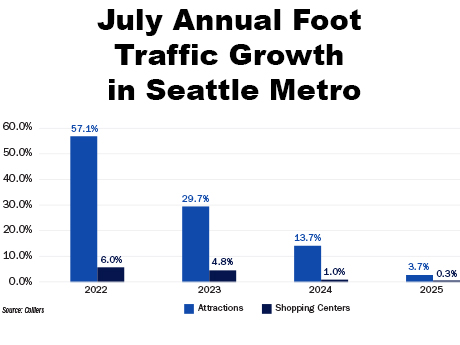

— By Jacob Pavlik of Colliers — As big-box retailers scale back or exit the market, a new class of tenants is reshaping the retail landscape across the Puget Sound region. Experiential retail is taking their space and providing destinations for consumers and the experiences they crave. This umbrella term includes concepts that prioritize interaction, entertainment and social connection. This is emerging as a compelling solution for landlords looking to drive foot traffic and re-energize shopping centers. The shift is not accidental. The pandemic disrupted traditional social experiences and accelerated the decline of large-format retail by getting people more accustomed to buying online, even if they “picked up” the item later in a store. Now, with consumers eager to reconnect in person, experiential concepts have gained traction. These tenants often don’t sell goods or services in the conventional sense. Instead, they offer immersive experiences that encourage group participation and repeat visits. Recent examples include Mirra, a 12,000-square-foot social entertainment venue that opened in Bellevue’s Lincoln Square, a mixed-use shopping center with three hotels, and more than 1.2 million square feet of office space. Adjacent to Cinemark Reserve in the South Tower, Mirra offers immersive virtual reality party games and transitions to …

Western Market Reports

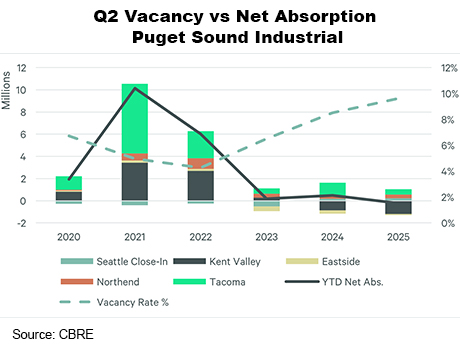

— By Andrew Hitchcock of CBRE — The Puget Sound industrial market is showing signs of modest recovery through the first half of 2025. Tenants are increasingly seeking flexible leases, renewing in place and right-sizing operations, resulting in smaller or more cautious leasing commitments rather than long-term deals. Shifts in port activity have also affected leasing decisions, exacerbated by the raft of universal tariff announcements in April. While some submarkets have regained momentum after a slow start, demand across the region is still uneven, with lingering uncertainty keeping vacancy rates elevated. Submarkets demonstrating momentum include Tacoma, which recorded 308,153 square feet of positive net absorption in the second quarter, alongside notable third-party logistics provider (3PL) leasing activity. The Seattle Close-In area also saw vacancy decrease to 9.3 percent, driven by healthy tenant demand from companies like Evergreen Goodwill and South West Plumbing. Conversely, Kent Valley faced challenges. The vacancy rate climbed to 8.4 percent due to significant speculative deliveries that outpaced absorption and traditional users downsizing. Port activity temporarily dampened demand, compounded by a 21.2 percent year-over-year drop in international imports in May. This reflects uncertainty surrounding future tariff rates. On the plus side, year-to-date container volumes remain above 2024 …

— By Dan Dahl of Kidder Matthews — Seattle’s office market has proven more resilient than other cities in past downturns, with smaller declines and quicker recoveries. This cycle is different. Seattle has been hit harder and is recovering more slowly than the rest of the country. San Francisco often signals what’s to come, with the Emerald City trailing by about 12 months. AI-driven leasing activity in San Francisco is gaining momentum — signaling growth for Seattle — but the local market still faces headwinds. Demand Softens as Tenants Downsize Demand for office space in Seattle remains weak. Most tenants with upcoming lease expirations are downsizing. Tech companies have historically driven office demand here, but now they are shedding space, laying off employees and working from home. Tenants have the leverage. Concessions like free rent, reduced rates and built-out spaces are abundant, providing the opportunity for tenants to pursue a flight to quality and upgrade to higher-end space. Investment Market Under Pressure The investment side is equally challenged. Owners with near-term loan expirations are often in a pinch. Their loan balances exceed current building values due to high vacancies, lower rental rates, elevated cap rates and higher interest rates. As a …

— Tim McKay of Cushman & Wakefield — Seattle’s multifamily market has faced challenges over the past few years. Rent growth has been flat as a significant number of new units were delivered in 2023 and 2024. This new supply also led to concessions and even rent declines in some markets. Submarket supply issues and the new statewide rent control legislation have also contributed to market headwinds. However, 2025 has brought signs of recovery, and there’s optimism about the market’s trajectory over the next few years. It feels like Seattle has bounced off the bottom and is starting to climb back up, similar to the recovery seen in 2011 after the Global Financial Crisis. Rebounding Demand The multifamily market has seen a recent uptick in demand, which can be attributed to several factors. A key driver has been the return-to-office mandates from major employers like Amazon and Starbucks. Seattle’s population is also expected to grow again, and the supply of new units hitting the market has drastically declined. These factors are contributing to renewed growth after a four- to five-year stagnation. Stabilizing Rental Rates Owners are starting to put properties under contract again. Land prices haven’t returned to previous levels, …

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …

— By Bryce Aberg and Brant Aberg of Cushman & Wakefield — Optimism is returning to the San Diego industrial market after a few quarters of recalibration. Buyer appetite has resurfaced in core submarkets like Otay Mesa, Miramar and Carlsbad, which has created a ripple effect across the Greater San Diego industrial market. With an inventory of 162 million square feet as of the second quarter, San Diego is beginning to see the benefit of limited supply. Natural barriers like Mexico, the Pacific Ocean, Camp Pendleton and the nearby mountains are driving the San Diego industrial market toward full build-out. There is currently only 2.4 million square feet of inventory under construction, with not much more proposed. Following the all-time highs in rent growth and positive absorption seen in 2021 and 2022, San Diego’s enduring fundamentals and built-in advantages have kept it in place as one of the most stable and competitive in Southern California. With a diversified tenant base, high barriers to entry and a strategic position on the U.S.-Mexico border, fundamentals have held while others in the Southern California region have struggled in comparison. Bid-ask spreads are also starting to narrow as buyer and seller sentiments begin to …

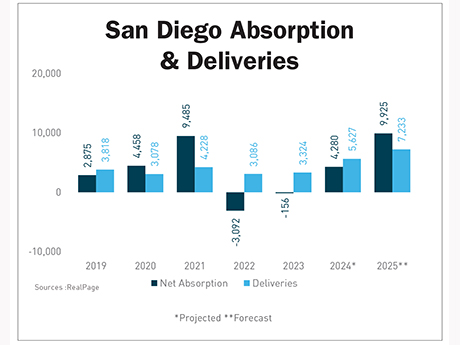

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

— By Bryan Cunningham of JLL — The retail sector continues to be a bright spot for commercial real estate in San Diego County. Despite financial headwinds that include interest rates, construction costs and increases in operating costs like labor and insurance, the resiliency of the consumer has allowed retailers and restaurants to continue to generate substantial sales volumes. Both national and regional retail and restaurant tenants continue to expand, although more cautiously than in years past. Retail vacancy rates in San Diego continue to hover around 5 percent, with the more desirable coastal communities closer to 3 percent. The lack of new development due to geographical constraints, as well as interest rates and construction costs, is driving expanding tenants to look purely at second-generation retail centers. While the retail tenant pool is somewhat shallow due to bankruptcies by Bed Bath & Beyond, 99 Cents Only, Party City, JoAnn Stores and the like, the lack of new product is keeping well-positioned shopping centers in high demand. Most grocery- and big box-anchored shopping centers are enjoying rents at record levels with very little vacancy. Retail centers continue to be at the forefront of interest from investors as well. While interest rates …

— By Brett Meinzer of MMG Real Estate Advisors — Despite ongoing challenges, Phoenix’s multifamily market is showing signs of stabilization and strength in key areas. Record Demand, Even in a Cooling Market In first-quarter 2025, net absorption reached 5,149 units, more than double the 10-year quarterly average and the second-highest quarterly total on record. On a 12-month basis, the market absorbed 18,413 units, setting a new high. “We’re seeing demand return to peak levels,” said Brett Meinzer, advisor at MMG Real Estate. “The number of units leased in the last year shows Phoenix’s long-term story remains intact.” Supply Is Slowing, Signaling Potential Stabilization While new supply remains elevated, the pace is shifting. First-quarter deliveries declined 36 percent from the prior quarter, and the development pipeline is now nearly 50 percent below its recent peak. “After years of heavy deliveries, the pipeline is thinning,” Meinzer said. “This pullback could help stabilize rent and occupancy rates as we head into 2025.” Rent Trends Still Negative But Improving Phoenix’s effective rent currently stands at $1,560, down 2.3 percent year over year, with average occupancy at 91.9 percent. Rent softness is largely driven by concessions and intense lease-up competition from new construction. However, …

— By Chris High, Steve Bruce and Conor Evans of Colliers — We’re in the middle of a market recalibration. On the office side, leasing has slowed significantly, with tenants downsizing footprints and pushing for shorter terms as hybrid work remains a dominant driver. In life sciences, we saw explosive growth from 2020 to mid-2022, but that pace has tapered off. VC funding is more selective, and some developers who stretched to convert commodity office and flex properties into lab space, often with less-than-ideal infrastructure, during the boom years, are now rethinking those strategies. Still, demand for high-quality, fitted lab space remains, especially in well-located projects by experienced owners like Longfellow, BioScience Properties, Sterling Bay, Healthpeak, BioMed, and ARE. These firms are adapting with thoughtful repositioning and delivering product that aligns with where tenant demand is today. In the near term, we expect continued headwinds. Commodity office space will face pressure on rents and absorption, while high-end life science campuses with strong sponsorship will be better positioned to attract demand. We expect Life Science to rebound in the next 12 to 18 months as capital markets settle and merger/acquisition (M&A) activity returns. Distressed office sales may continue as debt maturities …