CHICAGO — CEDARst Cos. and WeWork have unveiled plans to open the first WeWork location on Chicago’s North Side as part of the adaptive reuse project of the Bridgeview Bank building. The WeWork location will offer nearly 25,000 square feet of flexible workspace and is slated to open this fall. CEDARst is redeveloping the historic property into a $58 million mixed-use project. Plans call for 176 apartment units, 13,500 square feet of retail space and 19,000 square feet of office space in addition to the WeWork space. CEDARst’s property management company, FLATS, will manage the asset. The Bridgeview Bank building dates back to 1925.

Illinois

ELGIN, ILL. — McShane Construction Co. has broken ground on Hanover Landing, a 40-unit affordable housing community that will serve vulnerable populations and individuals with disabilities in Elgin. UPholdings is the developer. Located at 711 E. Chicago St., the three-story property will feature amenities such as a community lounge, computer room, fitness center, laundry facilities and outdoor space. Residents will also have access to services such as case management, life skill training and employment assistance. Hanover Township partnered with UPholdings and the Housing Opportunity Development Corp. on the project. Ecker Center for Behavioral Health will serve as the lead service provider and operate an onsite clinic. Hooker DeJong is the architect. Completion is slated for September 2023.

NEW LENOX, ILL. — Inland Green Capital LLC, an environmental finance and investment company, has originated $21.1 million in Commercial Property Assessed Clean Energy (C-PACE) financing for environmental improvements in the construction of a 220-unit multifamily property located at 232 N. Prairie Road in New Lenox. The C-PACE capital will help fund HVAC, LED lighting, roof, building envelope, air sealing, windows, water conservation and hot water system improvements. The improvements are expected to reduce the property’s annual electricity and water consumption by 834,000 kilowatt-hours and 378,000 gallons, respectively, when compared with a standard baseline building performance model. PACE is a financing tool that provides long-term, fixed-rate funding to private building owners for energy efficiency, renewable energy, water conservation, electric vehicle charging and resiliency projects to be installed in both existing and new commercial properties.

INDIANA, OHIO, ILLINOIS AND KENTUCKY — Extra Space Storage Inc. and its subsidiaries (NYSE: EXR) have completed the acquisition of multiple entities doing business as Storage Express, which owns 107 storage properties across Indiana, Ohio, Illinois and Kentucky. The sales price was approximately $590 million. The acquisition includes all Storage Express assets, including trademarks, contracts, licenses, intellectual property and 14 future development sites. The transaction was funded in part by the issuance of $125 million in operating partnership units, with the balance in cash drawn from its credit facilities. Latham & Watkins LLP served as outside legal counsel to Extra Space.

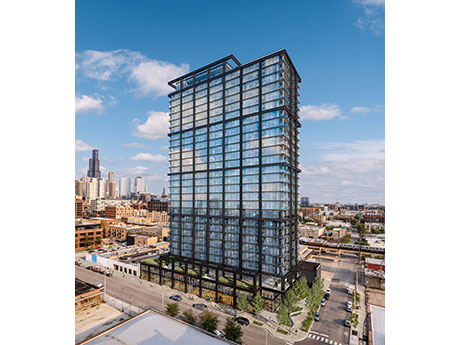

CHICAGO — Sterling Bay has broken ground on 225 N Elizabeth, a $155.6 million apartment development in Chicago’s Fulton Market district. The developer received $91.7 million in construction financing from Citizens and Old National Bank. The 28-story building will feature 350 units, 20 percent of which will be designated as affordable housing. Plans also call for roughly 9,000 square feet of retail space, 95 parking spaces and indoor and outdoor amenities on the third and top floors of the building. Sterling Bay is developing the project in partnership with Ascentris, a Denver-based private equity firm. Chicago-based McHugh Construction is the general contractor and Hartshorne Plunkard is the lead architect. Completion is slated for the second quarter of 2024.

PEORIA, ILL. — Northmarq has arranged the sale of Prairie Vista Apartments in Peoria for $45 million. Built in 2006, the 304-unit multifamily property features 38 buildings as well as a clubhouse, pool house and garages. The units are nearly fully occupied. Parker Stewart, Alex Malzone and Dominic Martinez of Northmarq brokered the sale. Dan Baker of Northmarq originated a $27 million Freddie Mac acquisition loan. The 10-year, fixed-rate loan features five years of interest-only payments followed by a 30-year amortization schedule. California-based Prairie Vista SPE Owner LLC was the buyer.

NAPERVILLE, ILL. — The Boulder Group has brokered the sale of a restaurant property net leased to KFC and Taco Bell in the Chicago suburb of Naperville for nearly $2 million. The 2,982-square-foot building is located along Reflection Drive. Randy Blankstein and Jimmy Goodman of Boulder represented the buyer, a Midwest-based real estate investor completing a 1031 exchange. A Southeast-based real estate company was the seller.

ITASCA, ILL. — Bulldog Cartage, a storage, staging and shipping company, has signed a 78,161-square-foot industrial lease at 1549 Glenlake Ave. in Itasca. Mike Antonelli and Dan Brown of Brown Commercial Group represented the tenant. John D’Orazio and Jonathan Kohn of Colliers represented the undisclosed landlord. Earlier this year, Brown Commercial Group negotiated a 37,819-square-foot lease for Bulldog Cartage in Addison, Ill.

ALGONQUIN, ILL. — FunCity Adventure Park has signed a 35,549-square-foot retail lease to open at River Pointe in the northwest Chicago suburb of Algonquin. The location will be FunCity’s 25th nationwide. FunCity is an indoor entertainment concept that offers activities such as trampolines, laser tag, foam pits, bumper cars, arcades and party rooms. River Pointe is a shopping center anchored by Jewel-Osco. KeyPoint Partners represented FunCity, which currently operates in eight states.

CHICAGO — Quantum Real Estate Advisors Inc. has negotiated the sale of a 12-unit multifamily building located at 3137 W. Wellington Ave. in Chicago for $2.8 million. Clay Maxfield of Quantum represented the seller, which purchased the asset in 2018. The property sold to a California-based buyer completing a 1031 exchange.