O’FALLON, ILL. — Poettker Construction has completed Revela at O’Fallon, a 92-unit senior living community in O’Fallon, about 20 miles east of St. Louis. A grand opening event is scheduled for Tuesday, Oct. 18. The 89,000-square-foot property offers independent living, assisted living and memory support. St. Louis Design Alliance was the project architect, and Premier Senior Living is the property manager.

Illinois

Marcus & Millichap Arranges $6.2M Sale of Rasmussen University-Occupied Property in Suburban Chicago

ROMEOVILLE, ILL. — Marcus & Millichap has arranged the sale of a 25,000-square-foot property occupied by Rasmussen University in the Chicago suburb of Romeoville for $6.2 million. The net-leased asset at 1400 W. Normantown Road was constructed as a build-to-suit for the university in 2009. Peter Doughty and Brent Holder of Marcus & Millichap represented the seller, a California-based private investor that had purchased the property through a 1031 exchange. The duo also represented the buyer, a New York-based private investor. American Public Education acquired Rasmussen University in 2021.

CHICAGO — Tradewater has signed a 3,565-square-foot office lease at the historic Auxiliary Building in Chicago’s West Fulton Market. The 90,000-square-foot building is located at 1550 W. Carroll Ave. Formerly an industrial building that served as the main factory for H.C. Evans & Co., the 100-year-old property was recently converted into office space. H.C. Evans & Co. was a manufacturer of casino equipment, pinball machines and jukeboxes. Tradewater works to prevent the emission of greenhouse gases. Zach Pruitt and Nicholas Schaefer of Cawley Chicago represented the private landlord. Dan Arends of Colliers represented the tenant.

CHICAGO — JLL Capital Markets has brokered the $19.2 million sale of 65 East Wacker Place, a 222,728-square-foot office and retail building in Chicago. The buyer, Intersection Realty Group, plans to convert a portion of the property into apartment units. Constructed in 1928, the 24-story building is recognized by the National Register of Historic Places and is currently 46 percent leased. Morton’s Steakhouse occupies floors one and two of the building. Sam DiFrancesca, Patrick Shields, Jaime Fink and Bruce Miller of JLL represented the seller, a New York-based investment firm. The team also procured the buyer.

By Tyler Hague, Colliers A colleague of mine recently had to move out of her West Loop apartment quickly and she faced a conundrum: how much am I willing to pay for a one-bedroom apartment in Chicago? The unfortunate answer: not even close to the $2,700 per month rent she was continually being asked to pay. She ended up renting a studio. The average price for a one-bedroom apartment in the central business district is $2,478 per month, a figure that has grown 9.5 percent in the last year alone and equates to a $235.41 year-over-year rental increase, according to Yardi Matrix. It also translates to a national housing insecurity crisis, not just a local and presumed urbanized problem, and one that has been exacerbated by many of the detrimental housing laws and zoning regulations that exist in Chicago today. Whether it is aldermanic privilege, the Affordable Requirements Ordinance (ARO) or general NIMBYism, it is clear rent is too darn high — and it isn’t the entrepreneurial real estate professional’s doing but rather a major (and obvious) supply dilemma. This summer, for the first time in U.S. history, median rent costs in major cities surpassed $2,000 per month, according to …

JOLIET, ILL. — PENN Entertainment has unveiled plans to build Hollywood Casino Joliet at the Rock Run Crossings development in Joliet. Construction is expected to begin in late 2023, subject to local regulatory approval. The project has an estimated budget of $185 million and will combine gaming, dining and 10,000 square feet of meeting and event space. The land-based casino will replace PENN’s riverboat casino in Joliet. Cullinan Properties owns Rock Run Crossings, which spans 310 acres and 1 million square feet.

ARCOLA, ILL. — Blue West Capital has brokered the $2.4 million sale of a 75,000-square-foot warehouse occupied by MasterBrand Cabinets in Arcola, a city in central Illinois. The tenant, which recently exercised an early lease extension option, stores raw materials at the property prior to them being assembled at a manufacturing plant 12 miles west in Arthur. Zach Wright and Robert Edwards of Blue West Capital represented the seller, a Midwest-based private equity real estate company. A local 1031 exchange investor was the buyer.

LOCKPORT, ILL. — Marcus & Millichap has negotiated the sale of a 56,326-square-foot industrial building in the Chicago suburb of Lockport for an undisclosed price. The building sits on a little over seven acres at 900 N. State St. Originally constructed in 1970, the property has received multiple expansions and is currently 83 percent leased to eight tenants. Brent Holder and Peter Doughty of Marcus & Millichap represented the seller, a local private investor who had owned the building for more than 20 years. A Mexico-based private investment group was the buyer.

CHICAGO — Chicago-based Puttshack, an indoor mini golf venue operator, has completed a growth capital round of $150 million from funds managed by BlackRock and continued support from Promethean Investments. The new funding will support Puttshack’s rapid growth strategy across the United States. New venues in Boston and Miami are scheduled to open this fall, followed by one in St. Louis this winter. Additional locations in Dallas, Denver, Houston, Nashville, Philadelphia, Pittsburgh and Scottsdale, plus a second location in Atlanta, are all slated to open in 2023. Additional U.S. locations will be announced soon, according to the company. Puttshack says the latest round of funding enables the team to continue securing unique and desirable real estate opportunities as it expands into more top markets. The company first introduced its tech-driven mini golf game in 2018 with the opening of the first location in London. Currently, Puttshack operates two locations in the United States and four in the United Kingdom. Puttshack’s patented Trackaball technology is integrated throughout the entire game, including automated scoring, bonus points opportunities and interactive games at each hole. Puttshack also offers a dining menu and drinks. “As the global leader in the emerging and growing market of …

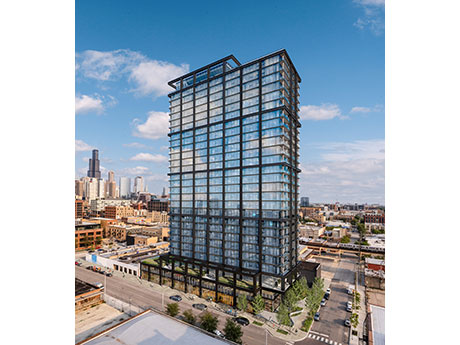

CHICAGO — Skender has completed construction of a new 200,000-square-foot office and retail building located at 345 N. Morgan St. in Chicago’s Fulton Market neighborhood. Sterling Bay was the developer. The building is 85 percent leased with tenants expected to start taking occupancy in March. The development features private outdoor terraces on each floor, a 5,000-square-foot roof deck, a bar and lounge, fitness center, coworking library and several conference spaces. Eckenhoff Saunders Architects was the project architect.