MADISON, WIS. — McShane Construction Co. will build Lock Lane Apartments, a 309-unit multifamily project in Madison. Vermilion Development is the developer. Located on an 8.5-acre site adjacent to Tenney Park, the project will consist of two five-story buildings with 289 apartment units and three two-story townhome buildings with 20 units. There will also be a two-level parking garage. Amenities will include green roof areas, fitness centers, clubrooms, coworking spaces, conference rooms, community gardens and a fenced dog run. JLL arranged equity capital through Quartz Lake Capital and Clarion Partners. CIBC is providing construction financing. Potter Lawson is the project architect.

Midwest

DECORAH, IOWA — The Opus Group has broken ground on a renovation and expansion of the Regents Center, the existing 200,000-square-foot athletic facility at Luther College in Decorah, a city in northeast Iowa. The development, which will be renamed the Gerdin Fieldhouse for Athletics and Wellness, will receive a 15,787-square-foot addition. Built in 1963, Regents Center has long housed the Luther Norse athletic teams. The Gerdin Fieldhouse, made possible through a $10 million gift from Michael and Nicole Gerdin and the Gerdin Charitable Foundation, marks one of the largest renovation projects in Luther’s 162-year history. The project scope includes a new 5,787-square-foot public lobby on the facility’s north end to include a new concession stand, restrooms and a Hall of Fame space. Opus will also build a new 10,200-square-foot wrestling training complex. The existing basketball and volleyball arena will receive extensive renovations. The athlete training and rehab facilities, locker rooms, and meeting and study spaces will also undergo renovations. Completion is slated for December 2025. Opus is serving as the design-builder in partnership with RDG Planning & Design.

CHICAGO — Interra Realty has brokered the $9 million sale of a 24-unit apartment building with two ground-floor commercial spaces in Chicago’s Hyde Park neighborhood. Originally constructed in 1907, the property at 5300 S. Blackstone Ave. features one one-bedroom unit, 11 two-bedroom units and 12 three-bedroom residences. All apartments feature renovated kitchens and bathrooms, in-unit laundry and individual HVAC. There is also a 16-car parking lot. The building’s corner retail space is leased to Philz Coffee, while the other commercial space is occupied by a local property management company. Joe Smazal and Mark Dykstra of Interra represented the buyer, Estia Properties, a Chicago-based real estate investment and management company. The duo also represented the seller, an East Coast-based investment group.

NORTH OLMSTED, OHIO — Marcus & Millichap Capital Corp. (MMCC) has secured an $8.5 million CMBS loan for the refinancing of the Hampton Inn by Hilton North Olmsted Cleveland Airport hotel in North Olmsted, a southwest suburb of Cleveland. Built in 2016, the 118-room property features a dining area, business center, meeting space, fitness center and indoor pool. Pete Fehlman and Jake Marshall of MMCC arranged the loan on behalf of the borrower, Riley Hotel Group. The five-year loan features interest-only payments for the full term, a fixed interest rate of 6.91 percent and a 70 percent loan-to-cost ratio.

STRONGSVILLE, OHIO — Peak Construction Corp. has completed a 56,000-square-foot tenant improvement project for Blackhawk Industrial Distribution in Strongsville, a southern suburb of Cleveland. Peak previously constructed the 310,000-square-foot building on behalf of developer Scannell Properties. The property features a clear height of 32 feet, nine docks and 3,500 square feet of office space. HSB Architects & Engineers was the project architect.

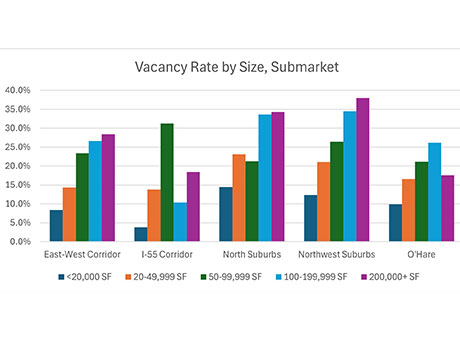

By Adam Johnson, NAI Hiffman For years, you’ve read headlines saying the U.S. office market is struggling with record-high vacancy that threatens to push many owners into default. And that is absolutely true. But there’s another side to the story that isn’t getting as much attention, and is playing out not only in Chicago, but also in metros across the country: that smaller, multi-tenant office properties — particularly in suburban locations closer to where workers live — continue to not only survive but thrive following the pandemic. Throughout suburban Chicago, office buildings with less than 50,000 square feet have considerably higher occupancy rates than larger ones. For instance, at the smallest buildings — those under 20,000 square feet — vacancy was as low as 3.8 percent as of the second quarter of 2024, whereas for the largest properties over 200,000 square feet, vacancy climbed as high as 38 percent, according to NAI Hiffman research. By comparison, mid-size, office buildings between 20,000 to 50,000 square feet reported vacancy rates ranging from 14.3 percent in the western suburbs to 23.1 percent north of the city. Small tenants, big impact We’ve all heard about larger office properties going back to their lenders. Look …

GRAND RAPIDS, MICH.— Grand Rapids-based food solutions company SpartanNash has acquired Fresh Encounter Inc. (FEI), a 49-store supermarket chain with locations in Ohio, Indiana and Kentucky. This move expands SpartanNash’s retail footprint by 33 percent and marks the company’s second retail acquisition this year, following its purchase of Metcalfe’s Market in April. FEI operates stores under the banners Community Markets, Remke Markets, Chief Markets and Needler’s Fresh Market, and has been a food distribution customer of SpartanNash for 58 years. The transaction is expected to close in late November, subject to customary conditions.

GENEVA, ILL. — Mid-America Real Estate Corp. has arranged the sale of Randall Square Shops in Geneva, about 40 miles west of Chicago. The sales price was undisclosed. The 54,147-square-foot retail center is home to McAlister’s Deli, Hand and Stone Massage, For Eyes, Men’s Wearhouse, Golf Tec, Milan Laser and Popeye’s. Joe Girardi and Emily Gadomski of Mid-America represented the seller, Viking Partners. Chicago-based Northpond Partners was the buyer.

ST. PAUL, MINN. — Marcus & Millichap has negotiated the sale of Wheelock Parkway Apartments in St. Paul for an undisclosed price. Located at 1609 N. Woodbridge St., the property features 44 one-bedroom units and 59 two-bedroom units across 85,580 rentable square feet. Amenities include an outdoor pool, laundry facilities, picnic areas, a walking path and playground. Constructed between 1965 and 1967, the community is situated near Como Park Zoo and Rosedale Center. Chris Collins, Evan Miller, Eric Wagner, Matthew Shide and Zack Olson of Marcus & Millichap represented the seller, a Minnesota-based limited liability company, and procured the undisclosed buyer.

BATAVIA, ILL. — Brown Commercial Group has brokered the sale of an 18,500-square-foot industrial building in the Chicago suburb of Batavia for an undisclosed price. Dan Brown of Brown Commercial Group represented the seller, Robart Manufacturing. Luke Dummitt of Brown Commercial Group represented the buyer, Acevision, an ultrasound sales, parts and repair provider. The company is expanding from its 9,000-square-foot lease in St. Charles, Ill.