BROOKLYN PARK, MINN. — Hanley Investment Group Real Estate Advisors has arranged the $11.9 million sale of Edinburgh Festival Centre in the Minneapolis suburb of Brooklyn Park. The 91,563-square-foot shopping center was 96 percent occupied at the time of sale. A 54,476-square-foot Festival Foods store anchors the property, which is located on Edinburgh Centre Drive. Bill Asher and Jeff Lefko of Hanley, in association with ParaSell Inc., represented the seller, LS Capital Inc., and the buyer, a private investor from northern California.

Minnesota

EAGAN, MINN. — Ryan Cos. US Inc. has entered into a purchase and sale agreement with Thomson Reuters for 179 acres of the company’s 263-acre campus in Eagan, a suburb of Minneapolis. Financial terms of the transaction were not disclosed. The campus includes a 1.1 million-square-foot office building, three data centers totaling 333,912 square feet and 90 acres of undeveloped land. Ryan will work with the City of Eagan, Thomson Reuters and other area stakeholders to explore redevelopment options for the site. The Minneapolis-St. Paul office of Thomson Reuters will remain in Eagan, but will relocate to its new site, The Landing, in the coming months. The company’s print manufacturing facility was not for sale and will continue operating at its current location. The project marks the third major redevelopment that Ryan has undertaken in the past year. All three are in Minnesota. Canada-based Thomson Reuters is a global content and technology company.

ST. PAUL, MINN. — JLL has arranged the sale of The Cosmopolitan Apartments in St. Paul’s Lowertown neighborhood for an undisclosed price. The 258-unit multifamily building has an estimated market value of about $45 million, according to the Minneapolis/St. Paul Business Journal. Formerly the Finch, Van Slyck and McConville Dry Goods Co. building, The Cosmopolitan Apartments was originally a Neoclassical building from 1911 that was transformed into apartments in 1989. Since then, the eight-story building has undergone $8 million in upgrades. The property features studio, one- and two-bedroom floor plans averaging 805 square feet. Amenities include a fitness center, spin/yoga room, internet lounge, barbecue and picnic area, fire pit, media room, clubhouse, courtyard and bocce court. Josh Talberg, Mox Gunderson, Dan Linnell, Adam Haydon and Devon Dvorak of JLL represented the seller, AEW Capital Management. Ken Dayton and Pat McMullen of JLL originated Fannie Mae acquisition financing on behalf of the buyer, Bigos Management. Will Tansey of law firm Felhaber Larson represented Bigos.

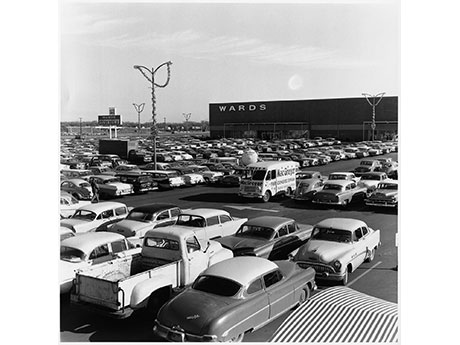

BLOOMINGTON, MINN. — Kraus-Anderson Realty & Development has begun to demolish the former Toys ‘R’ Us and Herberger’s buildings at Southtown Shopping Center in the Minneapolis suburb of Bloomington. Located at the corner of I-494 and Penn Avenue South, the shopping center opened in November 1960 and included a two-story, 150,000-square-foot Montgomery Wards, the largest in the retailer’s chain of 550 stores nationwide. The center also opened with 44 other shops, including Musicland, Red Owl, Walgreens and Texaco. The property has undergone numerous additions and renovations since then. Kraus-Anderson is demolishing the large vacant space on the northeast side of the center, often referred to as the old Herberger’s (originally Montgomery Wards) and Toys ‘R’ Us space. The demolition phase is expected to take approximately 12 weeks and is slated for completion at the end of March. The rest of the shopping center will remain open. Future plans regarding tenants or new uses were not released.

DAYTON, MINN. — CRG has completed The Cubes at French Lake, a 1 million-square-foot speculative industrial development in Dayton, a northwest suburb of Minneapolis. The project marks the largest speculative industrial project to date in Minnesota, according to CBRE. Dan Swartz, James DePietro and Austin Lovin of CBRE are marketing the property for lease. The facility features a clear height of 40 feet, 652 parking spaces, 231 trailer parking spaces, 100 dock doors, four drive-in doors, 60-foot speed bays and a 185-foot-depth concrete truck court. The 65-acre project is located approximately 35 miles from the Minneapolis-Saint Paul International Airport and offers convenient access to I-94 via the Dayton Parkway exchange. CRG’s integrated partner Lamar Johnson Collaborative served as the architect and its parent company, Clayco, was the design-builder. Construction began in 2022.

ST. LOUIS PARK, MINN. — JLL Capital Markets has brokered the $53.4 million sale of Elan West End in the Minneapolis suburb of St. Louis Park. Built in 2020, the 164-unit apartment complex features studios, one-, two- and three-bedroom units averaging 855 square feet. Amenities include a pool and spa, sky lounge, amenity deck, lounge area with golf and hockey simulator, and a fitness center. Located at 1325 Utica Ave. South, the property is situated in The West End, a prominent shopping, dining, industry and entertainment hub in St. Louis Park. Josh Talberg, Mox Gunderson, Dan Linnell, Adam Haydon and Devon Dvorak of JLL represented the undisclosed buyer and seller. Brock Yaffe of JLL arranged $25.5 million in acquisition financing on behalf of the buyer through a life insurance company.

CHASKA, MINN. — Continental Properties has opened Springs at McKnight Lake, a 280-unit apartment community in Chaska, a southwest suburb of Minneapolis. The property is located at 3 Oakridge Drive near a new Costco store. Springs at McKnight Lake offers studio, one-, two- and three-bedroom units. Amenities include a pool, clubhouse, outdoor grill area, fitness center, car care area and two dog parks. Situated on the slopes overlooking McKnight Lake, the property provides residents with a direct path to trails and water activities. Springs at McKnight Lake marks the ninth community in Continental’s Minnesota portfolio.

ST. PAUL, MINN. — Dominium has completed the final phase of Upper Post Flats, a 192-unit affordable housing development that repurposed buildings at the historic Fort Snelling site in St. Paul. Minneapolis-based BKV Group served as the architect. Preference is given to residents who are military members, veterans, first responders and their families. The 42-acre site included 26 buildings, including barracks, an administration building, gymnasium, morgue and hospital, all of which have been transformed into a residential community. Floor plans range from 285 to 2,676 square feet. The individual buildings were in poor condition, as some had stood vacant since the 1970s. But the project team was able to salvage original walls, doors and windows, entryways and staircases in many of them. Buildings requiring a more extensive structural overhaul were rebuilt to historical standards. Getting the project off the ground took years and the combined efforts of a public-private partnership that included the site’s owner, the Minnesota Department of Natural Resources, the National Park Service, Hennepin County, Minneapolis Park and Recreation Board and the Minnesota Historical Society, which operated the historic fort. Low-Income Housing Tax Credits contributed $70 million of the project’s $160 million total cost, making the below-market-rate rents …

MICHIGAN, MINNESOTA AND ARIZONA — Net Lease Office Properties (NYSE: NLOP) has sold four office assets across three states for gross proceeds totaling approximately $43.1 million. The properties included: a 143,650-square-foot building in Tucson, Ariz., primarily leased to Raytheon Corp.; a 58,722-square-foot asset in Dearborn, Mich., that is home to Carhartt Inc.; a 70,000-square-foot building in Plymouth, Mich., that is primarily leased to AVL Michigan Holding Corp.; and a 29,916-square-foot property leased to BCBSM Inc. in Eagan, Minn. Net proceeds after closing costs, together with funds from other sources, were used to repay approximately $46 million on J.P. Morgan’s senior secured mortgage and approximately $6 million on its mezzanine loan. Subsequent to the dispositions, NLOP owned 55 office properties, 50 of which are in the U.S. and five in Europe.

ARDEN HILLS, MINN. — Ryan Cos. US Inc. has purchased “Outlot A,” a 40-acre land site in Arden Hills, a northeast suburb of Minneapolis, for $12.7 million. The Ramsey County Board of Commissioners approved the purchase and sale agreement for the land parcel, which is situated adjacent to Rice Creek Commons, a planned residential and commercial redevelopment of the former Twin Cities Army Ammunition Plant (TCAAP). The parcel is zoned for commercial use under the city’s TCAAP Redevelopment Code. Alatus LLC continues to serve as the lead developer of the main 390-acre Rice Creek Commons redevelopment area. A preliminary development agreement with Alatus was approved in December. Ryan will offer Outlot A as a build-to-suit that can accommodate 400,000 to 600,000 square feet. Development possibilities include a corporate campus, a research and development center, life sciences offices or manufacturing facilities alongside retail and restaurant space. The parcel will connect to the Rice Creek North Regional Trail for bicycle and pedestrian access. Ryan also expects to incorporate green space and outdoor gathering areas. Ramsey County plans to request $25 million in funding from the Minnesota Legislature to build stormwater infrastructure and construct the main public roadway. The total future development value …