CHICAGO — SVN Chicago Commercial has brokered the $2.8 million sale of a fully leased apartment building located at 1555 N. Milwaukee Ave. in Chicago’s Bucktown neighborhood. The property features 17 apartment units and one street-level retail space. Wayne Caplan and José Colón of SVN Chicago Commercial represented the seller. The asset sold to a local apartment owner at a cap rate of 6.88 percent. The deal closed within 5 percent of the asking price in under three months.

Illinois

CHICAGO — Related Midwest, the Related Affordable Foundation and Related Affordable Management Co. have opened a newly renovated playground at Marshall Field Garden Apartment Homes in Chicago’s Old Town neighborhood. Related partnered with KABOOM!, a national nonprofit, to construct the playground at the 628-unit affordable housing community. Residents, volunteers, Related team members and community partners built the playground on July 23 and 24. The project’s completion comes nearly two months after Related and KABOOM! hosted a design day at the community, where children and adult residents shared visions for the playspace. There are more than 17,000 KABOOM! playspaces nationwide. Related led a $175 million renovation of Marshall Field Garden Apartment Homes following its acquisition of the property in 2016.

CHICAGO — The Aspire Center for Workforce Innovation has opened in Chicago’s Austin neighborhood. Lamar Johnson Collaborative (LJC) designed the adaptive reuse project, which involved the repurposing of the former Robert Emmet Elementary School that was built in 1913. Located at 5500 W. Madison St., the center offers workforce training, education, healthcare support and economic development. LJC incorporated a three-story lobby and designed a POPF!t pocket park. The lobby addition features a reception area, flexible open and private gathering zones, and a BMO bank branch. The project also includes a 100-foot mural by artist Shawn Michael Warren. Renovated classrooms now host anchor tenants: Jane Addams Resource Corp., Austin Coming Together, Westside Health Authority and BMO.

CHICAGO — Canyon Partners Real Estate LLC has provided a $106.3 million senior loan to refinance The Saint Grand, a newly built apartment tower in downtown Chicago’s Streeterville submarket. JLL arranged the loan on behalf of the borrower, a joint venture controlled by Mavrek Development. The 21-story property features 248 market-rate apartment units, a 103-stall parking garage and 46,946 square feet of retail space that is leased to Club Studio Fitness, Wintrust Bank and Tropical Smoothie Café. Amenities include coworking areas, electric vehicle charging stations, bike storage, a concierge, outdoor pet area and rooftop terrace with a fitness center, pool, fire pit and grilling stations.

CHICAGO RIDGE, ILL. — MedProperties Realty Advisors, a Dallas-based healthcare real estate investor, has acquired Millennium Medical Center, a 41,540-square-foot medical office building in the southwest Chicago suburb of Chicago Ridge. The two-story property at 10604 Southwest Highway was built in 2018 by a group of local physicians. The lead tenant is an affiliate of US Oncology, a national network of more than 600 cancer treatment centers. A complementary tenant base that serves patients suffering from cancer and related ailments makes up the balance of the tenancy at the property. Old National Bank provided debt for the acquisition. The seller was the original physician group.

NORMAL, ILL. — The Boulder Group has brokered the $3.1 million sale of a single-tenant restaurant property net leased to Raising Cane’s Chicken Fingers in Normal. The restaurant at 311 Veterans Parkway opened this month and is operating under a 15-year ground lease with 10 percent rental escalations every five years and five five-year renewal options. The property marks the only Raising Cane’s location within a 50-mile radius. Randy Blankstein and Jimmy Goodman of Boulder Group represented the seller, a Midwest-based developer. The buyer was a 1031 exchange investor. The transaction represented a 4.75 percent cap rate. Raising Cane’s, founded in Louisiana in 1996, operates more than 800 locations worldwide.

MOUNT PROSPECT, ILL. — Seefried Industrial Properties has preleased O’Hare Logistics Center 16, a 190,606-square-foot speculative distribution facility located at 1305 E. Algonquin Road in Mount Prospect. Accelerated Global Solutions, an air cargo and freight forwarding services company, is expanding its operations into the new property upon completion. Situated on a 13-acre site, O’Hare Logistics Center 16 is located six miles north of the Chicago O’Hare International Airport and features immediate access to I-90 and I-294. Jonathan Kohn and John D’Orazio of Colliers represented the tenant, while Jason Lev, John Suerth and Jimmy Kowalczyk of CBRE represented Seefried. FCL Builders is the general contractor, Kimley-Horn is the civil engineer and Harris Architects is the architect of record.

NORTHBROOK, ILL. — Skender has broken ground on Poupard Place, a 48-unit supportive housing development in the Chicago suburb of Northbrook. Developed by nonprofit Housing Opportunity Development Corp. and designed by Cordogan, Clark & Associates, the project marks the city’s first affordable housing community and is slated for completion in summer 2026. The 1.5-acre project site was donated by the Village of Northbrook. Poupard Place will offer affordable homes for individuals and families where at least one household member is living with a disability. The development is named for Tom Poupard, the retired director of Northbrook’s Development and Planning Services. The four-story building will include a mix of one-, two and three-bedroom apartment units. Plans also call for a children’s play area.

CHICAGO — Venture One Real Estate, through its acquisition fund VK Industrial VII LP, has purchased a 145,500-square-foot industrial building located at 11264 Corliss Ave. in Chicago. The single-tenant property was fully leased at the time of sale. Situated in the Pullman Industrial Park, the facility offers direct access to I-94 via 111th Street. Constructed in 1977, the asset features a clear height of 22 feet, 10 docks, two drive-in doors and parking for more than 129 cars. Mike Wilson, Erik Foster and Brian Colson of Avison Young represented the undisclosed seller. VK Industrial VII is co-sponsored by Venture One and Kovitz Investment Group.

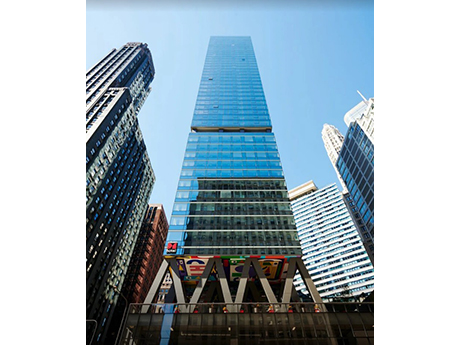

CHICAGO — A joint venture between Kayne Anderson Real Estate and CEDARst Cos. has acquired Millie on Michigan, a newly built luxury apartment tower in Chicago’s Loop. Completed in 2022 and located at 300 N. Michigan Ave., the property rises 47 stories with 289 apartment units and 25,000 square feet of retail space. Amenities include a rooftop pool and lounge, coworking spaces, a fitness center, dog run and integrated smart home features. The asset was 95 percent occupied at the time of sale. CEDARst, which owns and operates more than 5,000 apartment units in Chicago, utilized its Opportunistic Fund I, which launched in February.