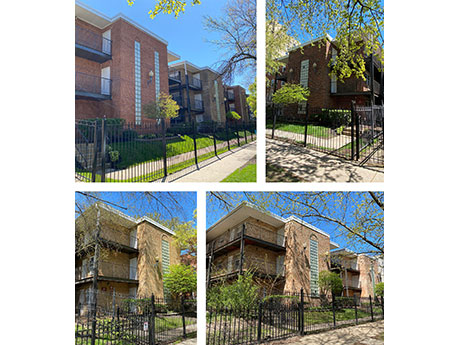

CHICAGO — Kiser Group has brokered the $17.2 million sale of Ravenswood Gardens, a multifamily portfolio consisting of 151 units across seven buildings in the Sheridan Park Historic District of Chicago’s Uptown neighborhood. Katie LeGrand, Lee Kiser and Jacob Price of Kiser brokered the transaction. Initially marketed in summer 2023, the portfolio went under contract but did not close due to market volatility. The seller, continuing its strategic exit from Chicago, revisited the sale in 2024. The buyer plans to reposition the units and rebrand them as Sheridan Park. The buyer assumed the seller’s existing loan, which features an interest rate below 4 percent for the next five years. The buyer now owns more than 400 units in the Uptown neighborhood.

Illinois

NAPERVILLE, ILL. — Bucksbaum Properties LLC has acquired River District, a retail and office property in downtown Naperville. Built in 1988, the asset sits on 2.7 acres at the southeast corner of Washington Street and Chicago Avenue. The property totals nearly 59,000 square feet of retail space with tenants such as Rosebud, Fat Rosie’s Taco & Tequila Bar, Chipotle and Five Guys, as well as 12,000 square feet of second-floor office space. The seller and sales price were not provided.

BOLINGBROOK, ILL. — JRK Property Holdings has acquired Brook on Janes Apartments, a 288-unit multifamily community in the Chicago suburb of Bolingbrook. The purchase price was undisclosed. JRK utilized its JRK Platform 5 Fund, a $1 billion multifamily value-add and core plus fund that targets higher-quality, well-located multifamily investments built after 1990. The fund’s portfolio is comprised of institutional-quality assets with an average year built of 2019 located in Illinois, Florida, Kansas and California. Built by the undisclosed seller in 2017, Brook on Janes rises three stories at 401 Janes Ave. Units come in studio, one-, two- and three-bedroom layouts. Amenities include a pool, clubhouse, fitness club, cookout area and gated dog park. Kevin Girard, Roberto Casas and Matt Lawton of JLL represented the seller. Annie Rice and Brandon Smith of JLL arranged agency acquisition financing with a 10-year, fixed-rate loan.

COLLINSVILLE, ILL. — Contegra Construction Co. is underway on Eastport Commerce Center, a 75,000-square-foot office and distribution facility in Collinsville, an eastern suburb of St. Louis. BHMG Engineers, a utility engineering firm based in Sunset Hills, Mo., has leased 25,000 square feet at the property. The new office will replace BHMG’s existing 5,000-square-foot office at 1902 Vandalia St. in Collinsville. Located on a 9.5-acre site at the intersection of Eastport Plaza Drive and Fairmont Avenue, the building is near the I-255/I-55 interchange. The property features a clear height of 28 feet, four dock doors, three drive-in doors and 160 parking spaces. A timeline for completion was not provided.

OAK PARK, ILL. — Mosaic Construction LLC has completed a new facility for Stride Autism Centers at 6400 W. North Ave. in Oak Park near Chicago. One of more than 20 Stride facilities across the country, the new location features a safe free-play natural environment space, circle time areas and more than 10 individualized instruction spaces customized for the needs of children with autism. The 6,700-square-foot space features a reading nook and mural wall inside the activity room as well as new flooring, appliances, paint and updates to the bathrooms and classrooms. Project partners included Huron Design Group, Splash 10, North Builders, D&D Flooring, Frank Bak Decorating, Brew Plumbing, Parkside Electric and G&C Glass, Mirror and Construction.

CHICAGO — Essex Realty Group has arranged the $1.7 million sale of a two-building multifamily portfolio totaling 26 units in Chicago’s Auburn Gresham neighborhood. Located at 8301 S. Paulina St. and 1469 W. 83rd St., each building features 13 units and a mix of two- and three-bedroom units. The properties were substantially occupied at the time of sale. Robert Berman, Michael Anguiano, Daniel Shabsin, Jeremy DeMarco and Joe Kahlhammer of Essex represented the private seller. Buyer information was not provided.

ELMHURST, ILL. — DarwinPW Realty/CORFAC International has brokered the sale of a 37,136-square-foot industrial building in the Chicago suburb of Elmhurst for an undisclosed price. Located at 737 N. Oaklawn Ave., the property features 13,920 square feet of office space, a clear height of 14.5 feet, two exterior docks, one drive-in door, 60 parking spaces and a fenced outdoor storage yard. George Cibula and Luke Ferzacca of DarwinPW Realty/CORFAC International represented the undisclosed seller. Joe Bronson of NAI Hiffman represented the buyer, Haskris, which is a manufacturer and distributor of engineered chillers and heat transfer systems. Haskris owns a building across the street and is planning to expand to the new facility.

CHICAGO — Cook County Health (CCH) has unveiled plans to build a new community health center at 467 E. 31st St. in Chicago’s Bronzeville neighborhood. Bronzeville Health Center will join CCH’s portfolio of more than a dozen community health centers located across Chicago and suburban Cook County. Anchored by CCH’s Provident Hospital, Bronzeville Health Center will offer family medicine, behavioral health and rehabilitation services, including physical therapy, occupational therapy and speech therapy. The 26,000-square-foot facility will include 44 exam rooms and a gym space for therapy services. The family medicine and behavioral health practices are moving from their existing location within Provident Hospital’s Sengstacke Health Center. The move also frees up more clinical space within Provident Hospital to allow for the expansion of hospital-based services. Patients will continue to be able to receive primary and specialty outpatient care at Sengstacke Health Center. CCH has spent more than $9 million to grow clinical services and modernize the Provident Hospital campus since 2020. The Cook County Bureau of Asset Management and CCH are investing $10 million to build out and furnish the new Bronzeville facility.

BENSENVILLE, ILL. — American Bear Logistics Corp. has signed a 56,264-square-foot industrial lease at 1065 Thorndale Ave. in the Chicago suburb of Bensenville. Chris Nelson and Calvin Gunn of Lee & Associates represented the landlord, Prologis. Nick Krejci of CORE Industrial Realty represented the tenant, which is a logistics company that focuses on integrating international freight forwarding, warehouse management, U.S. inland road transportation and import/export customs declaration services.

FRANKLIN PARK, ILL. — Entre Commercial Realty has arranged the sale of a 35,000-square-foot industrial building in the Chicago suburb of Franklin Park for an undisclosed price. The property at 10100 Pacific Ave. is situated near I-294 and O’Hare International Airport. Chris Wilbur and Jeffrey Locascio of Entre represented the seller, Climate Solutions Window & Doors, which expanded and relocated to a larger facility within Franklin Park. Edward Pohn of Coldwell Banker Commercial represented the undisclosed buyer.