CHICAGO — Kiser Group has brokered the sale of a four-building, 53-unit multifamily portfolio in Chicago for $4 million. Situated in the city’s Chicago Lawn neighborhood, the portfolio features seven one-bedroom units, 34 two-bedroom units, 10 three-bedroom residences, one four-bedroom apartment and one five-bedroom unit. All are fully occupied. John George and Joe Bianchi of Kiser brokered the sale. Buyer and seller information was not provided.

Illinois

ELGIN, ILL. — Seefried Properties has broken ground on a two-building speculative industrial development in Elgin. The 465,360-square-foot project is slated for completion in the third quarter of 2024. The buildings will feature clear heights ranging from 32 to 36 feet, 185-foot-deep truck courts and 236 trailer parking spaces. The project team includes Harris Architects, FCL Builders and Spaceco as civil engineer. Jason West and Doug Pilcher of Cushman & Wakefield are marketing the project for lease.

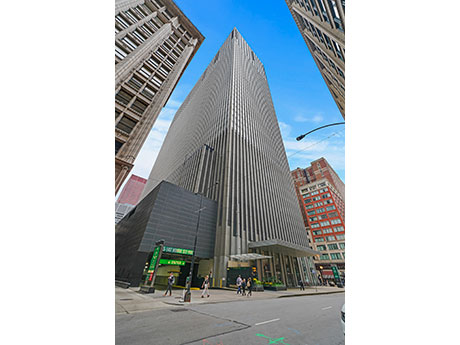

CHICAGO — Analytics8, a consulting firm that specializes in data strategy implementation, has signed a 13,355-square-foot office lease at 55 East Monroe in Chicago for its new U.S. headquarters. The firm is more than doubling its current 6,000-square-foot space at 150 N. Michigan. Victor Sanmiguel of Bespoke Commercial Real Estate represented Analytics8. Michael Lirtzman, Marina Zelenkova and Michelle Levy of Colliers represented the landlord, PGIM Real Estate. Rising 49 stories and totaling 1.2 million square feet, 55 East Monroe is situated in the city’s East Loop submarket. Amenities include a 3,400-square-foot conference center, 10,000-square-foot fitness center and the 10,000-square-foot Forum 55 food hall. More than 90,000 square feet of leases have been signed at the property within the last seven months. PGIM has unveiled plans to upgrade the building’s common areas, including the lobby, conference center and other amenity spaces in 2024.

FOREST PARK, ILL. — Interra Realty has brokered the $1.8 million sale of a 15-unit apartment building in the Chicago suburb of Forest Park. Located at 102 Rockford Ave., the three-story property was constructed in 1979. There are five studios and 10 one-bedroom units, all of which were fully occupied at the time of sale. Patrick Kennelly and Paul Waterloo of Interra represented both parties in the transaction. The buyer completed a 1031 exchange.

ALSIP, ILL. — SVN Chicago Commercial has negotiated the lease renewal for a roughly 45,000-square-foot warehouse located at 12600 S. Hamlin Court in Alsip. The Hines Building Supply division of US LBM is the tenant and has occupied space at the property since 2010. The new lease term is five years. Karen Kulczycki of SVN Chicago represented the undisclosed landlord, while CBRE represented the tenant. The property is situated on nearly five acres and features rail service.

CHICAGO — McHugh Construction has topped out construction of Cassidy on Canal, a 33-story apartment tower in Chicago’s Fulton River District. The project team includes co-developers The Habitat Co. and Diversified Real Estate Capital LLC as well as architect Solomon Cordwell Buenz. In a nod to the site’s history, bricks from the former Cassidy Tire building were used a baseline for selecting bricks for the new structure. The 355-foot-tall tower will offer studios, one- and two-bedroom units. The fifth-floor amenity space will include a fitness center, game room, various clubrooms, a coworking center, spa with sauna, pool, sun deck and grilling areas. First move-ins are slated for spring 2024.

CHICAGO — Life Care Services has opened Clarendale Six Corners, a 258-unit seniors housing community in the Portage Park neighborhood of Northwest Chicago. Rising 10 stories at the intersection of Milwaukee Avenue and Irving Park Road, the property features 114 independent living units with one-, two- and three-bedroom layouts, 98 assisted living units and 46 memory care apartments.

MOUNT PROSPECT, ILL. — Principle Construction Corp. has completed a 21,427-square-foot office and manufacturing expansion for Avery Dennison in the Chicago suburb of Mount Prospect. The company manufactures retro-reflective sheeting. The project encompasses 11,576 square feet of manufacturing and warehouse space and 9,851 square feet of two-story office space. Cornerstone Architects was the project architect and Vivek Singla of CBRE served as project manager on behalf of Avery Dennison. The facility is located at 902 Feehanville Drive.

BARTLETT, ILL. — Lee & Associates has brokered the sale of a 3.4-acre vacant lot near the southeast corner of West Bartlett Road and Route 25 in the Chicago suburb of Bartlett. The sales price was undisclosed. A new multi-story, self-storage facility is planned for the site. Rick Scardino of Lee & Associates represented the seller, Abbott Land. Dan Lynch of Colliers represented the buyer, Berman-Lapetina.

CHICAGO — The Community Builders has begun development of 4715 N Western, a 63-unit affordable housing building in Chicago’s Lincoln Square neighborhood. The six-story property will feature 25 studios, 29 one-bedroom units and nine two-bedroom residences. The units will be reserved for those who earn no more than 80 percent of the area median income. Amenities will include a lounge, terrace, bike room, package room and resident parking. The development will also feature 5,500 square feet of ground-floor commercial space and 18 public parking spaces. The project is being built with financial support from the City of Chicago, CIBC, Stratford Capital Group, Benefit Chicago, Chicago Housing Authority and ComEd Energy Efficiency Program. Leopardo Cos. is the general contractor and DesignBridge Ltd. is the architect. A timeline for completion was not provided.