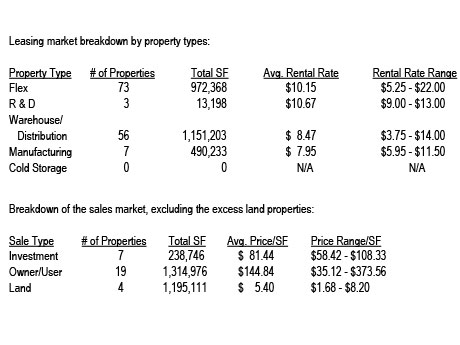

By John Dickerson, OMNE Partners Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year. In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well. Leasing pace Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year. Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.) One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square …

Midwest

FeaturesHeartland Feature ArchiveIllinoisMidwestNortheastNortheast Feature ArchiveOhioPennsylvaniaSeniors Housing

Dual Appraisal Methods Improve Opportunities to Get Fair Taxation for Seniors Housing Properties

by John Nelson

By Phil Brusk and Caleb Vahcic of Siegel Jennings Co. L.P.A. The seniors housing sector can’t seem to catch a break. Owners grappling with staffing shortages and other operational hardships lingering from the pandemic are facing new challenges related to debt and spiraling costs. High interest rates and loan maturations loom over the industry, with $19 billion in loans coming due within the next 24 months, according to Cushman & Wakefield’s “H1 2024 Market Trends and Investor Survey” on senior living and care. Factors driving high costs include wage pressures, inflation and — incredibly — rising property taxes. Despite operational challenges and declining occupancy at many facilities during the COVID-19 pandemic, property tax relief for seniors housing was mixed. Many assessors resisted downward adjustments to taxable values, maintaining that recovery was around the corner. Now, seniors housing operators face property tax assessments that equal or exceed pre-pandemic levels. As in the hospitality sector, most seniors housing owners understand that their operating properties include more value components than real property alone. In evaluating whether a tax assessment is reasonable and fair, however, owners need to realize that how an assessor addresses their real estate, personal property and intangible assets can drastically …

GRAND RAPIDS, MICH. — Microsoft Corp. has acquired 274 acres in Dorr, a southern suburb of Grand Rapids, for an undisclosed price. The property is located at 4400 144th Ave. and 14th Street. Matt Wickstra, Shawn O’Brien and Julie O’Brien of Colliers represented Microsoft in the transaction. Colliers also represented Microsoft in its purchase of 316 acres at 76th Street SE in Caledonia, bringing the company’s total holdings in the region to nearly 590 acres.

CHESTERFIELD, MO. — Keystone Construction Co. has broken ground on the new $60 million CarShield Sportsplex AAA Hockey & Futbol facility in the St. Louis suburb of Chesterfield. Completion is slated for January 2026. The indoor and outdoor sports facility will accommodate the growing CarShield AAA Hockey & Futbol clubs, which serve more than 500 kids and 45 teams in metro St. Louis. The 325,000-square-foot project will be situated on 33 acres at 530 N. Eatherton Road. The development will include four indoor turf soccer fields, two indoor ice rinks, team locker rooms, a pro shop, training and fitness spaces, a restaurant, bar, concessions and classrooms. Outside, there will be three turf soccer fields, concessions, a dining patio and children’s playground. The project team includes civil engineer Stock & Associates and architect Gray Design Group.

LIBERTY, MO. — Colliers has arranged the recapitalization of a 467,708-square-foot industrial asset in Liberty, a northeast suburb of Kansas City. The Class A heavy manufacturing facility is located in Heartland Meadows Industrial Park. Alex Cantu and Alex Davenport of Colliers arranged the joint venture between the property’s developer, Becknell Industrial, and investment funds managed by Morgan Stanley Real Estate Investing. LMV Automotive Systems, a division of Magna International Inc., has fully occupied the property since its completion in February 2023. The building features a clear height of 32 feet, 61 docks, 12,892 square feet of office space and 494 auto parking spaces.

MINNEAPOLIS — Gamer Packaging has signed a 20,192-square-foot office lease at Fifth Street Towers in Minneapolis. The full-service packaging company is moving its headquarters to the entire 19th floor of 100 S. Fifth St., the companion tower to 150 S. Fifth St. Reed Christianson and Trinette Wacker of Transwestern Real Estate Services handle leasing for the 1 million-square-foot office complex, which features amenities such as Sculpt Fitness, Connect Lounge and Sphere Bar + Restaurant. Gamer Packaging is currently designing its new headquarters and expects to take occupancy in the second half of 2026. Tad Jellison, John Lorence and Blake Hastings of CBRE represented Gamer Packaging.

JOLIET, ILL. — The Boulder Group has brokered the $2.1 million sale of a 3,500-square-foot retail property net leased to Sherwin-Williams in Joliet. The single-tenant building is located along Plainfield Road. Randy Blankstein and Jimmy Goodman of Boulder represented the seller, a Midwest-based real estate company. The buyer was a Southeast-based real estate investor. There are over eight years remaining on the lease with three five-year renewal options. The lease features 10 percent rental escalations every five years.

CHICAGO, BUFFALO GROVE AND MOKENA, ILL. — JLL Capital Markets has arranged a $63 million loan for the refinancing of a five-building industrial portfolio in metro Chicago. The portfolio comprises the following properties: Asbury Drive, a 157,000-square-foot building in Buffalo Grove; Rockwell Logistics Center, a 174,262-square-foot property in Chicago; Mokena Logistics I and II, two buildings totaling 268,226 square feet in Mokena; and Halsted Pershing Business Center, a 104,008-square-foot asset in the Stockyards submarket of Chicago. The properties total 703,996 square feet with suites ranging from 25,100 to 174,262 square feet. The portfolio is home to 10 tenants spanning industries such as IT, electronics manufacturing, healthcare, construction, food distribution and government agencies. Colby Mueck, Brian Walsh and Tara Hagerty of JLL arranged the five-year, fixed-rate loan on behalf of the owner, Stream Realty Partners.

CHICAGO — Development Solutions Inc. (DSI) and Karis Cold have broken ground on Stockyards Cold, a 100,000-square-foot cold storage facility in Chicago’s McKinley Park neighborhood. The project is situated on five acres at 3815 S. Ashland Ave. Completion is slated for the third quarter of 2025. Stockyards Cold will feature technology capable of maintaining temperatures as low as minus 10 degrees Fahrenheit. The project marks the first cold storage facility in Chicago to offer a clear height of 50 feet, according to the development team. Customizable features will include blast freezing, automated racking and advanced temperature monitoring systems. John Basile of NAI Hiffman is the leasing agent.

SPRINGFIELD, ILL. — Related Midwest has completed a $46.5 million redevelopment of Poplar Place, a 100-unit affordable housing community in Springfield. The property opened in 1950. Related Midwest completed the redevelopment through a collaboration with the City of Springfield, the Springfield Housing Authority and Illinois Housing Development Authority. LR Contracting Co., Related’s in-house construction arm, spearheaded the 15-month project, reducing density and fully renovating 75 buildings. The community now comprises 50 single-family and 25 duplex homes, which are fully occupied. Related also created 2.5 acres of green space for social and recreational use. Additionally, a new community center features a kitchen, management office, outdoor playground and walking paths. Financing for the project came from the Illinois Housing Development Authority, Springfield Housing Authority, Heartland Bank and Trust Co., Red Stone Equity Partners and CVS Health. Evan Lloyd Architects designed the redevelopment. Monthly rents range from $800 to $925. Qualified incomes for the income-restricted apartments range from $44,400 to $83,640.