CHAMPAIGN, ILL. — Marcus & Millichap has brokered the $150 million sale of a student housing portfolio comprising over 50 properties near the University of Illinois Urbana-Champaign campus in Champaign. The transaction represents the highest-ever portfolio sales price for Champaign County, according to Marcus & Millichap. The portfolio totals nearly 1,100 units. The newest property was constructed three years ago, while the oldest is more than 50 years old. Scott Harris and Bryan Kunze of Marcus & Millichap represented the seller, Campus Property Management, and procured the buyer, Fairlawn Capital. The buyer plans to reposition a number of the assets through unit upgrades and amenity additions.

Illinois

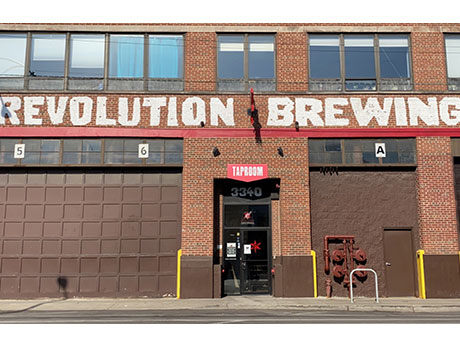

CHICAGO — Revolution Brewing, the largest independently owned brewery in Illinois, has purchased a 128,422-square-foot industrial property located on North Kedzie Avenue in Chicago. The purchase price was undisclosed. The building features clear heights ranging from 18 to 24 feet, 14 docks and one drive-in door. Mike Senner and Alex Kritt of Colliers represented the seller, a private investment group.

BOLINGBROOK, ILL. — M&J Wilkow and Bixby Bridge Capital have acquired The Promenade Bolingbrook in the Chicago suburb of Bolingbrook. The seller and sales price were undisclosed. The open-air lifestyle center spans 779,000 square feet. Some of the tenants include Macy’s, Bass Pro Shops, Binny’s Beverage Depot, Ulta and DSW. The shopping center opened in 2007. M&J Wilkow and Bixby also own Outlets of Maui in Hawaii together.

AURORA, ILL. — Panattoni Development has purchased 29 acres in Aurora with plans to build a 356,462-square-foot speculative industrial development. Panattoni expects to break ground on the project this month. The industrial facility will feature a clear height of 36 feet, 34 loading docks, 139 trailer positions and 290 car parking spaces. Completion is slated for the third or fourth quarter of this year. Nick Krejci and Noel Liston of Darwin Realty/CORFAC International represented Panattoni in the acquisition. Darwin has been retained to market the project for lease.

BATAVIA, ILL. — Transwestern Real Estate Services has arranged the sale of the Campana Building in the Chicago suburb of Batavia for an undisclosed price. The 131,000-square-foot industrial flex building is located at 901 N. Batavia Ave. Michael Marconi and Paige Gunn of Transwestern represented the seller, Campana Redevelopment, and the buyer, Batavia Business Center LLC. The property was 65 percent leased at the time of sale. The new ownership has retained Transwestern to provide leasing and property management services.

WILMETTE, ILL. — Chicago-based Newport Capital Partners has sold Edens Plaza in the Chicago suburb of Wilmette for $110 million. Massachusetts-based WS Development was the buyer. The shopping center spans 350,000 square feet. Current tenants include The Fresh Market, Walgreens, Chicagoland Children’s Health Alliance, Starbucks and Big Blue Swim School. The property also comprises a two-story department store that was formerly occupied by Carson Pirie Scott and is currently vacant. Newport acquired Edens Plaza in 2018 and the vacant department store in 2019. WS plans to open the first-ever bricks-and-mortar store for online furniture retailer Wayfair in the department store. Joe Girardi of Mid-America Real Estate Group brokered the transaction.

WINFIELD, ILL. — Interra Realty has arranged the $44.2 million sale of Winfield Station in Winfield, about 35 miles west of Chicago. The newly built, transit-oriented apartment complex features 162 units and is situated near the Winfield Metra station. The property was 82 percent occupied at the time of sale. Amenities include a resident lounge, business center, fitness center and outdoor pool. Jon Morgan, David Goss and Joe Smazal of Interra represented the seller, an affiliate of Chicago-based Synergy Construction Group, which completed construction of the property in August 2021. Patrick Kennelly and Paul Waterloo of Interra procured and represented the buyer, Mango Shadow LLC.

SCHAUMBURG, ILL. — RSM, a provider of audit, tax and consulting services focused on the middle market, has signed a 22,256-square-foot office lease at Schaumburg Towers in the Chicago suburb of Schaumburg. RSM plans to relocate from 20 N. Martingale Road in the fourth quarter of this year. Schaumburg Towers is now 73 percent leased. The two-building office complex spans 882,000 square feet. Owner American Landmark Properties has invested more than $20 million in property upgrades since 2017. Steve Kling and David Florent of Colliers represented ownership in the lease transaction. Rick Schuham of Savills represented RSM.

CHICAGO — Transwestern Real Estate Services has negotiated two lease expansions at 191 North Wacker Drive in Chicago’s West Loop. The 37-story office tower spans 733,759 square feet. Qualtrics, a software company for employee and customer experience, expanded its lease from 25,600 square feet to 51,200 square feet. Skills for Chicagoland’s Future, a nonprofit focused on increasing the economic mobility of unemployed and underemployed talent, also increased its lease from 3,828 square feet to 13,290 square feet. Katie Steele and Kathleen Bertrand of Transwestern represented ownership, Allianz Real Estate and JHUSA. Evan Djikas of Colliers represented Qualtrics, while Jon Milonas and Brandon Green of CBRE represented the nonprofit. Ownership plans to complete significant capital improvements to the property this year, including a renovated lobby, refreshed tenant lounge and upgraded fitness center.

CHICAGO — Allsteel Inc., an Iowa-based furniture manufacturer, has unveiled plans to open a new 24,000-square-foot showroom in Chicago’s Fulton Market district. The company plans to relocate from its current space at Merchandise Mart to 345 N. Morgan St. in the first quarter of 2023. Owner and developer Sterling Bay recently topped out the office and retail building, which is slated for completion later this summer. Chicago-based Partners by Design is the architect for Allsteel’s space.