain employees. As a large investor in top-tier commercial real estate, KBS has seen how these amenities can benefit office investors. This is one of the reasons we created an …

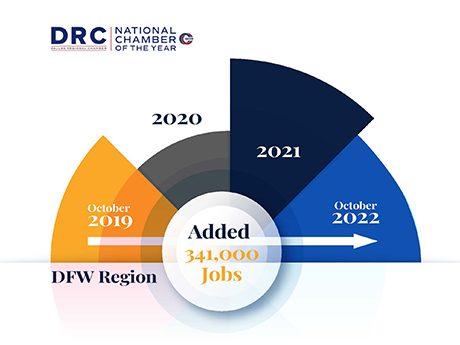

By Kent Elliott, principal, and Chase Fryhover, director, RETS Associates While December’s national jobs report painted an optimistic picture of the employment landscape, some sources have noted that workers in commercial real estate are leaving the industry. Yet although some national brokerage firms may be trimming the fat to cut costs in light of recent economic uncertainty, this trend does not seem to apply to Texas-based commercial real estate companies. In fact, according to Estateserve, with the Texas office market booming, vacancy rates dropping and rents rising, “Texas’ commercial real estate is experiencing a resurgence.” As a national executive search firm that has served the industry for more than two decades, RETS Associates has a seasoned perspective on job markets throughout the country. Here are the trends we are noticing throughout the industry in Texas and why we believe the market is poised for ongoing strength and stability. Continued In-Migration Texas is the ninth-largest economy in the world, as well as one of the leading markets in the country in job and economic growth. The Dallas-Fort Worth (DFW) area in particular, the fourth-largest MSA in the country, led the country in population growth in March 2022 and in post-pandemic job …

By Eric Barnes, director of business development at SiteAware Texas has been one of the most attractive states for corporate relocations and sustained construction growth, spurred on by attractive tax benefits, a low cost of living and business-friendly policies. As such, Texas remains well-positioned for a robust and profitable construction economy heading into 2023. According to The Wall Street Journal, Texas cities rank among the fastest-growing in the country in terms of population. This strong population growth, coupled with a robust job market and strategic location, continues to attract employers. In 2021, the state saw a record number of headquarters relocations. Though that figure dipped in 2022 due to the conclusion of state-sponsored tax breaks, the local market remains healthy and attractive to developers and investors. In addition, the slowing down of relocations isn’t necessarily bad because it allows the state to ensure the success of companies already operating in Texas. Regardless of this dip in activity, the heightened need for more multifamily and commercial development continues and has translated to an influx of construction projects within the state. Challenges, Opportunities Texas contractors and developers are looking for better ways to manage construction sites and take on more projects to …

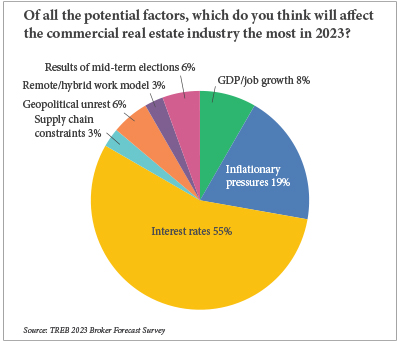

By Taylor Williams If inflation was the story of 2022, then basic economic theory dictates that interest rate hikes and their subsequent impacts will be the featured issue of 2023. For when it comes to whipping inflation, the Federal Reserve only has so many tools in its kit. The nation’s central bank can raise reserve requirements for lenders and sell Treasury notes all day long, but nothing has as direct and powerful of an effect on the monetary supply as movement in short-term interest rates. Simply put, higher interest rates discourage borrowing activity, which reduces the amount of money circulating in the system. In the past 12 months, the U.S. economy has seen no fewer than seven rate hikes totaling 425 basis points, with the Fed indicating that more increases are on the docket for 2023. Much like severe inflation itself, the rate hikes that inevitably follow rampant price escalation tend to touch nearly every facet of commercial real estate. Developers and investors respectively face higher interest rates on construction and acquisition loans. Brokers must adjust prices on properties they’re listing for sale or rent in response to these variables. End users tend to be somewhat insulated from these impacts, …

By David Ebro, president of Levey Group Despite the nearly 6.4 million square feet of new project starts during the fourth quarter of 2022, which grew the volume of Houston’s industrial space currently under construction to 33.5 million square feet, the market posted a record 30.3 million square feet of net absorption for the year. This activity drove Houston’s vacancy rate down to 3.8 percent — a decline of 220 basis points from the end of 2021. The remarkable growth throughout the Houston MSA — the nation’s fourth-largest metropolitan area — has developers racing to find buildable sites both within and beyond the city limits. As a result, industrial development is bulging out of the city and into submarkets such as Baytown, Richmond and Brookshire as developers pursue more economically feasible land among these growing population centers. Beyond favorable land opportunities, Houston’s outlying submarkets offer the workforces that tenants require for their warehouse and distribution operations. These growing submarkets are also generating an increasing amount of demand from e-commerce users in the consumer goods sector. Record Growth East of Houston Much of the industrial growth can be found east of town, near and along the Houston Ship Channel. For the …

By Taylor Williams From small-scale refreshes of neighborhood shopping centers to massive conversions of regional malls, retail redevelopment has become a budding business as seismic forces like e-commerce and COVID-19 have fundamentally altered the ways in which Americans shop, dine and seek entertainment. Yet empirical and anecdotal evidence shows that people still love to frequent brick-and-mortar stores, restaurants and entertainment centers. According to data from Transwestern, at the end of the third quarter, Dallas-Fort Worth, Houston, Austin and San Antonio all had marketwide retail vacancy rates under 6 percent. Year-over-year vacancy contracted by anywhere from 80 to 130 basis points across the four major markets, all of which also experienced positive net absorption in the third quarter. While these Texas-specific numbers reflect a steady, sustained rebound for brick-and-mortar retail in the post-COVID era, preliminary data on holiday shopping indicates that e-commerce’s foothold on the market is getting stronger. According to Adobe Analytics, online sales during Black Friday topped $9.1 billion, a 2.3 percent increase over 2021. While that number should be judged against the fact that this year, the public health risk of shopping in physical stores was substantially reduced, it also represents a 21.7 percent increase over pre-pandemic online …

By The Allen Economic Development Corp. Austin is often in the spotlight as one of the country’s top tech hubs, but Allen, a growing suburb located north of Dallas, has emerged as a mini tech hub in its own right. Most recently, the Allen Economic Development Corp. (AEDC) announced that Pushpay, a provider of payments and engagement solutions for faith-based and nonprofit businesses, has signed a lease at One Bethany West as the company looks to expand its presence in North Texas. Pushpay is one of several companies that has in recent years discovered that Allen has the right combination of qualities and amenities to support tech companies seeking a new home. Pushpay is one of several companies that has in recent years discovered that Allen has the right combination of qualities and amenities to support tech companies seeking a new home. Pushpay will occupy 10,000 square feet of office space in the 17-acre Watters Creek campus, which will be accessible to its employees in the metroplex, many of which include associates from its subsidiary, Resi Media. “Pushpay and Resi are the perfect additions to the growing roster of tech-focused companies in Allen,” says David Ellis, assistant director at AEDC. …

By Taylor Williams Success in today’s office sector is all about creating incentives. Some companies, from small professional services outfits to tech giants like Salesforce and Airbnb, have completely capitulated to remote work and have aggressively slashed their office footprints. Others remain dogged in their commitments to nonresidential (and nonretail) workspaces. What works for one company may not work for its competitors, and there remains a fundamental need for at least some traditional office space across all major markets. Against this backdrop, what separates the winners from the losers is the ability to create a draw, to give people legitimately good reasons to get up earlier, spend more time getting ready, endure traffic, put costly mileage on their cars, then deal with whatever quirky goings-on define their office experience. Needless to say, this can be a tough sell, especially for employees with families and suburban commutes. Which is why owners, both of businesses and of the office buildings that house them, are getting creative. These corporate leaders and landlords are working in tandem to ensure that the spaces meet the precise needs of their workforces, from design and layout within the suite to access to onsite amenities and surrounding retail, …