FAIRVIEW HEIGHTS, ILL. — The Illinois Department of Public Health has leased 9,923 square feet of office space at 11 Executive Drive in Fairview Heights, just east of St. Louis. Brokerage firm Barber Murphy represented the landlord, RETKO Group LLC. The representative of the tenant was not provided.

Illinois

DOWNERS GROVE, ILL. — Lifespace Communities has broken ground on an expansion project at Oak Trace, a nonprofit continuing care retirement community in the Chicago suburb of Downers Grove. The expansion is Phase II of a $112 million reinvestment project at the community. The first phase, which converted some units to assisted living to complete the continuum of care, was completed in 2019. Phase II will add 145 independent living apartments, bringing the total from 232 to 377. Completion is scheduled for 2023. In addition to increasing the number of available independent living apartments, new construction will include a clubhouse featuring a fitness center, pool, salon, casual dining venue, café seating, multipurpose room, living room and new lobby. Existing common areas will also be renovated. Once the second phase of construction is completed, the health center will be connected to the existing independent living building via the new clubhouse. In addition to the independent living units, the senior living community currently features 66 assisted living apartments, 28 memory support suites and 104 skilled nursing suites.

NORTH RIVERSIDE AND ELMHURST, ILL. — Mid-America Real Estate Corp. has brokered the sale of two shopping centers in suburban Chicago for an undisclosed price. North Riverside Plaza is a 384,707-square-foot regional shopping center in North Riverside. Tenants include Kohl’s, Burlington, Best Buy, Petco, Michaels and a new grocery store that is currently under construction. Elmhurst Crossing is a 347,505-square-foot, grocery-anchored shopping center in Elmhurst. Major tenants include Whole Foods Market, Kohl’s, At Home and Petco. Ben Wineman and Kathryn Sugrue of Mid-America represented the longtime owner and seller, Canada-based Federal Construction. Brixmor Property Group was the buyer.

BOURBONNAIS, ILL. — Maverick Commercial Mortgage Inc. has arranged $63.2 million in permanent financing for Tri-Star Estates, a mobile home park in Bourbonnais, about 50 miles south of Chicago. The property, which consists of 853 pad sites across 157 acres, was developed in three phases beginning in 1965. The current owner acquired Tri-Star in April 2012 when 380 homes were occupied. Today, 810 homes are occupied. Amenities include a basketball court, three playgrounds and a 7,500-square-foot clubhouse with a pool and fitness center. PGIM Real Estate provided the Freddie Mac loan. The 10-year, fixed-rate loan features five years of interest-only payments followed by a 30-year amortization schedule. Proceeds from the loan paid off the existing lender, provided cash to the borrower and paid for closing costs.

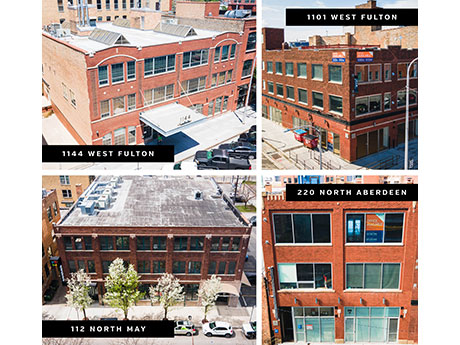

CHICAGO — SVN | Chicago Commercial has brokered the sale of a portfolio of office and retail buildings in Chicago’s Fulton Market district for $33.5 million. The portfolio comprises four buildings totaling more than 76,000 square feet as well as deeded parking spaces that can hold up to 58 cars. Scott Maesel, Drew Dillon, Chad Schroedl, Adam Thomas and Logan Parsons of SVN | Chicago Commercial’s Urban Team represented the seller. Buyer and seller information was not provided.

CRESTWOOD, ILL. — Entre Commercial Realty has arranged the sale of a 20,273-square-foot industrial building in Crestwood, a southwest suburb of Chicago. The sales price was undisclosed. The property features five drive-in doors and an outdoor storage yard. The building is fully leased to two tenants. Jeff Locascio and Chris Wilbur of Entre represented the seller, TFZ Enterprises. Matthew Lee of Darwin Realty/CORFAC International represented the buyer, Commercial Business Properties LLC.

CHICAGO — Chicago-based JLL has arranged the sale of a 27-property healthcare portfolio totaling 1.2 million square feet for $600 million. The assets are located in Arizona, California, Colorado, Illinois, Indiana, Florida, Massachusetts, Minnesota, Oklahoma and Texas. The portfolio includes 15 medical office buildings, five micro-hospitals, four behavioral hospitals, two inpatient rehabilitation hospitals and one heart and surgical hospital. Nine of the properties are in Arizona. The portfolio is 97 percent occupied by tenants such as Advocate Aurora Health, Rush University Medical Center, Memorial Hermann, Ascension, Banner Health, Tenet Health, Lutheran Health Network, Baylor Scott & White Health and Edward-Elmhurst Healthcare. A JLL Healthcare Capital Markets team led by Mindy Berman, Evan Kovac, Andrew Milne and Brian Bacharach represented the seller, Harrison Street. NorthWest Healthcare Properties was the buyer.

WAUKEGAN AND ZION, ILL. — Colliers has brokered the sale of the Amhurst Lake Portfolio in northeast Illinois for an undisclosed price. The portfolio consists of 11 buildings totaling 1.4 million square feet. Ten of the buildings are located in the Amhurst Lakes Business Park in Waukegan, while one property is situated in Trumpet Business Park in Zion. Tenants include pharmaceutical, home goods, logistics and manufacturing entities. Jeff Devine, Steve Disse and Chris Volkert of CBRE represented the seller, a global real estate investment advisor. Link Logistics was the buyer.

CHICAGO — A partnership between Mavrek Development, GW Properties and Luxury Living Chicago Realty has unveiled plans to develop a mixed-use project in Chicago’s Streeterville neighborhood. Plans call for 248 luxury apartment units, 40,000 square feet of office space and 8,000 square feet of retail space. Amenities will include a fitness center, outdoor pool, coworking lounge and package service. Both apartment renters and office tenants will have access to the amenities. The project will replace a parking garage. Demolition is expected to begin this summer with groundbreaking scheduled by the end of the year. The office portion is expected to be ready for tenant buildouts in the third quarter of 2023, with the residential units slated for completion in early 2024. NORR is the project architect.

CHICAGO — Skender has completed a renovation of the interior office space for Equity LifeStyle Properties (ELS) at 2 N. Riverside Drive in Chicago’s West Loop. The renovation project updated the company’s 65,000-square-foot space across two-and-a-half floors and added a new roof deck. The office includes a mix of conference rooms, private offices, collaboration areas, cafés and pantries. Employees can work or socialize outdoors on the new roof deck. Skender collaborated with Partners by Design, McGuire Engineers, Structural Shop, Engineering Plus, CBRE and Spark Chicago. ELS owns and operates manufactured home communities, RV resorts, campgrounds and marinas.