— By Patrick Dempsey, senior managing director of JLL Capital Markets — The Phoenix retail capital markets environment is showing signs of resilience in the face of current economic conditions. While the market has experienced a period of lower transaction volume, recent drops in interest rates have begun to bridge the gap between buyer and seller expectations, potentially paving the way for increased activity. Notably, Phoenix stands out with impressive positive rent growth, recording the highest rate at 7.4 percent among major metros and Sun Belt markets. Phoenix’s robust employment market, especially in the semiconductor sector, continues to be a major advantage. The city boasts a strong base of major employers, contributing to its ongoing economic vitality. Investor demand remains concentrated on grocery-anchored properties and premium retail locations, highlighting the enduring value of strategically positioned assets. This trend is especially pronounced in high-growth submarkets. For example, the Southeast Valley is experiencing significant suburban and residential growth, driving the development of new grocery centers to serve the expanding population. Similarly, Northwest Phoenix with areas like Peoria and Glendale are seeing strategic investments from grocers anticipating future population growth. Looking ahead, there’s increasing optimism for a stabilization of retail capital markets transactions …

Western Market Reports

— By Ryan Sarbinoff, first vice president and regional manager, Marcus & Millichap — Phoenix ranks third among the major markets in terms of both total net in-migration and job creation since the end of 2019. The region has also posted one of the largest jumps in median household income. Combined, these factors underpin heightened demand for housing and support elevated multifamily development. While total deliveries will rise for the fourth consecutive year in 2024 to a record high of 22,000 rentals, apartment absorption has notably kept pace through mid-year. As such, metro-wide vacancy is on track to dip to 7 percent by December. This would mark both a 30-basis-point decline from the 2023 peak, as well as an 18-month low. The improving alignment of supply and demand will encourage a return to rent growth, albeit slight. The average effective rent will end 2024 at $1,585 per month, up from the year before but down 5.3 percent from the peak set in 2021. Apartment completions over the past year (ending in June) were most prevalent in the Avondale-Goodyear-West Glendale submarket, where a collective 5,200 units opened. This represented a 23.8 percent boost to existing stock. Yet, the substantial wave of openings …

— By Shawn Jaenson, executive vice president, Kidder Mathews — Reno’s industrial market has demonstrated remarkable resilience in the face of challenging economic conditions. Despite such uncertainties, the region has maintained a strong industrial presence, showcasing its ability to adapt and thrive. Overall, the market delivered more than 22 million square feet of new construction since the start of 2020 and has experienced more than 50 percent rent growth over the same period, rising from $0.55 (triple net) in fourth-quarter 2019 to $0.84 at mid-year 2024. As the nation grapples with inflation, supply chain disruptions and shifting consumer behaviors, Reno’s industrial sector has managed to effectively weather these challenges. The city’s strategic location and pro-business environment have positioned it as a critical logistics and distribution hub. These factors have allowed local businesses to remain competitive, even as national economic pressures mount. Sales activity has seen a recent uptick with four major sales occurring in the second quarter of this year. Prospect Ridge bought the four-building, 893,632-square-foot Airway Commerce Center from Tolles Development; CapRock bought a 707,010-square-foot building from Manulife; and Pure Development sold two buildings – one with 354,640 square feet and the other with 322,400 square feet – to Exeter …

— By Roxanne Stevenson, senior vice president of Colliers — Reno’s retail market saw a dip in net absorption and a slight uptick in regional vacancy toward the middle of 2024. Tenant demand began to moderate this year after the robust leasing activity of 2022 and 2023. Vacancy reached a record low at the beginning of the year, dipping to 3.8 percent in the first quarter, though it now sits just above 4 percent. When analyzing the state of Reno’s retail market, there are several categories to consider: Tenant Activity Strong tenant demand, particularly in food and beverage, automotive,fitness and experiential concepts, should continue to stabilize the market. Reno has seen a handful of existing tenants expanding, as well as new entrants in recent years. Trader Joe’s opened its second location in South Reno and intends to plant a third flag in northern Sparks. Bob’s Discount Furniture and Twin Peaks are also opening their first locations in Northern Nevada at Redfield Promenade. Other notable and active tenants include Miniso, In-N-Out Burger, Starbucks, Dave’s Hot Chicken, Panera, Ace Hardware and Einstein Bros. Bagels. A few tenants, however, have shuttered their doors. There were three 99 Cents Only locations that filed bankruptcy …

— Jason Hallahan, associate of Colliers Reno — Northern Nevada’s office market has shown continued resilience in 2024 as the region has seen robust tenant demand, fewer sublease availabilities and evolving market trends. Though Northern Nevada experienced an influx of vacant space that hit the market in the middle of the year, year-to-date tenant demand has been largely positive. Robust absorption in the first and third quarters of 2024 has driven annual net absorption to more than 77,500 square feet. While many larger office markets felt an immediate impact at the onset of the pandemic, Reno’s office market began to see the wave of sublease space hit the market at the start of 2022 — nearly two years later. At its peak in the first quarter of 2023, available sublease space accounted for 28.2 percent of all available space on the market. Northern Nevada’s sublease market has continued to shrink over the past two years as the total square footage recently dropped below 90,000 square feet. This is less than one-third of the 2023 peak, which was 303,000 square feet of available sublease space. This loss of sublease space is due to large sublease suites being occupied by new subtenants, …

— By Ben Galles, senior vice president of CBRE — Interest rates have been the biggest factor for Reno’s multifamily market this year, reaching some of the highest levels seen in a long time. The market for multifamily properties in Northern Nevada has been slow to adjust to the new lending environment, with sellers unwilling to price assets at a rate of return that would provide most buyers with positive leverage. In other words, the interest rate on loans used to purchase many of the current listings is higher than said property’s cap rate. Multifamily sales volume in Northern Nevada is down 14 percent compared to the same time last year. One of the major drivers for the drop in sales volume is that only three deals have secured bank debt, with the average loan to value (LTV) of those loans being roughly 48 percent. While cash transactions have represented more than 58 percent of the transactions, a large percentage of deals have involved owner financing. Some owners who needed to move their assets over the past 12 months found that offering below-market interest rate owner financing was a significant selling point. Many of the deals that closed with owner …

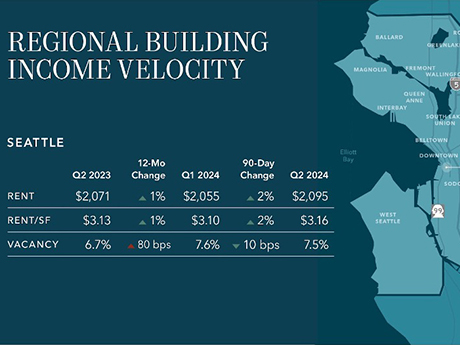

— By Dylan Simon, executive vice president, Kidder Mathews — This summer marked a major milestone in Seattle’s apartment market, demonstrating signs of vibrancy with increases in rental rates, growing liquidity and clarity in pricing in capital transactions. The city is gaining momentum and continues to bounce back from recent market fluctuations and the harsh impacts of the pandemic. Urbanization is here to stay — corporate employers are voting against Zoom as an effective tool — as we trend back toward human nature, which requires community and proximity. With limited new construction breaking ground, the stage is set for sustained rental rate growth, which will invariably result in a surge in sales prices. Transaction Activity on the Rise Transaction activity is steadily on the rise in Seattle’s multifamily market, proving conviction from the investment community. This uptick offers greater clarity on property values as the market adjusts from peak interest rates back in fall 2023. For owners and potential sellers, this shift suggests pricing hit a bottom in the past nine months and the only direction in pricing from here is upward. In our recently launched third-quarter Seattle market report, we’ve uncovered key sales insights that underscore this resurgence. During the …

— By Leah Masson, senior director, Cushman & Wakefield — The real estate landscape in the Puget Sound region is shaped by a dynamic contrast between the Eastside and Downtown Seattle. The Eastside continues to thrive, particularly with its robust tech activity. Major developments, such as the Eight, Skanska’s 540,000-square-foot project, is nearing full occupancy, underscoring the area’s strong demand. OpenAI is actively seeking space on the Eastside, with expectations of more artificial intelligence groups to follow. It’s worth noting that the Eastside is not plagued by the safety issues that have been a concern for Downtown Seattle. The anticipated 2025 opening of the light rail is set to drive even more growth in the area. Downtown Seattle is also experiencing an uptick in leasing activity, with active tenants expanding in terms of both square footage and lease term lengths. Since 2021, professional services groups, such as law and engineering firms, have been the primary drivers of leasing, but there is now a welcome return of tech companies to the Seattle market. New AI-focused tenants are beginning to emerge, moving out of coworking spaces and seeking permanent office locations in the city. However, Downtown Seattle continues to face significant challenges, …

— By R.J. Vara, first vice president of investments, Marcus & Millichap’s The Vara Group — The Seattle industrial market is undergoing a transitional phase marked by rising vacancies, fluctuating demand and evolving investment dynamics. There was a robust surge from 2020 to 2022, which saw nearly 19 million square feet of industrial space absorbed and more than $8.4 billion in transaction volume. However, the market experienced a reversal in 2023, with roughly 2 million square feet of previously absorbed space becoming available. This shift, driven by decreased container traffic at local ports, rising interest rates and elevated inflation, has continued into 2024, with speculative construction projects contributing to elevated vacancy rates. As of mid-year, Seattle’s industrial vacancy rate has increased by about 2 percent year over year, reaching 7.7 percent. This has surpassed the national average of 6.6 percent. The rise in vacancies is primarily attributed to the completion of new distribution facilities, with spaces of more than 100,000 square feet now available in double digits. Delivery numbers are expected to fall to their lowest level since 2017, but investors are beginning to explore opportunities in the southern regions. Regarding investment activity, Seattle’s industrial sales volume has notably increased …

— By Jacob Pavlik, research manager, Colliers — A 10-mile drive east of Seattle, Bellevue is the top destination for urban retail activity in the Puget Sound. High incomes, healthy daytime employment and the most active office leasing market in the Pacific Northwest means not much more is needed to make a retail space thrive. That is, except reasonable fit-out costs for new space. The Bellevue CBD has seen significant new construction for office buildings (with lots of ground-floor retail opportunities), delivering 3.3 million square feet over the past year alone. Unfortunately, sky-high construction pricing and office market financing challenges have made it difficult to get retail leases done in new buildings. Second-generation spaces in the submarket are the reasonable but diminishing alternative. Second-generation spaces are filling up faster than they become available. The demand is partially from tenants whose buildings were torn down for redevelopment. Given the cost of fitting out a space in a brand-new building elsewhere in the Bellevue CBD, second-generation space is the most lucrative alternative. First-generation space, which delivers as a cold shell without HVAC, plumbing or dry wall, can cost upward of $400 per square foot to build out. Landlords tend to offer $100 …