— By Josh McDonald, Executive Vice President, CBRE’s Institutional Multifamily Investment Services — Recent data points to positive trends in Portland’s multifamily leasing market heading into the summer months. The rebound in absorption and declining new supply — primarily driven by an active suburban renter base — highlight the resilience and growth potential of the local rental market. The positive leasing trends in Portland have contributed to create an increase in recent investment sales opportunities. Strong leasing performance, as indicated by elevated absorption rates and demand for rental properties, often translates into positive investor sentiment and heightened investment activity in the multifamily sector. This may signal to investors that the market has opportunities for solid returns and growth potential. The green shoots in seasonal leasing are weighted in the suburbs with demand accounting for more than 65 percent of the net change in occupied units, emphasizing a strong preference for suburban living. With more than 3,100 units absorbed in 2024 already, the year is on track to surpass the full-year totals for both 2022 and 2023. This may potentially exceeding the 10-year average as well, according to CoStar. Denser urban areas and the Central Business District also experienced an increase …

Western Market Reports

Orange County Industrial Sector Experiences Leasing Slowdown, but Investment Remains Active

by Jeff Shaw

— By Erick Parulan — The Orange County industrial market, along with Los Angeles and the Inland Empire, is experiencing a general decline in leasing activity as it navigates the post-pandemic landscape. Tenant demand and leasing have significantly slowed as occupiers adopt a more cautious approach to expansion, with some occupiers deciding to downsize and consolidate their industrial footprints. Tenant occupancies continue to contract in the second quarter, with manufacturers, retailers and 3PL (third-party logistics) companies shedding unused space that may have been acquired during the pandemic frenzy, further increasing sublet availabilities. Orange County sublet availabilities surpassed 3.3 million square feet in the second quarter of 2024, raising total availabilities to 9.5 percent for the quarter. While pandemic-driven rental rates hit historic highs, they have since cooled amid softening demand. Many landlords now offer increased free rent concessions to attract new tenants. Average asking lease rates have been on the decline in Orange County over the past two quarters. They decreased by 5.2 percent from the prior quarter, reaching $1.64 per square foot in second-quarter 2024. High market rents previously deterred many occupiers, but with rents on the decline, some tenants have adopted a wait-and-see approach to see where rates …

— By Gabe Schnitzer, Vice President of Industrial Properties, Norris & Stevens — Portland and Southwest Washington possess a total industrial real estate market of 233 million square feet. Portland is frequently praised as the most affordable city on the West Coast, offering lower average home prices compared to its northern and southern counterparts, while providing a high quality of life for its residents. From 2017 to 2022, Portland’s average annual industrial sales volume was $810 million, with institutional funds accounting for 20 percent of the total sales volume during that time. This represented the highest average industrial volume for the city, with early 2022 boasting nearly $1.4 billion in total sales volume. Then Portland experienced its wake-up call. Ill-conceived legislation, poor leadership and damaging national media coverage caused the city’s reputation to decline. This, in turn, led to a significant drop in the city’s industrial sales volume. From 2022 to 2023, the volume fell by almost $500 million. Despite hopes of stabilization in 2024, sales volume dropped further by nearly $150 million. While some of this decline can be attributed to interest rates and other macroeconomic factors beyond Portland’s control, the impact on institutional investors has been severe. Their …

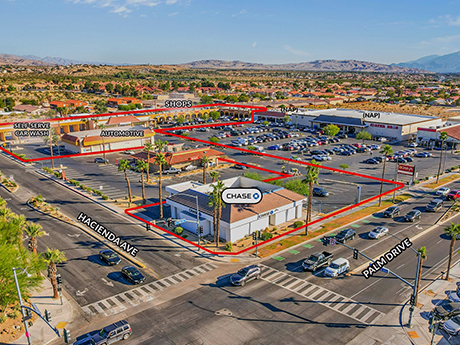

— By John R. Read — Orange County’s retail market continues to shine, mirroring its famously consistent weather. Despite challenges like persistent interest rate fluctuations, capital markets volatility and signs of a slowing economy, the region remains a beacon for retailers and investors alike. This resilience has cemented Orange County as one of the strongest retail markets in Southern California and the nation. As 2023 drew to a close, a notable drop in the 10-year U.S. Treasury yield to below 4 percent and signals from the Federal Reserve of potential rate cuts in the upcoming year fueled optimism among real estate investors. However, 2024 has continued to see volatility, with yields reaching mid-4 percent levels and no rate cuts yet implemented. This environment has impacted Orange County’s retail investment sales volume, which saw a 29 percent drop in 2023 from the prior five-year averages and a muted start in 2024. Despite this, investor demand and pricing have remained strong due to Orange County’s high barriers to entry, with average cap rates in the mid-5 percent range and several significant transactions highlighting the market this year. This includes the April sale of an El Pollo Loco in Orange for $3.8 million …

— By Jessica Ramey, Executive Vice President and Co-Lead for Agency Leasing, and Patricia Raicht, Head of Research for U.S. West and Latin America, JLL — Portland’s office sector is a tale of market cycles, with many signs trending in positive directions. Leasing continues to strengthen, tenants are taking space for longer terms and certain sectors are performing better than others. All of this provides opportunities for those able to execute on them. Portland’s suburban market is second best in the U.S. with a 13 percent vacancy that is significantly below the U.S. average of 21.9 percent. By contrast, the urban market recently tied with Phoenix for the fifth-highest vacancy nationally. Vacancy had been increasing in downtown Portland, but the rate of negative absorption is starting to moderate. JLL anticipates the numbers will turn positive in 2025. Urban/Downtown Market Green-Shoots Rising The revitalization of downtown is making significant progress thanks to efforts by both local government and private-sector groups. As such, the migration of tenants out of the urban core has largely subsided. Nevertheless, as corporations begin to evaluate their space needs and location options, they remain concerned about safety and parking. Many are also increasingly looking at public transit and area amenities …

— By Mark Bridge, Managing Director, Bridge Multifamily Team, Capital Markets, Americas, Cushman & Wakefield — Vacancy The vacancy rate is 4.0 percent as of the mid-point in the second quarter of 2024, up 30 basis points (bps) quarter-over-quarter (QOQ) and year-over-year (YOY). The rate has been increasing in eight out of the last 11 quarters from a market low of 2.1 percent in third quarter 2021. The rate is currently 40 bps above the five-year quarterly average of 3.6 percent. Despite this recent increase, Orange County’s vacancy rate is considerably lower than the national average at 7.7 percent. OC’s vacancy rate ranks it second lowest among the nation’s 50 largest markets. Rent The average asking rent per unit currently sits at $2,513 as of the mid-point in the second quarter of 2024. The market high asking rent per unit peaked in fourth 2023 at $2,530 and has come down 0.7 percent since then. Despite the recent decrease, the asking rent per unit is still up 0.9 percent YOY. Given the tightness of the market and a healthy development pipeline, it is likely that the asking rent will remain elevated. Construction/Deliveries There are currently 23 buildings or 8,183 units under …

— By Holly Chetwood, Retail Specialist, TOK Commercial — The Boise MSA retail market had one of its strongest quarters on record with net absorption reaching 559,000 square feet at the end of March of this year. Multiple big-box spaces were backfilled in the first 90 days of the year including the former K-Mart and Gordmans spaces in Nampa as well as both Bed, Bath, and Beyond locations in Boise and Meridian. In addition, the highly anticipated Scheels opened its first Idaho store at Ten Mile and I-84 in Meridian. Along with a healthy level of net absorption, nearly 100 transactions were recorded, the highest number of deals seen in a quarter since 2021. The top five deals of the quarter were all over 25,000 square feet, however, leasing activity continues to be primarily driven by tenants in spaces below 2,000 square feet. These deals have accounted for 52 percent of transactions over the past 12 months. As demand stayed high, vacancy continued to tighten throughout the first 3 months of the year. Total vacancy ended the quarter at 4.4 percent, its lowest level in nearly a year. The majority of submarkets are seeing vacancy remain between 2 to 4 percent. …

— By Candice Chevaillier, CCIM, Principal, Lee & Associates | Pacific Northwest Multifamily Team — Absorption still lags supply in the Seattle MSA contributing to higher vacancy and flat rents. In Q1 2024 3,000 units were delivered, yet only 2,800 were absorbed. Vacancy is stabilizing at 6.9 percent this quarter and then is expected to trend down starting in Q3, finally allowing meaningful growth in rents. Construction costs remain high and options for financing limited, curtailing new development. This is creating demand for existing value-add acquisitions. 2024 and 2023 sale volume in the Seattle MSA is still a trickle of what it was in 2022 and 2021, shifting Cap Rates slowly upwards. This trend is expected to be short-lived. As interest rates finally begin to fall, and rents begin to rise, investors who catch this inflection point will prevail from best pricing and benefit while more conservative capital sits on the sidelines.

— By Brad Umansky, President & Head Coach, Progressive Real Estate Partners — Occupancy and lease rates have continued to trend higher throughout Southern California’s Inland Empire retail market as a lack of new construction combined with strong retail demand has kept vacancies near record lows. Looking ahead, factors affecting the market are 99 Cent Only’s bankruptcy, the substantial slowdown in sales activity, and the minimum wage increase to $20/hour for fast food workers. Occupancy & Lease Rates Occupancy is currently reported at 94.3% by Costar, but removing spaces 10,000 SF or larger, results in occupancy of 97.2% which demonstrates the lack of available shop space. In my 30+ years of working in this market, I have never seen such a lack of options for shop tenants. As a result, when shop spaces become available owners are mostly commanding a higher lease rate than what the previous tenant was paying. 99 Cent Only Bankruptcy Dominates Recent Activity Since April, when 99 Cent Only declared bankruptcy and promptly decided to liquidate all 371 stores in the chain, industry participants have been analyzing these locations. As of June 2nd, it has been determined that Dollar Tree is acquiring 170 of the …

— By Alex Muir, Senior Vice President, Lee & Associates | Seattle — As we near the halfway mark of 2024, capital markets activity in Seattle remains slow. The year has largely consisted of price discovery and waiting for interest rates to drop. With that said, the sales volume for office assets has nearly surpassed the 2023 total. Four transactions over $30 million have occurred year-to-date, all of which are larger than any deal last year. These sales are emblematic of the type of deals that are driving investment activity, with three being owner-user acquisitions — Alaska Airlines, Costco, Seattle Housing Authority — and the fourth involving a loan assumption. Distressed sales are occurring more frequently as well, with several buildings in downtown Seattle trading below $150/SF. While it has yet to materially impact vacancy, there are signs of life in the leasing market. Pokémon recently signed a lease for 16 floors in The Eight, an under-construction tower in the Bellevue CBD. This is the largest lease in the market in three years. Other tenants, such as ByteDance and Snowflake, have signed leases larger than 100,000 SF, as a new wave of tech companies grow in the market. With the …