OMAHA, NEB. — Cavan Cos. has received two construction loans totaling $87.5 million for the development of The Bungalows on Honeysuckle and The Bungalows at Whitehawk Lake, two build-to-rent (BTR) projects in Omaha. ORIX Corp. USA’s Real Estate Capital Group provided the financing. Timelines for completion were not disclosed. Combined, the two projects will feature 466 single-story homes in one-, two- or three-bedroom layouts. Each residence will include open floor plans, 10-foot ceilings, laundry rooms, walk-in closets and fenced back yards with artificial turf. Select homes will also have garages. Both communities will offer amenities such as pools, fitness centers, community spaces, dog parks and other pet-friendly spaces. “The demand for rental homes continues to increase across the United States, particularly in markets like Omaha,” says Gary Burton, CEO of Cavan Cos. “Our BTR model aligns with shifting market preferences, as more residents are seeking lifestyle-driven housing options without the long-term commitment of traditional homeownership.” Cavan Cos. is a BTR development firm based in the Phoenix suburb of Scottsdale. The company’s portfolio consists of approximately 5,000 BTR units in Arizona. In addition to The Bungalows on Honeysuckle and The Bungalows at Whitehawk Lake, as well as multiple projects in Arizona, Cavan Cos. plans to develop …

Nebraska

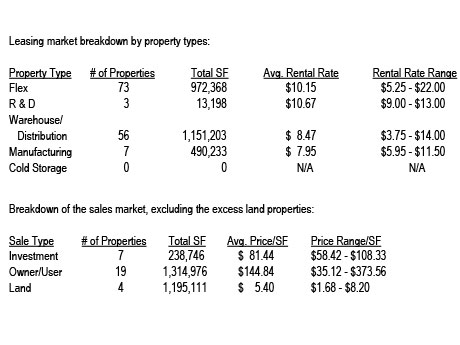

By John Dickerson, OMNE Partners Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year. In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well. Leasing pace Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year. Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.) One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square …

OMAHA, NEB. — Cushman & Wakefield has brokered the sale-leaseback of a 70,000-square-foot specialty orthopedic hospital in Omaha for an undisclosed price. Built in 2004 and expanded in 2020, the property is fully occupied by OrthoNebraska. The two-story facility is dedicated to musculoskeletal care with 24 inpatient beds, 12 operating rooms and several treatment rooms. Gino Lollio, Travis Ives, Sushil Puria and Tyler Morss of Cushman & Wakefield, along with TJ Twit of The Lund Co., an alliance of Cushman & Wakefield, represented OrthoNebraska in the transaction. Montecito Medical Real Estate was the buyer.

By Tom D’Arcy and Brad Soderwall, Hines The Omaha market has experienced strong growth in recent years, with $8 billion in commercial real estate development currently underway driven by consistent migration of new residents and professionals to the area. The city’s attractiveness is attributed in large part to its high quality of life and attractive cost of living, both of which present compelling opportunities for new development that further incentivizes in-migration, and cultivates and enhances the unique lifestyle that makes Omaha a desirable place for families and young professionals to put down roots. Shifting demographics drive growth in Omaha Omaha’s low unemployment rate (at 2.6 percent as of July 2024, per the Nebraska Department of Labor), quality of life, affordable cost of living and expanding cultural opportunities are driving migration into the area. The Omaha-Council Bluffs metropolitan area saw its strongest population growth since pre-pandemic (2019) in 2023, with an increase of 0.8 percent, substantially outpacing the national average of 0.5 percent, per the U.S. Census Bureau. 2023 also saw a net migration of over 3,400 residents to the area. This population growth is fueling demand in the multifamily market, where we saw a record-setting year for development in 2023 …

OMAHA, NEB. — Plum Market Travel Services has been awarded a contract to operate 10 dining, retail and Gourmet Natural Market locations at Omaha Eppley Airfield (OMA) in Nebraska. The agreement, part of OMA’s $950 million terminal expansion and modernization plan, comprises the majority of the food-and-beverage offerings. Plum Market Travel Services is a subsidiary of Plum Market, a natural food, beverage and wellness essentials retailer. The 10 locations consist of nine brands spanning various cuisines and formats. Notable brands include Runza, Panda Express and Sambazon, along with several local Omaha restaurants such as Block 16 and Fernando’s. Additionally, Plum Market will open two of its own concepts: a full-service kitchen and bar with all-natural snacks and travel essentials, and a convenient grab-and-go, quick-service format. The terminal expansion is slated to open in 2027.

ELKHORN, NEB. — CBRE has arranged the sale of The Trails, an 85-unit build-to-rent community in the Omaha suburb of Elkhorn. The sales price was undisclosed. Located at 19111 Grand Ave. and completed this year, the property features a range of four- and five-bedroom floor plans averaging 1,814 square feet. Ted Abramson, Mark Seger and Jeremy Fink of CBRE represented the undisclosed seller. Curtis Capital Group was the buyer.

OMAHA, NEB. — Darland Construction Co. is building a new 6,114-square-foot branch for CharterWest Bank & Mortgage Center on South 24th Street in South Omaha. The facility will offer a full suite of financial services, including consumer and commercial banking as well as mortgage lending. The building’s exterior will feature a distinctive Spanish style with a natural stone finish and a barrel tile roof. Completion is slated for early 2025. EK Schulz is the project architect.

OMAHA, NEB. — Northmarq has provided a $75.5 million Fannie Mae loan for the refinancing of Brickline at The Mercantile in Omaha. Completed in 2023, the luxury apartment complex features 379 units along with commercial space leased to three restaurant/entertainment concepts. Amenities include a resort-style pool, golf simulator, fitness center, yoga studio, electric vehicle charging stations and coworking spaces. Kevin McCarthy, Jeff Frankel, Alex Czachor and Jason Kinnison of Northmarq originated the loan on behalf of the borrower, a joint venture between Hines and Cresset Real Estate Partners. The eight-year, fixed-rate loan features interest-only payments and a flexible prepayment option starting after the sixth year.

OMAHA, NEB. — Colliers Mortgage has provided a $29.9 million Fannie Mae loan for the refinancing of Highline Apartments in Omaha. The 306-unit apartment complex consists of two buildings connected by a covered parking garage. Amenities include rooftop decks, basketball courts, a business center, fitness center, outdoor pool and clubhouse. Brett Olson and Jeff Witt of Colliers Mortgage originated the 10-year loan, which features interest-only payments for the full term.

OMAHA, NEB. — Investors Realty has brokered the sale of the Candlewood Hills retail center in Omaha for $4.7 million. Located at 12424 W. Dodge Road, the property totals 11,700 square feet and is situated near a Costco store. Ember Grummons of Investors Realty represented the seller, Royce Candlewood WR LLC. Tim Kerrigan and Grant Kobes of Investors Realty represented the local buyer.