DETROIT — Following a six-year renovation by Ford Motor Co. (NYSE: F), Michigan Central Station is scheduled to officially open on Thursday, June 6. Ford embarked on the preservation project after acquiring the abandoned train station in 2018 to serve as the centerpiece of Michigan Central, a 30-acre technology and cultural hub in Detroit’s Corktown neighborhood. According to multiple media outlets, the rehabilitation of Michigan Central Station totaled $950 million and included the restoration of the 18-story train station, which is now dubbed The Station. The rehabilitation also included an adjacent 270,000-square-foot former book depository building and other supporting facilities. CNBC reports the project’s funding includes $300 million in state, local and historic rehabilitation tax incentives. Christman-Brinker, a joint venture between Detroit-based firms The Christman Co. and L.S. Brinker, A Brinker Co., led the restoration work of The Station along with Ford. Key collaborators in Michigan Central include Ford, Google, the State of Michigan, the City of Detroit and Newlab, which operates the former book depository building. The Station will provide 640,000 square feet of cultural, technology, community and convening spaces designed for use by established companies such as Ford, as well as universities, growing startups, youth initiatives and students. …

Michigan

WYOMING, MICH. — Thompson Thrift has completed The BLVD at Wilson Crossings, a 344-unit apartment community in the Grand Rapids suburb of Wyoming. The property, which is 45 percent leased, offers townhome-style units with up to four bedrooms. Amenities include a clubhouse, fitness center, pool, pickleball courts, turf game lawn and dog park. The project marks the third Michigan development for Indianapolis-based Thompson Thrift.

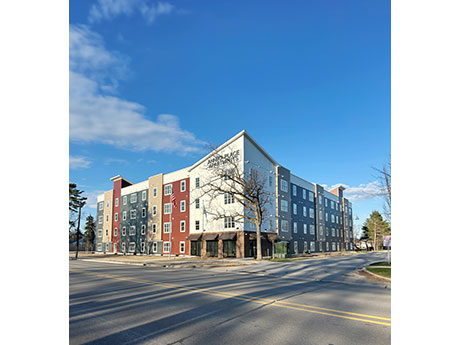

TRAVERSE CITY, MICH. — Woda Cooper Cos. Inc. has opened Annika Place, a 53-unit affordable housing community in Traverse City. The $14.7 million project offers 29 one-bedroom units and 24 two-bedroom units for residents who earn 30 to 80 percent of the area median income. Rental rates range from $377 to $1,125 per month, depending on the income restriction and size of unit. The Traverse City Housing Commission will provide rental assistance for eight units to be occupied by formerly homeless residents. The four-story development features amenities such as a community kitchen, fitness center, rooftop terrace, patio, picnic table, grill, park benches and playground. Annika Place is made possible with funding supported by Low-Income Housing Tax Credits allocated by the Michigan State Housing Development Authority. Affordable housing finance syndicator CREA LLC invested in the credits to provide equity financing. Huntington Bank provided a construction loan and permanent financing. The project honors the memory of U.S. Coast Guardsman Douglas Munro, who lost his life at the Guadalcanal on Sept. 27, 1942, because of heroic measures with his Higgins boat that shielded and saved the lives of 500 Marines. He is the only Coast Guard member to receive the Medal of Honor. …

ONEIDA TOWNSHIP, MICH. — University of Michigan Health has unveiled plans to purchase an 11-acre site near Lansing for a new healthcare center. The purchase price is $2 million, and funding will be provided from U-M Health reserves. The site is at 5677 E. Saginaw Highway in Oneida Township and consists of a former CARite dealership. University of Michigan Health-Sparrow will operate the new ambulatory care center, which is expected to house both primary and specialty care offerings, including radiology and rehabilitation services. Further details regarding construction were not provided.

DETROIT — Architecture firm Gensler has relocated its Detroit office from 150 W. Jefferson Ave. to 1265 Griswold St. in the city’s Capitol Park neighborhood. The 7,300-square-foot space is situated on the ground floor of the historic Bamlet Building, which is owned by Bedrock. The office offers a mix of spaces for focused work, teamwork and gathering; a resource library of sustainable design materials; and a 3D printing workshop.

WINDSOR, ONTARIO AND DETROIT — The construction team for the Gordie Howe International Bridge project has begun the final steps to connect the bridge deck over the Detroit River, connecting the United States to Canada via Detroit and Windsor, Ontario. The remaining portion is 85 feet, the same width as an official NHL rink. The project team anticipates that the two sides will connect at the end of June. Crews must install one more segment on the U.S. side that measures 49 feet before work starts on the final segment, known as the mid-span closure. Once connected, the bridge deck spanning the distance between the two towers will measure 0.53 miles, making it the longest main span of any cable-stayed bridge in North America and the 10th longest in the world. It will also be the longest composite steel and concrete bridge deck for any cable-stayed bridge in the world. Even though it will appear the bridge is completed, there is still work remaining before the bridge opens in fall 2025. Crews will stress stay cables and install electrical, fire suppression and drainage systems, barriers, signage, lighting, deck paving and pavement markings, and complete the multi-use path. Windsor-Detroit Bridge Authority …

SOUTH LYON, MICH. — Orangetheory Fitness has signed a 2,800-square-foot retail lease at Brookdale Square in South Lyon, about 40 miles northwest of Detroit. The shopping center is located near the intersection of 9 Mile Road and Pontiac Trail. Michael Murphy and Tjader Gerdom of Gerdom Realty & Investment represented the landlord, Beztak Properties. There are still a few vacancies left at the center.

CANTON, MICH. — Bernard Financial Group (BFG) has arranged a $5 million loan for the acquisition of a 61,148-square-foot industrial property in Canton, a western suburb of Detroit. Dan Duggan of BFG arranged the loan on behalf of the borrower, 55111 Grand River Partners LLC. StanCorp Life Insurance Co. provided the loan.

DETROIT — Detroit City Football Club (FC) has acquired the site of the former Southwest Detroit Hospital at the corner of Michigan Avenue and 20th Street for an undisclosed price. The organization plans to build a new stadium that will serve as the permanent home for soccer in Detroit, with a goal of opening a new soccer-specific stadium by the club’s 2027 season. Southwest Detroit Hospital opened in 1973 as the first Detroit hospital to hire and accredit African American doctors and nurses. The hospital existed for 17 years before closing in 1991 and declaring bankruptcy. The building has been abandoned for 18 years. Detroit City FC games are currently played at Keyworth Stadium in Hamtramck, about five miles north of downtown Detroit. The club will reveal more details around the stadium vision and programming after further consultation with city officials, local residents and long-time fans. A public engagement process is anticipated to kick off later this year.

DAVISBURG, MICH. — Cali Girl Books has signed a 1,600-square-foot retail lease at Oak Hill Plaza in Davisburg, about 23 miles south of Flint. Michael Murphy and Tjader Gerdom of Gerdom Realty & Investment represented the landlord, Kassab Associates. Located at 10785 Dixie Highway, Oak Hill Plaza is home to tenants such as Locri Pizzeria, Davisburg Nutrition and Diamond All Star Cheer.