By David Goldfisher, The Henley Group Secondary and tertiary office markets across the Midwest, including Chicago, Minneapolis, Madison, Milwaukee, Cleveland, Cincinnati, Columbus and St. Louis, are facing mounting pressure. While each city has its own challenges, a common theme is clear — vacancies remain high and liquidity is thin. Tenant shuffling One of the defining dynamics today is tenant reshuffling rather than net growth. As leases expire, employers frequently move from one building to another, seeking modernized space and stronger amenities. Renovating in place is disruptive and costly, while relocating allows businesses to upgrade with minimal operational downtime. This “musical chairs” effect highlights a deeper structural issue. There are only so many large anchor tenants in Midwest cities and few new entrants are seeking major blocks of space. There is more repositioning for existing tenants than attracting new ones. Flight to quality Landlords and developers are competing to deliver amenities that encourage office attendance and support talent retention. Modernized lobbies, tenant lounges and flexible collaboration areas have become standard expectations. Hines’ upgrades at Chicago’s 333 West Wacker Drive and 601W Cos.’ reinvestment in the Old Post Office demonstrate the scale of investment required. But not all landlords can compete. With …

Minnesota

EDINA, MINN. — Cushman & Wakefield has negotiated several new long-term leases totaling more than 150,000 square feet at Southdale Office Centre, a six-building campus along France Avenue in the Twin Cities suburb of Edina. First-time tenant Southdale Pediatrics inked a lease for 38,306 square feet at 6600 France Avenue, a specialty medical outpatient property that recently underwent major renovations to the first- and second-floor lobbies and common areas. Edina Realty signed a lease renewal for 38,676 square feet at 6800 France Avenue, and Evereve doubled its footprint to 41,113 square feet. Several other companies have also recently signed new leases or renewals. Bill Rothstein and Eric King of Cushman & Wakefield represented property ownership, Wildamere Capital Management and Olympus Ventures.

OAKDALE, MINN. — Brisky Net Lease has brokered the $23 million sale of a 199,919-square-foot industrial building in Oakdale, a suburb of the Twin Cities. Superior 3rd Party Logistics occupies the facility, which is located at 3490 Hayward Ave. Brian Brisky of Brisky Net Lease was the only broker involved in the sale of the property, which was built in 2022 on 15.1 acres within the larger 4Front Technology & Office Campus.

ALBERTVILLE, MINN. — Colliers has negotiated the $11.2 million sale of Albertville Meadows, a 75-unit affordable housing community in the Twin Cities suburb of Albertville. Built in 1993, the property is located along I-94. The asset benefits from Minnesota’s new 4d(1) property tax classification, effective 2025, which implemented a major tax reduction for affordable housing properties. Mox Gunderson, Dan Linnell, Adam Haydon and Devon Dvorak of Colliers represented the seller, Dominium. The buyer was undisclosed.

CLOQUET, MINN. — Kraus-Anderson Construction has broken ground on a new $18.9 million fire and ambulance headquarters serving the Cloquet Area Fire District in Cloquet, a city in northeastern Minnesota. Designed by LHB Architects, the 35,700-square-foot facility will feature an eight-stall apparatus bay for ambulance, fire and rescue vehicles and equipment. The building will house a two-story administrative and dormitory area, training tower and elevator. The first floor will include offices, conference rooms, a training room, fitness room and personal protective equipment storage. The second floor will include 11 dorms, a kitchen, dining room and day room. A new paved area will be used for training. The project is slated for completion by December 2026.

MAPLE GROVE, MINN. — CBRE has negotiated the sale of Mills Creek, a 66-unit build-to-rent community in the Twin Cities suburb of Maple Grove. Curtis Capital Group purchased the property from a joint venture between Watermark and PCCP for an undisclosed amount. CBRE’s Ted Abramson, Keith Collins and Abe Appert represented the seller. Built in 2019, the asset features detached homes averaging 1,679 square feet. Amenities include a clubroom, business center, pool, dog park, fitness center, community garden and walking trails.

ROCHESTER, MINN. — BioLabs has signed a 16,000-square-foot lease at Two Discovery Square in Rochester. JLL handles leasing for the building in partnership with Mortenson Properties. Slated to open in late 2026, the Rochester site marks the first location in the Midwest for BioLabs. The facility will offer lab and office space for early-stage biotech and HealthTech companies. Discovery Square is an emerging innovation district within walking distance of Mayo Clinic’s flagship campus that offers more than 250,000 square feet of purpose-built space designed for research and technology uses. Jessica Mogilka and William McArdle of JLL led the building leasing efforts.

BLOOMINGTON, MINN. — JLL Capital Markets has arranged the sale of Hayden Grove Bloomington, a 166-unit seniors housing property in the Minneapolis suburb of Bloomington. Delivered in 2021, the four-story building offers a continuum of care from independent living to assisted living to memory care. Amenities include underground parking, a private dining room, bistro, coffee lounge, game room, party room, theater, event center, library, craft room, beauty salon and fitness program. JLL represented the seller, Verdot Capital. The buyer was undisclosed. The operator, Great Lakes Management, will stay in place to manage the community.

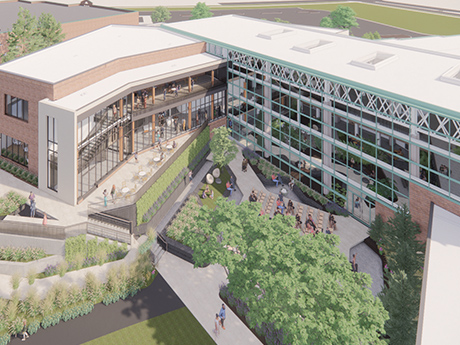

WOODBURY, MINN. — Kraus-Anderson has completed a $42.3 million revitalization of Woodbury Central Park, which is located at 8595 Central Park Place in Woodbury. Designed by HGA Architects, the three-story, 62,708-square-foot project included enclosing the existing amphitheater, a new multipurpose space addition, expanded public gathering areas and an updated Lookout Ridge indoor playground. Improvements also increased parking and pedestrian access, added art installations and space for public art and enhanced accessibility with ADA updates. Sustainability was a core focus of the project, including the integration of a Darcy Geothermal Well system, solar energy and other energy-efficiency initiatives to reduce environmental impact and operating costs. Construction began in April 2024.

EDEN PRAIRIE, MINN. — JLL Capital Markets has arranged a $50 million refinancing for The Fox & The Grouse, a 237-unit multifamily property in the Golden Triangle neighborhood of Eden Prairie. The first units of The Fox & The Grouse Phase I delivered in December 2024, and construction was completed in April 2025. The development features 205,561 square feet of rentable space across alcove, one-, two- and three-bedroom units averaging 867 square feet. The project includes a 25 percent affordable housing component, with 49 units reserved for residents at 50 percent of the area median income (AMI) and 12 units at 80 percent AMI. Amenities include an outdoor pool, golf simulator, pickleball courts, a wellness center, work-from-home spaces, a theater room and underground parking. Scott Loving, Josh Talberg, Joe Peris, Will Hintz and Colin Ryan of JLL represented the borrower, a partnership of Greco and Eagle Ridge Partners, as well as joint venture equity partner Amstar Group. JLL arranged the five-year loan through PNC Bank.