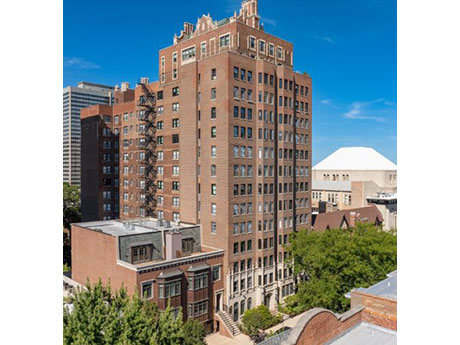

CHICAGO — Greystone has provided an $18.2 million Fannie Mae loan for the acquisition of Cornelia-Stratford in Chicago. Originally constructed in 1927, the 139-unit multifamily property features studio, one-, two-, three- and four-bedroom units. Amenities include bike storage, laundry facilities and a tenant lounge. Clint Darby and Andrew Remenschneider of Greystone originated the nonrecourse loan, which features a fixed interest rate, 15-year term and five years of interest-only payments. The borrower was undisclosed.

Midwest

ROSEVILLE, MINN. — A next-generation Dick’s Sporting Goods store totaling 80,000 square feet is scheduled to open later this month at Rosedale Center in the Minneapolis suburb of Roseville. The store will feature golf hitting bays with TrackMan technology, a HitTrax multi-sport cage, House of Cleats, equipment services counter, expanded footwear selection and apparel, accessories and equipment. Holly Rome and Lane Walsh of JLL handle leasing efforts at Rosedale Center and secured the lease with Dick’s. JLL’s retail development partner, Poag Development Group, led construction of the project at the parcel formerly occupied by Herberger’s. Rosedale Center is a 1.1 million-square-foot shopping center.

HIGHLAND PARK, ILL. — Colliers has arranged the $7.4 million sale of a 55,033-square-foot commercial building in the Chicago suburb of Highland Park. Located at 1770 1st St., the property features 17 apartment units on the upper three floors and 36,000 square feet of medical office space home to Robb Orthodontics, Highland Park Maxillofacial & Implant Surgery and Pediatric Dentistry of the North Shore. The apartment units are fully leased, and the medical office portion is 61 percent leased. Constructed in 1988, the building sits atop a 447-space public parking garage and is across the street from the Highland Park Metra stop. Alissa Adler, John Homsher, Tyler Hague and Lauren Stoliar of Colliers represented the seller, Fulton Design + Build. QMR Partners was the buyer.

CHICAGO — Workbox, a national workspace operator founded in 2019, has moved its corporate headquarters to Chicago’s Fulton Market neighborhood. In less than three years, the company has grown from nine employees to over 35 nationwide and is relocating a majority of its Chicago-based team to 220 N. Green St. At over 60,000 square feet, Workbox Chicago – Fulton Market is the company’s sixth and largest workspace in Chicago. The Workbox team will share its new corporate space with its member base.

ANN ARBOR, MICH. — The Annex Group has unveiled plans to build Union at A2, an $82 million affordable housing community in Ann Arbor. The 250-unit development will include one-, two- and three-bedroom floor plans for residents who earn at or below 70 percent of the area median income. Amenities will include a community center, bike storage, fitness center, outdoor picnic area and playground. Partners on the project include BKV Group, Midwestern Consulting and the City of Ann Arbor. Michigan State Housing Development Authority provided $35 million in permanent mortgage dollars and $15 million of soft debt, Grow America provided $22.5 million in Low-Income Housing Tax Credits equity and Ann Arbor Housing Commission provided $3 million of soft debt. An official groundbreaking will be announced in the coming days. Completion is slated for fall 2026. The project marks Annex Group’s third community in Michigan.

MILWAUKEE — Crow Holdings has expanded the scope of its South Cargo Logistics Hub project at the Milwaukee Mitchell International Airport in Wisconsin. The development is a public-private partnership whereby most of the $75 million in capital cost and resources necessary to complete the project will come from private sources. The developer signed a ground lease with the county. At the end of the term, the county will have the option for all improvements to become its property. Crow has expanded the size of the new facility by nearly 50,000 square feet for a total of 337,000 square feet, which is consistent with the 2022 Airport Master Plan prepared by Milwaukee County. Crow will also deliver a new garage for the Milwaukee County Highway department. The project scope has also grown to include large-scale repairs to the roughly 16 acres of public taxiway area directly adjacent to the project. This added work will enable modern wide-body cargo traffic to operate in this part of the airport on a consistent basis for the first time, according to a release. The increased size will facilitate the simultaneous parking of up to five Boeing 777-8F, or equivalent, plane parking positions along with a …

WESTFIELD, IND. — MBG is underway on the construction of The James at Chatham Hills in Westfield, about 30 miles north of Indianapolis. Mia Rose Holdings is developing the 250-unit luxury apartment project. Completion is slated for May 2025. The project marks the first multifamily development for MBG’s new Indianapolis office. Located on a 21-acre site within the Chatham Hills planned residential and recreational development, The James at Chatham Hills will feature eight two- and three-story buildings with 124 one bedrooms, 114 two bedrooms and 12 three-bedroom units. Amenities will include access to a nature trail and lake recreation, a pool, pickleball courts, golf simulator, fitness facility and conference spaces. The project team includes architect Rosemann & Associates, civil engineer V3 Cos. and mechanical, electrical and plumbing engineer Engenuity.

SOUTHFIELD, MICH. — NAI Farbman, the brokerage arm of Farbman Group, has brokered the sale of a 114,397-square-foot office building in Southfield. The H.N. and Frances C. Berger Foundation, a California-based nonprofit that supports established organizations promoting healthcare, social services and education, purchased the property in 2012 as an investment. Given the current state of the office industry, the foundation opted to gift the building to another nonprofit, Volunteers of America, a Virginia-based organization founded in 1896 that provides affordable housing and other assistance to low-income residents. David Haboian of REDICO and Edward Wujek of CBRE represented H.N. and Frances C. Berger Foundation, while Ron Goldstone of NAI Farbman represented Volunteers of America. Following the gifting of the asset, Volunteers of America executed an analysis on the building to determine if it could be converted into a multi-story thrift store, a common practice for the group, which operates dozens of thrift stores nationwide. But the conversion proved too difficult to execute. The property then traded to the Tamaroff Jeffrey Automotive Group, a local automotive dealer of new and used cars. As a result, Volunteers of America raised money for its charity by trading the asset. The property is situated adjacent …

NAPERVILLE, ILL. — A joint venture between Capital Healthcare Properties and HSG Medical has entered the permitting phase of a project to create a specialized cardiovascular center in the Chicago suburb of Naperville. The outpatient ambulatory surgery treatment center (ASTC) will be built for a Chicago-area healthcare system. The ASTC will transform a former 43,000-square-foot fitness facility at 1836 Freedom Drive. The joint venture has been coordinating with consultants, the health system and the city for over a year. The original design and use of the building as a fitness center, including 25-foot ceiling heights and minimal columns, promotes an efficient and flexible floor plan to maximize the space for a complex healthcare build-out, according to the development team. The building, constructed in 2008, sits on a five-acre lot and offers more than 200 parking spaces. Construction is set to commence this quarter, with the first patients expected to be seen in the new facility in 2026. The project team includes architects Antunovich Associates and HDR, civil engineer V3 Cos., mechanical, electrical and plumbing engineer IMEG, landscape architect Hitchcock Design Group and general contractor Boldt. Brett Berlin of Quantum Real Estate Advisors Inc. brokered the $7.5 million sale of the …

CHICAGO — JLL Capital Markets has arranged the sale and acquisition financing of The Parker, a 29-story luxury apartment tower in Chicago’s Fulton Market district. The sales price was $93.3 million, according to Crain’s Chicago Business. Developed by Atlantic Residential, Shapack Partners and Focus Development in 2016, the 227-unit property features panoramic views of downtown Chicago. Units range from studios to three-bedroom layouts. Amenities include a fitness center, yoga studio, rooftop pool, clubroom, work-from-home space, outdoor dog run, indoor dog wash, private parking garage, package concierge system, dry-cleaning pickup lockers and bicycle storage. The property is located at 730 W. Couch Place, steps from the Randolph Street Restaurant Row. Kevin Girard, Mark Stern, Zach Kaufman, Jennifer Hull and Colleen Watson of JLL represented the seller, institutional investors advised by J.P. Morgan Asset Management and Atlantic Residential. Danny Kaufman, Matthew Schoenfeldt, Medina Spiodic, Mary Dooley, Rebecca Brielmaier and Yougsoo Yang of JLL arranged a fixed-rate, five-year acquisition loan through Northwestern Mutual Life on behalf of the buyer, JDL Development.