CHICAGO — Stream Realty Partners has acquired Halsted Pershing Business Center in Chicago’s Stockyards submarket for an undisclosed price. The 104,008-square-foot industrial property is fully leased to three tenants. Patrick Russo, Mustafa Ali and Ben Harrison of Stream facilitated the acquisition. Ed Halaburt, Sean Devaney, John Huguenard, Kurt Sarbaugh, Will McCormack and Michael Conway of JLL represented the undisclosed seller. Stream currently manages a portfolio of 41 investments totaling 23.2 million square feet.

Illinois

BATAVIA, ILL. — Noble Self Storage has broken ground on Batavia Square, a 130,000-square-foot self-storage facility and a 44,729-square-foot electric car dealership in the Chicago suburb of Batavia. Noble Self Storage acquired the shuttered Sam’s Club building at 510 N. Randall Road in March. Linda Kost of Grid 7 properties dba Realty Metrix Commercial represented the seller, 501 N. Randall Rd Batavia LLC, and the buyer, Noble Self Storage/Bradley Financial Corp. Sam’s Club vacated the property in January 2018. The two-story, climate-controlled self-storage facility will be in the rear of the building and the car dealership will occupy the entire frontage. Completion is slated for early 2025.

HUNTLEY, ILL. — John B. Sanfilippo & Son Inc. has inked a 444,600-square-foot industrial lease at Venture Park 47 in the Chicago suburb of Huntley. Completed in 2023, the building at 12300 Jim Dhamer Drive totals 729,823 square feet. Frank Griffin and John Sharpe of Lee & Associates represented the tenant, which has begun occupying the facility concurrently with a tenant improvement build-out. Brian Kling and Reed Adler of Colliers represented the owner, Venture One Real Estate. The transaction marks the largest industrial lease of the second quarter in Chicago’s North Kane County submarket and the fourth largest in metro Chicago, according to Lee & Associates. John B. Sanfilippo & Son is a processor, packager and marketer of a wide variety of nut and snack products.

WOODRIDGE, ILL. — Krusinski Construction Co. has completed the build-out of a 66,000-square-foot interior warehouse space on behalf of J&P Warehousing and Tardella Foods in the Chicago suburb of Woodridge. J&P Warehousing is a third-party logistics firm and will serve its food-and-beverage client, Tardella Foods, out of the Woodridge facility at 2250 W. 75th St. Krusinski previously completed construction of the building, a 100,400-square-foot facility, on behalf of developer Molto Properties. The interior build-out included minor office modifications, installing a demising wall to separate the J&P Warehousing space from the adjacent 34,400-square-foot tenant space. Krusinski also separated gas and electrical services to accommodate the multi-tenant property. Additional project elements consisted of installing tenant-specific electrical and HVAC equipment, including a charging station for electric pallet jacks and an air compressor. Harris Architects designed the building.

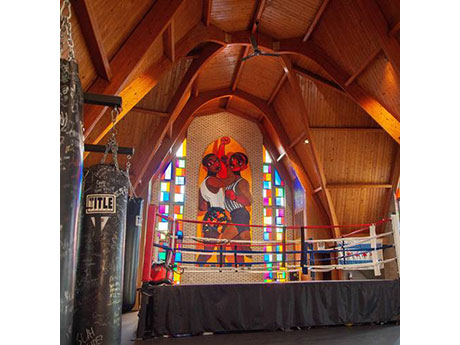

CHICAGO — Summit Design + Build has begun Phase III of interior renovations for The Bloc, a nonprofit in Chicago. The Bloc is a boxing club that also provides training, tutoring and mentorship to guide youth toward academic, social and athletic achievements. Summit has completed two phases of renovations, including major upgrades to the building’s mechanical systems, a full kitchen remodel and other finishes of the space. The third phase includes flooring upgrades, electrical repairs and the reconfiguration of restroom plumbing, fixtures and layouts. Future Film is the architect.

CHICAGO — Related Midwest has broken ground on 400 Lake Shore, a multifamily project in the Streeterville neighborhood on the Near North Side of Chicago. Situated on a waterfront site where Lake Michigan meets the Chicago River, the two-tower development will occupy the last undeveloped parcel at the location. 400 Lake Shore’s first phase will feature a 72-story, 858-foot tower. The building will feature 635 apartments, with 20 percent of the residences (127 units) designated as affordable housing. Units will include studio, one-, two- and three-bedroom apartments. Related Midwest’s in-house contracting company, LR Contracting Co., will build the first phase of the project with BOWA Construction. Skidmore, Owings & Merrill designed the development, with building interiors designed by MAWD. Stantec is serving as the architect of record. Related will also lead the development of a 3.3-acre park — with a $10 million commitment from the company — and an extension of the Chicago Riverwalk, in conjunction with the construction of the first tower. Dubbed DuSable Park, the park will comprise a portion of the 4.5 acres of public space included in the 400 Lake Shore project, which will also feature a plaza with amenities, two-story podium and public art. The …

CHICAGO — Concord Summit Capital LLC has arranged $10 million in mezzanine financing for the construction of a luxury apartment complex in Chicago. Daniel Eidson, David Larson and Keegan Burger of Concord Summit arranged the financing, which included a senior loan with a C-PACE component. The project will feature amenities such as a fitness center, lounge, game room, private event space, outdoor pool and ground-floor coworking spaces. The lender and borrower were not disclosed.

OAK LAWN, ILL. — Interra Realty has arranged the $3.1 million sale of a multifamily portfolio in Oak Lawn, a southwest suburb of Chicago. Each of the three buildings on Mansfield Avenue houses eight units. At the time of sale, the buildings were 96 percent occupied. Michael Duckler of Interra represented the seller, a private investor. The seller replaced water tanks, added new windows, repaired roofs and completed painting and carpeting.

WHEATON, ILL. — Core Acquisitions has purchased Rice Lake Square, a 251,584-square-foot shopping center in the Chicago suburb of Wheaton, for $34.2 million. Developed in 1989 and renovated in 2011 and 2019, the property is anchored by Pete’s Fresh Market, Studio Movie Grill and PetSmart. Additional tenants include Massage Envy, Orangetheory Fitness, Potbelly Sandwich Shop, Men’s Wearhouse, Xfinity and Taco Bell. The value-add center was 76.2 percent leased at the time of sale. Rick Drogosz of Mid-America Real Estate Corp. represented the undisclosed seller. Old National Bank provided acquisition financing. Core Acquisitions will provide property management services, and Mid-America Asset Management, which has handled leasing at the property for 20 years, will continue to serve as the leasing agent.

By Dougal Jeppe, Colliers Over the past few years, we have been inundated with less than positive industry news. While it’s true we are at a historic moment in commercial real estate, and users are facing complex, never-before-seen questions about how to use their space, there remain many positives as we head toward the second half of 2024. So, let’s take a look at the good news from the Chicago office market. For now, downtown Chicago remains a tenant’s market, a trend expected to persist throughout 2024. With over 47.2 million square feet of office space available, tenants have a plethora of high-quality options to choose from, making it an opportune time for businesses seeking favorable lease terms to secure space. And companies are doing just that. There has been a recent uptick in large space renewals by long-term office tenants including some consolidations reflecting the commitments many Fortune 500 companies, such as Mesirow and PNC Bank, have made to the City of Chicago. Notably, JPMorgan Chase announced plans to reinvest in Chicago by renovating its namesake tower and keeping its 7,200 employees in the city. Similarly, Google has committed to the Central Loop, and plans to move about 1,000 …