PHILADELPHIA — Philadelphia-based Alterra IOS has acquired seven industrial outdoor storage (IOS) sites totaling 23 usable acres largely in the Midwest region. The purchase price was undisclosed. The sites are fully leased to a national telecommunications and broadband network company. Each parcel is located across metro areas in Dallas, Minneapolis, Indianapolis, Chicago, Nashville, Cleveland and St. Louis. Specifically, the properties are located in Haslet, Texas; Osseo, Minn.; Indianapolis; Frankfort, Ill.; La Vergne, Tenn.; Avon, Ohio; and St. Peters, Mo. All of the assets in the portfolio are located near city downtowns, interstate highways, international airports and rail networks. CRE Advising facilitated the acquisition.

Indiana

WEST LAFAYETTE, IND. — LV Collective has unveiled plans to build Rambler Levee District, a two-building apartment development totaling 583 units in the Levee District of West Lafayette near Purdue University. LV is partnering with Harrison Street and obtained financing from Pacific Life for the project. Amenities will include coworking spaces, a clubroom, multiple pools, internal courtyards, fitness facilities, a yoga studio, resident lounge and saunas. The 799,289-square-foot project will be centered around a 20,000-square-foot public plaza and green space. Plans also call for 15,600 square feet of retail space. Site work will begin this quarter, with completion slated for fall 2027. Project partners include development group Landmark Properties Inc., architect WDG, general contractor Brinkmann Constructors, interior designer Variant Collaborative and DLA Piper for legal counsel. TSB Capital Advisors consulted on construction financing.

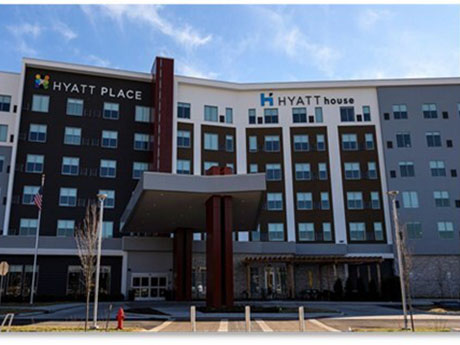

FISHERS, IND. — Noble Investment Group has acquired the Courtyard by Marriott Indianapolis | Fishers and the dual-branded Hyatt House & Hyatt Place Indianapolis | Fishers. The two newly built hotels are located within the Fishers District, a 150-acre mixed-use development in the Indianapolis suburb of Fishers. The seller and sales price were undisclosed. Noble is a real estate investment manager specializing in the travel and hospitality sector.

AUBURN, IND. — The Zacher Co. has arranged the sale of a 9,917-square-foot industrial building in Auburn, about 22 miles north of Fort Wayne. The sales price was undisclosed. The property is located at 1004 Auburn Drive. Dan Gabbard of Zacher represented the seller, The Richard and Phyllis Poff Estate. Ideal Property LLC was the buyer.

SOUTH BEND, IND. — Toll Brothers Campus Living has completed The 87, an 810-bed student housing community located near the University of Notre Dame campus in South Bend. Centier Bank provided $91 million in construction financing for the project, which broke ground in September 2022. The community also serves students attending Holy Cross College and St. Mary’s College. The development offers 335 fully furnished units with bed-to-bath parity in studio through four-bedroom configurations, alongside townhomes. Shared amenities include study lounges with private seating options; a social lounge and coffee bar; content creation studio; golf and sports simulator; fitness center; lounge with four large-screen televisions; and multiple courtyards with grills, fire pits, yard games and hammocks. KTGY designed the property.

CROWN POINT, IND. — Saxum Real Estate has begun development of a 322,600-square-foot cold storage project for Arcadia Cold in Crown Point, a city in northwest Indiana. FCL Builders is the general contractor. The project will feature a clear height of 50 feet, ample dock space and dock doors to expedite distribution and container handling services, and convertible rooms with temperature capabilities between minus 10 and 38 degrees Fahrenheit. Completion is slated for the second quarter of 2026. Arcadia Cold specializes in providing third-party handling, storage, distribution and value-add services to the food industry and is the seventh-largest cold storage operator in the U.S., according to a release.

GRAND RAPIDS, MICH.— Grand Rapids-based food solutions company SpartanNash has acquired Fresh Encounter Inc. (FEI), a 49-store supermarket chain with locations in Ohio, Indiana and Kentucky. This move expands SpartanNash’s retail footprint by 33 percent and marks the company’s second retail acquisition this year, following its purchase of Metcalfe’s Market in April. FEI operates stores under the banners Community Markets, Remke Markets, Chief Markets and Needler’s Fresh Market, and has been a food distribution customer of SpartanNash for 58 years. The transaction is expected to close in late November, subject to customary conditions.

GREENWOOD, IND. — CBRE has brokered the sale of Westminster, a 438-unit multifamily property in the Indianapolis suburb of Greenwood. The sales price was undisclosed. Built in 1971, the community has undergone extensive renovations totaling nearly $20 million since 2014. Residences come in one-, two- and three-bedroom layouts averaging 918 square feet. George Tikijian, Hannah Ott, Cam Benz, Claire Bullard and Ryan Stockamp of CBRE represented the seller, Van Rooy Properties, which acquired the asset in 2010. Monarch was the buyer.

INDIANAPOLIS — Rubenstein Partners LP has completed a new equity investment that fully recapitalizes the Parkwood Crossing office campus in Indianapolis. Rubenstein acquired the eight-building, 1.2 million-square-foot office park in 2016. The company has implemented a comprehensive renovation of the Class A property since taking ownership. The new recapitalization enables Rubenstein to continue to modernize the campus with further amenities and the addition of two large greenspaces. Rubenstein has spent $36 million upgrading building lobbies, restrooms, entry facades and building systems as well as adding a number of indoor and outdoor amenities. The improvements are expected to coincide with two new roundabouts and roadway beautification projects through the center of the campus.

FORT WAYNE, IND. — Benco Dental Supply Co. Inc. has renewed its 108,800-square-foot industrial lease at 3424 Centennial Drive in Fort Wayne. Steve Zacher of The Zacher Co. represented the landlord, STAG Industrial Holdings LLC. The representative of the tenant was not provided.